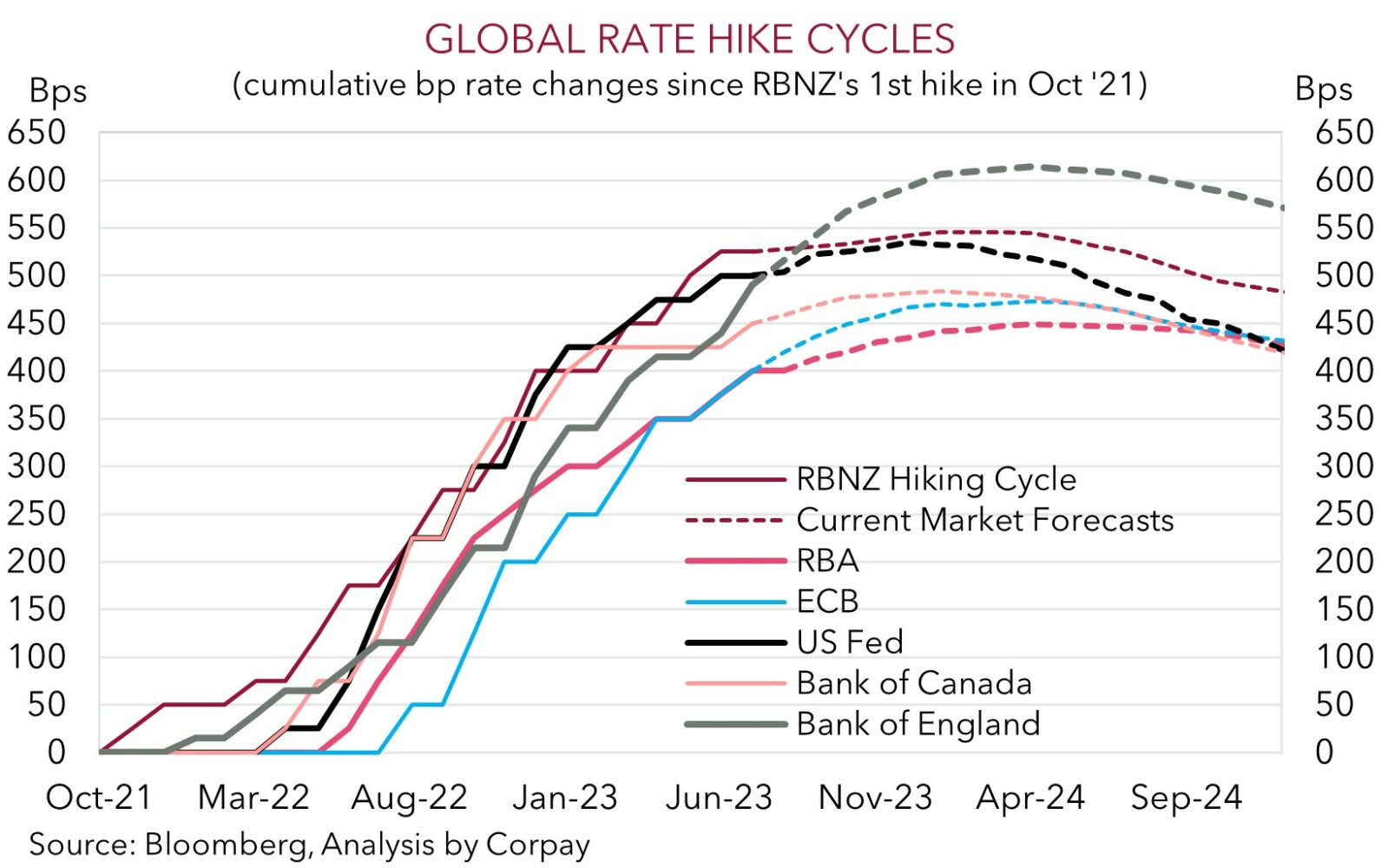

As was universally expected the Reserve Bank of New Zealand kept its Official Cash Rate at 5.5% at today’s meeting. This is the first time the RBNZ has not raised the OCR since the August 2021 meeting. The RBNZ went early and hard, delivering an eye-watering 525bps worth of rate hikes between October 2021 and May 2023. As a result, policy settings in NZ are well into ‘restrictive’ territory (i.e. above the estimated equilibrium ‘neutral’ rate). From our perspective, the underlying message from the RBNZ and developments across the NZ economy suggest that without another positive inflation shock the move in late-May was the last rate rise this cycle. An extended ‘pause’ followed by an easing cycle from H1 2024 now looks set to unfold, in our view.

