• Lower yields. A drop in US job openings & dovish ECB comments weighed on bond yields. But relatively larger falls in Europe supported the USD.

• RBA holds. No change from the RBA. The lack of a tweak to its guidance compounded the firmer USD. The AUD’s pull-back extended overnight.

• Data flow. Q3 AU GDP due today, while in the US labour stats will remain in focus with ADP employment tonight & non-farm payrolls rounding out the week.

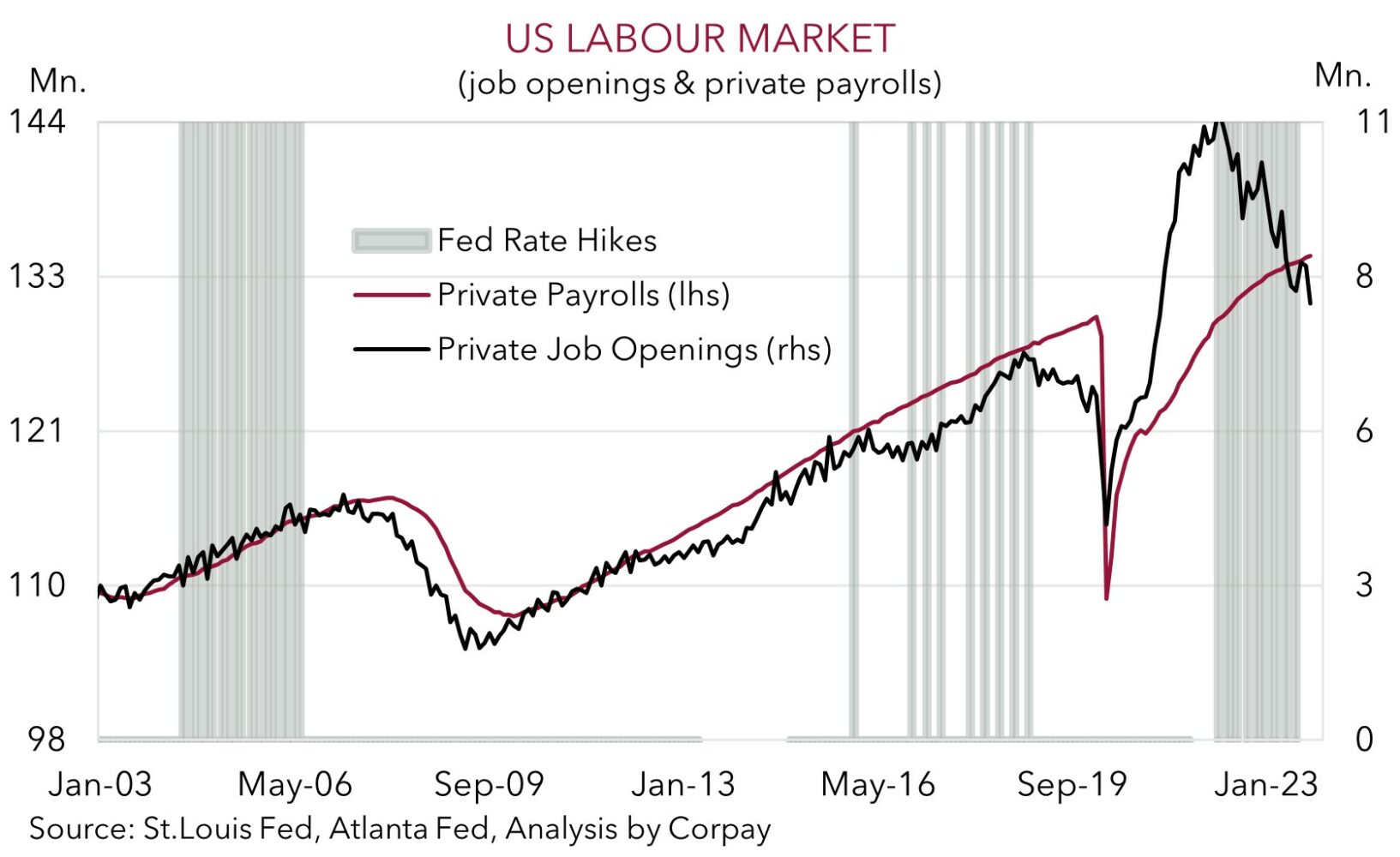

Bond market moves were in focus overnight and this flowed through to FX with the USD firmer thanks to some EUR and GBP weakness. Bond yields fell again as economic data and central bank comments reinforced expectations the tightening phase has ended and that the next steps by central banks will be to ease policy. In Europe, the ECB’s Schnabel, typically a ‘hawkish’ council member, made some ‘dovish’ observations. According to Schnabel Eurozone core inflation was “falling more quickly than we had anticipated” and “this is quite remarkable”. On the policy front Schnabel noted another rate hike was “rather unlikely”, though she wouldn’t be drawn on when cuts may start. In the US, job openings (a gauge of labour demand) fell more than expected in October. Private job openings are now running at their lowest since early-2021. As a result, the ratio of openings to unemployed persons has declined to ~1.3, not that different to the average in the year before COVID. This is another indication the excessive heat is coming out of the US labour market and that wages and inflation should continue to moderate over time. Elsewhere, while the headline US services ISM ticked up in November stagnant new orders and higher inventories point to a loss of momentum down the track.

The benchmark US 10yr yield shed another 8bps to be down at 4.17%, a low since early September. The US 2yr rate is ~6bps lower (now 4.58%) with markets factoring in a steady stream of rate cuts by the US Fed from May 2024. That said, there were larger moves in Europe with the German 10yr yield falling ~11bps (now ~2.24%) and the UK 10yr tumbling ~17bps (now 4.02%). Interest rate reductions by the ECB and Bank of England are now priced in from April and June, respectively. This generated a bit of support for equities with the US tech-focused