• Stronger USD. A positive US jobs report has seen US rate expectations reprice higher, supporting the USD. AUD has fallen to mid-September levels.

• China reopening. Financial markets in mainland China reopen today after a holiday. This will be in focus, as will a briefing by its economic planners.

• Local events. Consumer confidence, business conditions, RBA meeting minutes, & speech by RBA Dep. Governor Hauser also on the radar.

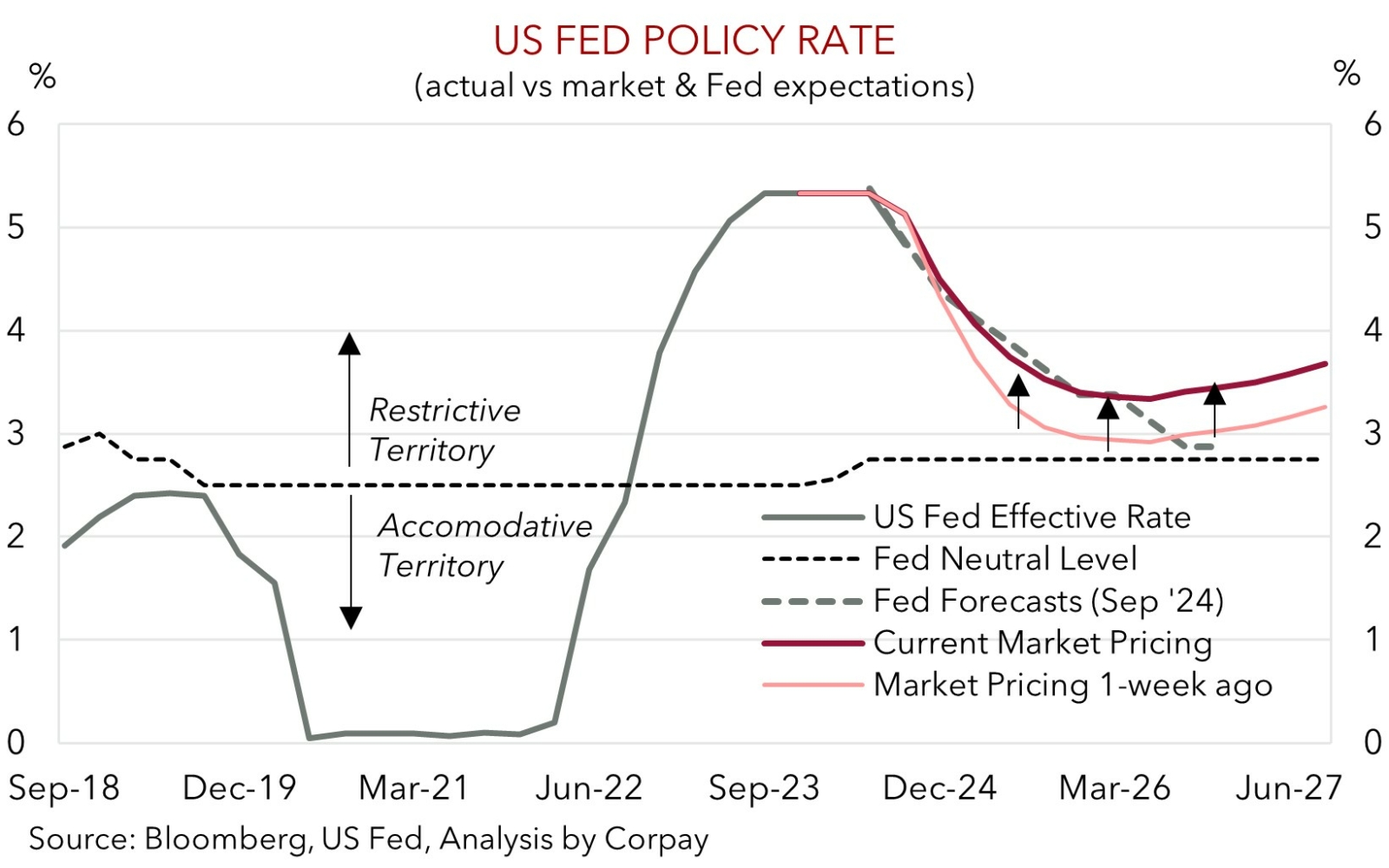

Last Friday’s stronger than anticipated monthly US jobs report generated a market jolt. The robust job creation (non-farm payrolls rose 254,000 in August), positive revisions to history, dip in the unemployment rate (now 4.1%), and firmer wages (now 4%pa) was a ‘hawkish’ surprise that has seen US interest rate expectations adjustment rather abruptly. Odds of another outsized 50bp reduction by the US Fed at its next meeting have tumbled with markets now assuming ~21bps of cuts. This is down from ~40bps priced in in late-September. This has cascaded across other markets. US bond yields have extended their upswing with the benchmark 10yr rate (now ~4.03%) at its highest since the early-August, while the 2yr rate (now ~3.99%) is ~50bps above its 25 September low.

The upward repricing in US yields, coupled with ongoing geopolitical risks stemming from the conflict in the Middle East (brent crude oil prices have risen above US$81/brl for the first time since August), and company specific news regarding the megacap Alphabet, took some of the heat out of the US stockmarket overnight. The US S&P500 dipped ~1%, though it remains within striking distance of its record highs. In FX, the backdrop, particularly the shift up in US yields has boosted the USD. EUR (now ~$1.0973) is near a 2-month low, GBP (now ~$1.3083) is around a 1-month low, and the interest rate sensitive USD/JPY has climbed to levels last traded in mid-August (now ~148.20). USD/SGD has also snapped back above ~1.30 for the first time in a few weeks. Ahead of tomorrow’s RBNZ meeting where a 50bp rate cut could be on the cards NZD is down close to its 100-day moving average (~$0.6123), while the AUD has dropped to where it was tracking in mid-September (now ~$0.6757).

