After a rather torrid May, the AUD has sprung back to life over the past few weeks. At ~$0.6820 the AUD is around the top of its ~4-month range. The AUD has also outperformed on the crosses. AUD/EUR is near its highest level since mid-March, AUD/GBP has moved above its 50-day moving average (~0.5341), diverging interest rate and macro trends have propelled AUD/NZD over ~1.10 for the first time since late-February, AUD/CNH has touched a ~2-year high, and AUD/JPY is north of ~96 (heights it hasn’t been at since last September).

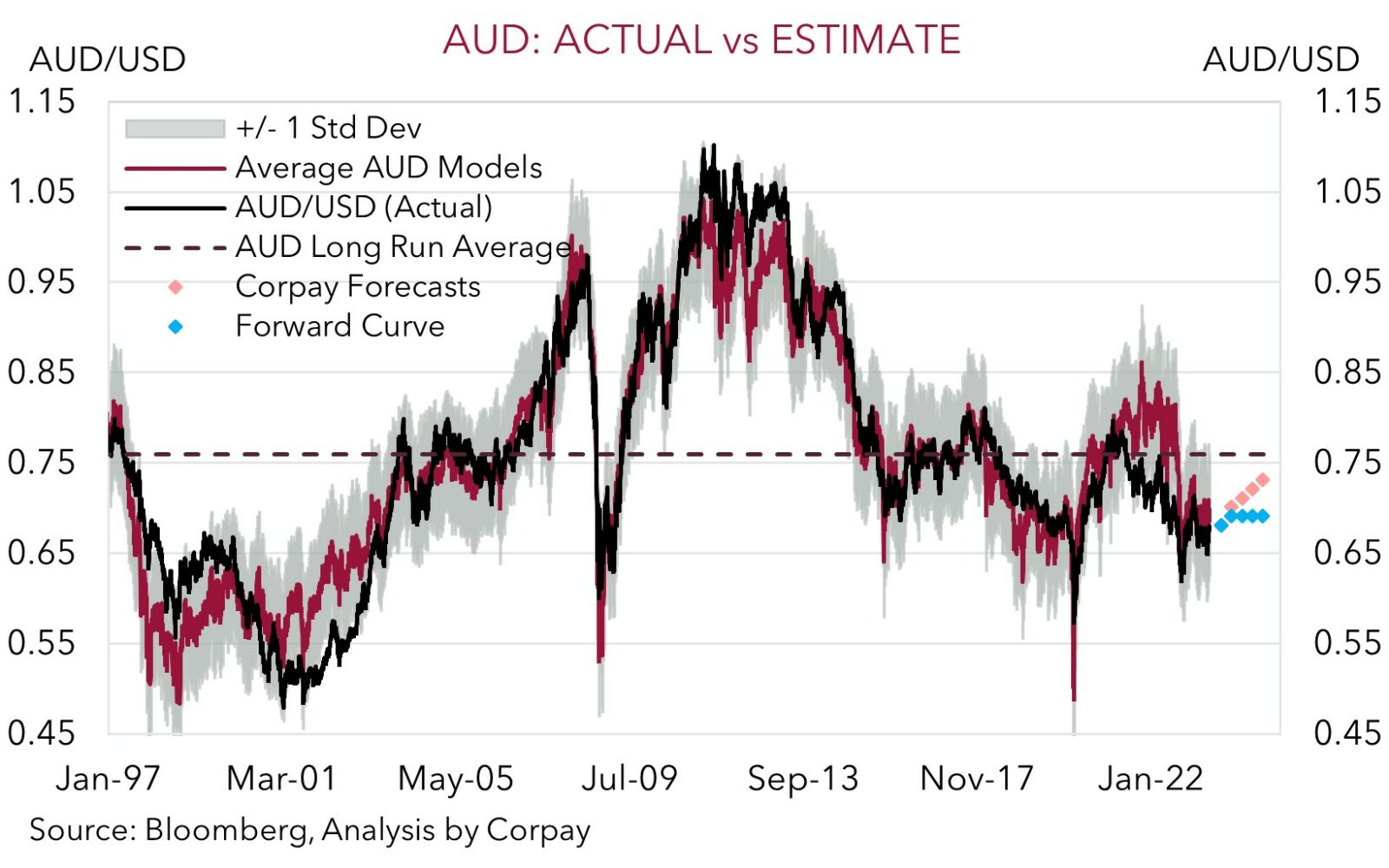

There has been raft of important economic events and data over the past few days, and we have used developments as an opportunity to take stock of our AUD thoughts. It is important to remember that FX is a relative price, how things unfold compared to consensus expectations matters, and that when it comes to the AUD global forces tend to matter more than domestic trends. And on this score, we think that the AUD’s upswing may soon run out of steam. The AUD looks to have moved too far too fast, and we think external headwinds could soon re-emerge, resulting in some renewed underperformance against currencies like the USD, EUR, GBP, and JPY over the period ahead. Overall, we continue to forecast the AUD’s more sustained revival to only come through later this year and over early 2024 with AUD/USD projected to grind back into the low $0.70s over that time.

