It has been one-way traffic for the JPY over recent weeks. The JPY has depreciated rather sharply against a range of other currencies, including the USD, AUD, and SGD since the Bank of Japan disappointed markets by maintaining its ultra-accommodative stance in late-April. Over the same period interest rate expectations for other major central banks like the RBA, Bank of England, and US Fed have risen (to differing degrees) due to ongoing inflation pressures, while market sentiment has also generally been positive.

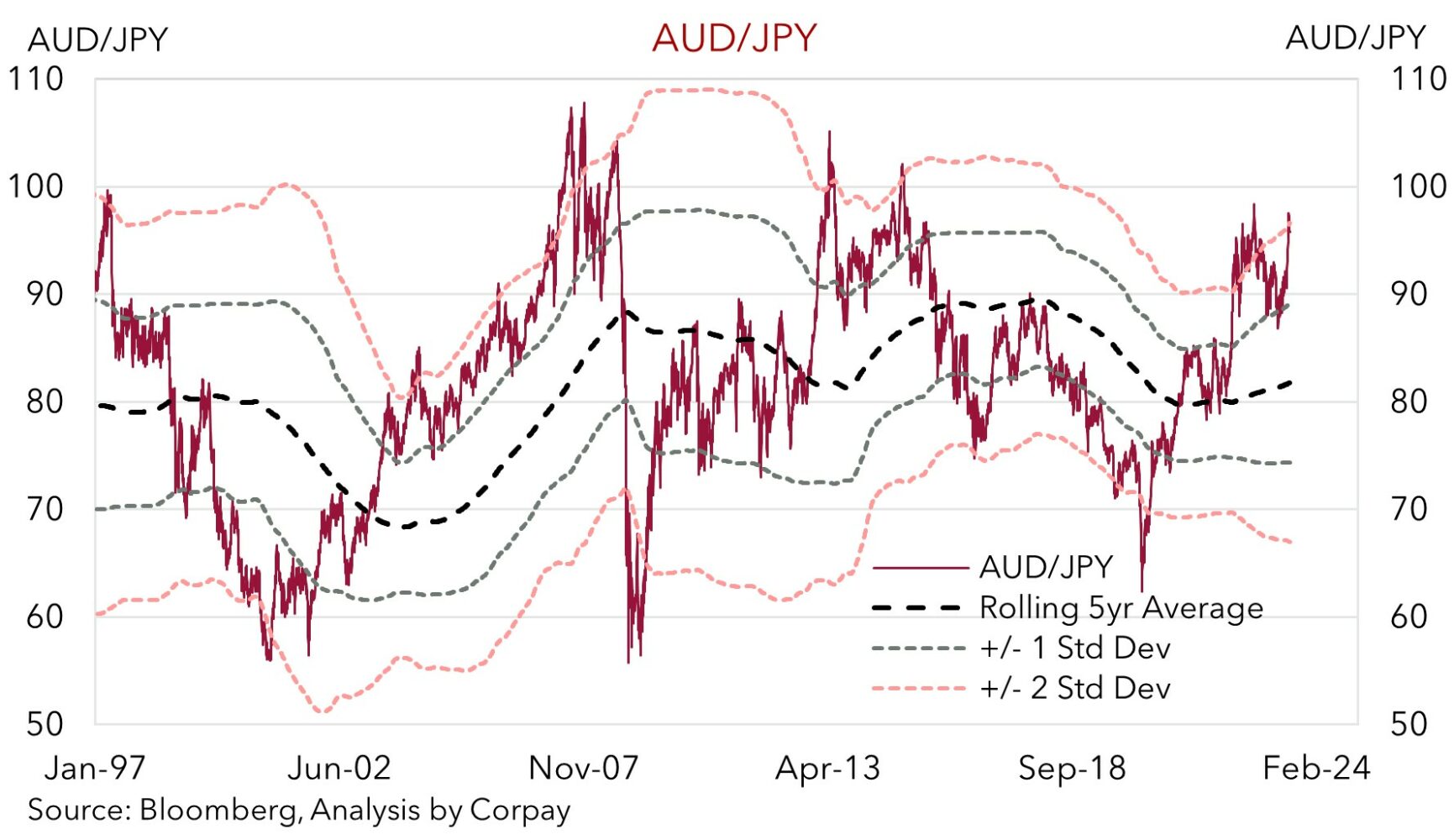

Given where USD/JPY, AUD/JPY, SGD/JPY, and the JPY more broadly are now trading, we think the distribution of medium-term outcomes is becoming increasingly uneven. We see more upside than downside risks to the JPY from current low levels from here (i.e. in our view there is more scope for a large snapback in the JPY over the period ahead with any further weakness likely to be fairly limited). Indeed, as our first chart shows, at ~96 AUD/JPY is around ~2 standard deviations away from its rolling 5-year average. These types of extreme ‘divergences’ haven’t tended to last, with AUD/JPY only trading at ~96 or higher ~5% of the time since 2010. Similarly, SGD/JPY is near record highs, while USD/JPY and EUR/JPY are ~5-7% away from their respectively multi-decade peaks.

Over the medium- to long-term, we expect the JPY to re-strengthen, with USD/JPY projected to fall back down towards the mid-120s over the next few quarters, and AUD/JPY predicted to move back down into the high 80s. A few factors underpin our positive medium- to long-term JPY views.

The BoJ’s policy stance looks untenable

Markets were underwhelmed by the lack of action at the late-April BoJ meeting, the first for new Governor Ueda. However, we think this is unlikely to remain the case for much longer. After years of providing wave after wave of extraordinary stimulus to weaken the JPY, boost growth and lift inflation, the stars finally look to be aligning for the BoJ’s policy impulse to change direction.

