• US jobs. Lukewarm US jobs report didn’t stir the market pot. US equities rose, as did bond yields. EUR extended its upswing. AUD drifted back.

• EUR strength. Prospect of more EU fiscal spending is supporting the EUR. AUD/EUR & AUD/GBP down near multi-year lows. Is too much priced in?

• Event Radar. US CPI (Weds) due. Bank of Canada (Weds night) expected to cut rates again. News about US tariffs & EU fiscal spending also likely.

Global Trends

After a volatile spell, particularly in European assets, last week ended without any new significant market ructions. The monthly US jobs report was in focus and on net the data was lukewarm with many of the topline bits and pieces landing close to expectations. US non-farm payrolls rose by 151,000 in February, a slight uptick from the weather distorted January result, average hourly earnings (a wages proxy) consolidated at 4%pa, and the unemployment rate nudged back up to 4.1% (its 1-year average). When speaking after the US data was released Fed Chair Powell noted there is increased uncertainty with regards to the economic outlook due to the changing policy landscape however things are still “fine” and hence the Fed doesn’t need to rush to adjust policy.

In terms of the market moves, after falling back initially the US S&P500 reversed course later in the session to end the day in positive territory (+0.6%). That said, this only partially unwound some of the recent declines. Last week’s 3.1% fall in the S&P500 was the biggest weekly drop since early-September. US bond yields also ticked up with rates rising 2-3bps across the curve. The US 10yr yield (now 4.30%) is oscillating near its 6-month average. In FX, although the USD index eased this reflected the continued upswing in the EUR (now ~$1.0835, around the top of its 4-month range) with investors still caught up in how the proposed lift in European defence/fiscal spending might boost regional growth and in turn inflation and interest rates. GBP has also been dragged along for the ride (now ~$1.2920). USD/JPY tread water close to ~148 (the lower end of its multi-month range) while USD/SGD is down near ~1.33. By contrast, NZD (now ~$0.5719) and AUD (now ~$0.6310) gave back a bit of ground, though both strengthened over the week.

