• Firmer USD. The USD has continued to claw back ground. The AUD has remained on the backfoot and is now ~2.4% below its mid-July high.

• Busy week. Locally, Q2 CPI (Weds) & retail sales (Fri) are due. Offshore, the US Fed (Thurs), ECB (Thurs) & BoJ (Fri) meet.

• More AUD pressure? On net, we think the upcoming events/data could give the USD some more support, with AUD headwinds still in place.

Markets had a quiet end to last week. But things could heat up this week with a string of major data points and central bank meetings on the radar US equities were little changed on Friday with the S&P500 hovering near the top end of its ~15-month range. In bonds, the lift in yields following a stronger than predicted UK retail sales report (+0.7% in June vs +0.2% expected) wasn’t maintained. The US 2-year yield is tracking around ~4.84%, up ~6bps over the week, while the 10-year yield is now 3.83%. In FX, the USD continued to recoup lost ground. EUR (the major USD alternative) is down at ~$1.1130 (~1.3% below last week’s cyclical peak), USD/JPY is approaching ~142, and GBP (now ~$1.2860) is more than 2% from its recent highs. AUD and NZD have remained on the backfoot. The AUD is just above its 200-day moving average (~$0.6720), and the NZD has edged down to its 50-day moving average (~$0.6173).

On the global data front, today’s Eurozone (6pm AEST), UK (6:30pm AEST), and US (11:45pm AEST) business PMIs for July will give another read on how resilient economies are in the face of rising interest rates. In our view, risks are tilted to the data underwhelming expectations. If realised, this could dampen risk sentiment and give the USD some further short-term support.

