• US politics. No major market reaction to news Pres. Biden has withdrawn from the election. US equities bounce, while yields & the USD consolidate.

• AUD turbulence. AUD lost more ground. Monetary easing in China & weaker industrial metals prices have exerted downward pressure on the AUD.

• Data flow. No major releases today. Tomorrow global PMIs are due & BoC is expected to cut rates. US GDP (Thurs) & PCE deflator (Fri) also looming.

News US President Biden has withdrawn from the election race clearly generated a lot of media attention, but the impact on financial markets has been minimal. The Democrats look to be falling in line behind Vice President Harris’ candidacy with several party heavyweights endorsing her run. Market odds of Harris winning are now at ~41%, above where Biden has been tracking since his poor showing in the first debate, but still below former President Trump. That said, at ~60% the estimated probability of a Trump win is ~10%pts lower than it was a week ago.

In terms of markets US and European equities had a positive session. The US outperformed thanks to a rebound in the tech-sector (S&P500 +1.1% vs NASDAQ +1.6%). As a result, the S&P500 is less than 2% from its record highs ahead of a string of earnings results from US corporates. Elsewhere, US and European bond yields rose modestly (US 10yr +1bps to 4.25%). There were relatively larger moves coming through in Europe (German 10yr +3bps to 2.5%, UK 10yr +4bps to 4.16%) which helped EUR (now ~$1.0890) and GBP (now ~$1.2931) tick up. The JPY was also a bit firmer (USD/JPY slipped below ~157) which is somewhat surprising given the uptick in bond yields and reports suggesting another rate hike by the Bank of Japan at next week’s meeting isn’t locked in.

In China, the central bank surprised by easing monetary policy a little more yesterday. The PBoC lowered its 1yr and 5yr loan prime rates by 10bps to “step up financial support for the real economy”. This pushed up USD/CNH (now ~7.2955) with the lingering concerns about China’s growth pulse also exerting further downward pressure on industrial metal prices. Copper shed another 0.9% while iron ore lost 1.8% to be back near the bottom of its 3-month range. The backdrop kept the NZD and AUD on the backfoot with the former dipping sub $0.60 for the first time since mid-May. At ~$0.6645 the AUD is also a touch below where it started July.

Data wise it is a quiet day globally with very few releases on the schedule. Tomorrow the latest batch of global PMIs are due, with the Bank of Canada (Weds 11:45pm AEST) also expected to deliver its second rate cut this cycle. Further out, US Q1 GDP (Thurs AEST) and the PCE deflator (the Fed’s preferred inflation gauge) (Fri AEST) will be in focus. In our view, while there was likely to have been a re-acceleration in US activity in Q2 growth should still be below the US’ potential run-rate. This, and a step down in inflation pressures, should give policymakers confidence things are on the right path and bolster expectations a Fed policy easing cycle may get underway in September. If realised, we think this type of mix may drag on US yields and the USD.

AUD Corner

The AUD has lost some more ground at the start of the new week with yesterday’s surprise (modest) monetary policy easing in China keeping CNH on the backfoot, while growth concerns have maintained the downward pressure on industrial metal prices (see above). At ~$0.6645 the AUD is now slightly below where it started July and a bit more than 2% from its recent multi-month highs. The AUD has also underperformed on the crosses. AUD/EUR (now ~0.61) is around a 1-month low, AUD/GBP (now ~0.5136) is near the bottom end of its 2024 range, AUD/CNH (now ~4.8465) is back where it was trading in late-June, and AUD/JPY (now ~104.35) is ~4.5% from its mid-July multi-decade peak. By contrast, AUD/NZD is consolidating just above ~1.11, a region it hasn’t traded at since Q4 2022.

