• Oil spike. Comments by US President Biden relating to the Middle East conflict pushed up oil. Shaky risk sentiment supported the USD. AUD a bit lower.

• GBP weaker. Dovish BoE rhetoric weighed on GBP. AUD/GBP near levels last traded in mid-July. AUD/NZD higher ahead of next week’s RBNZ meeting.

• US jobs. US non-farm payrolls released tonight. Signs conditions are cooling may see the USD reverse course, but a lot will depend on geopolitics.

Cautious trade across risk assets continued overnight. Nervousness about the situation in the Middle East remains with oil prices spiking ~5% higher on fears facilities in Iran might be targeted after US President Biden stated “we’re discussing that” before adding “I think that would be a little…” and then trailing off. At ~US$77.85/brl Brent Crude oil is tracking broadly inline with where it was in early-September, though it remans below its 1-year average. In addition, the US ISM services survey also came in stronger than anticipated with the lift to its highest level since Q1 2023 driven by strength in new orders which overpowered a drop in hiring intentions.

The combination of factors pushed up long-end bond yields with the benchmark US 10yr rate rising ~6bps to its highest level in a month (now ~3.85%). The US 2yr yield also rose (+6bps to ~3.71%) with traders modestly paring back their US Fed rate cut expectations. In FX, the backdrop helped the USD index tick up a bit more. EUR (now ~$1.1032) it hovering near a 2-week low, USD/JPY (now ~146.85) is around a 1-month high with the JPY continuing to be weighed down by comments from new Japanese PM Ishiba that the economy isn’t ready for higher interest rates, and GBP underperformed (-1.1% to ~$1.3125) due to ‘dovish’ rhetoric from Bank of England Governor Bailey. According to Governor Bailey the BoE could become a “bit more aggressive” and “a bit more activist” in terms of cutting rates if the news on inflation remains positive. Markets are now pricing in ~70bps of BoE rate cuts by February, up from ~60bps a few days ago. Elsewhere, cyclical currencies lost ground. USD/SGD has edged up to ~1.2970 (a 2-week high). Ahead of next week’s RBNZ meeting where an outsized rate cut is a strong possibility NZD touched a 2-week low (now ~$0.6217), and the AUD (now ~$0.6842) has also lost more altitude, though it remains only 1.4% from its recently hit multi-quarter peak.