Interest rates are a relative game

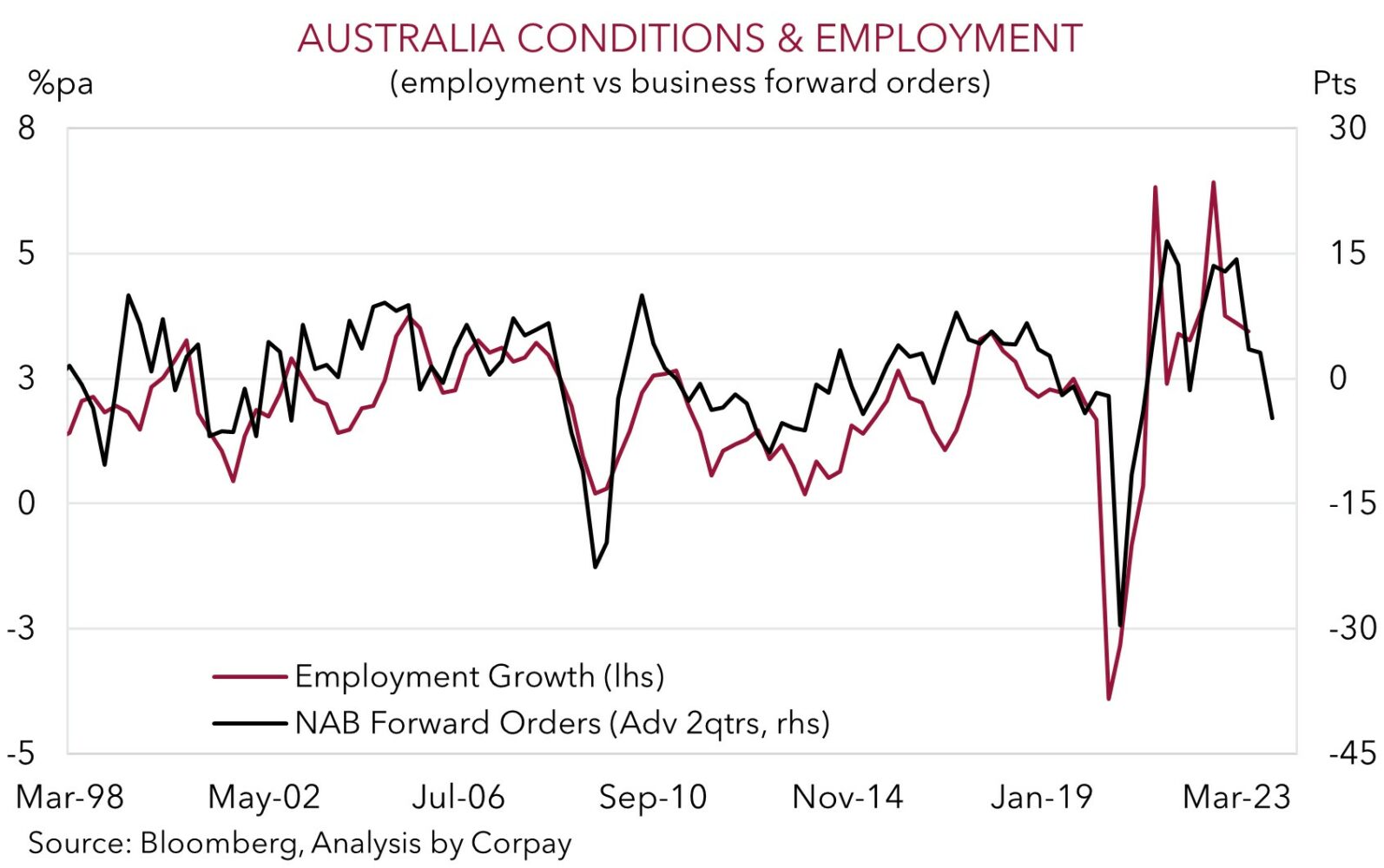

The upward repricing in RBA interest rate expectations following the ‘surprise’ early-June hike has been a factor that has boosted the AUD. The strong May Australian employment report, which showed that an outsized ~75,900 jobs were added in the month and that the unemployment rate dipped back to 3.6%, has reinforced market pricing looking for further RBA rate rises over coming months. In our view, the last legs of the RBA rate cycle now appear well priced, with ~2 more hikes factored in. While inflation pressures remain high and the RBA’s priority, a more forward-looking approach, as evidence that the indebted household sector is feeling the weight of higher mortgage costs piles up, may see the RBA struggle to deliver more than what is now discounted, in our view. The Australia economy already looks to be losing speed, and leading indicators for private sector activity, such as forward orders, have fallen sharply. This points to much weaker growth and employment over H2.

