• Risk sentiment improves. Equites and bond yields bounced back overnight, but the moves in FX have been more contained.

• US inflation. Core inflation remains stubbornly high. Services prices remain the key driver. This points to further Fed rate hikes and a USD rebound.

• AUD data flow. China data is released today. Tomorrow, the Australian labour force report is due. Positive data may give the AUD a short-term boost.

After a few turbulent days the tone across markets was more positive overnight, though reports late in the session that a Russian fighter jet collided with a US drone did see equities and yields ease a touch. European and US equities rose 1-2%, with beleaguered bank stocks leading the way. Investors look to be finally acknowledging that the measures put in place by US authorities at the start of the week are likely to limit contagion across the system. Elsewhere, bond yields partially unwound some of the sharp falls that have come through. European yields were up ~15-20bps across the curve, while in the US the 2yr yield jumped ~25bps to be back up at 4.22% and the 10yr rose a relatively more modest 10bps (now 3.67%). In FX, moves were more contained. The USD has been range bound. EUR is tracking near 1.0750, USD/JPY is hovering just above 134, and the AUD has ticked up to ~$0.6680.

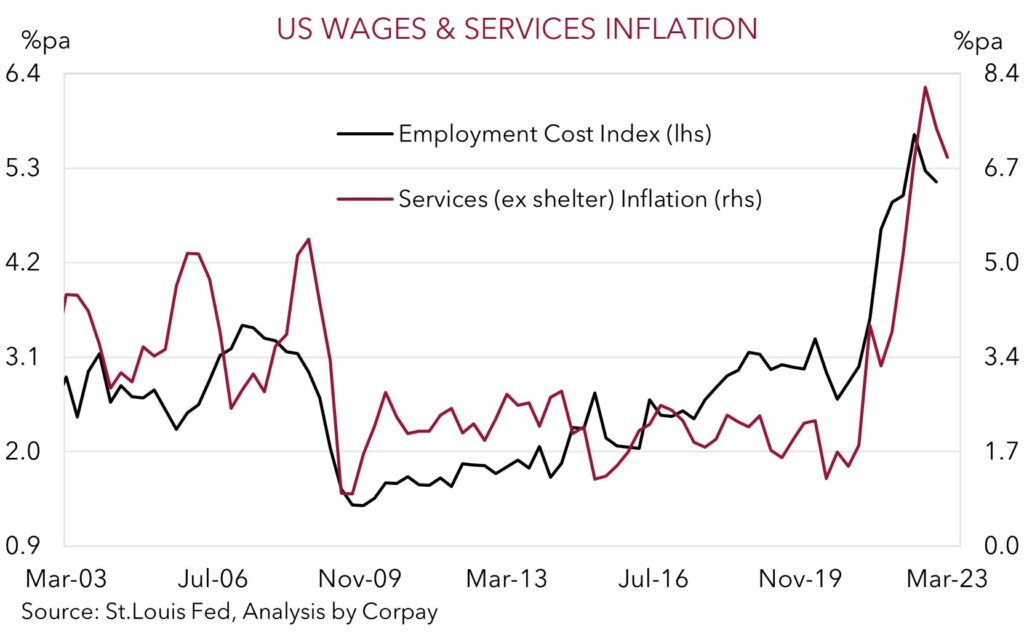

Market pricing for next week’s US Fed meeting and the rest of the cycle has shifted higher. Markets are now assigning a ~71% chance the Fed will hike rates by another 25bps on 23 March, with odds of a follow up move in May also rising. Improved sentiment about the situation in the regional banking system was compounded by another strong US inflation report. Base-effects, as large rises from last year rolled out of calculations, saw headline inflation ease to 6%pa, with core inflation (i.e. ex food and energy) running at high 5.5%pa. Importantly however, the detail continues to show that sticky services inflation, which is tethered to the tight US labour market and strong wage growth, remains the key driver. For services inflation to come down, labour market slack needs to increase, and for that to happen the Fed’s settings need to remain ‘restrictive’ for some time so that the US economy slows down.

As outlined yesterday, we think markets may have gone too far too fast when it comes to repricing the outlook for US interest rates, and that volatility should persist (see Market Musings: Buckle up, volatility should continue). The US’ services-driven inflation problem means the Fed still has more work to do, and in our opinion the bar to crystallise thoughts of near-term rate cuts is quite high. Inflation trends mean the Fed’s reaction function is different to what markets grew accustomed to after the GFC. Low/stable inflation allowed the US Fed to quickly shift course once growth or financial risks flared up, but high inflation doesn’t give policymakers that luxury. We believe that a further rebound in US interest rate expectations should provide some renewed support for the USD. US retail sales are released tonight (11:30pm AEDT). Following the very strong January result, some payback is anticipated.

Global event radar: China Activity Data (Today), US Retail Sales (Tonight), ECB Meeting (Fri), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr).

