• Mixed markets. European equities rose, while US stocks slipped back. Dovish European central bank outcomes weighed on EUR & GBP. USD a bit firmer.

• Central banks. SNB cut rates again. The BoE opened the door to a move in August. The cross-currents pushed AUD/EUR & AUD/GBP higher.

• Data flow. PMIs in focus today with data from Europe & the US due. Is the US’ outperformance fading? If so, the USD may lose ground.

There were several pieces of global economic news overnight, yet for the most part the net financial market moves were modest. Equities across Europe rose again (EuroStoxx50 +1.3%) as concerns about the upcoming French parliamentary election continued to fade. By contrast, US equities drifted lower from their record highs (S&P500 -0.3%) as a run of tepid US data dampened the mood. Across bonds, US yields ticked up ~3-4bps across the curve, while in the UK yields slipped back following the Bank of England’s ‘dovish’ rhetoric. In FX, the USD Index edged up a bit due to weakness across the major European currencies and a softer JPY. EUR dipped towards ~$1.07, GBP declined to the bottom of its ~1-month range (now ~$1.2660), and USD/JPY is within 0.8% of its multi-decade peak (now ~158.90). The firmer USD meant that the NZD (now ~$0.6118) and AUD (now ~$0.6657) lost some ground.

European central banks were in focus, and they continue to lead the way in the global easing cycle. The Swiss National Bank cut interest rates for the second straight time, and its downgraded inflation outlook suggests there is more to go. In the UK, the BoE kept rates steady, but its underlying tone was ‘dovish’. The door to a move as soon as the next BoE meeting on 1 August remains wide open. While the BoE committee again voted 7:2 in favour of no policy change, the minutes revealed that for some of the 7 the decision was ‘finely balanced’ and that key gauges of inflationary persistence “had continued to moderate”. Markets are assigning a ~62% chance the BoE kicks off its easing cycle in August. Data wise, there were more signs the interest rate/credit sensitive segments of the US economy are losing steam with housing starts and building permits both undershooting analyst’s expectations. As did the Philly Fed business outlook survey, with the recovery in weekly initial jobless claims also not as much as predicted. The first US Fed rate cut is fully discounted by November, with a second move priced in by January.

