• Quiet trade. A public holiday in the US. European equities a bit lower. UK yields a touch higher after UK services inflation surprised. USD consolidates.

• AUD trends. The AUD’s post RBA grind higher extended. AUD/EUR touched a 1-year high, AUD/JPY at levels last traded in 2013.

• Global data. Q1 NZ GDP shows economy emerged from ‘technical recession’. Bank of England meeting tonight.

With the US away on a mid-week public holiday markets were quiet overnight. US equity and bond markets were closed. In Europe, equities gave back a little ground (EuroStoxx50 -0.6%), although the UK FTSE100 moved in the opposite direction (+0.2%). European bond yields generally ticked up a few basis points with UK 2yr rates rising ~4bps (now 4.16%) after the detail within the latest UK CPI inflation data saw traders pare back the odds of an August rate cut (now ~32% compared to ~44% earlier this week). While UK headline (now 2%pa for the first time since mid-2021) and core inflation slowed as expected, sticky services prices held up. That said, a closer look suggests the services inflation surprise largely reflected a jump in volatile airfare prices. In FX, the major currencies tracked in narrow ranges. The USD index tread water with EUR (now ~$1.0745) and GBP (now ~$1.2721) a bit firmer and USD/JPY consolidating at high levels (now ~158). The AUD has extended its post-RBA meeting grind higher (now ~$0.6670).

Tonight, attention will be on the Bank of England decision (9pm AEST), with US weekly jobless claims and housing starts/building permits also due (10:30pm AEST). No change is expected from the BoE, with the 1 August meeting still viewed as a potential jumping off point for the rate cutting cycle. Indeed, as mentioned although the latest services inflation data went against the grain the UK’s broader disinflation trend still appears intact, especially as the cracks in the UK labour market are also widening. From our perspective, signs the BoE is unconcerned about some of the recent UK data gyrations or a lift in the number of committee members voting for a cut might rekindle the markets longer-dated easing expectations. This in turn could drag on GBP.

Outside of that we continue to think that without another flare up in European political risks the USD might remain on the backfoot given various signals are showing the US economy is losing steam, the labour market is cooling, and the inflation pulse is heading in the right direction for ~1-2 Fed rate cuts later this year. Notably, this is coming through as momentum in other economies may be bottoming out. Indications the US’ relative outperformance is fading in the latest global business PMIs (released Friday) could see the USD soften and close the modest gap that looks to have opened with US interest rate expectations (see chart below).