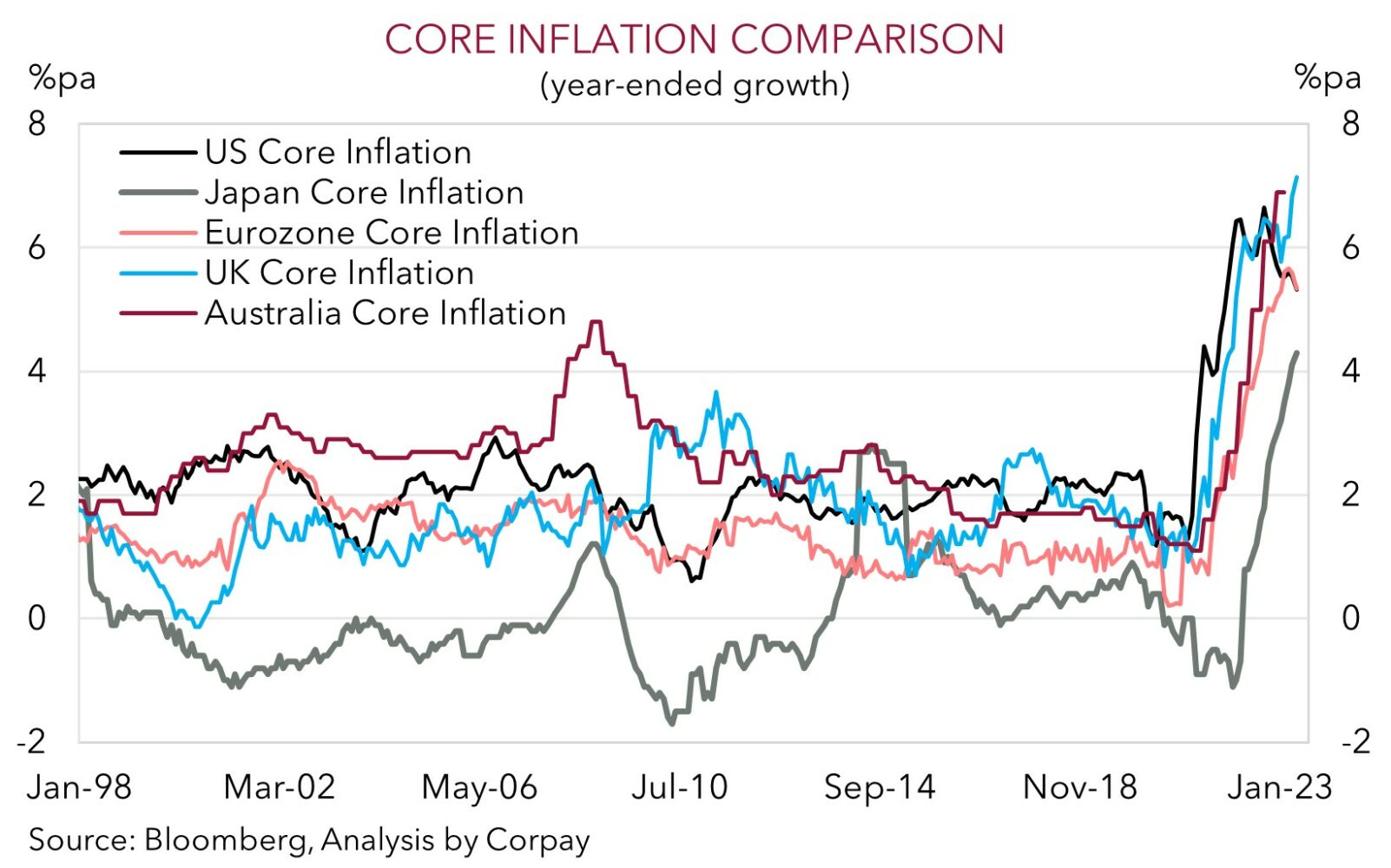

In our judgement, it seems to be a matter of when, not if, adjustments are made, with the BoJ’s ultra-accommodative policy stance looking increasingly untenable based on the upswing in Japanese inflation. As shown, Japan isn’t different, it is only lagging its peers. Core inflation (i.e. ex fresh food and energy) in Japan is now running north of 4%pa, the highest since 1981. Moreover, the recent broad-based JPY weakness, which boosts imported prices, is a added inflation tailwind which could play on policymaker’s minds. Indeed, earlier today in a shot across the bow of FX markets, Japanese Vice Minister Kanda noted that recent moves appear rapid and one-sided, and that he “won’t rule out any options” when it comes to handling the JPY situation. Japan last intervened to strengthen the JPY in October 2022. And while USD/JPY isn’t currently as high as it was back then, the JPY trade-weighted index is a bit weaker reflecting the broader nature of the recent depreciation.