The return of market participants in China after a weeklong holiday will be in focus today. The Hang Seng China Enterprises index rallied almost ~11% over the China break, which implies some catch up by the mainland markets might occur. If realised, and/or China’s National Development and Reform Commission outlines more stimulus measures are in the pipeline at today’s briefing (from 1pm AEDT), risk sentiment may improve and the resurgent USD could lose a bit of ground, in our opinion. Later this week attention will be on the latest reading of US CPI inflation (Thurs night AEDT). We think signs US price pressures are continuing to moderate might also see US yields and the USD unwind some of its recent strength.

AUD Corner

The USD’s revival on the back of the stronger than predicted US jobs report and upward repricing in US rate expectations has weighed on the AUD over the past few sessions (see above). At ~$0.6757 the AUD is back down around where it was tracking in mid-September, ~2.6% below last week’s peak. Some of the heat has also come out of the AUD on the crosses. AUD/EUR (now ~0.6160) has unwound its late-September push higher, AUD/GBP is hovering between its 50-day (~0.5137) and 100-day (~0.5173) moving averages, AUD/JPY has dipped under its 200-day moving average (~100.14), and AUD/CNH (now ~4.7771) has eased towards its ~1-year average.

In addition to the reopening of China’s mainland financial markets after a weeklong holiday, locally the latest reads on consumer confidence (10:30am AEST), business conditions (11:30am AEDT), minutes of the last RBA meeting (11:30am AEDT), and speech by RBA Deputy Governor Hauser (12pm AEDT) are also on the schedule. On net, we believe a combination of a catch up in China’s equity market, indications more stimulus measures could be forthcoming in today’s briefing by China’s National Development and Reform Commission (from 1pm AEDT), and/or rhetoric by the RBA that it still feels rate cuts in Australia may be some time away could generate renewed support for the AUD. We remain of the opinion that the start of a modest and limited RBA easing cycle is a story for H1 2025, and that the ongoing shift in relative interest rate expectations in Australia’s favour should be AUD supportive against currencies like the EUR, CAD, GBP, NZD, and USD (to a lesser extent) over the medium-term.