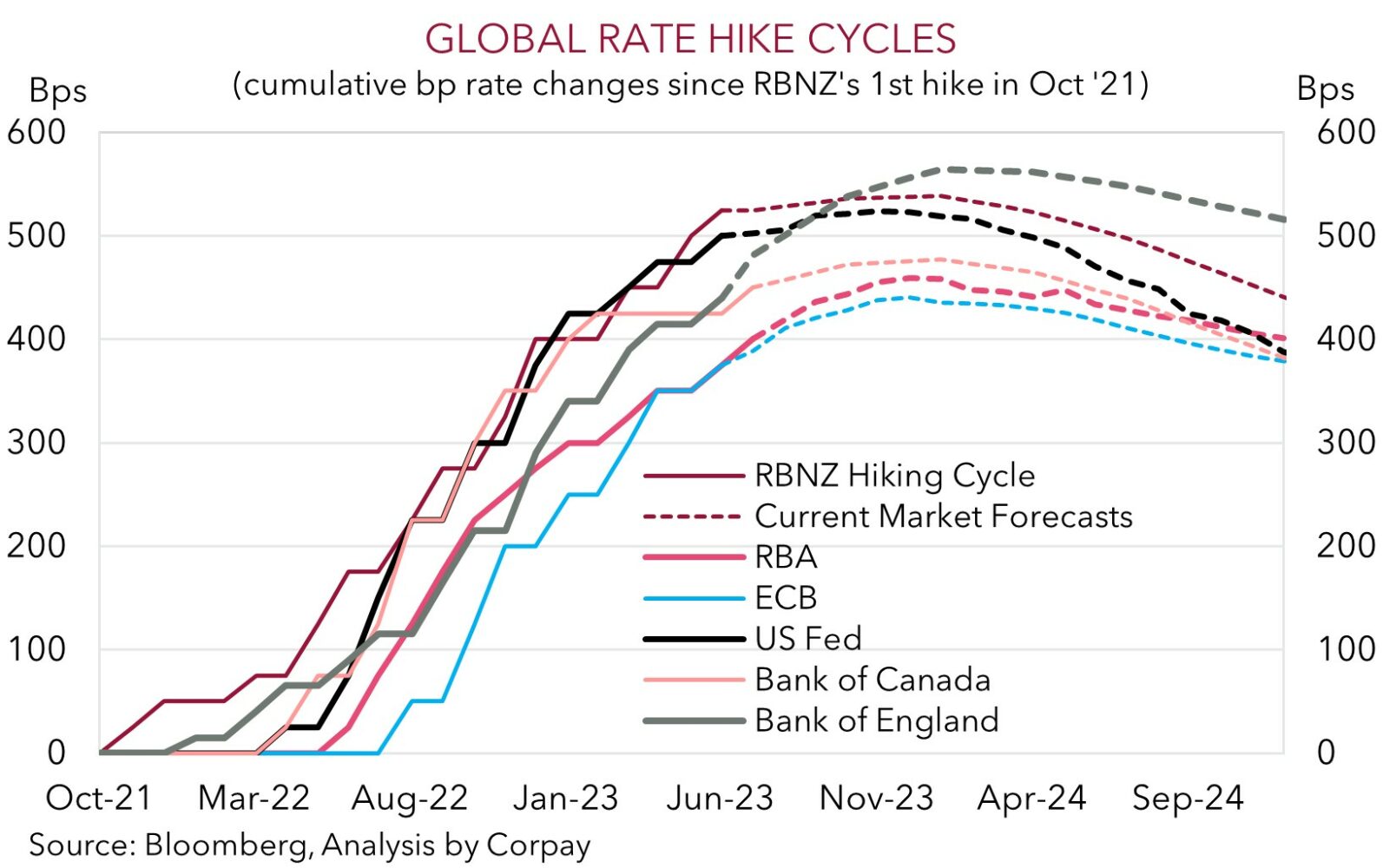

Importantly, the RBA is not alone in this, with other central banks also still in the fight against inflation. As our chart shows, expectations for further interest rate rises by the ECB, and particularly the Bank of England remain firmly in place. We think crystallisation of these predictions should be a relative positive for the EUR and GBP over the AUD. Added to that, while the US Fed ‘paused’ its rate hiking cycle at its mid-June meeting, its underlying message remained quite ‘hawkish’. The FOMC upgraded its interest rate outlook with another ~50bps of hikes now projected over the rest of 2023. However, this still isn’t reflected in US interest rate markets. We think it is wrong for the markets to test the Fed’s resolve and believe that the ‘stickiness’ in inflation and tight labour conditions could see US interest rate expectations adjust higher, which if realised, is likely to reinvigorate the USD at the expense of the AUD.