AUD Corner

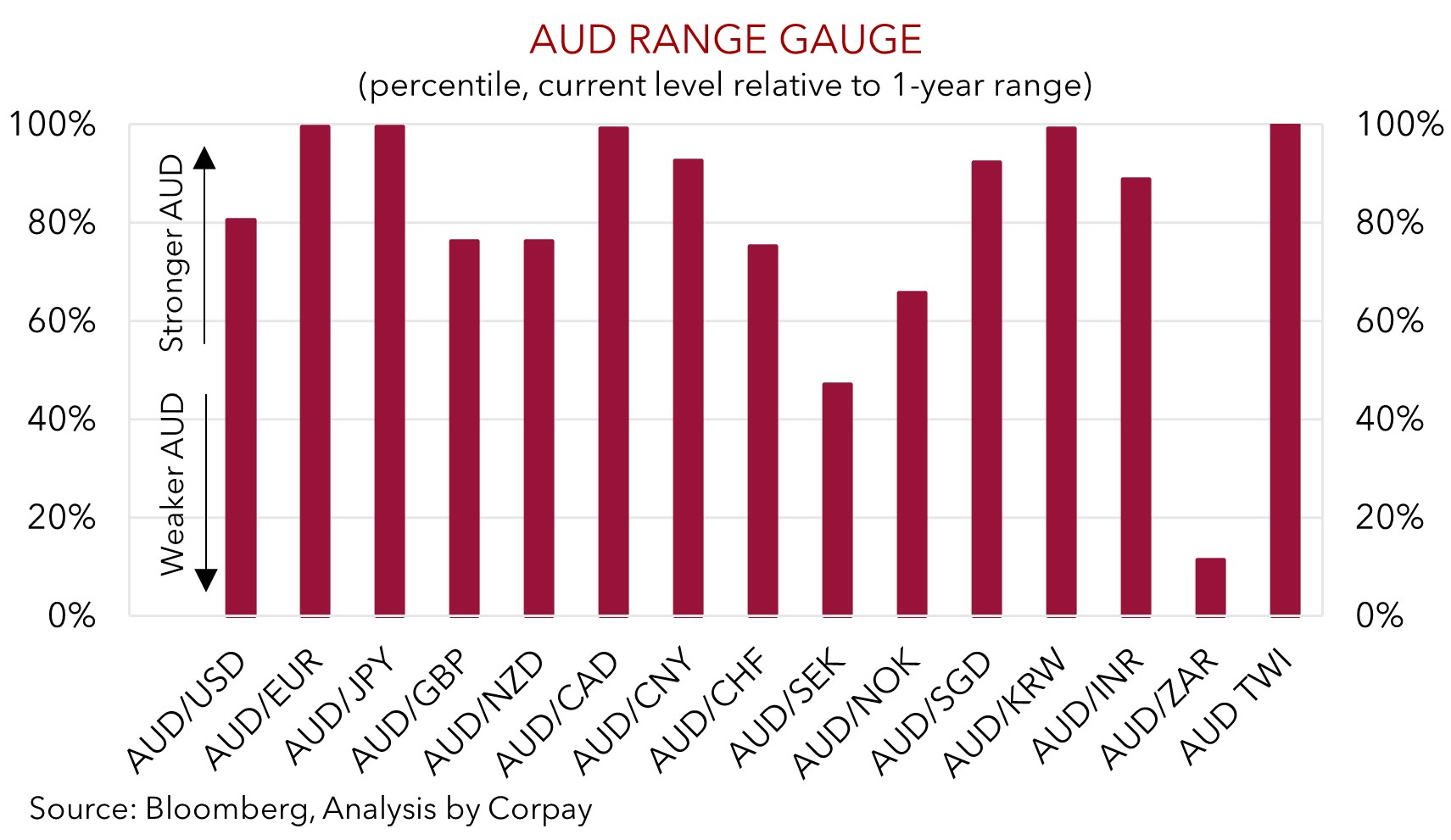

The AUD’s upswing has extended in the otherwise quiet market trading as the impact of the RBA’s ‘hawkish’ vibes continues to wash through. At ~$0.6670 AUD/USD is within striking distance of its multi-month highs. The AUD has also continued to outperform on the crosses (see our AUD range gauge chart below). AUD/EUR (now ~0.6209) touched a ~1-year high, AUD/JPY (now ~105.40) is around levels last traded in 2013, AUD/CNH (now ~4.8565) is at the top of its multi-month range, AUD/CAD (now ~0.9140) is just below its 1-year peak, and ahead of tonight’s Bank of England decision (9pm AEST) AUD/GBP (now ~0.5240) is north of its 1-year average.

AUD/NZD has slipped back a little this morning (now ~1.0860) after Q1 NZ GDP came in slightly above low expectations. The NZ economy emerged from ‘technical’ recession with the economy expanding by a modest 0.2% in Q1. As a result, annual growth is running at a well below potential 0.3%pa pace. This was broadly inline with the RBNZ’s projections. We don’t foresee the pull-back in AUD/NZD to be overly pronounced. The Australian and NZ economies are on a slightly different path, as are the respective central banks. The RBNZ is (still) talking tough, but rate cuts should be the next move and we believe they may end up going sooner and faster than markets anticipate. The shift in relative interest rate expectations and growth trends should, in our opinion, be AUD/NZD supportive over the medium-term.

More broadly, as outlined over recent days the RBA’s ‘hawkish’ tone reinforces our thinking that it is likely to lag its global peers in terms of when it starts and how far it goes during the next easing cycle. As discussed, while growth rates have slowed, the level of activity is high with the aggregate Australian economy still in a state of ‘excess demand’ due to resilience across services sectors and labour market conditions. This points to core inflation moderating slowly over the period ahead (for more see Market Musings: RBA: No retreat, No surrender. From our perspective, the macro and policy trends should be AUD supportive, not just against the USD but also on crosses like AUD/EUR, AUD/GBP, AUD/CAD, and AUD/NZD.