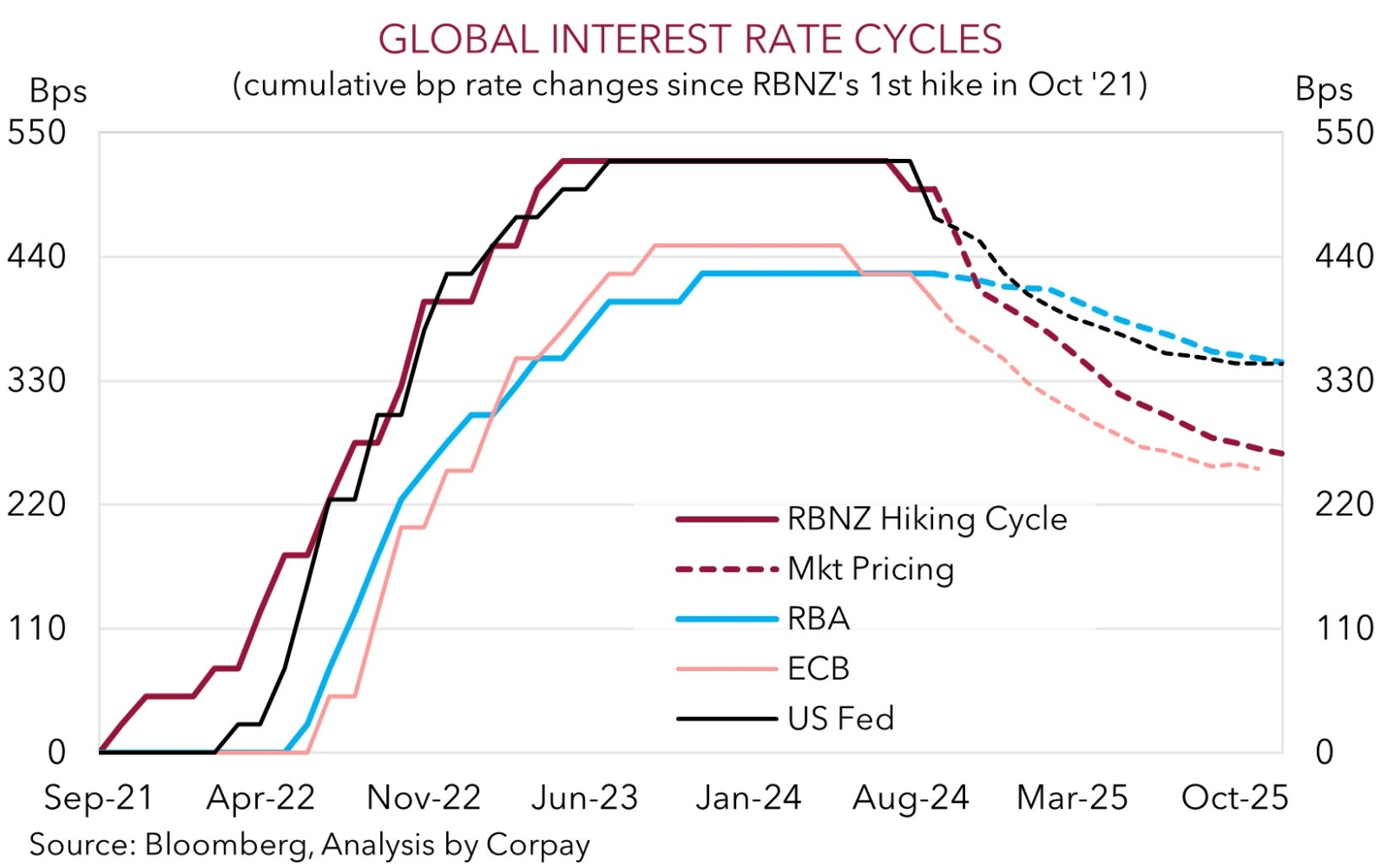

More specifically, AUD/NZD, which has moved above ~1.10 for the first time since mid-August will be in focus over coming days. The RBNZ meets tomorrow, and given the harsher NZ economic climate, loosening labour market conditions, and cooling price pressures markets are looking for another rate cut. Indeed, we and consensus believe the backdrop points to the RBNZ lowering interest rates towards ‘neutral’ more quickly than it had been anticipating, and as such a 50bp rate cut and signal more outsized moves might follow is more likely than not. The contrasting fortunes between Australia and NZ, and diverging RBA and RBNZ policy impulses is suggesting a further appreciation in AUD/NZD over the next few quarters should be anticipated. We are projecting AUD/NZD to edge up towards ~1.15 by Q1 2025. For more see Market Musings: AUD/NZD: RBNZ needs to get moving.