• Macro trends. Weaker EZ PMIs weighed on EUR. Positive US surprises also helped the USD. AUD drifted lower, but still rose over the week.

• AUD crosses. Diverging trends still AUD supportive, particularly on crosses. AUD/EUR & AUD/CAD near respective 1-year highs. AUD/JPY north of 106.

• Event radar. Locally, monthly CPI (Weds) & speech by the RBA Dep. Gov in focus. US PCE deflator due (Fri) & first Presidential Election debate will be held.

Diverging business PMI data from Europe and the US generated a few intra-session market gyrations on Friday. The US data defied gravity with the PMIs improving in June rather than falling back as predicted. However, in Europe the opposite occurred with manufacturing falling further into ‘contractionary’ territory and the services sector losing steam. In response, European bond yields (Germany 10yr -2bps), equity markets (EuroStoxx600 -0.7%) and the EUR (now ~$1.0690) slipped back.

By contrast, although the US stockmarket ended a touch lower (S&P500 -0.2%) bond yields consolidated with the benchmark US 10yr rate hovering around 4.26% and the USD ticked up. In addition to the EUR’s pullback, the USD was also propped up by: (i) a softer GBP (now ~$1.2638) with a drop in the UK services PMI to a 7-month low overpowering the positive surprise in UK retail sales; and (ii) a weaker JPY which was weighed down by a slightly bigger than forecast deceleration in Japanese core inflation. USD/JPY (now ~159.75) is a whisker away from its late-April multi-decade peak, levels which previously triggered bouts of intervention by Japanese authorities. The firmer USD and decline in base metal (copper and iron ore fell 2.3%) and energy prices (WTI crude oil -0.9%) took some of the heat out of the AUD (now ~$0.6640).

This week there are a few global events on the radar. In Europe, the German IFO survey is released (6pm AEST) and the first round of the French parliamentary elections will be held next weekend. In the US speeches by Fed members are scattered throughout the week, durable goods orders (a proxy for business investment) (Thurs AEST) and the PCE deflator (the Fed’s preferred inflation gauge) (Fri AEST) are due, and the first debate between President Biden and former President Trump will be held (Fri morning AEST).

