• Trends extend. European equities ticked up, bond yields rose. Oil gave back ground. Iron ore elevated. AUD at the top of its multi-month range.

• Weaker USD. USD remains under pressure. USD index is near where it started the year. Factors that propelled the USD higher have changed course.

• Event radar. Locally, retail sales & monthly CPI are due. Offshore, US PCE deflator, manufacturing ISM, China PMIs & Eurozone inflation are released.

It was a fairly quiet end to last week across markets with the US having a holiday shortened session on Friday following the Thanksgiving break. European equities ticked up (EuroStoxx50 +0.3%) while the US S&P500 was flat. Oil prices lost more ground with WTI crude down another 2%. At ~US$75.50/brl WTI is ~21% below its late-September highs. By contrast, iron ore remains north of US$130/tonne (up ~52% over the past 6-months).

Bonds extended their sell-off with German and UK 10yr yields rising another 2-3bps. The benchmark US 10yr rate played a bit of catch up, lifting by ~6bps (now 4.47%). Indications growth in Germany may be stabilising after the IFO business survey improved slightly, coupled with concerns about greater German bond supply following the suspension of the limit on new borrowing, and ‘hawkish’ central bank rhetoric pushed up yields. In the UK, BoE chief economist Pill stressed that the bank won’t relent in its inflation fight despite the weakening UK economy. Only a few weeks ago Pill had indicated expectations for easing from mid-2024 appeared reasonable.

In FX, the USD remained under downward pressure. After its recent slide the USD Index is close to where it was trading at the start of the year. EUR has edged up to ~$1.0937, USD/JPY has held steady (now ~149.44, little net change over the past week), and GBP strengthened (now ~$1.2594) as markets priced in a chance of another BoE rate rise and watered down rate cut assumptions. AUD (now ~$0.6583) and NZD (now ~$0.6078) added to their recent gains with both near multi-month highs.