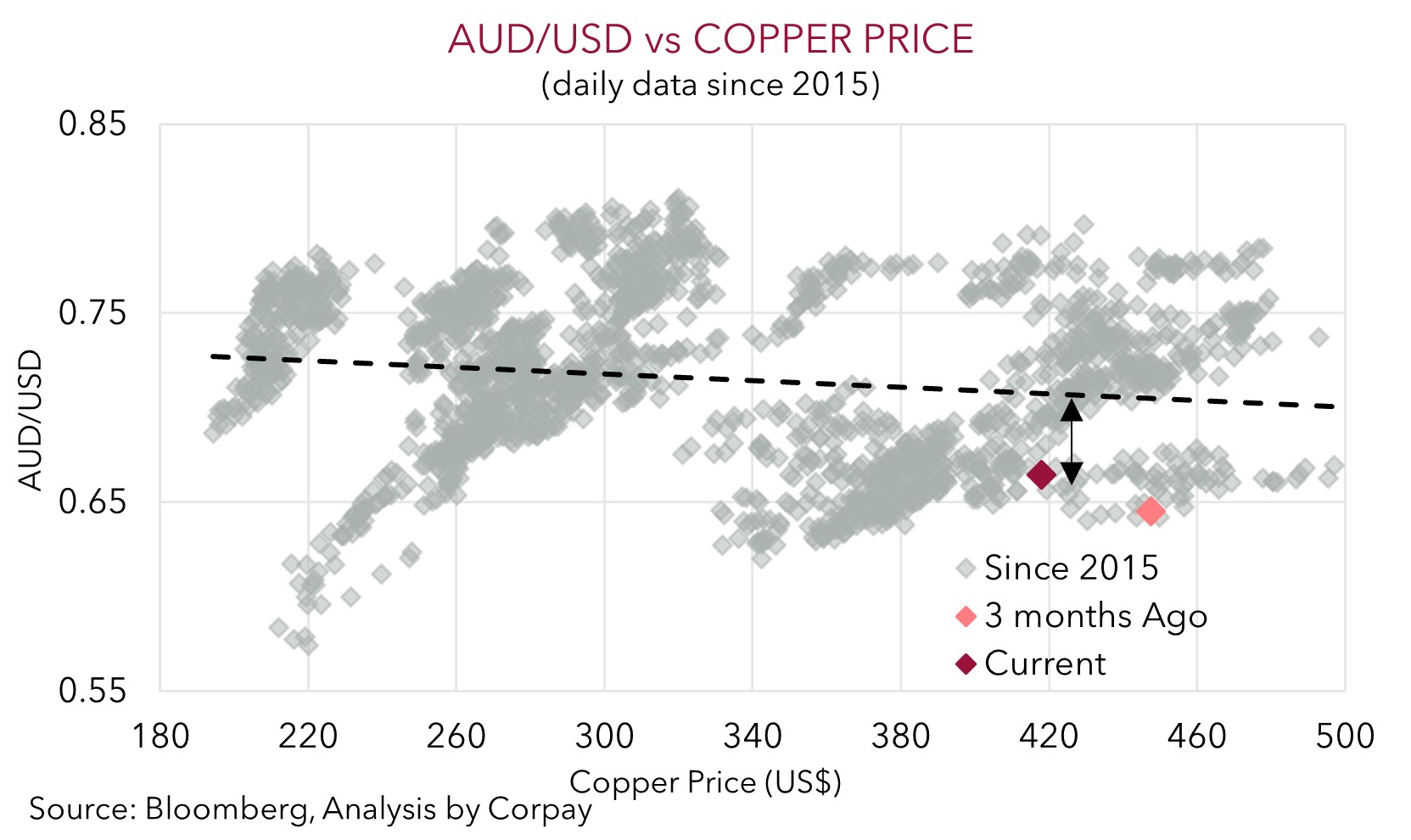

We continue to think there is more downside potential in AUD/JPY, mainly due to our thoughts that the undervalued JPY could rebound further as the BoJ continues to normalise its policy stance at a time other major central banks are easing. Indeed, as outlined over the past few weeks, even after its partial reversal we feel AUD/JPY is still looking stretched compared to long-run relative interest rate expectations. But outside of AUD/JPY we believe the pull-back in AUD/USD and other major crosses such as AUD/EUR, AUD/GBP, and AUD/CAD may soon run its course. While industrial commodity prices have fallen, from a longer-run perspective many of them remain at high levels. Indeed, as our chart shows, based on the current level of the copper price the AUD looks to be ‘cheap’.

