• Geopolitics. Developments in the Middle East dampened sentiment. Equities & bond yields declined. USD a little firmer. AUD modestly lower.

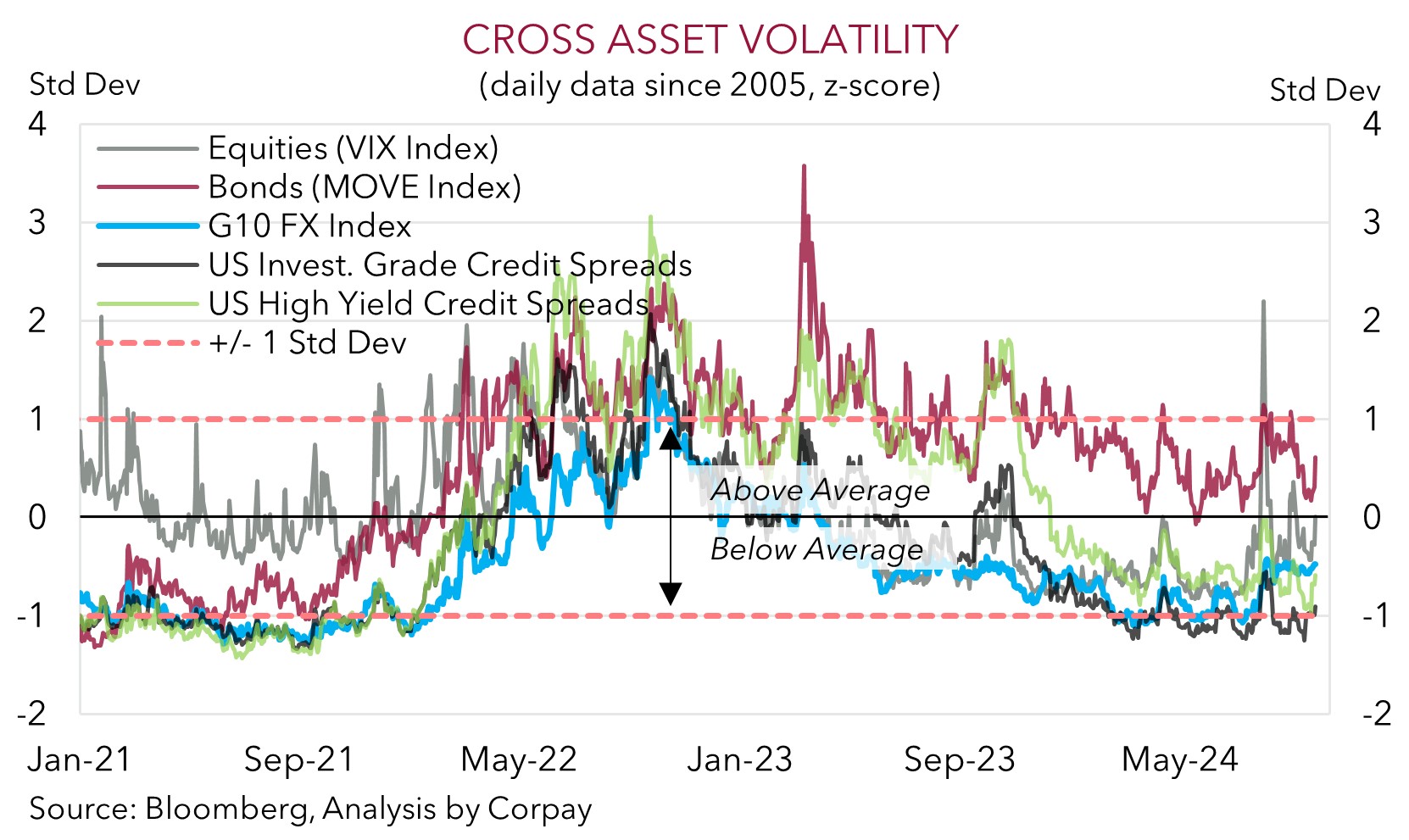

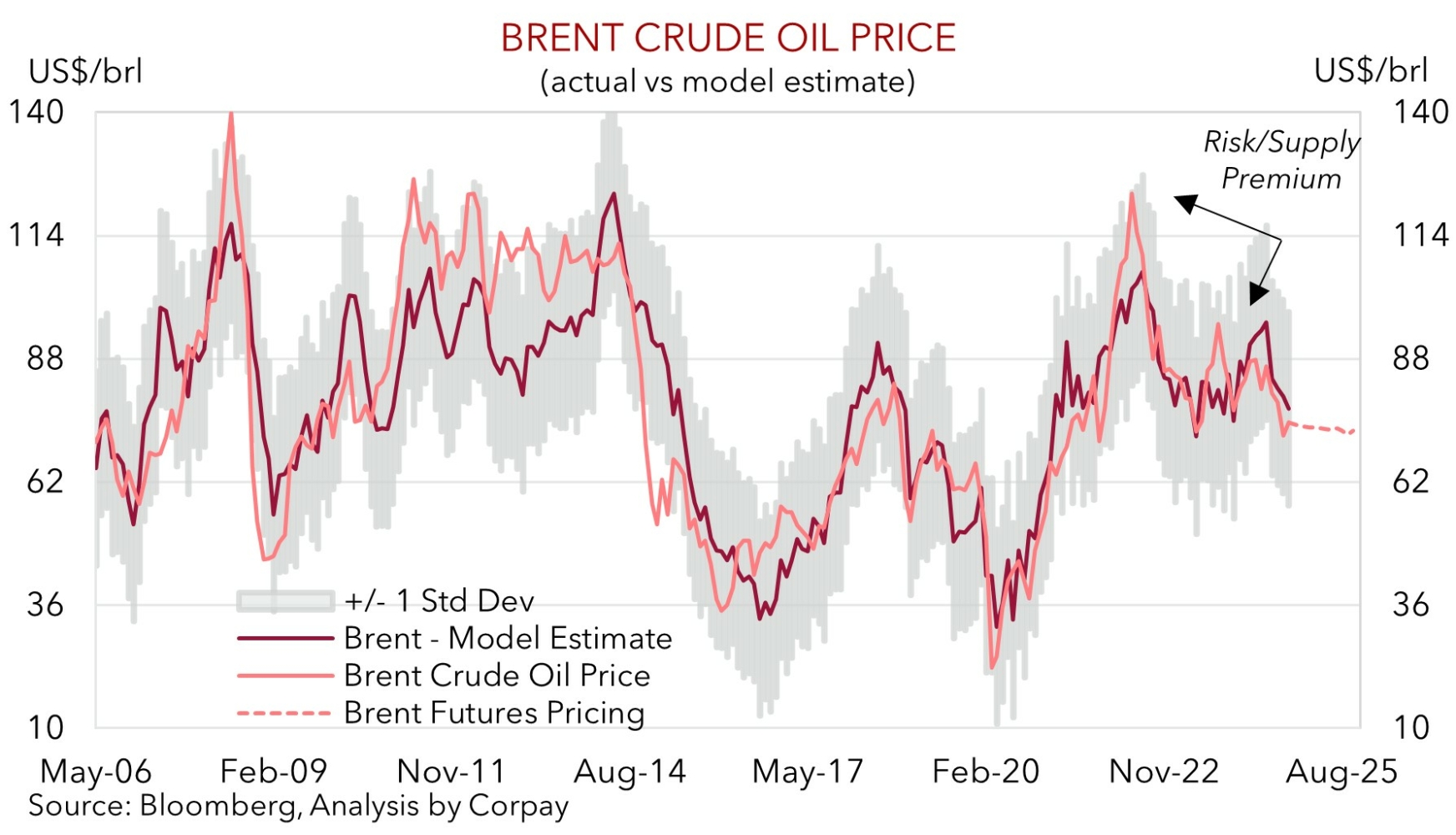

• Oil & vol. Brent crude prices increased, but now look to be tracking inline with fundamentals. Measures of volatility also not showing much stress.

• NZD weaker. NZD fell, AUD/NZD rose. NZIER Survey showed price pressures are cooling fast raising the odds the RBNZ cuts rates by 50bps.