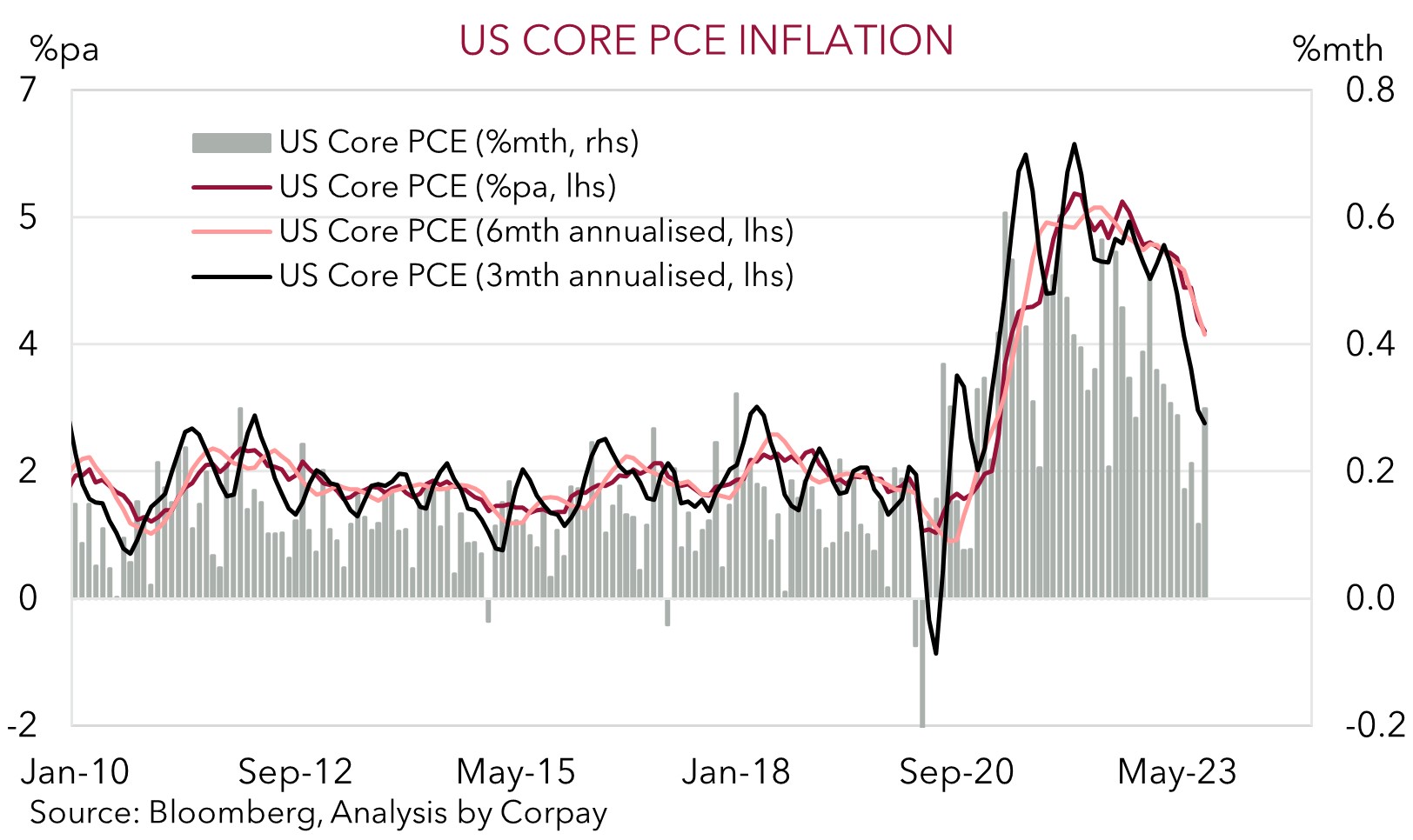

As outlined, we believe the Q3-October period was likely to be ‘as good as it gets’ for the USD. The US economy and US Fed policy impulses which propelled the USD higher look to have passed pivotal inflection points (see Market Musings: USD losing its shine). This week attention in the US will be on the PCE deflator (the US Fed’s preferred inflation gauge) (released Fri AEDT), the manufacturing ISM (released Sat AEDT), and Fed Chair Powell’s fireside chat (Sat AEDT). The excessive heat is coming out of the US labour market, rents are decelerating, and goods prices are normalising. The PCE deflator should continue to slow. At the same time growth momentum is waning, with the ISM predicted to remain in ‘contractionary’ territory once again. In our opinion, this should reinforce the view the Fed’s rate hiking phase is over, and the next move will probably be a cut, albeit in H2 2024. When combined with improvement in the China PMIs (released Thurs) we think this mix can keep the USD on the backfoot.

AUD corner

The AUD ended last week’s US holiday impacted trade on firm footing. On the back of the weaker USD, the AUD (now ~$0.6585) is at the top of the range it has occupied since early-August, and is around its 200-day moving average (a major technical indicator it was last above in late-July). That said, on the crosses the AUD put in a mix performance over the back end of last week. Ahead of this Wednesday’s RBNZ decision where no change in interest rates is predicted, AUD/NZD has edged a bit lower (now ~1.0832). By contrast, AUD/EUR has ticked higher (now ~0.6019), and AUD/JPY is within striking distance of its cyclical peak (now ~98.37). As pointed out previously, AUD/JPY is in somewhat rarefied air, and we see more medium-term downside than upside potential from current levels. Since 1995 AUD/JPY has only traded above where it is ~4% of the time.

We continue to expect the AUD to gradually appreciate over coming quarters given our outlook for a softer USD, a reacceleration in China’s economy, and our assessment that the RBA could lag its peers when the next global easing cycle comes around due to domestic factors (see Market Wire: RBA: it ain’t over till it’s over). Our longstanding forecasts are for the AUD to reach ~$0.68 in Q1, and ~$0.70 in a years-time. However, markets don’t move in straight lines, and following its recent rapid climb we think the AUD might face some domestic headwinds and experience a bout of volatility over the near-term which may counteract the anticipated weakening in the USD (see above).