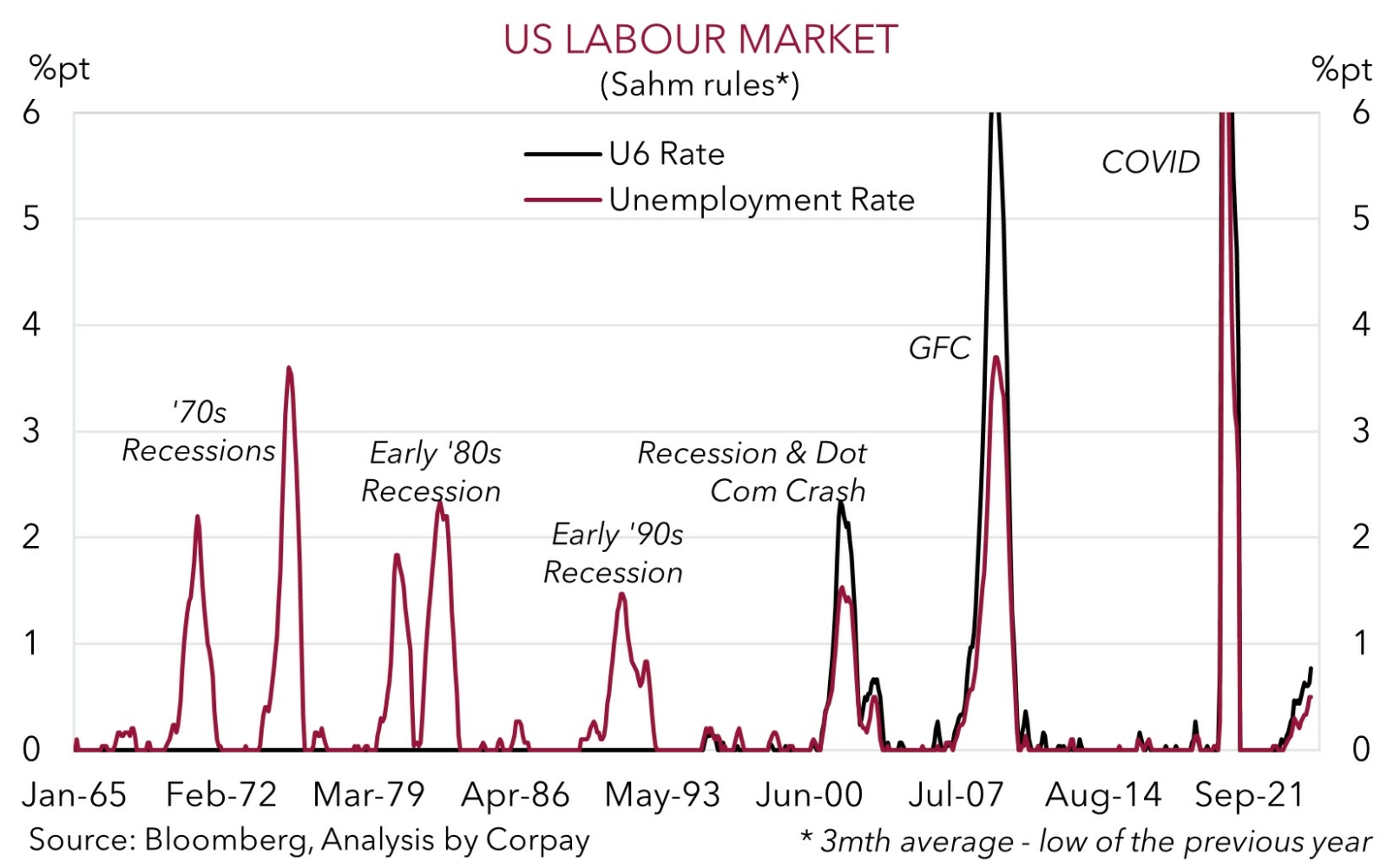

The situation in the Middle East should continue to be a focal point over the near-term. A further deterioration would likely generate greater market volatility, exert downward pressure on cyclical assets, and generate USD support. That said, on the assumption things simmer down rather than boil over we believe the incoming US data and US interest rate outlook could quickly swing back into the spotlight. The monthly US non-farm payrolls report is due tonight (10:30pm AEST). Consensus is looking for another rather soft print. In our opinion, various leading indicators suggest conditions loosened with the risks tilted to the US unemployment rate increasing. If realised, we think this may see the USD unwind some of its recent geopolitical driven strength.

AUD Corner

The shaky risk sentiment stemming from events in the Middle East, and uptick in US bond yields due to positive US ISM services data, has supported the USD and exerted a bit more pressure on the AUD (see above). At ~$0.6842 the AUD is down where it was trading last Thursday, ~1.4% from Monday’s cyclical peak. The AUD has continued to be mixed on the crosses. AUD/EUR has lost a bit of ground over the past 24hrs; however it remains near the upper end of its 2024 range (now ~0.62). AUD/JPY is oscillating between its 100-day (~101.37) and 200-day (~100.09) moving averages, while AUD/CNH (now ~4.8250) is still north of its 10tear average. Elsewhere, dovish rhetoric from Bank of England Governor Bailey and downward adjustment in UK interest rate expectations has pushed AUD/GBP (now ~0.5213) to its highest point since mid-July. AUD/NZD (now ~1.10) has also continued to drift higher ahead of next Wednesday’s RBNZ meeting where a larger 50bp rate cut looks possible in an effort to revive growth and cushion the blow to the NZ jobs markets.

