• Quiet times. US equities & yields consolidate. JPY’s revival continues. USD/JPY & AUD/JPY lower. Can this trend extend?

• Commodity moves. Pull-back in base metal & energy prices continues. China growth concerns a driver. But copper price levels are still high.

• AUD pressure. Commodity moves exerting pressure on AUD. Global PMIs due today. Bank of Canada also expected to cut rates again.

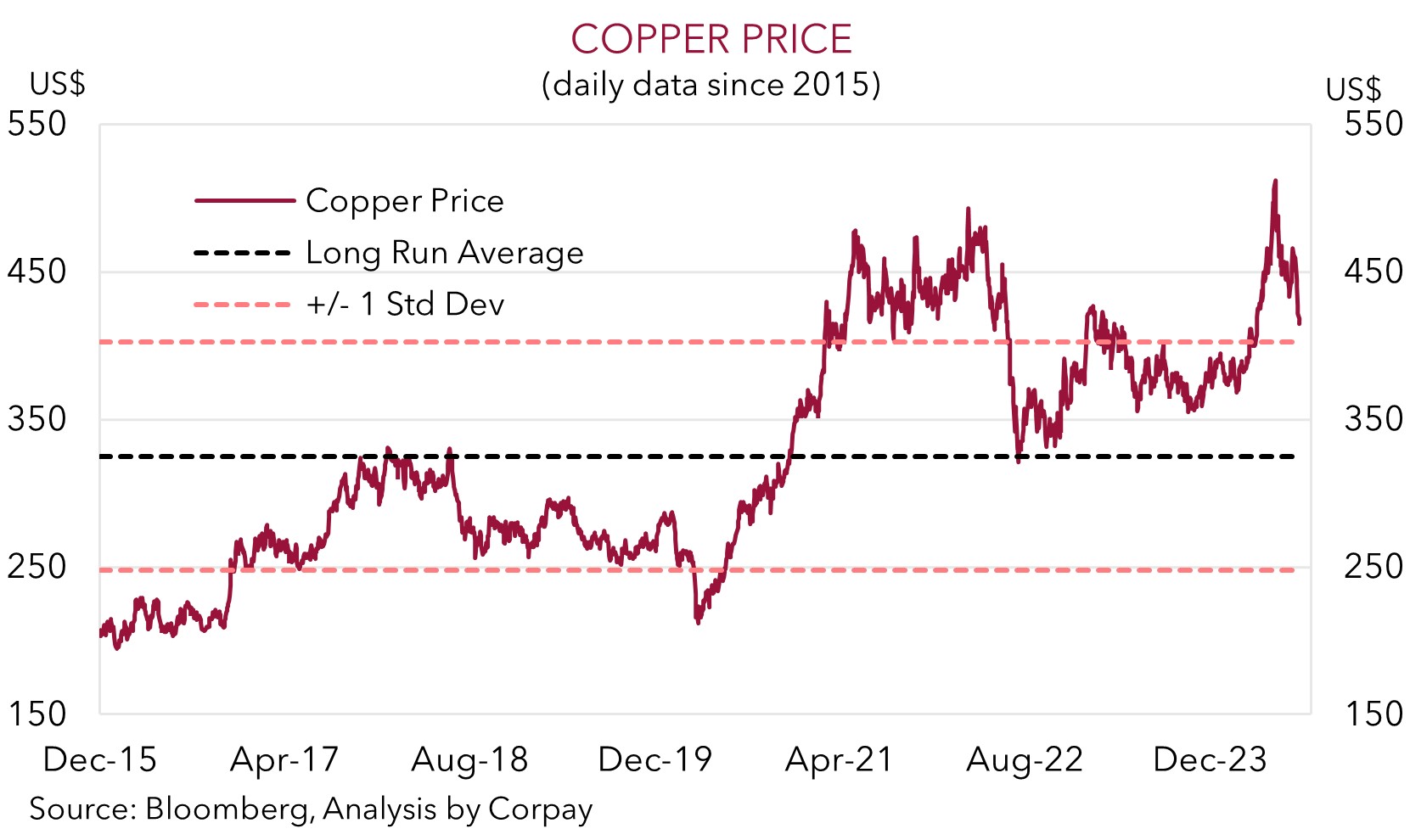

The limited economic and geopolitical news flow meant it was a largely uneventful session overnight across most asset classes. US equities ended the day slightly lower (S&P500 -0.2%) with underwhelming earnings results from a couple of megacap stocks likely to maintain pressure on the index. US bond yields consolidated with the 2yr rate slipping 3bps (now ~4.49%) and the benchmark 10yr rate treading water (now ~4.25%). There were slightly bigger falls in European bonds with the 10yr yields in the UK and Germany declining 4-6bps. The pull-back in commodity prices has continued with China growth concerns still being pointed to. WTI crude oil shed 1.2% to be back near US$77.50/brl (where it was trading a little more than a month ago), iron ore lost 1.3% to be at ~US$102/tonne (the bottom of its 3-month range), and copper eased another 0.8%. The copper price is now ~19% from its May highs, which at the time were viewed as being unsustainable. As our chart shows the copper price is still at historically high levels and ~28% above its long-run average, so it isn’t as ‘doom and gloom’ as some may be making out.