NASDAQ lifting (+0.3%), while European markets outperformed (EuroStoxx50 +0.9%). In FX, the relatively larger drop in European rates and shift in yield differentials in favour of the US supported the USD. EUR slipped back under ~$1.08 and GBP is tracking below ~$1.26. USD/JPY consolidated (now ~147.25) and USD/SGD has edged up a little (now ~1.3414, near its highest level in just over a week). The AUD (now ~$0.6555) extended its pull-back with the lack of a change by the RBA to its forward guidance and another dip in base metal prices (copper -1.2%) compounding the stronger USD.

US labour market stats will remain in focus over coming days. ADP employment is due tonight (12:15am AEDT) and non-farm payrolls rounds out the week (Sat 12:30am AEDT). A one-off return of striking autoworkers and actors may help prop up employment in November, but this should be looked through. We think the broader set of figures should show US labour market conditions are loosening. If realised, this may see the USD reverse course.

AUD corner

The AUD has given back some more ground over the past 24hrs with the firmer USD and softer base metal prices adding to the dip that came through in the wake of the RBA meeting (see above). That said, things remain very much in in the eye of the beholder. At ~$0.6555, while the AUD is ~2% below Monday’s intra-day peak, it is only back where it was trading a week ago and it is 2% above its September-November average. The AUD has also weakened on the crosses, with AUD/JPY (-1% to ~96.52) enduring the largest move. AUD/EUR declined back under its 200-day moving average (~0.6080) and AUD/NZD is sub ~1.07 for the first time since mid-October.

In terms of the RBA, as widely anticipated there was no policy change with the cash rate held steady at 4.35%. The policy guidance also remained unaltered with the RBA reiterating that “whether further tightening of monetary policy is required” will depend upon the data and evolving risks. The lack of a more ‘hawkish’ tone looks to have disappointed some and it has seen markets pare back their RBA rate expectations. Another move by February is now assigned less than a 20% chance, although unlike its peer’s markets are still discounting a ‘higher for longer’ view with a full rate cut not factored in until 2025.

