• Mixed markets. S&P500 & gold hit record highs. Bond yields slipped back, while the USD index consolidated. AUD gave back a bit of ground.

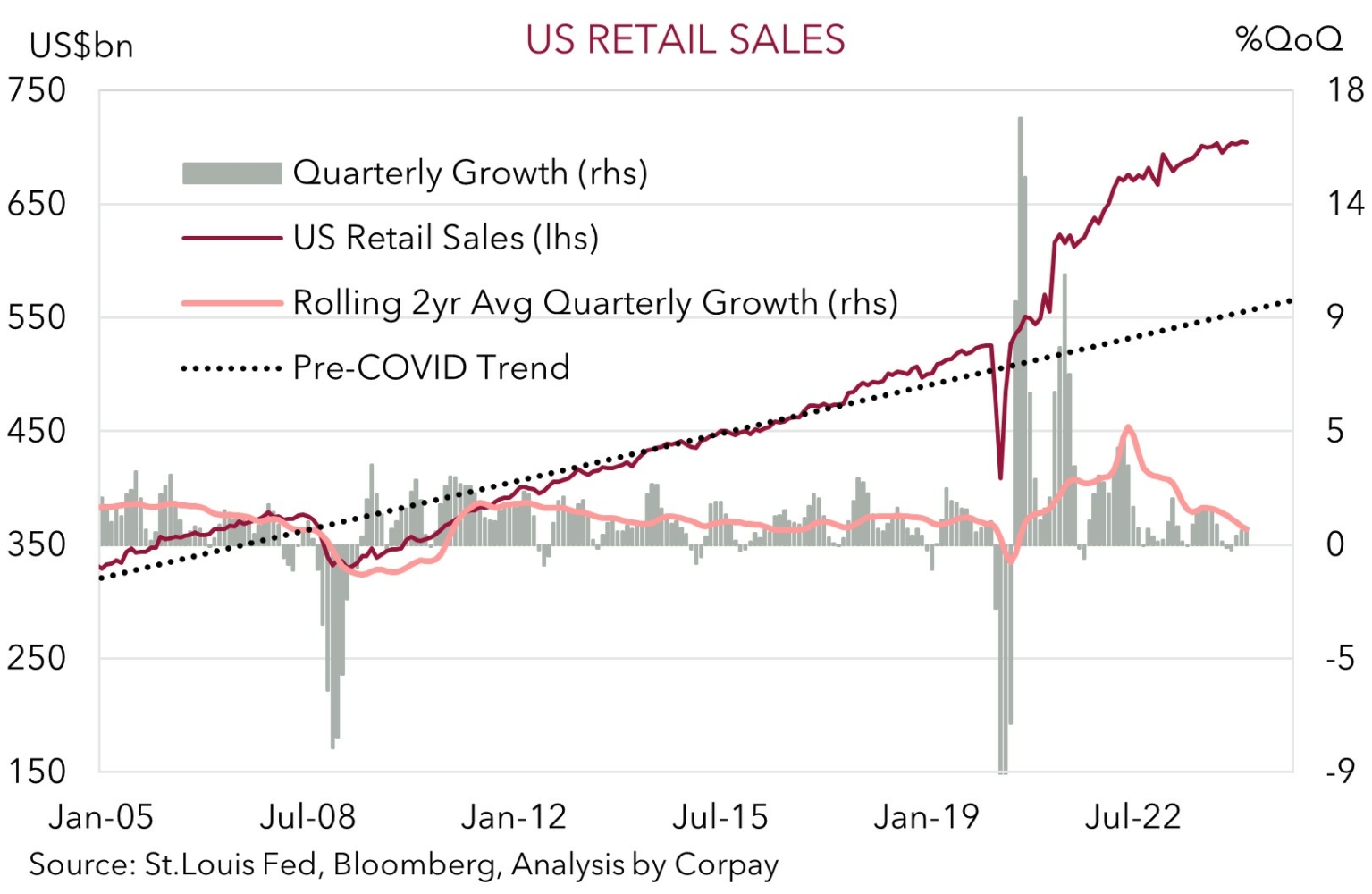

• US data. US retail sales better than expected in June. But the underlying trend still shows sluggish momentum. Fed rate cuts priced in from September.

• NZ CPI. NZ headline inflation slowed in Q2. The door to RBNZ rate cuts continues to open. Australian jobs report released tomorrow.