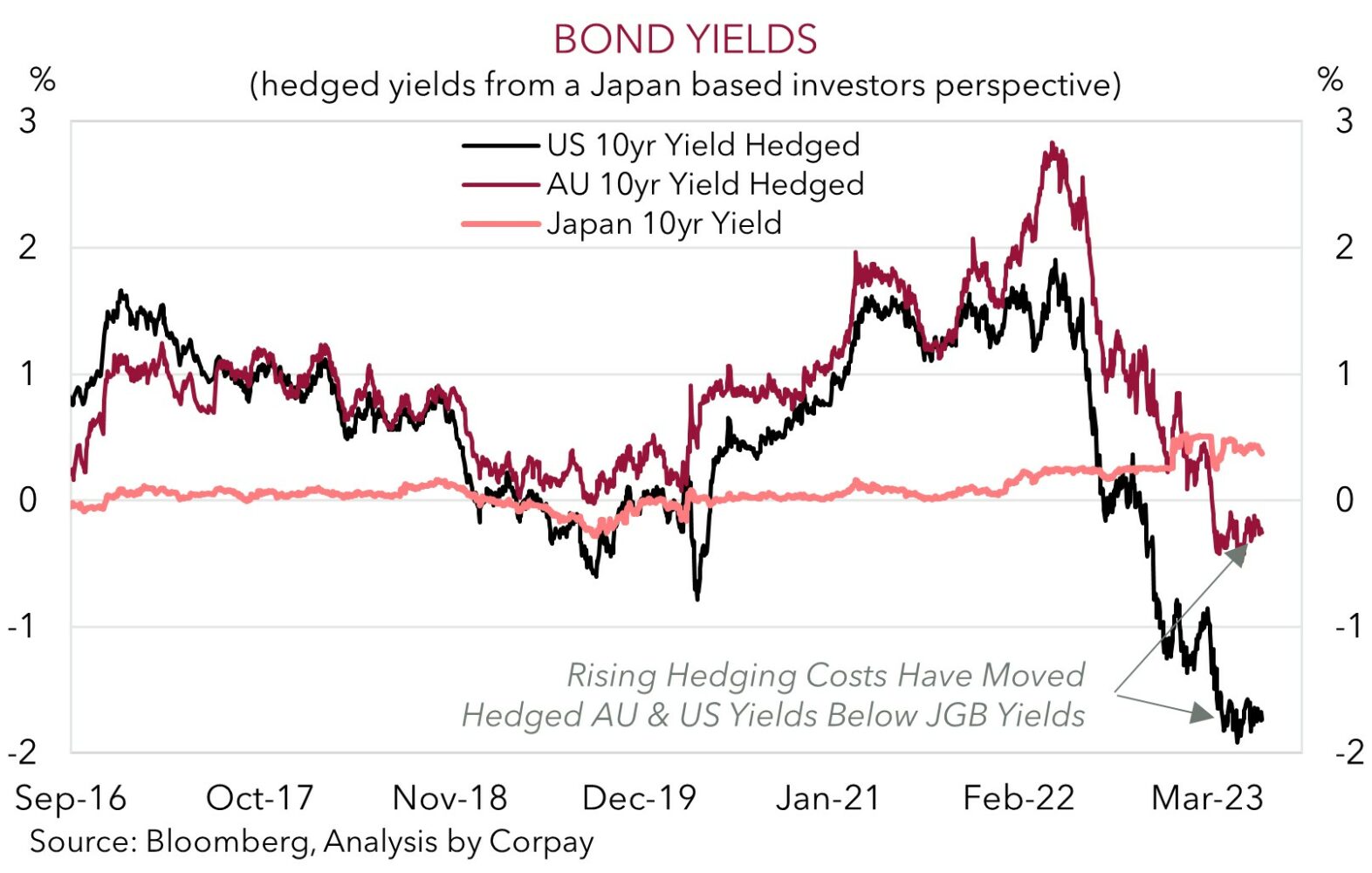

Overall, we believe the data and recent global and domestic trends could see the BoJ upgrade its inflation outlook at upcoming meetings, with the odds policy tweaks are made at the 28 July meeting picking up. Over time, we think shifts by the BoJ could see relative yield differentials progressively move in favour of a stronger JPY, especially as it is likely to be occurring when other central banks are at or very close to the end of their respective tightening cycles. This could also have wide-ranging (and JPY positive) capital flow implications as it may encourage greater inflows into Japan and/or discourage offshore allocations by Japanese investors.

