• US yields higher. Positive US job openings pushed US yields higher. This helped the USD & weighed on risk sentiment. AUD slipped below ~$0.63.

• USD/JPY volatility. After moving above ~150 USD/JPY tumbled. FX intervention wasn’t confirmed. The moves helped the USD stabilise.

• RBA & RBNZ. No change from the RBA yesterday. RBNZ meets today with rates expected to be held steady. AUD/NZD is near levels last traded in late-May.

Familiar themes and trends were on show again overnight. A stronger US JOLTS (i.e. job openings) report generated another jump up in bond yields and some further USD strength which in turn dampened risk sentiment. The US 10yr yield rose 11bps to 4.79%, a high since August 2007, and the 2yr rate increased to 5.15% (+4bps). Interest rate markets continue to assign just over a ~50% chance of another hike by the US Fed by year-end. This is little changed from yesterday with a modest rate cutting cycle penciled in from Q3 2024. The move up in the US spilled over into other bond markets with UK and German 10yr yields ticking up 3-4bps, while the ‘higher for longer’ interest rate outlook applied more pressure on equities. The major European equity markets declined by ~1%. In the US the tech-focused NASDAQ underperformed (-1.9% vs S&P500 -1.4%).

In FX, the USD index edged a bit higher with the shift in relative yield differentials in favour of the US a supportive factor. Though the overnight moves were modest with most of the USD appreciation over the past 24hrs coming through during yesterday’s Asian and European sessions. EUR (now ~$1.0469) has consolidated near its 2023 lows, and GBP is hovering around ~$1.2080 (levels last traded in mid-March). USD/JPY exhibited some volatility, and this helped contribute to the stabilisation in the USD. After punching through 150, the yen strengthened sharply (USD/JPY plunged ~1.8% to ~147.40) before settling under 149. According to reports Japanese officials wouldn’t comment whether intervention to boost the JPY took place, but a ‘drive by’ and ‘price check’ with dealers could have been enough to rattle a few nerves. The AUD continues to be caught up in the wash with the mix of factors pushing it briefly below ~$0.63, yet another fresh 2023 low. USD/SGD (now ~1.3730) has followed the broader USD pattern and is tracking near its highest level since last November.