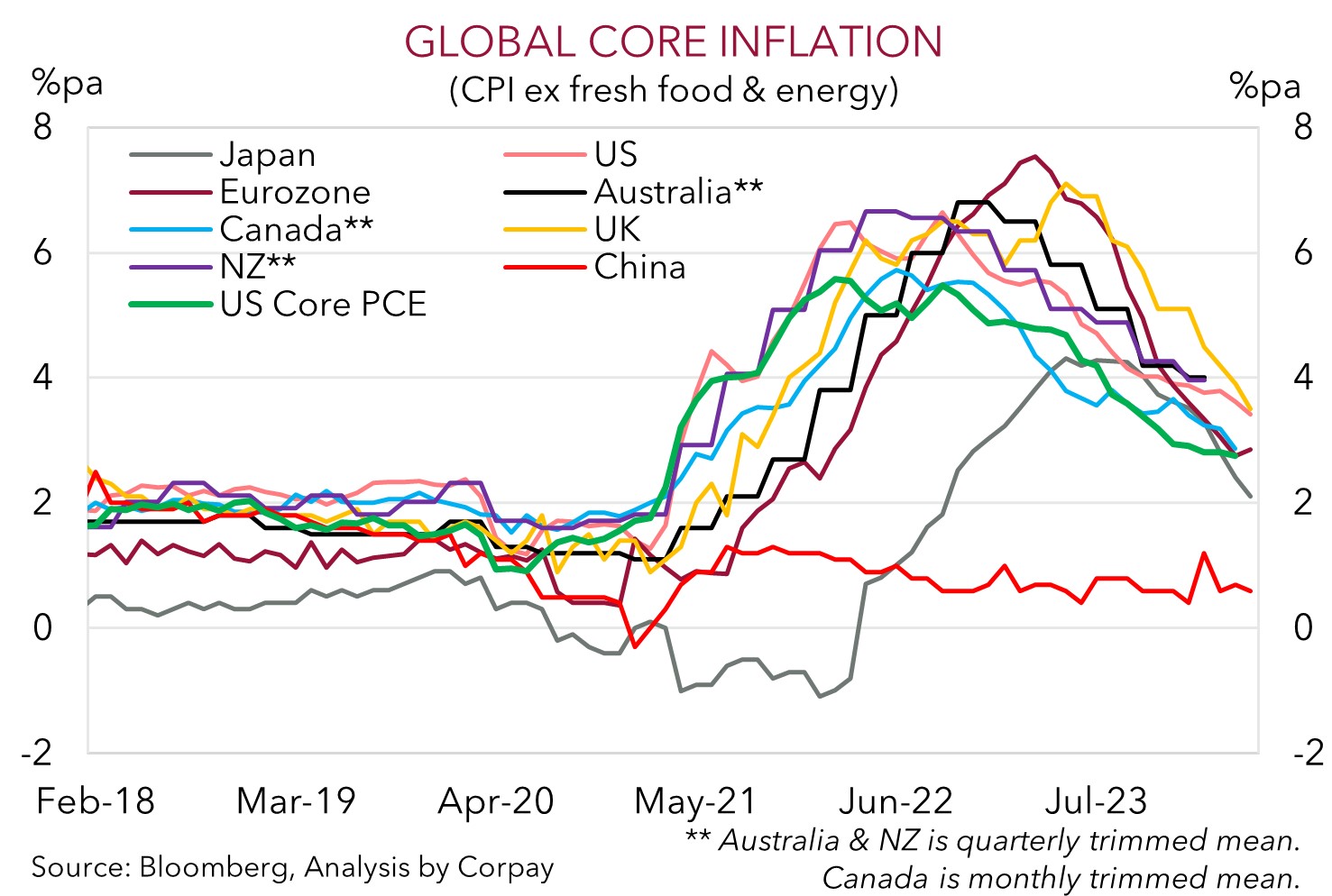

All up, while jitters about the upcoming French elections and sluggish momentum across the Eurozone economy may hold back the EUR, we think a decent amount of negative sentiment is already discounted around current levels. Indeed, we believe the incoming US news could create renewed USD headwinds. Based on the bits and pieces that flow through from the already released CPI and PPI reports, we think the core PCE deflator should step down. If the markets 2.6%pa forecasts are realised this would be slowest pace of core inflation since Q1 2021. This, coupled with subdued durable goods orders might bolster Fed rate cut bets, exerting pressure on the USD.

AUD Corner

The firmer USD stemming from the relative outperformance in the US PMI data, combined with some negative risk sentiment (as illustrated by weaker US/European equity markets and lower base metal/energy prices) exerted a little downward pressure on the AUD on Friday. That said, the AUD (now ~$0.6640) still recorded its second straight weekly gain, the first time this has happened since February, with the currency tracking near its 1-month average. The AUD also slipped back a fraction on most of the major crosses, though this comes after a strong run. Indeed, AUD/EUR (now ~0.6210) and AUD/CAD (now ~0.9095) are still around the upper end of their respective 1-year ranges. AUD/CNH (now ~4.84) is just shy of multi-month highs, and AUD/NZD is approaching its 50-day moving average (~1.0884). By contrast, the upswing in AUD/JPY extended with the pair (now ~106.08) at levels last traded in Q4 2007. This is quite rarefied air. On our calculations, since 1995 AUD/JPY has only been above 106 on 17 occasions (i.e. 0.2% of the time).