Global growth pulse

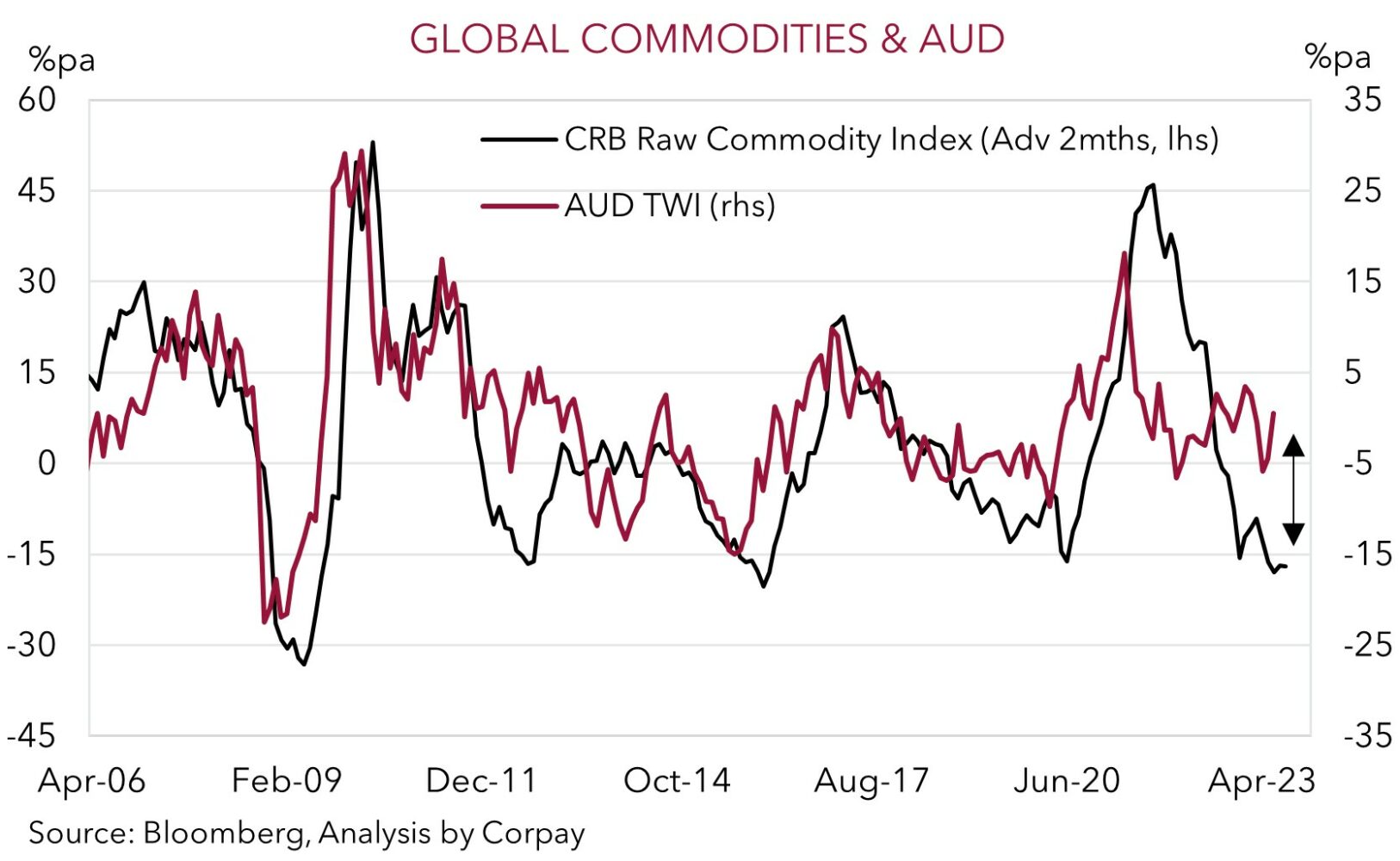

Global growth is slowing as the income squeeze from higher inflation and rising interest rates, and tighter credit conditions act to constrain activity. We expect these adverse effects to intensify over the next few months, with the outlook for commodity-heavy industrial activity looking particularly troublesome. In contrast to the AUD’s recent upturn, a range of leading indicators, such as manufacturing PMIs, freight volumes, export growth, and raw commodity prices are pointing to a step down in global industrial activity. Notably, the weakening growth across many of the major economies is occurring at the same time as China’s post COVID recovery is faltering. China’s May activity data batch again underwhelmed, with momentum slowing across retail sales, industrial production, and fixed asset investment.

While China’s sluggish rebound suggests stimulus measures are increasingly probable, we believe high debt levels and worries about financial stability mean that a more targeted approach aimed at bolstering labour-intensive consumption is more likely than the ‘big bang’ commodity-intensive infrastructure push markets had become accustomed to. Failure by Chinese policymakers to match the markets lofty stimulus expectations, either in size or scope, could be a drag on the cyclical AUD.