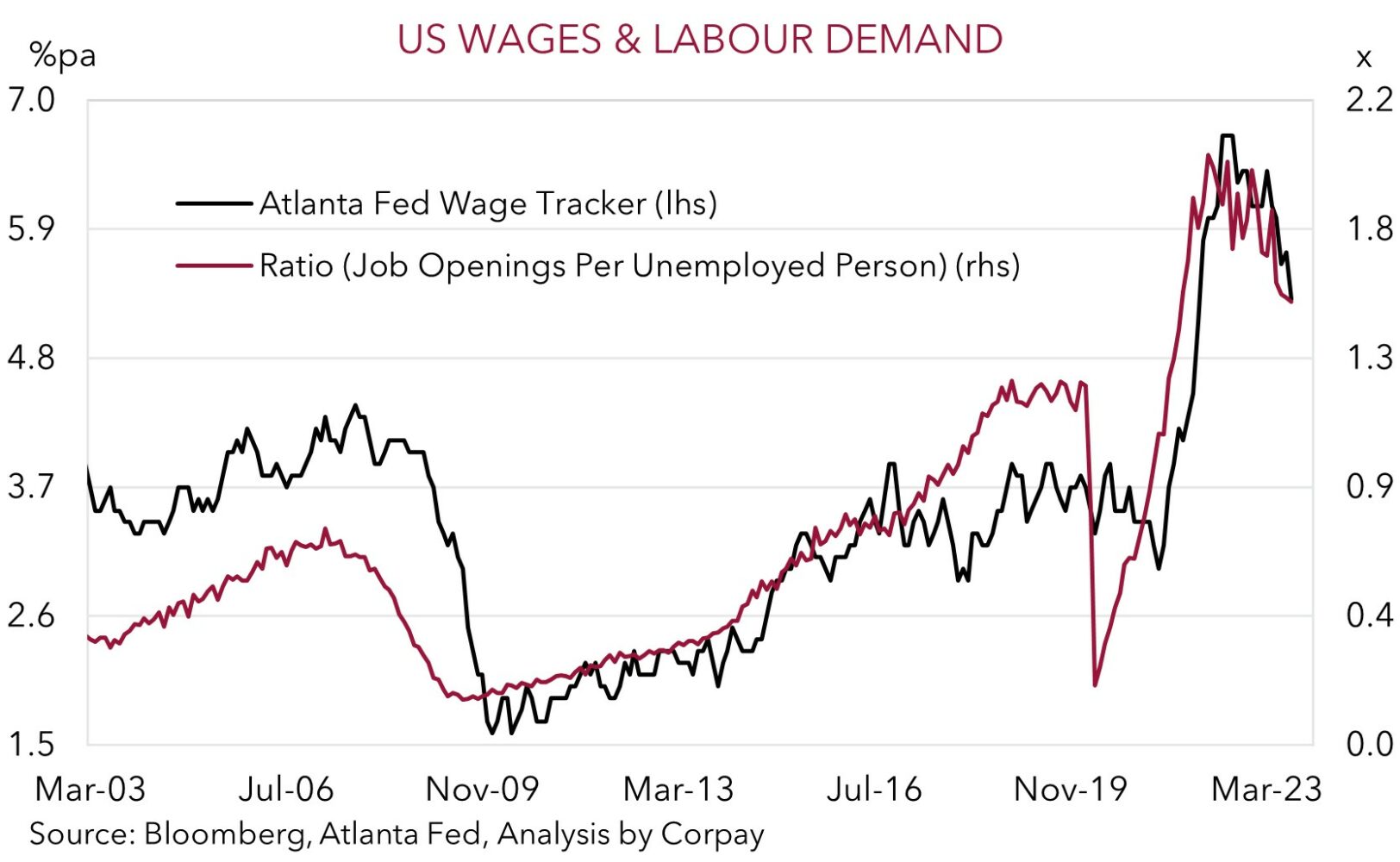

In terms of the US data, job openings rebounded to 9.61mn in August, breaking a run of falls in 6 of the past 7 months. A solid outcome, but a closer look at the detail suggests to us that markets may have over-reacted to the headline JOLTS result. We would note that there was a similar positive surprise a few months ago, but it quickly unwound; a large share of the increase in vacancies in August was concentrated in one sector (professional and business services) rather than being broad-based; and other measures more closely aligned to wage growth (i.e. the quits rate and ratio of vacancies to unemployed workers) held steady or improved.

In our view, a lot now looks to be baked into the USD. And based on current elevated levels and market positioning we think there could be a larger and more negative reaction in US yields and the USD if the incoming ADP employment (11:15pm AEDT), US services ISM (1am AEDT) and/or Friday’s non-farm payrolls report underwhelm.

AUD corner

The AUD has remained on the backfoot over the past 24hrs, with the rise in US yields on the back of the jump up in job openings supporting the USD and dampening risk appetite (see above). This compounded yesterday’s no change RBA decision (see below). The AUD briefly dipped below $0.63 overnight before the sharp fall in USD/JPY stemming from possible Japanese FX intervention helped the USD stabilise. The AUD also lost ground on the crosses, with AUD/JPY the main mover (-1.7% to ~93.80), although it also weakened by ~0.9-1% against the EUR, GBP, and CNH compared to this time yesterday.

AUD/NZD (now 1.0666) is at its lowest level since late-May. Higher prices at the latest dairy auction have given the NZD a bit of a relative helping hand ahead of today’s RBNZ meeting (12pm AEDT) and press conference (1pm AEDT). No change in rates is expected, however the RBNZ could reinforcing its ‘higher for longer’ thoughts via its interest rate forecasts which are already showing the chance of another hike over coming months. If realised, we expect this to keep the pressure on AUD/NZD.

As mentioned, the RBA kept policy steady yesterday with the cash rate remaining at 4.1% for the fourth straight month (see Market Wire: RBA: New governor, same result). This wasn’t a surprise, but the lack of any noticeable change to the post-meeting rhetoric by new Governor Bullock did disappoint some thinking there could be a tweak to the inflation commentary. From our perspective, the hurdle to move again appears high, but it is probably lower than many are now assuming. Another rate rise by the RBA still shouldn’t be completely ruled out given the underlying inflation and wage dynamics. At the very least, we think these undercurrents may mean the RBA doesn’t have the capacity to move as early or go as far as other central banks whenever the global policy easing cycle begins. Over the time, this points to relative yield differentials moving in an AUD supportive direction.