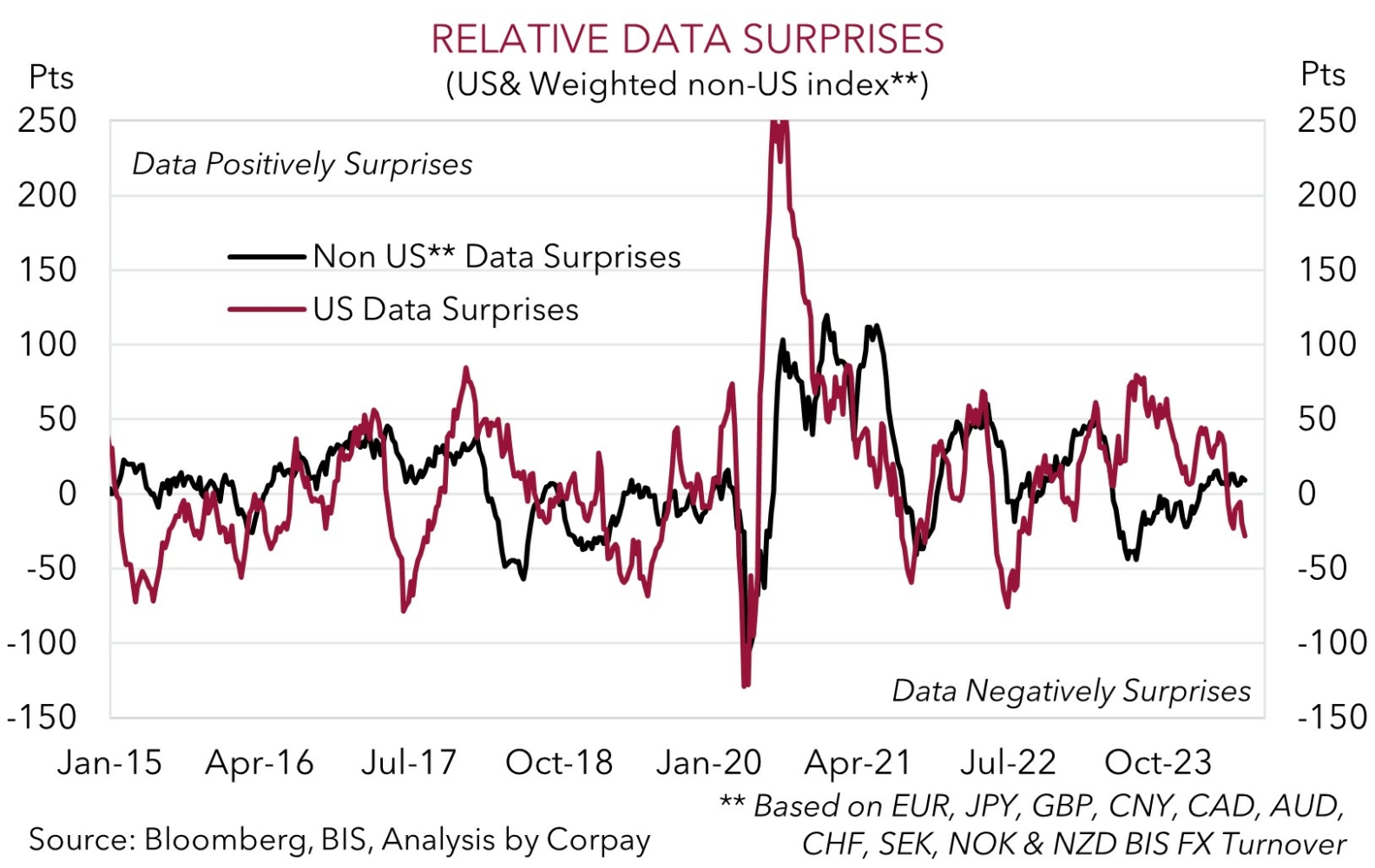

As our chart shows, the weakening in the data pulse has pushed the US data surprise index to its most ‘negative’ level since mid-2022. At the same time, the aggregate data from the other major economies have started to exceed forecasts. Business PMIs for June are released today with data for Japan (10:30am AEST), the Eurozone (6pm AEST), the UK (6:30pm AEST), and the US (11:45pm AEST) due. In our view, as the US’ relative economic strength was a pillar behind the USD’s outperformance over the past year or so, particularly in early 2024, more signs that the growth gap is closing via positive surprises in the non-US data and/or negative surprises in the US PMIs, could see the USD soften as traders bolster their US Fed rate cut bets.

AUD Corner

The uptick in the USD on the back of the softer EUR, GBP, CHF, and JPY overnight following dovish rhetoric by the BoE, a SNB rate cut, and lift in US bond yields, has exerted a little downward pressure on the AUD (see above). That said, at ~$0.6655 the AUD is still above its 1-month average, with the macro under-currents continuing to support the AUD on most of the major crosses. AUD/EUR (now ~0.6220) is at a 1-year high, AUD/JPY (now ~105.75) touched its highest level since Q4 2007, AUD/GBP (now ~0.5258) is north of its 6-month average, and AUD/NZD hovering near its 50-day moving average (~1.0885).

As discussed over recent days the RBA’s ‘hawkish’ vibes has reinforced our long-held view that the bank is likely to lag its global peers in terms of when it starts and how far it goes during the next easing cycle. Momentum across the interest rate sensitive sectors of the Australian economy has lost steam, but the level of activity remains elevated (particularly across the service providing sectors). This, and the resilient labour market point to core inflation moderating slowly over the period ahead (for more see Market Musings: RBA: No retreat, No surrender). The May CPI reading is coming up (26 June) and we think it could show the annual pace of inflation quickened. In our opinion, the diverging macro and interest rate trends should be AUD positive, especially on crosses like AUD/EUR, AUD/GBP, AUD/CAD, and AUD/NZD.

