• Consolidation. Quiet start to the week. Easing French election risks supported European equities & the EUR. Softer USD pushed AUD a bit higher.

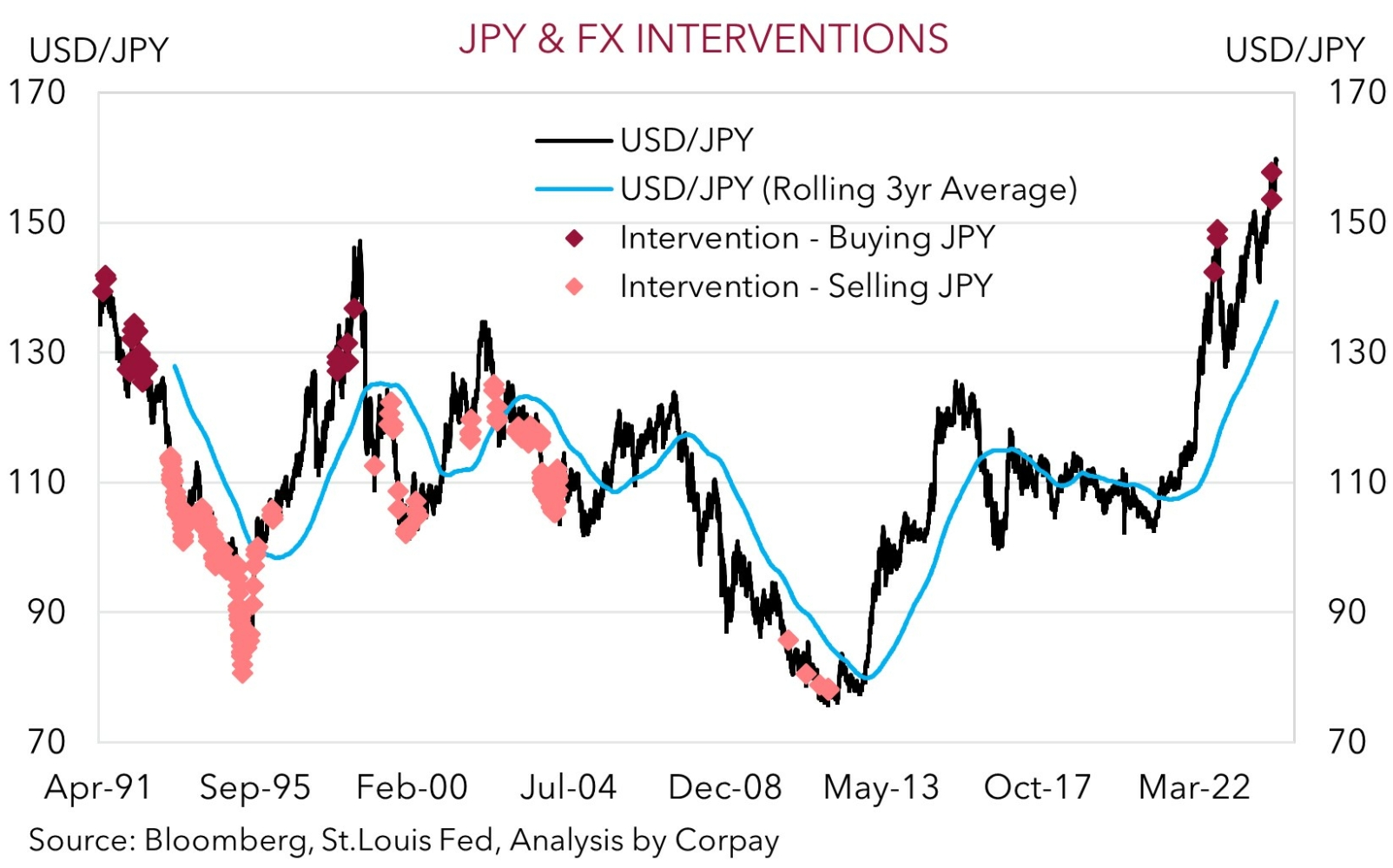

• JPY watch. USD/JPY is around levels which previously triggered bouts of FX intervention. Verbal rhetoric by Japanese officials is starting to pick up.