Japan’s improved flow dynamics

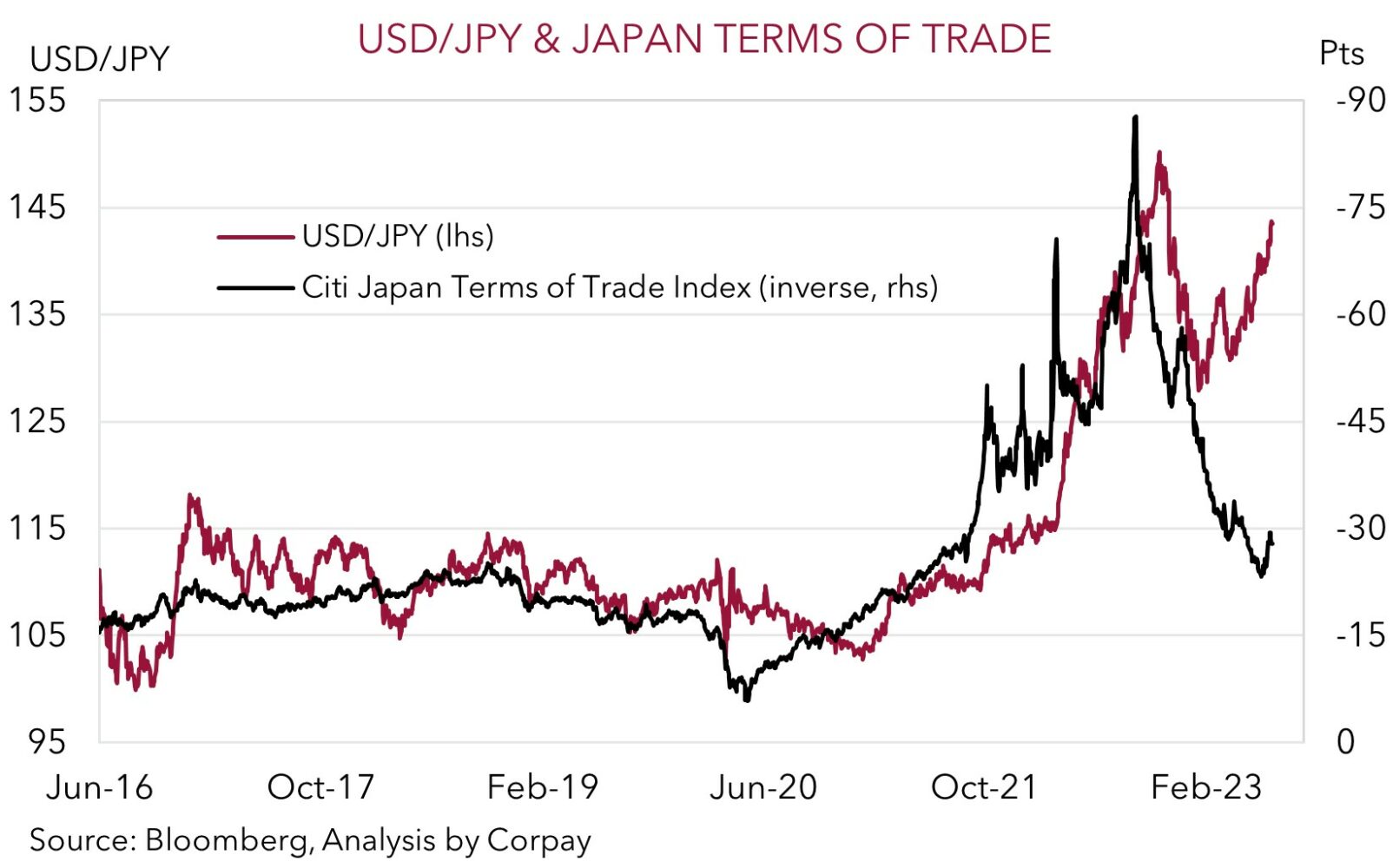

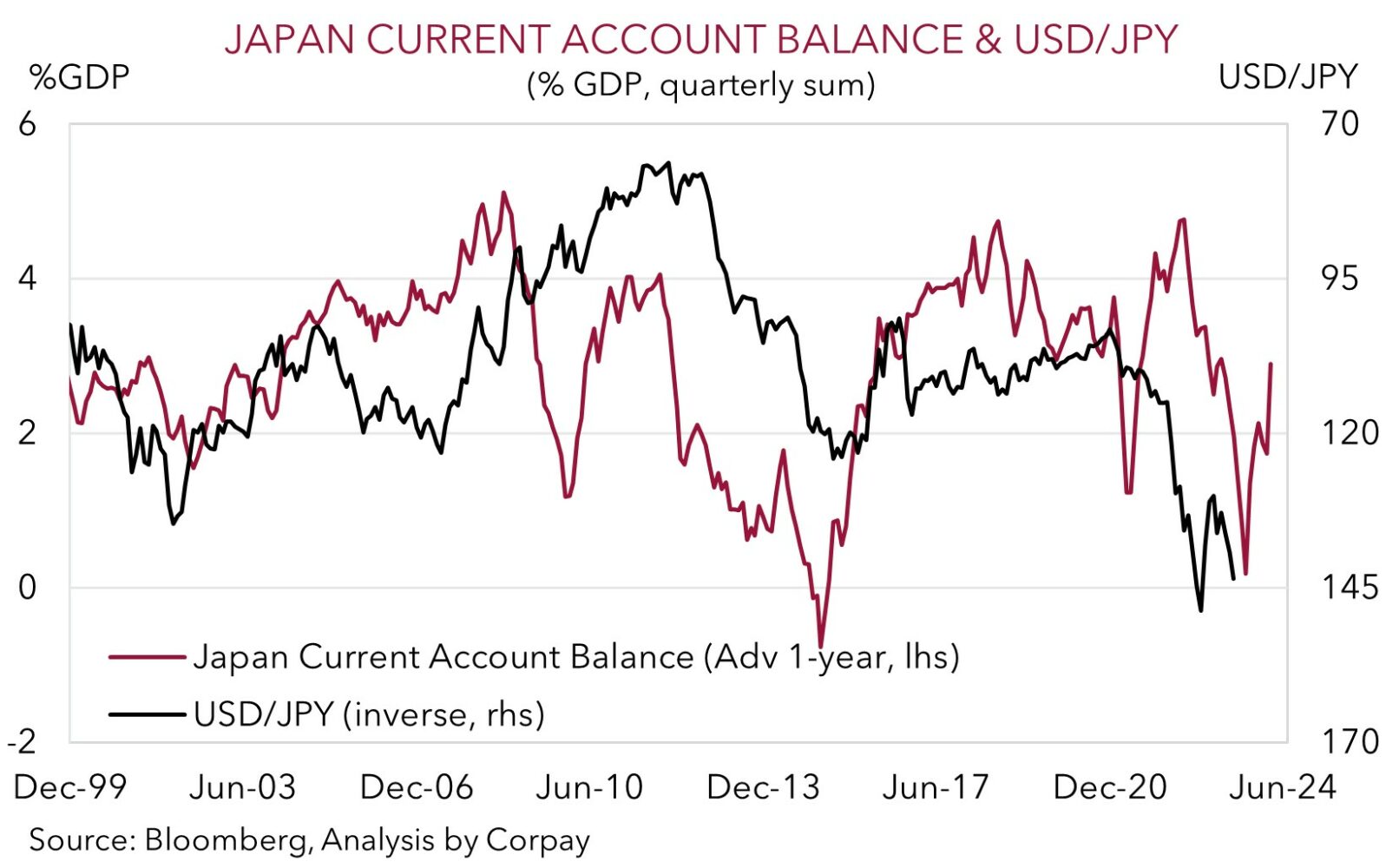

Japan’s trade and balance-of-payments positions, historically sources of JPY strength, have turned more favourable. Last year’s large spike in energy prices effectively wiped-out Japan’s current account surplus and generated a sharp fall in Japan’s terms-of-trade. However, the pullback in energy prices is reversing these trends. This should be a relative positive for the JPY which (as yet) hasn’t been reflected in the price. The last time Japan’s quarterly current account surplus was running at ~3% of GDP and Japan’s terms-of-trade was close to current levels, USD/JPY was near ~115-120.