Indeed, in today’s post meeting statement, rather than provide any strong signals about future steps, the RBNZ simply repeated that policy “will need to remain at a restrictive level for the foreseeable future” to get inflation back down to the 1-3% target range. The RBNZ’s past aggressive actions are clearly starting to gain traction, and this should intensify over the coming months as cumulative intertwined effects kick in. According to the RBNZ, consumer spending has eased, residential construction has declined, and more broadly, businesses are reporting slower demand for goods and services, and weak investment intentions. This, combined with the jump in net migration following the reopening of NZ’s international borders is seeing labour market pressures dissipate. We expect the NZ economy, which has already entered a ‘technical recession’, to be hit quite hard by the RBNZ’s ultra-restrictive stance. In a nutshell, the longer interest rates stay up here, the harder they will bite, particularly once amplifiers such as high debt burdens, lower confidence, and/or rising unemployment take hold.

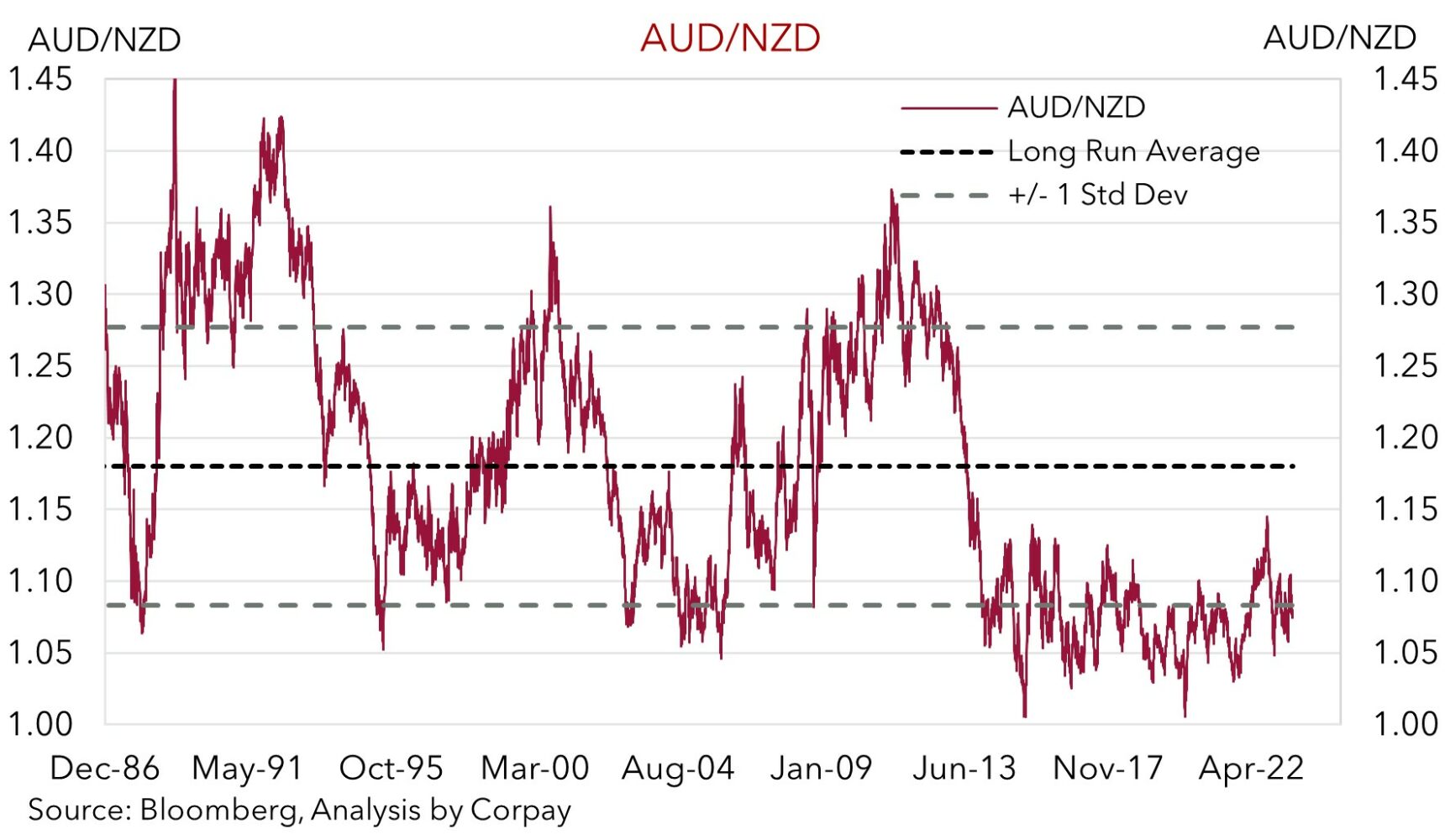

In terms of the NZD, we continue to think that as tightening cycles end (as it looks like it has in NZ), FX markets should progressively focus more on other relative differentials such as growth and labour market trends, current account dynamics, commodity prices, and when policy easing could begin. On this broader set of measures, we believe the NZD, which may also be buffeted by the unfolding global slowdown, should underperform. It will be a bumpy road, but over the next year we see AUD/NZD grinding up above ~1.10 and towards its long-run average (~1.18).