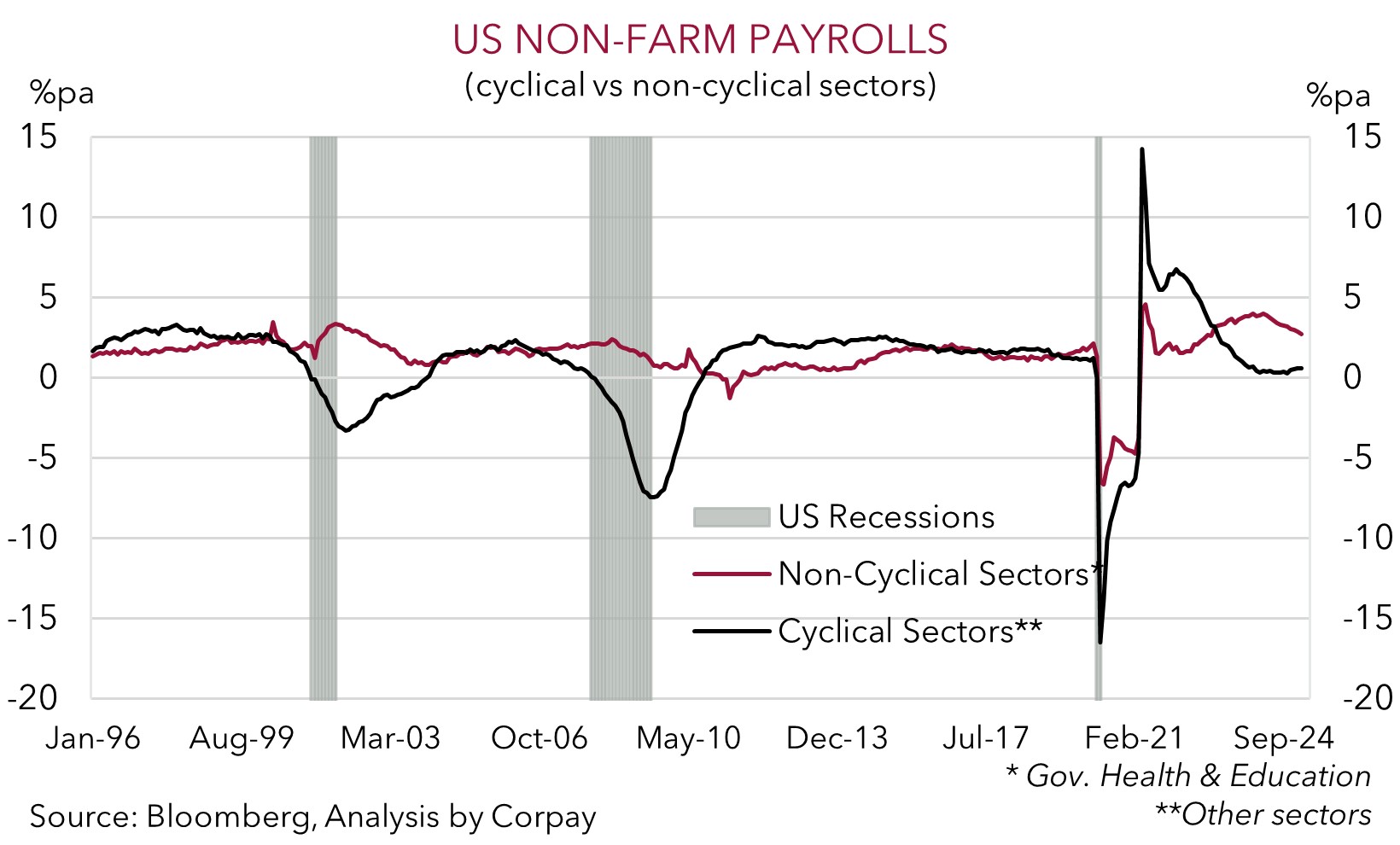

We don’t really share the Fed’s optimism about the underlying state of the US economy. A closer look at the detail within the US jobs report suggests conditions might deteriorate over coming months. As our chart shows, employment across ‘cyclical’ sectors has stalled and it is only growth in ‘non-cyclical’ sectors such as government and healthcare that are holding things up. These are areas in the sights of the Trump Administrations new DOGE initiatives which could trigger a lot of layoffs. US CPI is due this week (Weds night AEDT). We believe signs core inflation is moderating, combined with the headwinds the US economy is facing from greater business uncertainty and tariffs could see the USD remain on the backfoot. Particularly with EUR (the major USD alternative) likely to remain supported near-term via the shift in the European fiscal policy environment.

Trans-Tasman Zone

After a solid rebound over the previous few days the AUD (now ~$0.6310) and NZD (now ~$0.5719) drifted back a little on Friday as the largely as predicted US jobs report and comments by US Fed Chair Powell about not needing to rush with respect to further policy moves supported US bond yields (see above). That said, on net, the AUD and NZD still appreciated by ~1.6-1.9% last week. Some relative underperformance on the crosses also acted as a drag on the AUD on Friday. The EUR extended its upswing. This in turn pushed AUD/EUR (now ~0.5823) down to levels last traded in April 2020. AUD/GBP (now ~0.4883) is also around multi-year lows, with AUD/JPY (now ~93.35) and AUD/CNH (now ~4.5708) also backpedaling a little.

In Australia this week monthly consumer confidence and business conditions readings are the main data releases (both Tues). They don’t tend to move the needle. Hence, offshore developments should remain in the AUD driver’s seat. We think a few bursts of volatility are possible with US CPI inflation (Weds night AEDT) due and with tariffs on US steel and aluminium imports also scheduled to be imposed (Weds). The latter may generate a few knee-jerk headlines. But as we have outlined before, despite some of the media hype these aren’t economically significant. Steel and aluminium account for ~1.5% of US imports, with the bulk coming from Canada, Mexico, and Brazil. Australia sends just ~4% of its total exports to the US, and only a small share of that is steel/aluminium (note: steel and alumimum exports to the US equate to ~0.2% of Australia’s total goods exports).