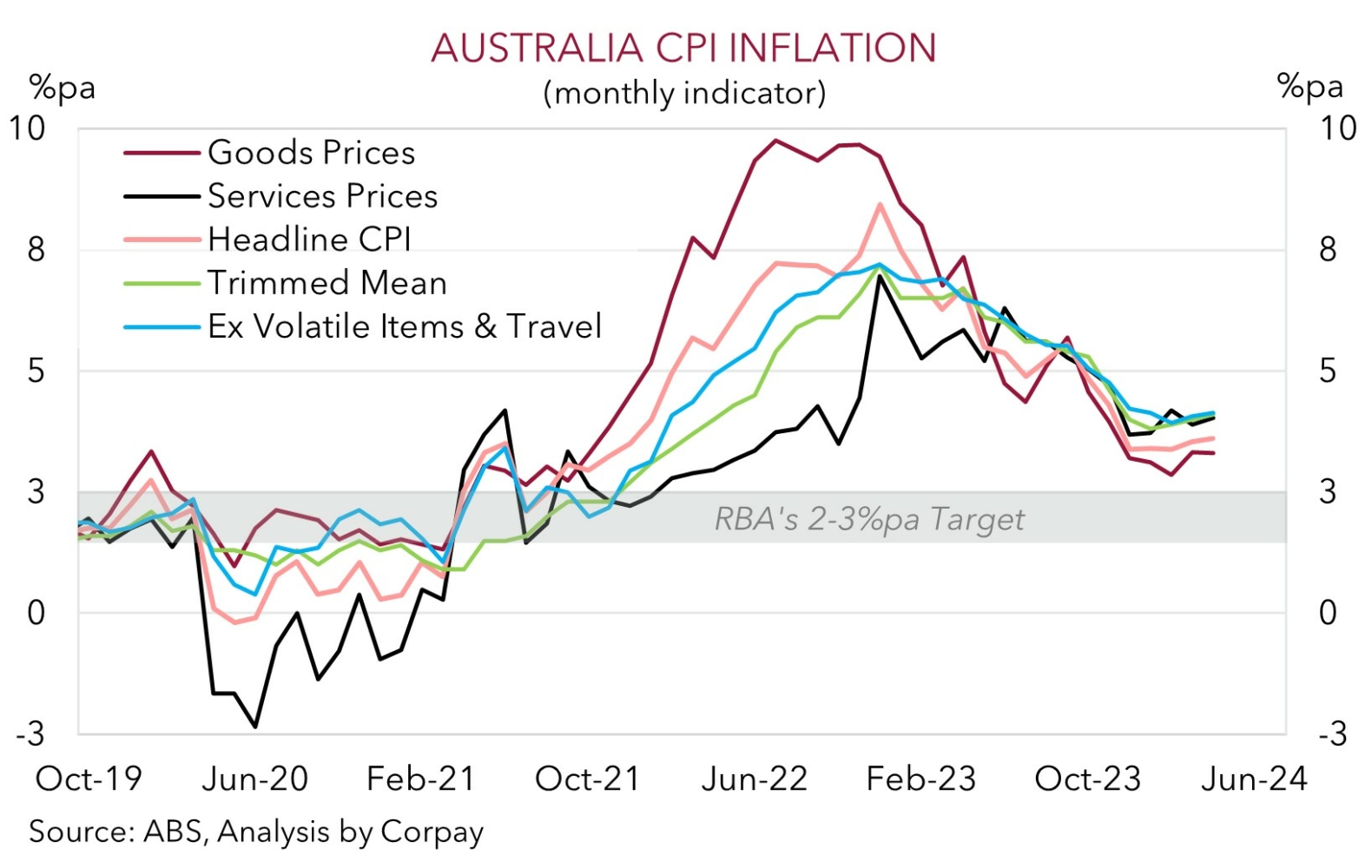

This week, in addition to the global events mentioned (e.g. US durable goods (Thurs night AEST), US PCE deflator (Fri night AEST), US Fed speakers, US Presidential Election debate (Fri morning AEST)), the AUD could also be influenced by the local monthly CPI indicator (Weds) and a speech by RBA Deputy Governor Hauser (Thurs night AEST). In our opinion, thanks to positive base-effects and more information on sticky services prices this time out, annual inflation rate looks to have quickened in May. Analysts are looking for headline inflation to accelerate from 3.6%pa to 3.8%pa.

We believe more signs the improvement in Australian inflation is stalling and/or cautious comments from Deputy Governor Hauser could solidify thinking that the RBA is on a different path to other central banks. This narrative would also be reinforced by confirmation in the US PCE deflator data that US inflation pressures are also receding. We remain of the view that the start of the RBA’s easing cycle is some way off. Markets agree with the first RBA rate cut now not fully factored in until mid-2025, with a ~20% chance another rate hike is delivered by September also priced in. In our judgement, the diverging economic and monetary policy trends between Australia and others, and a paring back of bearish ‘net short’ positioning (as measured by CFTC futures) can be AUD supportive in the near-term, not just against the USD but also on crosses like AUD/EUR, AUD/CAD, AUD/NZD, and AUD/CNH (for more see Market Musings: RBA: No retreat, No surrender).