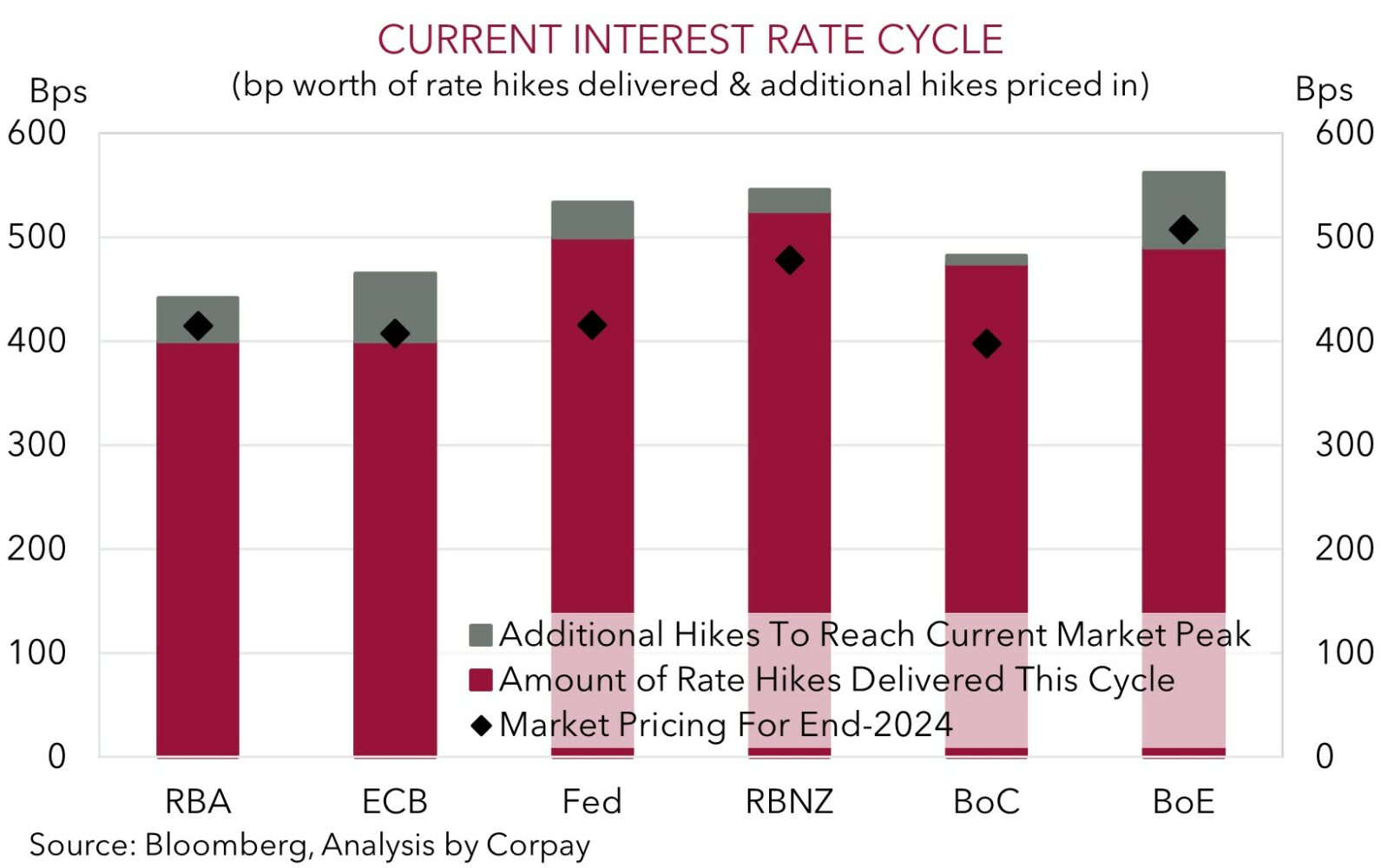

Further ahead, the main macro focus (and source of market volatility) this week will be on the policy decisions of the US Fed (Thursday 4am AEST), European Central Bank (Thursday 10:15pm AEST), and the Bank of Japan (Friday AEST, no set time). Another 25bp rate hike is widely anticipated from both the US Fed and ECB, so guidance from Fed Chair Powell and ECB President Lagarde about the outlook will be of more interest. While headline inflation has started to cool, underlying price pressures remain uncomfortably high, a function of still tight labour markets. As such, we think the US Fed and ECB should reiterate that the fight against inflation still isn’t over, that the door to further tightening is open, and that thoughts of rate cuts are some ways away. In our opinion, a “higher for longer” rhetoric could rattle market nerves and support the USD and EUR against cyclical currencies like the AUD and NZD. Though we think there could be more upside pressure on the USD given the prospect of solid US Q2 GDP (Thursday 10:30pm) and Employment Cost Index (Friday 10:30pm AEST) data.

A potential wild card for FX markets is this Friday’s BoJ meeting. No change in policy is the base case for most analysts, however given the upswing in Japanese inflation and potential upgrade by the BoJ of its inflation outlook, we believe there is a chance a tweak is made to its yield curve control policy. A ‘surprise’ adjustment would be JPY supportive, with the resultant falls in USD/JPY cascading across other FX pairs.

Global event radar: Eurozone/UK PMIs (Mon), US FOMC Meeting (Thurs), Fed Chair Powell Speaks (Thurs), ECB Meeting (Thurs), US GDP (Thurs), Bank of Japan Meeting (Fri), US PCE Deflator (Fri), US Employment Cost Index (Fri), China PMIs (31st July), Eurozone GDP & CPI (31st July), US ISM (2nd Aug), Bank of England Meeting (3rd Aug), US Jobs (4th Aug).

AUD corner

The AUD has continued to drift back, with the firmer USD the key driver (see above). At ~$0.6730 the AUD is just above its 200-day moving average, and ~2.4% below its mid-July highs. The AUD has been mixed on the crosses, with the AUD losing ground against the EUR and GBP (both -0.7%) and CNH (-0.6%), but it has outperformed the NZD (+0.2%) and JPY (+0.4%). AUD/NZD is back above ~1.09, and as stated previously, although it should be a bumpy ride, in our view the diverging economic, labour market, and capital flow trends point to AUD/NZD moving higher over the medium-term (see Market Musings: Cross-Check: AUD/NZD – Diverging trends).