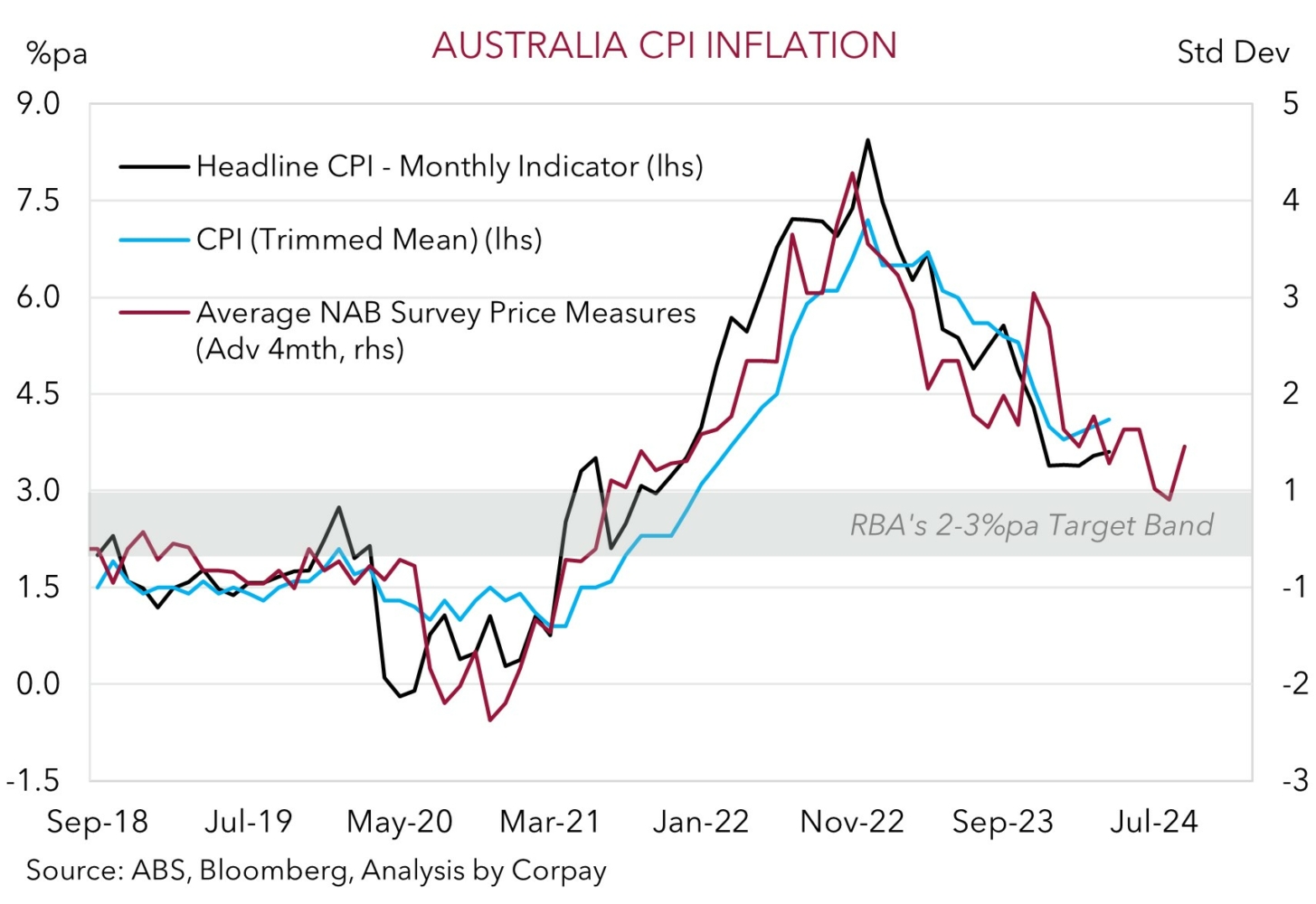

• Inflation pulse. US core PCE deflator (due Fri) likely to slow, while monthly AU CPI (due Weds) could re-accelerate. Diverging trends are AUD supportive.