Risk backdrop & global growth pulse

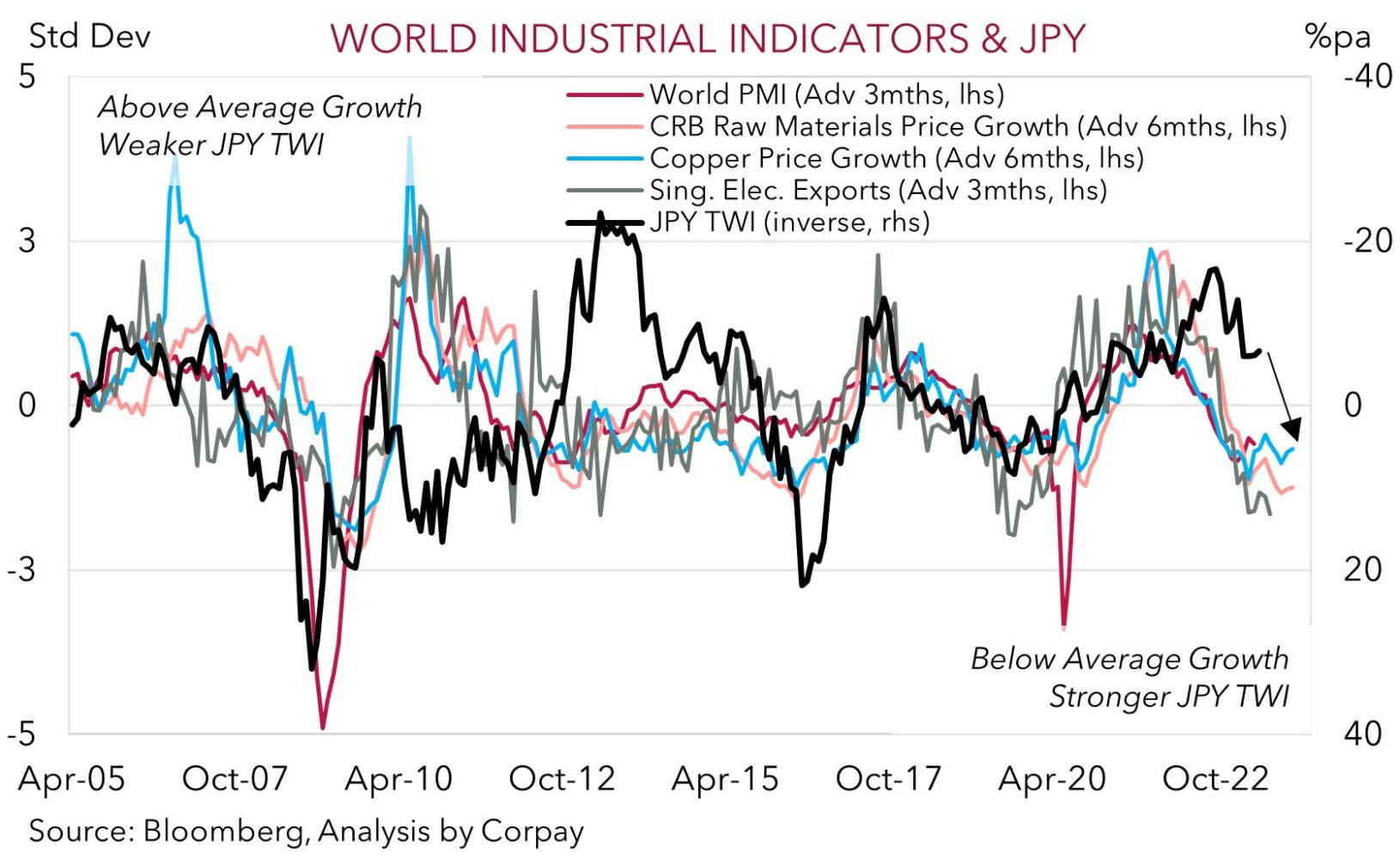

China’s post COVID recovery is faltering while the jump up in interest rates is raising recession odds across many other major economies. In our assessment, the outlook for industrial activity looks particularly troublesome based on China’s sluggish rebound, the high inventory levels in major economies like the US, and tighter credit conditions which should constrain consumer demand and production.

We expect global growth to continue to slow over the coming months. This is the signal a range of leading indicators for industrial activity are pointing to. A step down in activity, and our belief that renewed bouts of market volatility are likely as more ‘aftershocks’ from the most abrupt global tightening cycle in several decades continue to manifest, is normally a positive environment for the JPY.