In FX, the USD index nudged up, with a softer EUR (now ~$1.0855) and GBP (now ~$1.2910) offsetting the JPY rebound. USD/JPY is trading below ~156, ~4% from its early-July multi-decade peak. Expectations the Bank of Japan could raise rates further over upcoming meetings have risen (markets are factoring in two hikes by December) with comments by a Japanese political heavyweight that the bank should show its intention to normalise its policy stance reinforcing calls that more steps will be taken. We think the undervalued JPY’s revival has further to run. Elsewhere, the weakness in commodities has kept the NZD and AUD on the backfoot. At ~$0.5960 the NZD is at levels last traded in early-May, while the AUD (now ~$0.6615) is around 6-week lows.

The global business PMIs for July are released today with data for Japan (10:30am AEST), the Eurozone (6pm AEST), the UK (6:30pm AEST), and the US (11:45pm AEST) due. In Canada, the BoC is expected to cut rates for the second time this cycle (11:45pm AEST) with another 25bp reduction ~88% priced in. Based on what is baked in the larger CAD reaction could stem from a surprise move by the BoC to hold fire. In terms of the PMIs, in our opinion, signs Eurozone/UK growth momentum may be on the improve and/or a slowdown in the US is unfolding could see the USD lose some ground. The US’ relative economic outperformance was a driver behind the USD strength earlier in the year.

AUD Corner

The AUD has lost more altitude with the weakness in industrial metal and energy prices continuing to drag on the currency. At ~$0.6615 the AUD is back down where it was trading in mid-June, ~2.7% from its mid-July highs. While AUD/NZD has consolidated just above 1.11, the AUD has lost more ground on the other major crosses with falls of ~0.1-0.5% recorded against the EUR, GBP, CAD, and CNH over the past 24hrs. AUD/JPY has been the largest mover with a 1.3% drop coming through. At ~102.95 AUD/JPY is also at a ~6-week low, and nearly 6% from its multi-decade peak touched only a few weeks ago.