Mixed performance across markets overnight. US equities continued to power ahead with the S&P500 (+0.6%) hitting another record. The S&P500 is now up ~24% compared to a year ago. The pull-back in bond yields and expectations the US Fed might soon start lowering interest rates helped sentiment, with a positive surprise in US retail sales not really dampening the mood. The benchmark US 10yr rate (-7bps to 4.16%) more than unwound yesterday’s ‘Trump Trade’ bump to be near its lowest level since early April. The US 2yr yield (-4bps to 4.42%) is also at a multi-month low with markets factoring in the first Fed rate cut by September (three moves are fully discounted by January).

In FX, the USD ignored the drop in US yields to be little changed from this time yesterday. EUR/USD is hovering near ~$1.09, GBP is around ~$1.2975 ahead of today’s UK CPI data (4pm AEST), and USD/JPY nudged up to ~158.30 (still ~2.2% below its cyclical peak, with last weeks suspected intervention by Japanese authorities to prop up the weak JPY remaining front-of-mind). Elsewhere, USD/CAD consolidated (now ~1.3675) despite another soft Canadian CPI print. Canadian headline inflation dipped to 2.7%pa, its slowest pace since Q1 2021, solidifying views that the Bank of Canada could deliver a follow up rate cut in late-July after kicking off its easing cycle last month. USD/SGD (now ~1.3445) is treading water near the bottom end of its ~4-month range, USD/CNH (now ~7.2890) is close to its 1-month average, and AUD (now ~$0.6735) slipped back a touch. Although gold reached a record high (US$2469/ounce) base metal prices drifted lower (copper -1.5%). The NZD (now ~$0.6060) also lost ground. Q2 NZ CPI inflation undershot analyst forecasts this morning, further opening the door to RBNZ rate cuts later this year, in our opinion.

As mentioned, US retail sales were a better than predicted. Topline retail sales were flat in June, in contrast to predictions of a small fall. ‘Control group’ sales, which feed into US GDP, rose 0.9% in the month. In part this looks like it was due to some catch up spending in a few areas. That said, if you step back from the month-to-month swings, as our chart shows, US retail sales have tracked sideways since last December. We think the mix of a cooling US labour market, slower income growth, below average confidence, and tighter credit conditions are likely to see consumers cut back spending over the period ahead. This would support the case for the US Fed to deliver a steady stream of rate cuts over the next year, in our view.