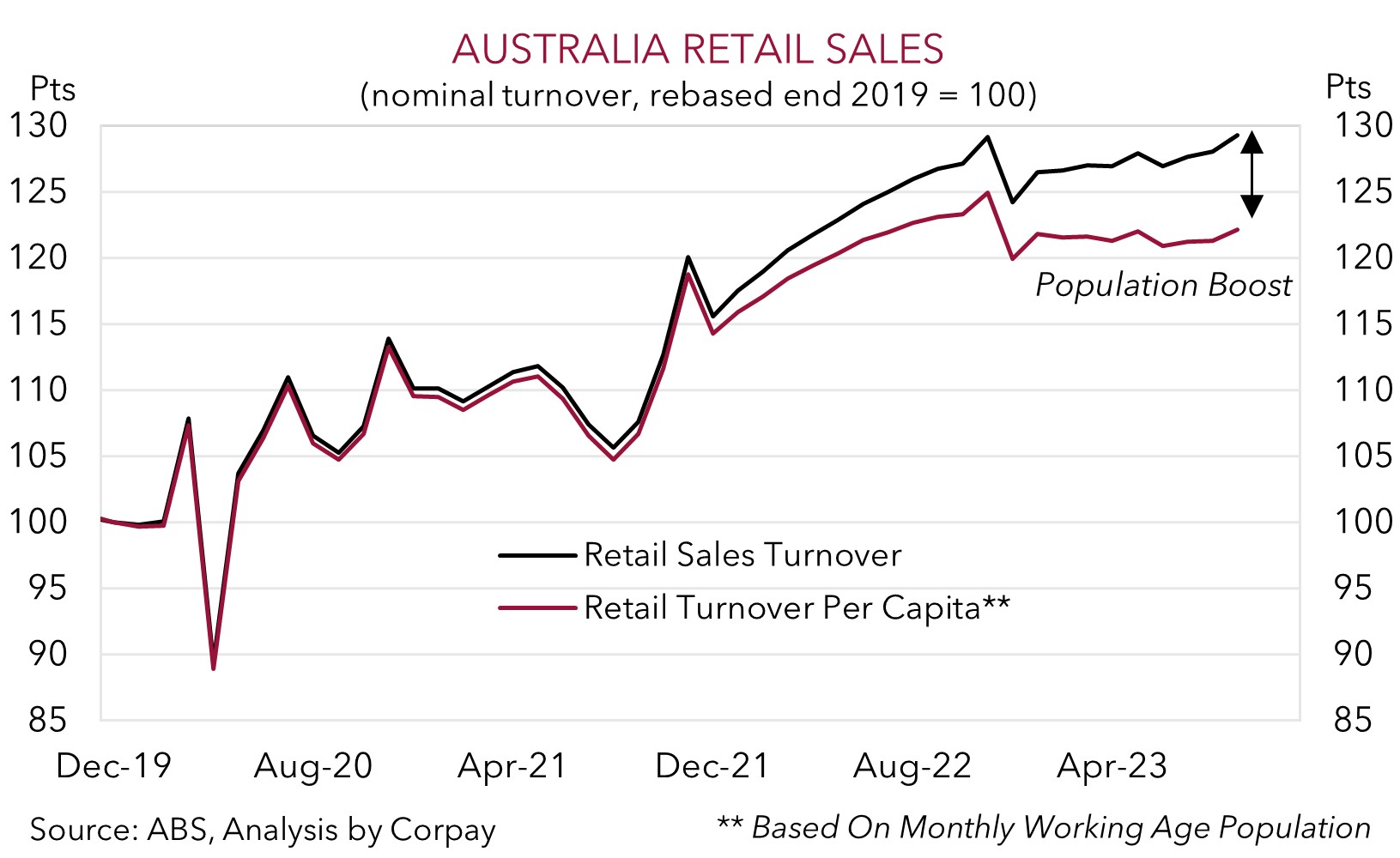

Locally, retail sales (released Tues) and the monthly CPI indicator (released Weds) are due this week. In our opinion, a few quirks in the data could take some of the heat out of the built-up RBA rate hike pricing and the AUD. Both risk underwhelming consensus expectations. Despite the support from the population surge, after a bumper September (retail sales rose 0.9%, the strongest since January) we believe squeezed households might have pared back their spending in October as they hold off for the November ‘Black Friday’ sales.

Additionally, given it is the first month of the quarter, the October CPI indicator reading will be skewed towards ‘goods’ (which are on a disinflation trend) and utilities prices, rather than sticky ‘services’ prices. Slower moving services prices are heavily linked to wages. This is the area that drove the positive surprise in the recent quarterly CPI and is the focus of the RBA’s inflation anxiety. Services pressures will be better captured in the subsequent November/December CPI reports. Something similar occurred a few months ago when the July CPI stepped down, triggering a drop in Australian interest rate expectations and the AUD, only for inflation to re-accelerate over August/September forcing the RBA’s hand to hike rates again.

AUD levels to watch (support / resistance): 0.6480, 0.6520 / 0.6610, 0.6650

SGD corner

USD/SGD eased back a little further last week. At ~1.3405 USD/SGD is ~2.6% below its early-October peak and around the bottom end of the range it has occupied since August. The weaker USD, on the back of the adjustment in US interest rate expectations and signs the Fed’s policy actions are gaining traction to weaken the US economy and sustainably lower inflation, have been the main drivers. On the crosses, EUR/SGD (now ~1.4661) has remained range bound, with minimal net movement over the past week, while SGD/JPY (now ~111.52) is still historically high.

As discussed, we think the downward pressure on the USD should continue over the medium-term with the underlying macro forces shifting in favour of a further gradual deflating over coming quarters (see Market Musings: USD losing its shine). Later this week, the focus will be on the US PCE deflator (the US Fed’s preferred inflation gauge), the manufacturing ISM, and Fed Chair Powell’s fireside chat. In China the PMI data is due, while in the Eurozone CPI inflation is released. In our opinion, further signs US inflation is moderating and growth is sluggish, in combination with improvement in China may see the USD (and USD/SGD) lose more ground.

SGD levels to watch (support / resistance): 1.3320, 1.3360 / 1.3470, 1.3500