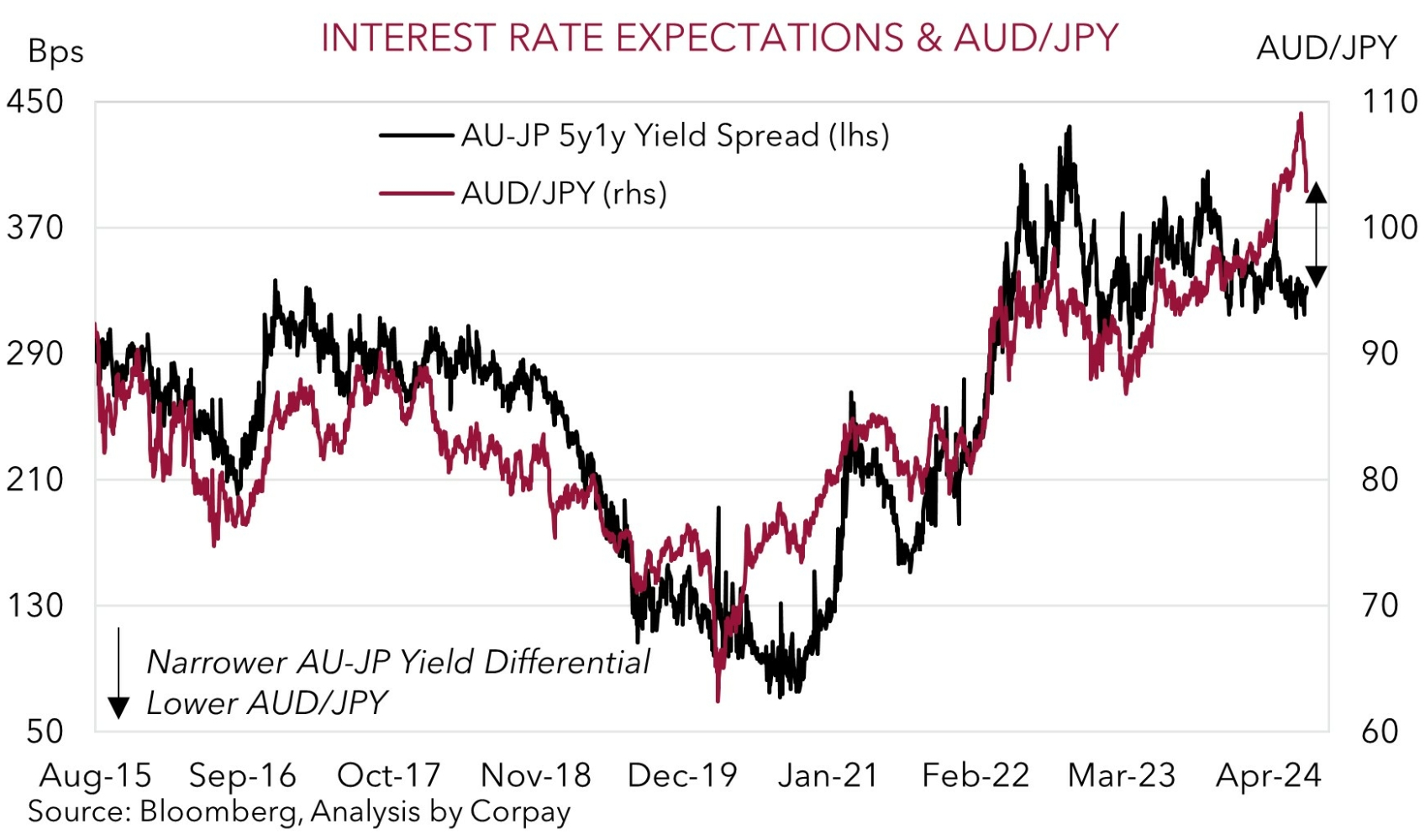

As outlined over the past week we believe there is more downside potential in AUD/JPY due to our view that the undervalued JPY’s revival may extend as the BoJ normalises its policy stance at a time other major central banks are easing. And as our chart shows, even after its recent reversal we think AUD/JPY still looks stretched relative to long-run interest rate expectations. That said, outside of AUD/JPY we feel that the AUD’s struggles may soon run their course. While commodity prices have declined, as discussed above current levels are still high and this is an important input into the AUD’s valuation.

On top of that, the diverging economic and policy expectation trends between Australia and others should remain in the AUD’s favour. Unlike the rate cuts being factored in for most major central banks, markets are assigning a ~33% chance the RBA hikes again by September, with the first RBA rate reduction not fully priced in until August 2025 due to the resilience in the Australian labour market, sticky inflation, and fiscal/income support flowing to the household sector. The upcoming Q2 CPI inflation data (released 31 July) is likely to make or break the case for another near-term RBA rate hike. But irrespective, we are still of the view RBA rate cuts are some time away, and as a result yield spreads look set to progressively move in a more AUD supportive direction over the medium-term. In our view, a ‘dovish’ rate cut by the BoC tonight (11:45pm AEST) and/or indications momentum in the Eurozone/UK is improving but remains sluggish in the latest PMIs (6pm/6:30pm AEST) could see the AUD recoup lost ground against the CAD, EUR, and GBP, with renewed AUD demand also likely to help AUD/USD.