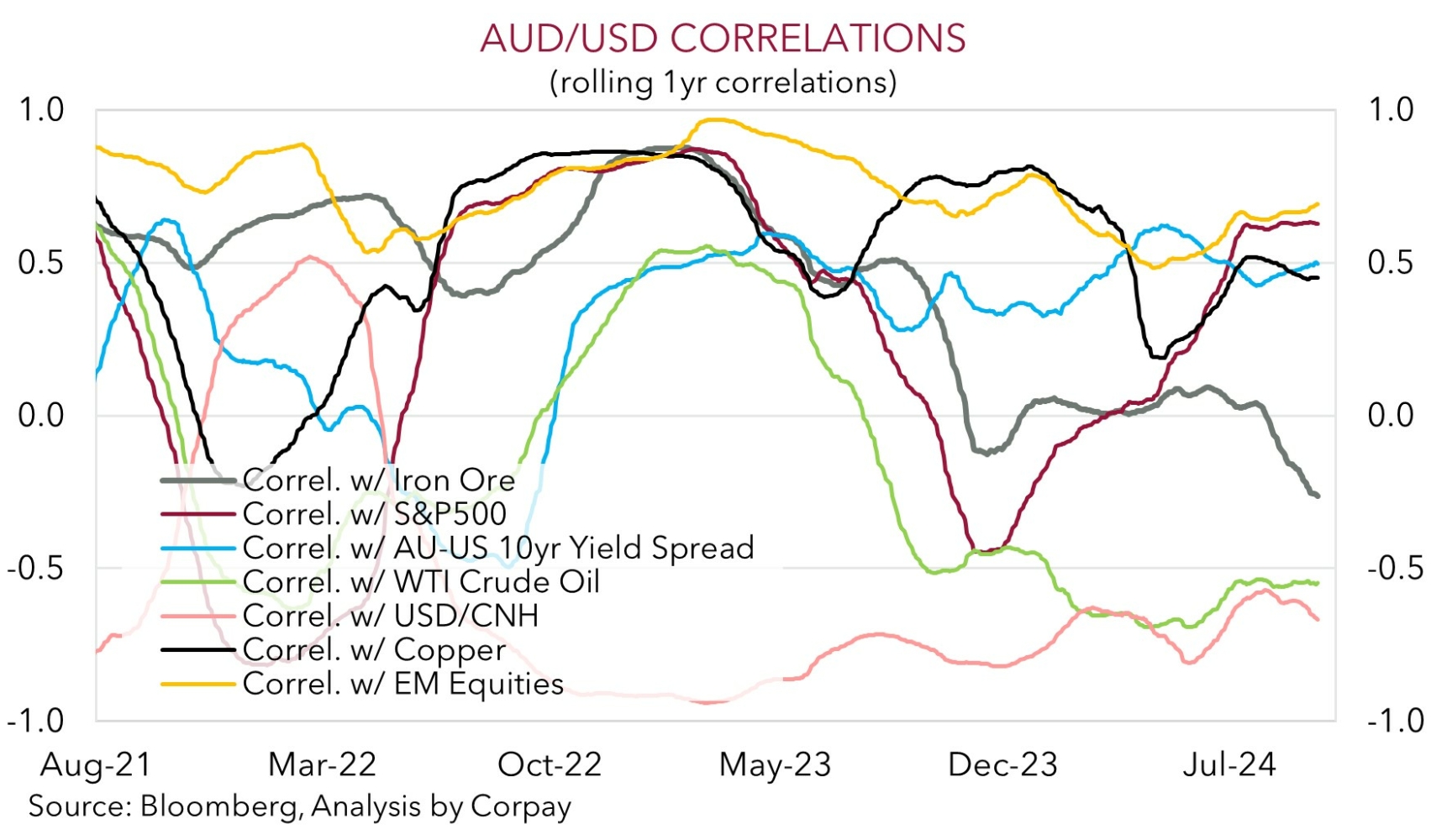

Developments in the Middle East will continue to be on the radar over the near-term. As mentioned above, we believe a worsening in the conflict could see a further lift in energy prices and weigh on cyclical assets like equities. We feel this would exert some more downward pressure on the AUD. As our chart illustrates, the AUD has been positively correlated to global equities over the past year and had a negative correlation to moves in oil. The latter reflects the USD’s positive relationship with oil stemming from the US’ swing to a net energy exporter a few years ago.

That said, on the proviso volatility settles down and relative fundamentals re-assert themselves, we expect the AUD to bounce back, and outperform currencies like the EUR, CAD, GBP, and NZD over the medium-term given their respective central banks should deliver more rate cuts over coming months. By contrast, we believe the start of a modest and limited RBA easing cycle is a story for H1 2025. This relative policy divergence theme could get another kick along tonight with the release of the monthly US non-farm payrolls report (10:30pm AEST). As discussed, we feel that the risks are tilted to US labour market conditions loosening further. If this comes through, we think expectations looking for a steady stream of US interest rate cuts should be reinforced which in turn may see the USD unwind some of its geopolitical driven support.