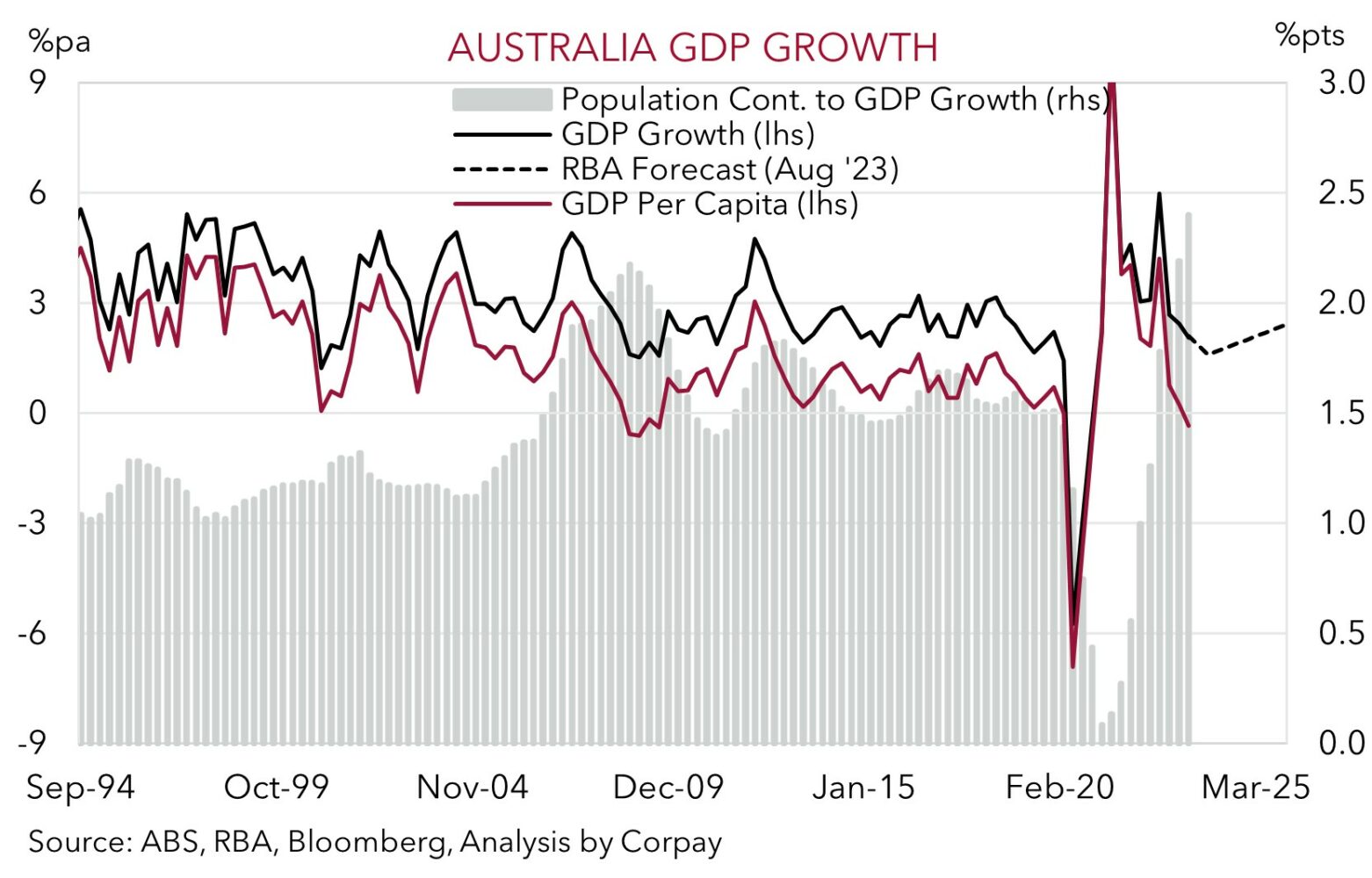

We think it is still too early to completely rule out further tightening by the RBA this cycle given the tight labour market, Australia’s slower move wage dynamics, and pressures across services inflation (see Market Wire: RBA: Hold the line). Growth wise, although many indebted households and businesses are feeling the pinch from the jump up in mortgage rates, working in the other direction, and helping prop up aggregate demand is Australia’s robust population growth, as well as the cohort of people that are net savers or which have large buffers to draw upon. This should be on display once again today with Q3 GDP expected to show another quarter of positive growth (mkt 0.5%qoq) (11:30am AEDT). Indeed, on balance we think risks are tilted to a stronger result which if realised may generate some renewed AUD support. As would further signs the US labour market is losing momentum (ADP employment (tonight 12:15am AEDT) and non-farm payrolls (Sat 12:30am AEDT)).

Beyond some more potential short-term gyrations, as flagged previously, we believe the underlying fundamentals are moving in favour of the AUD edging higher over the medium-term. On top of signs China’s economy is turning the corner, which is encouraging for regional growth prospects and commodity demand, we think bond yield spreads should continue to narrow as the RBA lags its peers when the next global easing cycle kicks in. This would compound the weakening in the USD that we are projecting over the next few quarters (see Market Musings: USD losing its shine).

AUD levels to watch (support / resistance): 0.6510, 0.6540 / 0.6580, 0.6610