Risk sentiment

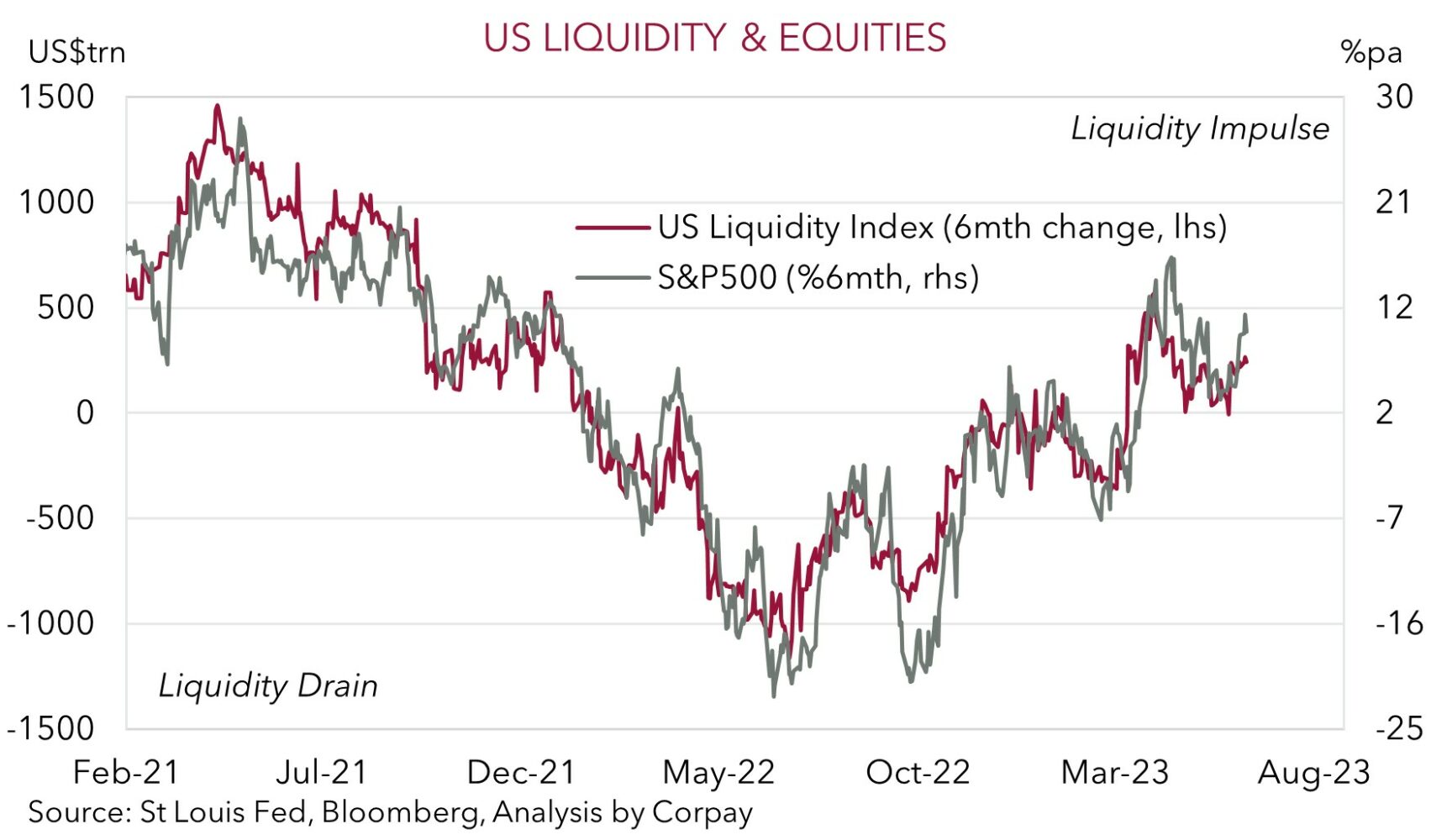

Given the strong correlation to risk markets, another factor underpinning the AUD’s recent revival has been the move higher in global equities. The US S&P500 has risen over the past few months and is now at its highest level since April 2022. A closer look suggests to us that this recent narrowly based rally (a handful of stocks explain the bulk of the market movements) may not be on solid footing. Current above average market valuations leave little room for error as the economy weakens and the outlook for corporate earnings becomes more challenging.