Geopolitics trumped economics overnight with escalating tensions in the Middle East generating a bout of risk aversion. Iran launched a barrage of missiles at Israel, a few hours after the US had warned an attacked was imminent, as a reprisal of the attacks carried out on Lebanon recently. While Israel’s defense system intercepted the bulk concerns further tit-for-tat moves are possible were reinforced by PM Netanyahu’s vow to retaliate. Markets responded in typical ‘risk off’ fashion, although the size of the moves was relatively modest with some of the initial knee-jerk reaction unwinding late in the US trading session. On net, the major European and US equity markets ended the day ~1-1.5% lower. Bond yields also lost ground with the benchmark US 10yr rate shedding ~5bps (now ~3.73%). And while oil prices rose, the ~3.5% lift in brent crude oil prices has only moved things back to where they were a week ago (now ~US$74.50). Indeed, as illustrated in the chart below, brent crude oil prices are tracking broadly in line with where our demand/supply based model implies they should be, and the futures market is still anticipating a gradual moderation over time.

In FX, the USD ticked up, though this also looks to reflect some diverging economic trends. The US JOLTS job opening report showed a surprising lift in vacancies in August, suggesting labour demand is stabilising and that the US Fed may not need to follow up its recent outsized rate cut with another in November. By contrast, EUR slipped back (now ~$1.1070) with the step down in Eurozone CPI inflation to 1.8%pa (a low since April 2021) reinforcing assumptions the ECB might lower rates again in mid-October. GBP also weakened (now ~$1.3285), though it remains near the upper end of the range it has occupied since Q1 2022, USD/JPY tread water (now ~143.51), and USD/SGD (now ~1.2883) nudged up a touch. The shaky risk sentiment has taken a little heat out of the AUD (now ~$0.6883), while NZD underperformed (-1% to ~$0.6282) after the Q3 NZIER Survey indicated the NZ economy is struggling and that price pressures are cooling fast. This has bolstered bets the RBNZ may slash interest rates by 50bps at next week’s meeting.

The situation in the Middle East should continue to be a focal point over the near-term. However on the assumption things simmer down rather than boil over we believe the incoming US data could swing back into the spotlight. In our view, upcoming US labour market metrics risk underwhelming, which if realised may see the USD ease. US ADP employment is due tonight (10:15pm AEST) and the monthly non-farm payrolls report rounds out the week (Fri night AEST).

AUD Corner

The modest bout of risk aversion stemming from the geopolitical developments in the Middle East has generated a bit of USD support and exerted a little downward pressure on the AUD overnight (see above). That said, at ~$0.6883 the AUD is still hovering near the upper end of its 18-month range. Indeed, as shown, while there have been a few gyrations, for the most part markets look to be taking things in their stride with the volatility gauges and credit spreads we monitor still at or below average.

The AUD has been mixed on the crosses with modest gains recorded against the EUR (now ~0.6218, close to the top of its 2024 range) and GBP (now ~0.5181, approaching its 1-year average). AUD/NZD has also pushed up towards ~1.0960 as the soft pricing intentions within the Q3 NZIER Survey raised expectations the RBNZ could deliver a 50bp rate cut next week. By contrast, AUD/JPY (now ~98.81) has eased, as has AUD/CAD (now ~0.9285), although the latter remains close to its multi-quarter peak.

Locally, retail sales for August were released yesterday. Retail spending exceeded consensus thinking (+0.7%mom) as warmer weather, Father’s Day sales, and income support from the stage 3 tax cuts boosted consumer activity. From our perspective, the fiscal measures, coupled with a still tight labour market, and receding inflation should help household spending pick up over the back end of 2024. This in turn should see the RBA hold rates steady for a while yet, in our opinion.

We continue to believe the start of a modest and limited RBA easing cycle is a story for H1 2025. Over time, the divergence between the RBA and its global peers should see interest rate differentials adjust further in Australia’s favour. On the assumption volatility settles down and relative fundamentals re-assert themselves, we expect this to be AUD supportive, particularly against EUR, CAD, USD, GBP, and NZD given their respective central banks should deliver further rate cuts over coming months. We believe AUD/NZD has scope to recover more lost ground over the period ahead as we feel the stage is set for the RBNZ to lower rates aggressively over future meetings to revive growth and cushion the blow to the NZ jobs markets.