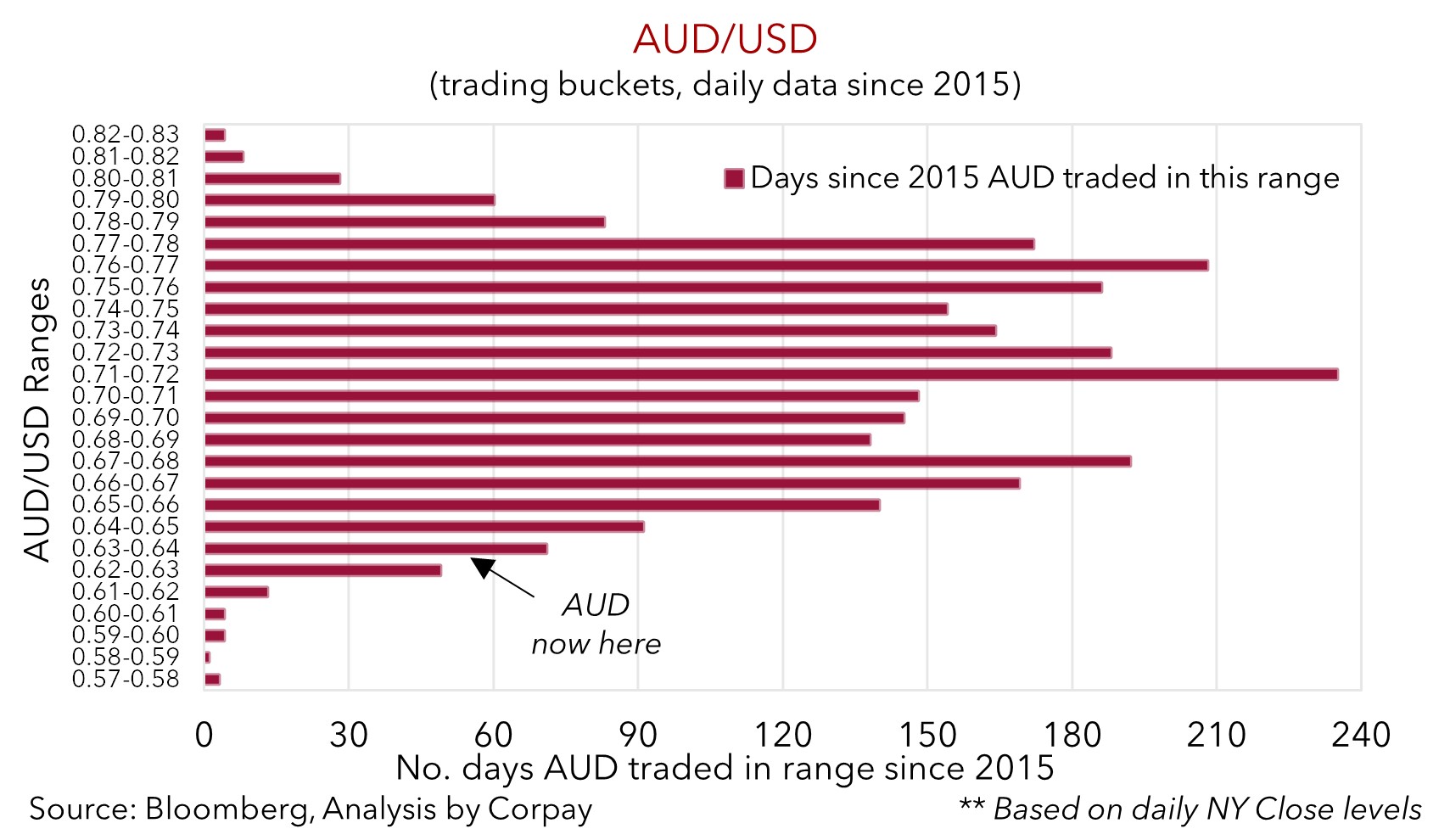

On balance, we remain of the view that from a medium-term perspective there are uneven risks for the AUD around current levels (i.e. there is more upside than sustained downside potential). In addition to diverging monetary policy trends between the “cautious” RBA and prospect for the market to factor in more policy easing in the US if core inflation moderates and labour market weakens (see above), the signals from China at last week’s National People’s Congress that more stimulus measures are in the pipeline and indications from Europe that they will boost fiscal spending should be AUD positives. The latter is a ‘sea change’ that is a EUR tailwind. And given it is the major USD alternative this can indirectly help the undervalued AUD recapture ground. Relative to our ‘fair value’ models the AUD still looks ~3-4 cents too low. We would also remind readers that the AUD has not traded much below where it is over the last decade (AUD has been sub-$0.6350 less than ~4% of the time since 2015). Underlying dynamics that have cushioned the AUD down in this region (i.e. Australia’s improved capital flow trends and higher terms of trade) remain in place.