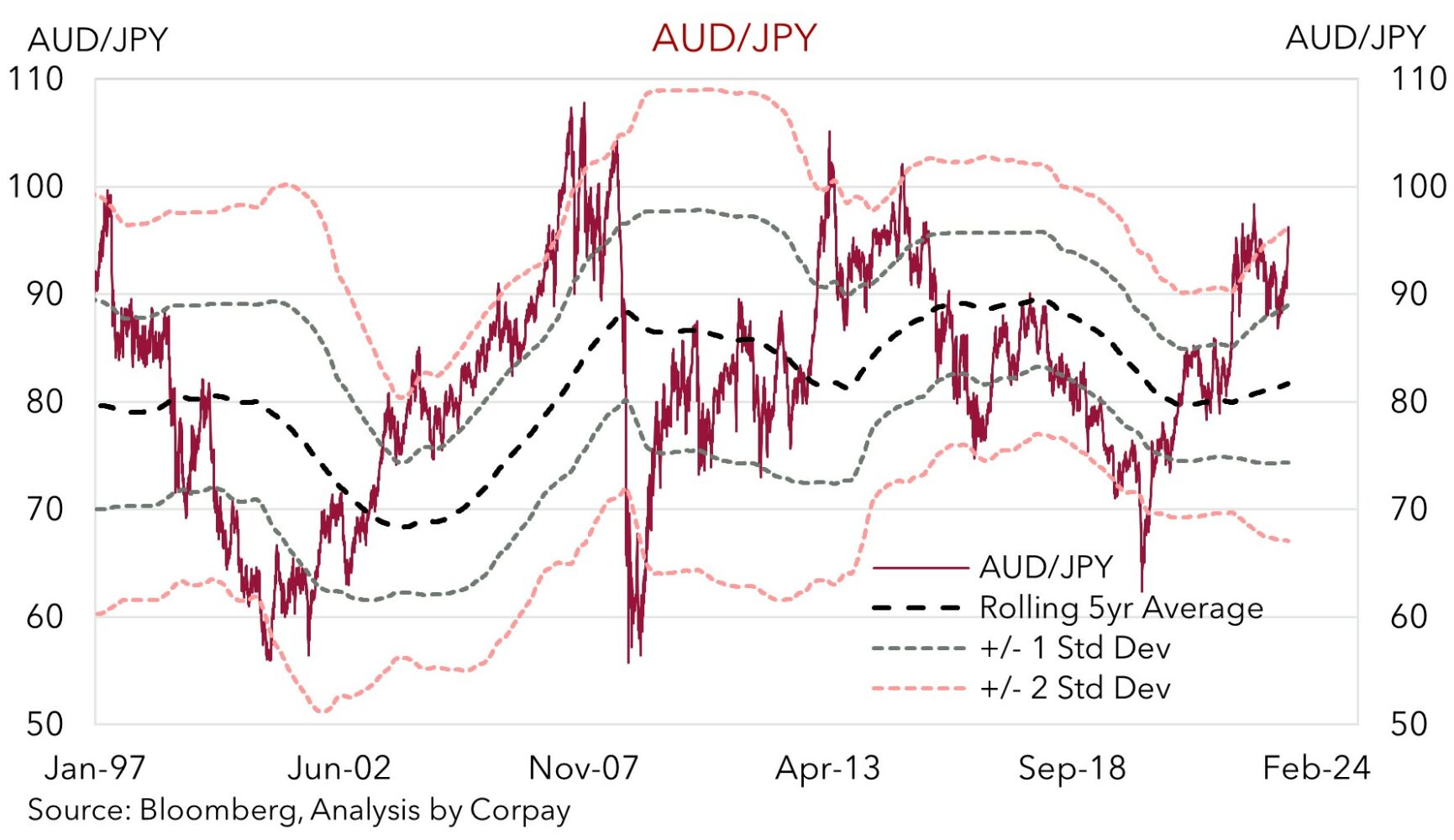

Interestingly, our analysis has also found that the recent rise in US equities may be more a reflection of additional liquidity rather than an improvement in fundamentals. The extra liquidity pumped into the financial system as the US Treasury drew down its General Account during the debt ceiling standoff has coincided with the stock market upswing. However, with the depleted TGA set to be replenished over the next few weeks, the US Fed still undertaking Quantitative Tightening, and a large ECB TLRTO repayment coming up, risk markets could be facing a bit of a ‘liquidity vacuum’. Based on its positive relationship heightened volatility and/or a pullback in equities could exert some pressure on the AUD. Crosses such as AUD/JPY, which have an even higher correlation to equity markets and have performed very strongly, stand out to us as being most vulnerable. At ~96.25 AUD/JPY is now tracking more than 2 standard deviations above its ~5-year average. As illustrated this type of ‘extreme divergence’ hasn’t tended to last that long in the past, with AUD/JPY only trading at ~96 or above ~5% of the time since 2010.