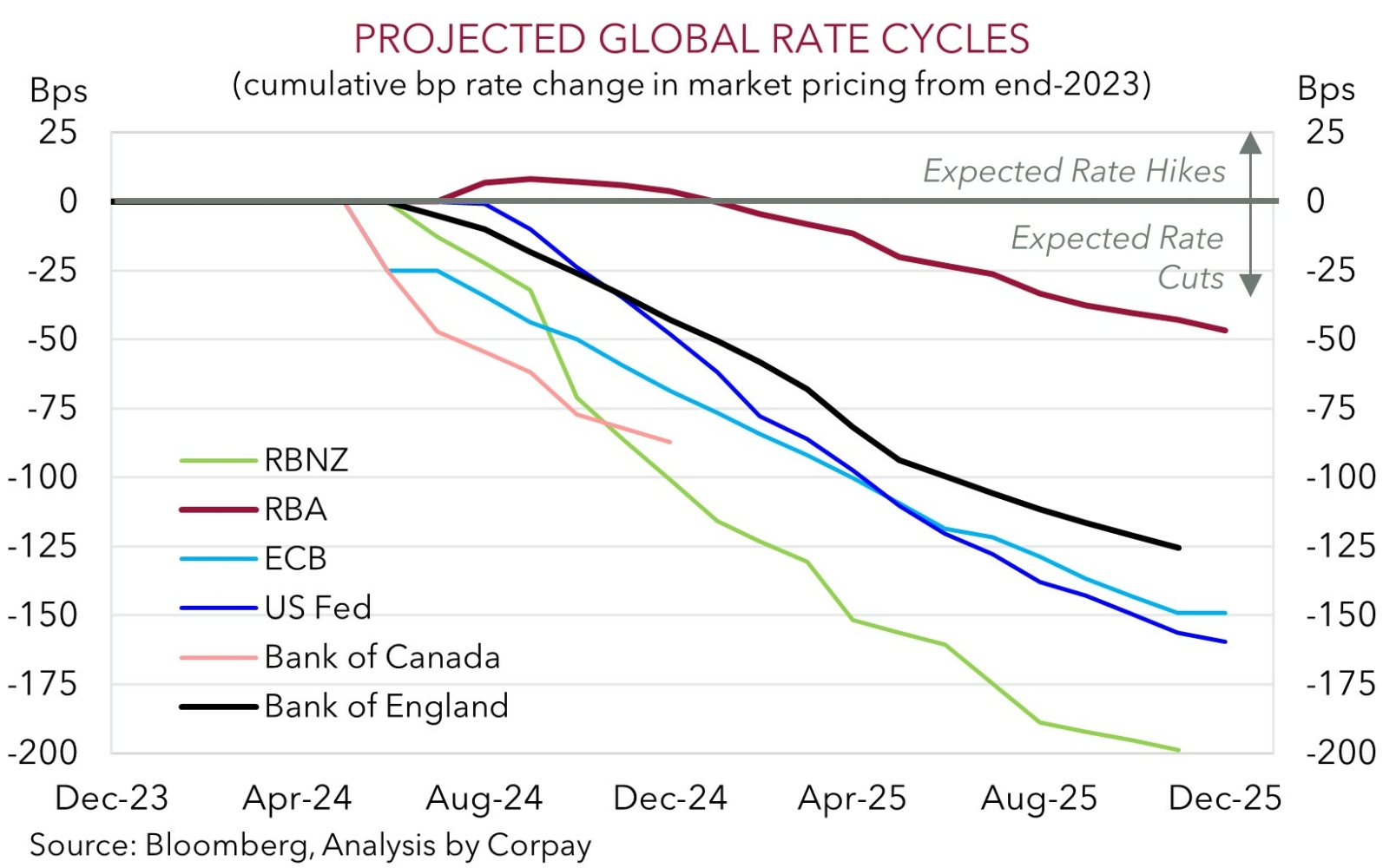

Added to that, we continue to think that the diverging economic and policy expectation trends between Australia and others should be AUD supportive over the period ahead. In contrast to the interest rate cuts factored in for other major central banks markets are assigning a ~33% chance the RBA hikes again by November, with the first RBA rate cut not fully discounted until mid-2025 because of the resilience in the Australian labour market, sticky core inflation, and fiscal/income support that is flowing to the household sector. The upcoming Q2 CPI inflation data (released 31 July) is likely to make or break the case for another near-term RBA rate hike. But irrespective, we are still of the opinion RBA rate cuts are some time away and as a result yield spreads look set to progressively shift in a more AUD supportive direction over the medium-term.