AUD corner

AUD has ticked up slightly over the past 24hrs, supported by improved risk sentiment. Though at ~$0.6680 AUD is only back trading where it was a week ago. AUD intra-day volatility may pick up over the next few sessions, and on net we think the AUD can edge up a bit further near-term. Today, the China activity data for February is released (1pm AEDT), while tomorrow the Australian labour force report is due. China’s shift away from COVID zero should see activity rebound. A positive set of China data should bolster risk sentiment, and this is likely to feed through to the AUD, in our opinion. Similarly, following two weak results, Australian employment looks set to have risen meaningfully in February. There were a large number of people identifying as being unemployed but waiting to start a new job last month. While only a technical driver, this points to a strong monthly jobs result and for the unemployment to have dipped back. A positive result may see April RBA rate hike pricing (and the AUD) lift.

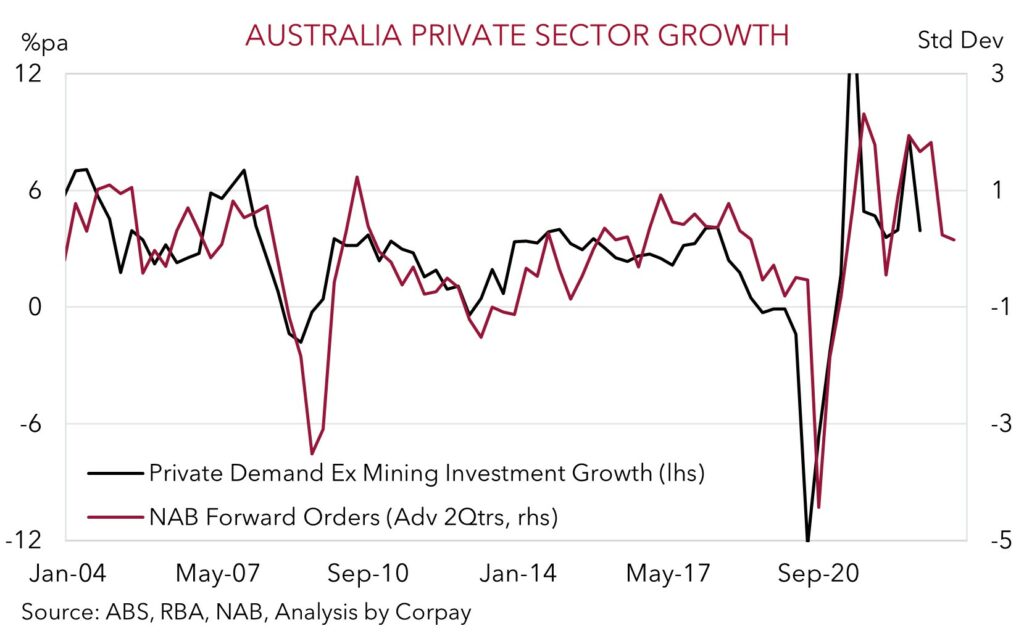

That said, beyond a short-term data boost, we think upside in the AUD could be limited, with a further retracement in US bond yields likely to see the USD bounce back, particularly as we head into next weeks US Fed meeting. Stubbornly high US inflation points to the Fed having to raise interest rates further over upcoming meetings. We think US rate expectations have scope to recover further over the period ahead. At the same time, while positive employment data may see domestic rate expectations increase, we continue to believe that the pragmatic RBA is nearing the end of its tightening cycle. We see the cash rate topping out at ~3.85%. Hence, relative interest rate differentials should, in our view, move back in favour of the USD. Indeed, the consumer/business sentiment data released yesterday shows that the RBA’s actions are gaining traction. Consumer confidence remains well below average. This points to weak consumer spending down the track. And while business conditions are still elevated, forward orders (a guide to future private demand) have declined. Given the substantial amount of policy tightening that has been put through we see growth slowing materially over the next few quarters.

AUD event radar: China Activity Data (Today), US Retail Sales (Tonight), AU Jobs Data (Thurs), ECB Meeting (Fri), US FOMC Meeting (23rd Mar), AU Retail Sales (28th Mar), AU CPI Indicator (29th Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), RBA Governor Lowe Speaks (5th Apr).

AUD levels to watch (support / resistance): 0.6490, 0.6522 / 0.6740, 0.6800

SGD corner

USD/SGD has remained range bound near 1.3450, with improved risk sentiment and rebound in equity markets counteracting the shift in US Fed expectations and higher bond yields (see above). In our view stubbornly high services-driven US inflation means the Fed has more work to do, and that further rate hikes are likely over upcoming meetings. We see the Fed raising rates by another 25bps next week, and think that despite the issues in the regional banking system it should reiterate that ‘restrictive’ policy settings will be needed for some time in order to get inflation on a path back down to target. In our view, risks are skewed to a further upward repricing in US rate expectations, which if realised should be USD (and USD/SGD) supportive over the period ahead.

Over the next 24hrs USD/SGD volatility could pick up. During Asian trade, the February China activity data is released, while tonight US retail sales are due. The China data is expected to show that the economy is springing back to life following the shift away from COVID zero. This should be positive for regional growth prospects and provide some support for Asian FX. At the same time however, a better-than-expected US retail sales print would help reinforce our thinking that current market pricing for the rest of the Fed tightening cycle has become too low.

SGD event radar: China Activity Data (Today), US Retail Sales (Tonight), ECB Meeting (Fri), Singapore CPI (23rd Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), MAS Review (by mid-Apr).

SGD levels to watch (support / resistance): 1.3320, 1.3377 / 1.3516, 1.3590