It has been a quiet start to the new week. This isn’t surprising given the bulk of the potential market moving global releases such as US durable goods orders (a proxy for business CAPEX) (Thurs AEST) and the US PCE deflator (the Fed’s preferred inflation gauge) (Fri AEST) are due later this week. On top of that the first debate between President Biden and former President Trump will also be held (Fri morning AEST).

In Europe an easing of French election jitters ahead of this weekends first round of voting saw equities rebound (EuroStoxx50 +0.9%), the spread between French and German bond yields (a gauge of inter-region stress) narrow, and the EUR tick up (now ~$1.0735). Improved sentiment towards the upcoming French elections more than offset another soft Eurozone activity survey with the German IFO expectations index falling for the first time in five months. By contrast, US equities slipped back with weakness in market heavyweight NVIDIA dragging on the IT sector and the whole index (S&P500 -0.3%, NASDAQ -1.1%). US bond yields also shed ~1-2bps. This, and the modest rebound in the EUR and GBP (now ~$1.2688), exerted a bit of downward pressure on the USD index.

Elsewhere, USD/SGD is hovering near its 50-day moving average (~1.3531), the AUD has edged up a little (now ~$0.6660), as has the NZD (now ~$0.6125). USD/JPY is tracking just shy of ~160, a historically high rate given it last sustainably traded above this level in the mid-1980’s. As our chart shows, USD/JPY is also in the ballpark which previously triggered bouts of intervention by Japanese authorities aimed at propping up the weak JPY. Unsurprisingly, the verbal rhetoric has started to ramp up. Yesterday Japan’s Vice Finance Minister Kanda stressed that “in the event of excessive moves based on speculation, we are prepared to take appropriate action”. While a fresh round of FX intervention wouldn’t change the underlying trend, it could likely create more two-way risk in the JPY. And given it is the second most traded currency pair a knee-jerk fall in USD/JPY could give other currencies like the AUD a boost.

Tonight, the US Fed’s Bowman (9pm AEST) and Cook (2am AEST) speak on the outlook. Mixed signals are probable given Bowman is normally at the ‘hawkish’ end of the spectrum while Cook is typically more ‘dovish’. As such, the net market impact may be limited. Beyond that the incoming data will be key. As outlined yesterday, we think a step down in the US core PCE deflator, coupled with subdued durable goods orders might bolster US Fed rate cut bets, weighing on the USD.

AUD Corner

The AUD has nudged up a touch at the start of the new week with the slightly softer USD driven by the rebound in the major European currencies a factor (see above). At ~$0.6660 the AUD is within 0.9% of its multi-month highs. On the crosses, it has been a mixed 24hrs with the AUD ~0.1-0.2% firmer against the JPY, NZD, and CNH, while it is ~0.15% softer against the EUR and GBP. That said, in level terms AUD/EUR (now ~0.62) is still near the upper end of its 1-year range. AUD/NZD (now ~1.0870) is above its 6-month average. And AUD/JPY (now ~106.25), which we feel is looking stretched relative to long-term interest rate differentials, is also historically high given it has only traded above 106 ~0.2% of the time since 1995.

Locally, as flagged yesterday, the monthly CPI data (released Weds) and a speech by RBA Deputy Governor Hauser (Thurs night AEST) are the main events this week. Due to positive base-effects, more information on sticky services prices in the May data, and the signal from leading indicators, we believe annual inflation re-accelerated. Analysts are looking for headline inflation to have quickened from 3.6%pa to 3.8%pa.

In our opinion, more signs Australia’s disinflation trend is stalling and/or cautious comments from Deputy Governor Hauser suggesting further rate hikes aren’t off the table may reinforce thinking that the RBA is on a different path to other central banks. We continue to hold the view that the start of the RBA’s easing cycle is some way off. Markets aren’t factoring in the first RBA rate cut until mid-2025, with a ~20% chance another rate hike is delivered by September also priced in. The diverging economic and monetary policy trends between Australia and others, and a reduction of still bearish ‘net short’ positioning (as measured by CFTC futures) can be AUD supportive in the near-term, in our view, not just against the USD but also on crosses such as AUD/EUR, AUD/CAD, AUD/NZD, and AUD/CNH (for more see Market Musings: RBA: No retreat, No surrender).