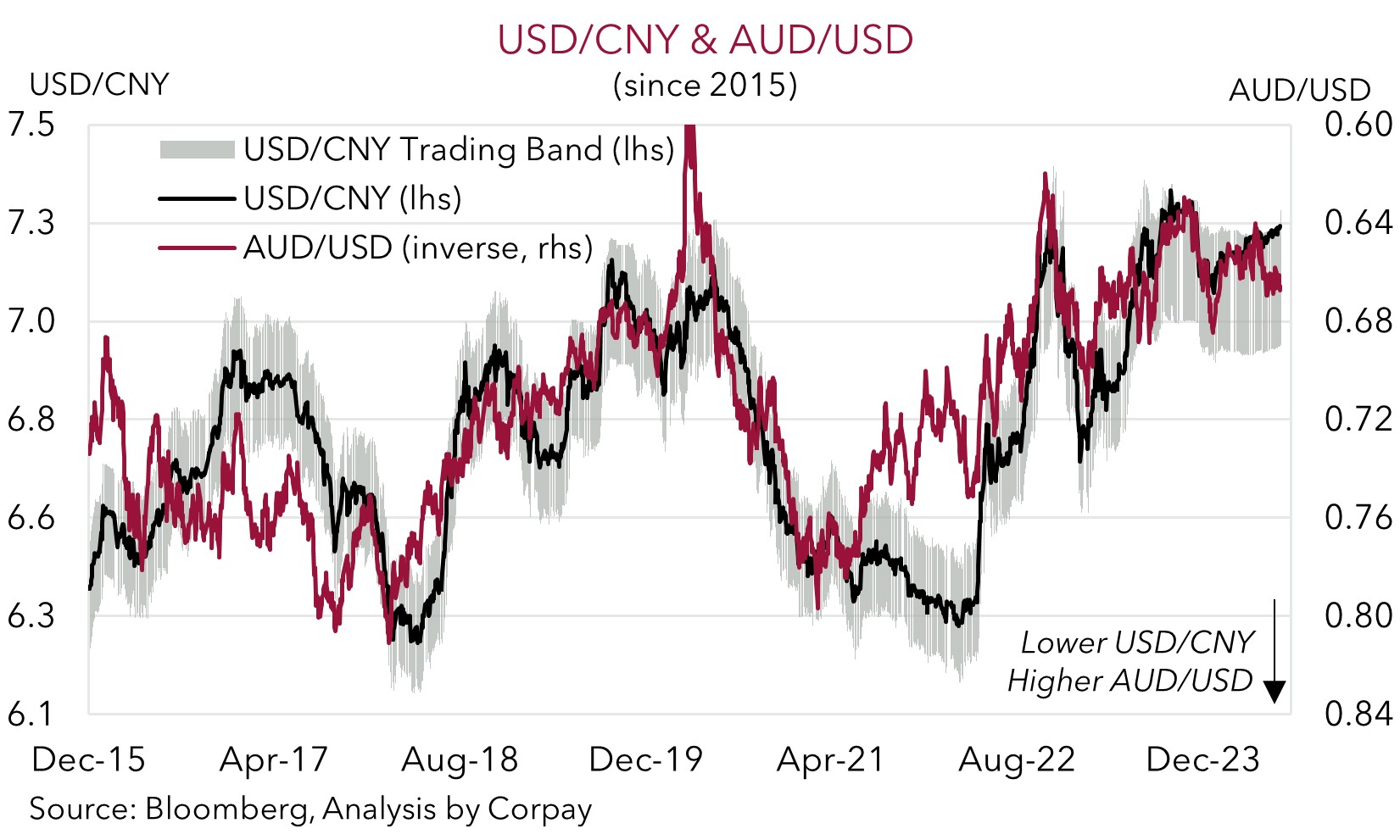

However, working in the other direction is the building pressure on CNY. Yesterday the People’s Bank of China set the CNY daily reference rate at its weakest level since November. Lower yields in China due to the sluggish economic performance has weighed on the CNY (pushed USD/CNY higher). Given the correlation between the currencies further weakness in CNY (i.e. a higher USD/CNY) could be a drag on the AUD. But as observed recently, and as our chart shows, we believe this would be more akin to a handbrake that partially offsets AUD positive factors like upbeat risk sentiment, elevated base metal prices and the diverging outlook between the RBA and others, rather than something that pushes the AUD lower.