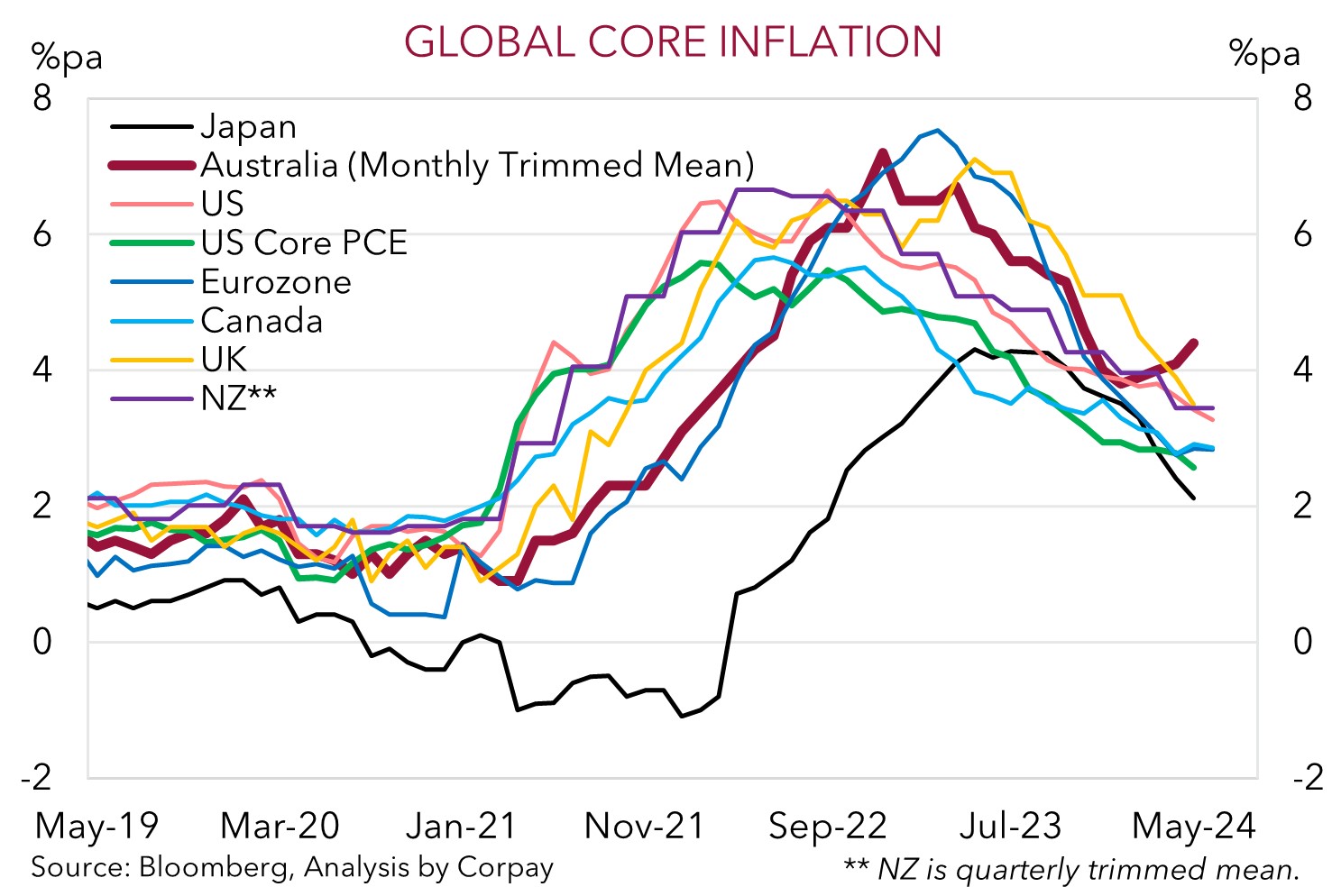

Today, in addition to UK inflation (4pm AEST), US Fed members Barkin (11pm AEST) and Waller (11:35pm AEST) are speaking on the outlook. We think comments that the recent US CPI data is giving policymakers ‘more confidence’ inflation is on a sustainable path back to target could reinforce Fed rate cut expectations, which in turn may exert downward pressure on the USD.

AUD Corner

The AUD has drifted back a bit further over the past 24hrs, with the dip in base metal prices (copper -1.5%) dragging on the currency. At $0.6735 the AUD is near where it was tracking a week ago. The modest pull-back isn’t overly surprising given the AUD’s strong run over early July saw it reach ‘overbought’ levels on short-term technical RSI indicators last week. The AUD has also given back a little more ground on most of the major crosses. AUD/EUR (now ~0.6180) is just above its 50-day moving average, while AUD/GBP (now ~0.5190) is below its 1-year average. AUD/JPY has also extended its retracement (now ~106.65), and we think this might have more room to run given the pair still looks stretched compared to relative long-term interest rate expectations. AUD/CNH (now ~4.9085) has also eased, however it remains near the upper end of its ~1-year range.

Locally, the next major economic data release is tomorrow’s June jobs report. The monthly jobs data has whipped around recently. But we think the still high level of activity across the labour-intensive services sectors could see the jobs market continue to hold up. Another positive showing via solid jobs growth (mkt +20,000) and/or low unemployment (mkt 4.1%) may bolster thinking the RBA is on a different path to many of its global central bank peers. In contrast to the rate cuts factored in around the world, markets are assigning a ~15% chance the RBA hikes again in August with the first RBA rate cut not fully priced in until May 2025. In our judgement, the economic and policy divergence between Australia and others should be AUD supportive over the medium-term, particularly on crosses like AUD/EUR, AUD/GBP, AUD/CAD, and AUD/NZD.

Indeed, in terms of AUD/NZD, Q2 NZ CPI released this morning showed things continue to move in the right direction on the inflation front. NZ headline inflation slowed from 4%pa to 3.3%pa. This was slightly under the RBNZ’s forecast. NZ tradeables inflation fell again in Q2, while non-tradeables/domestic inflation also cooled (although it was a fraction higher than what the RBNZ penciled in). In our view, the slack that is opening in the NZ economy due to the weak environment stemming from ‘restrictive’ monetary settings points to the cracks in the labour market widening and inflation falling further down the track. Contrasting trends should underpin AUD/NZD over coming months. Our long-held forecast is for AUD/NZD to edge up towards ~1.13 by Q4 (see Market Musings: AUD/NZD – Diverging macro fundamentals).