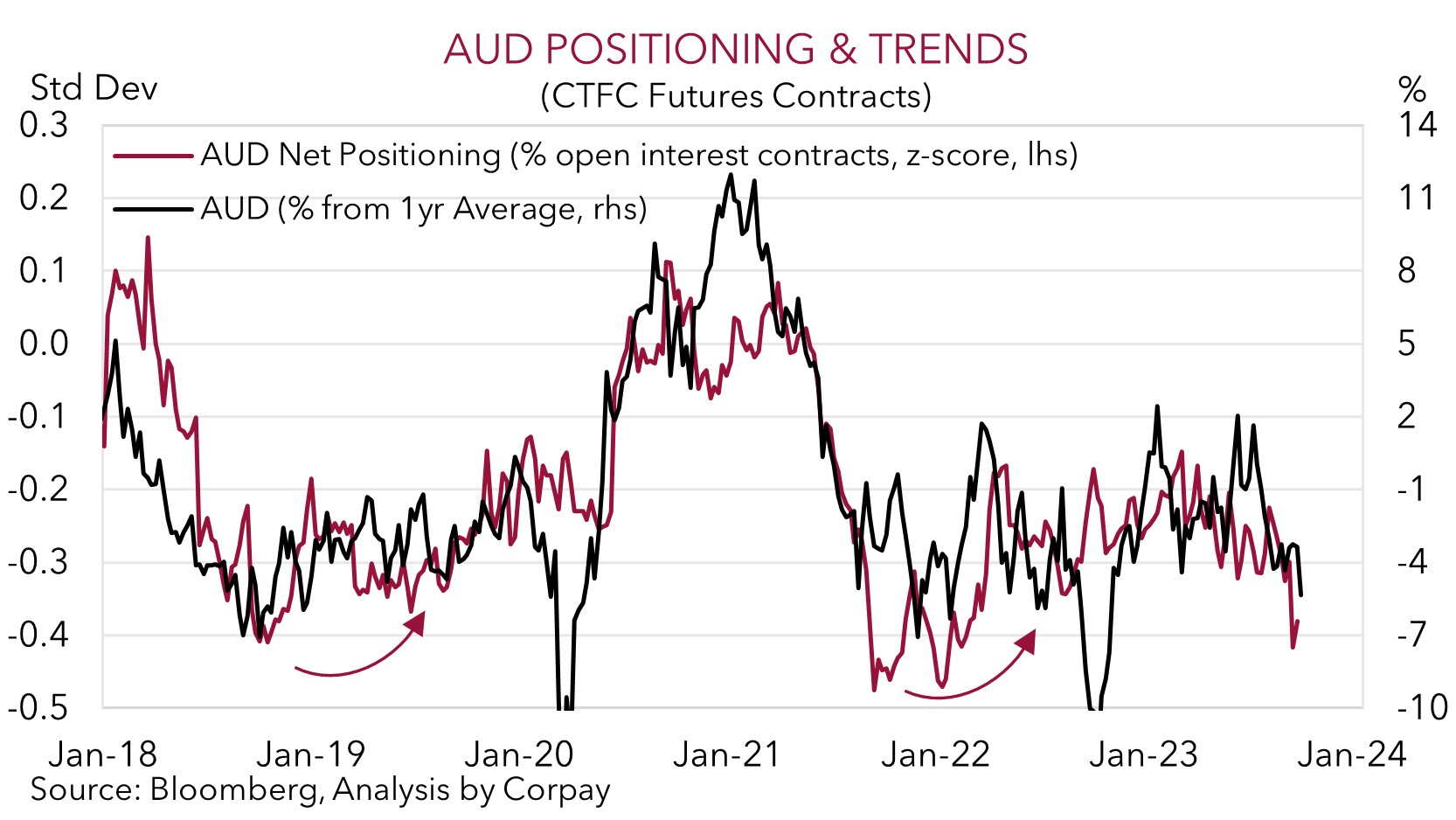

While we believe the market backdrop can keep the AUD heavy over the very near-term, we continue to think that down near current low levels a lot of ‘bad news’ is priced into the AUD and there are uneven medium-term risks from here (Market Musings: AUD: Always darkest before the dawn). Indeed, since 2015, the AUD has only traded sub ~$0.63 around ~1% of the time. Outcomes relative to expectations drive markets. As discussed above, we think a lot of positives now appear factored into the USD with the ‘higher for longer’ US Fed rate view well discounted. As such, we believe the USD is vulnerable to a run of softer US data, an improvement in other major economies, and/or actions to strengthen their currencies. On top of that, AUD positioning and technical momentum indicators are starting to look stretched. History shows that when these forces are in place it may not take much of a shift in market sentiment to see the AUD snap back (see chart below).

AUD levels to watch (support / resistance): 0.6170, 0.6250 / 0.6469, 0.6547