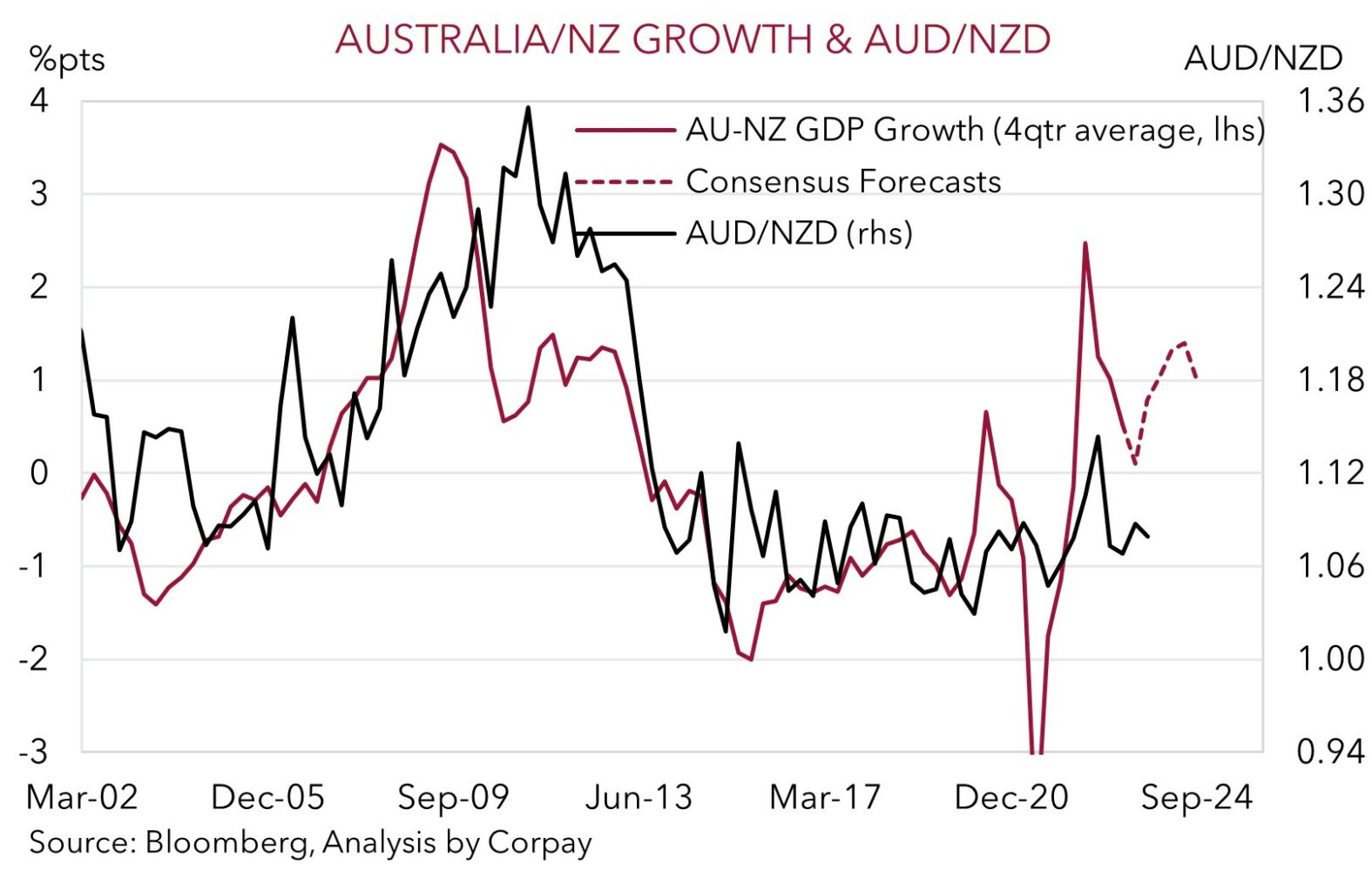

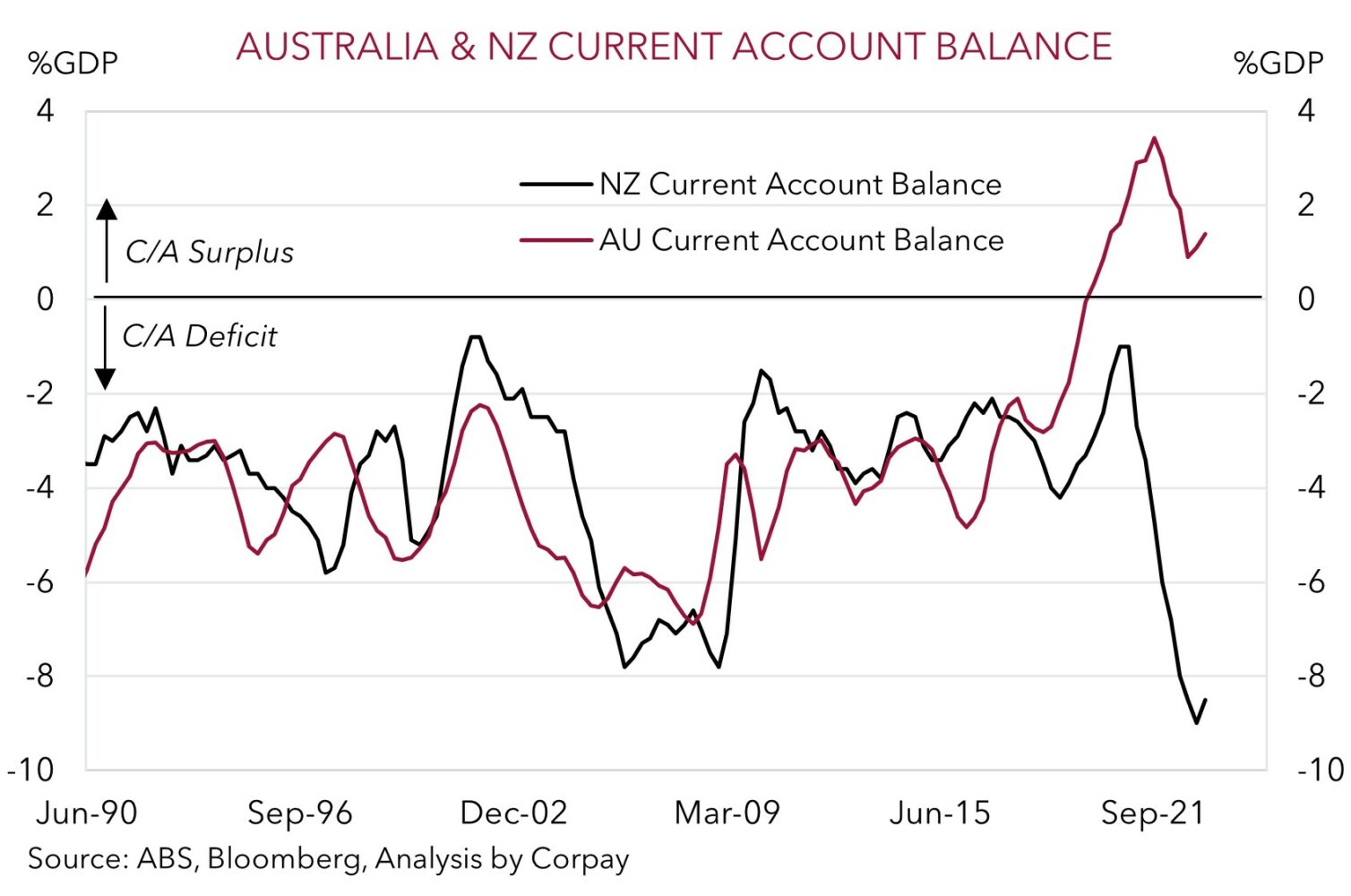

FX is a relative price. In contrast to NZ, which is running a very large current account deficit (now ~8.5% of GDP) that leaves the NZD relatively more exposed during periods of heighted market volatility, Australia has a current account surplus (~1.4% of GDP). This is a flow support that can help insulate the AUD. Moreover, as discussed above, the RBNZ’s earlier and more forceful steps compared to the RBA so far this cycle point greater downside risks in NZ’s economic fortunes. As our chart shows, relative growth and labour market swings between Australia and NZ have generally provided a good guide to medium-term AUD/NZD direction. In our judgement, the expected relatively sturdier growth in Australia points to a higher AUD/NZD over time.