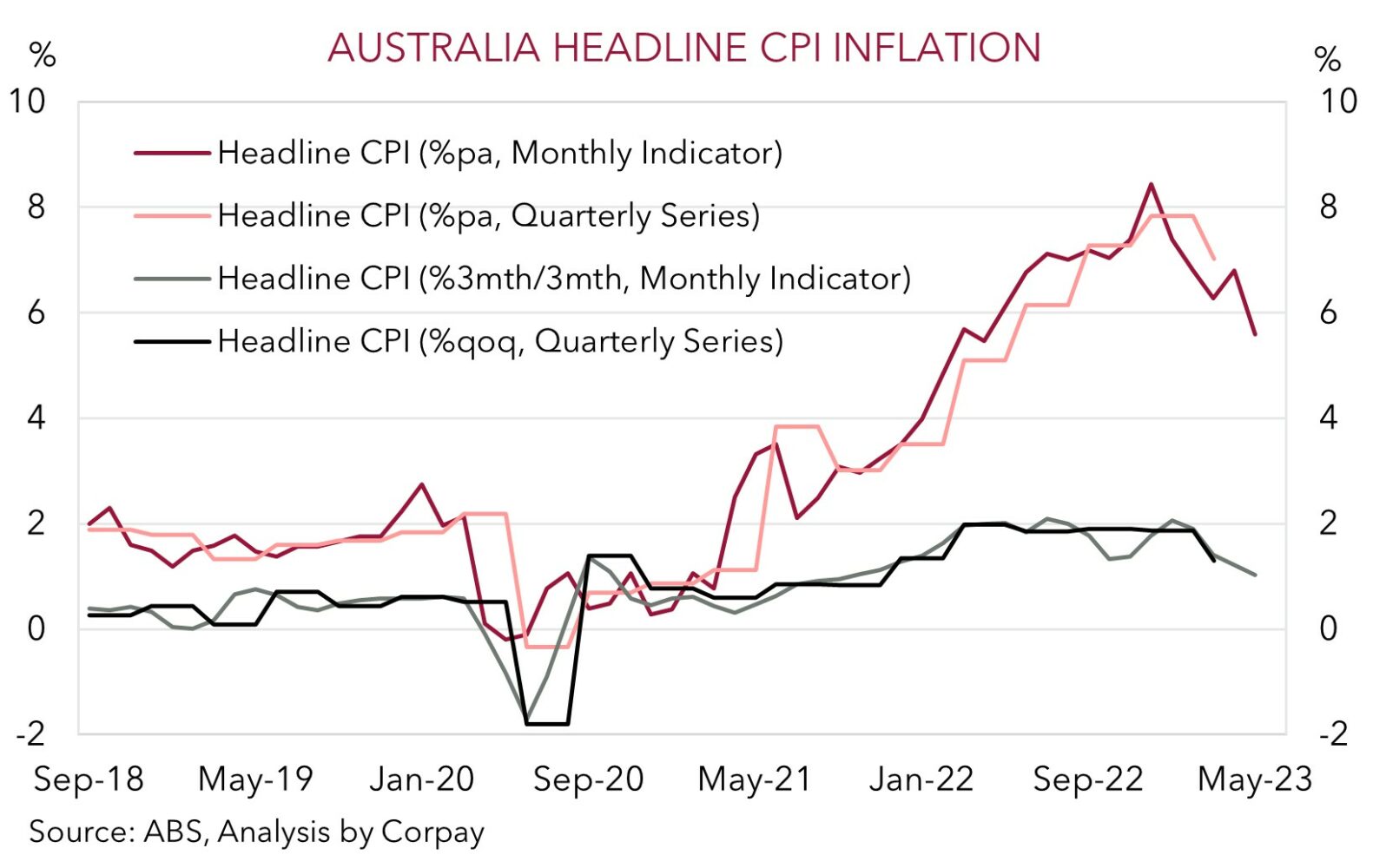

AUD volatility could continue this week given the top tier local and global economic data, and offshore central bank meetings on the schedule. On net, we think the macro events are likely to keep the AUD on the backfoot. Locally, Q2 CPI inflation (Wednesday) and June retail sales (Friday) are due. Base effects, as last year’s large price rises roll out of calculations, and other temporary factors such as government rebates for energy look set to drag down inflation. Markets are looking for headline inflation to step down from ~7%pa to 6%pa. This is inline with the RBA’s forecasts. If realised, and retail sales underwhelms (which is where we judge the risks reside), we expect RBA rate rise expectations to be pared back, exerting pressure on the AUD.

Globally, we also believe the upcoming events may generate AUD headwinds. China’s Politburo is due to hold its meeting by end-July. China’s post COVID recovery is faltering, with youth unemployment at a record high. We are looking for policymakers to announce more measures to reinvigorate China’s economy. However, we think support could be skewed towards labor-intensive consumption growth, rather than commodity-intensive (and more AUD positive) infrastructure spending. On the central bank front, as discussed, we are also looking for the US Fed (Thursday 4am AEST) and ECB (Thursday 10:15pm AEST) to both hike rates by another 25bps, and anticipate that based on the still high core inflation and robust labour markets policymakers could stress that further tightening is possible and/or that ‘restrictive’ settings may be needed for some time. This type of messaging, in our opinion, could unnerve buoyant risk markets, and weigh on cyclical currencies such as the AUD.

Finally, as outlined above, while we think the BoJ is more likely to keep its settings steady, based on the upturn in Japanese inflation we believe there is some chance that the BoJ tweaks (or flags a future change) to its yield curve control policy. A ‘surprise’ by the BoJ would be a positive jolt for the under-valued JPY. Though it would also wash through other major currencies via the potential pull-back in USD/JPY, and the impact on broader risk appetite.

AUD event radar: Eurozone/UK PMIs (Mon), AU CPI (Weds), US FOMC Meeting (Thurs), Fed Chair Powell Speaks (Thurs), ECB Meeting (Thurs), US GDP (Thurs), Bank of Japan Meeting (Fri), AU Retail Sales (Fri), US PCE Deflator (Fri), US Employment Cost Index (Fri), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug), US ISM (2nd Aug), NZ Jobs (2nd Aug), Bank of England Meeting (3rd Aug), US Jobs (4th Aug).

AUD levels to watch (support / resistance): 0.6692, 0.6720 / 0.6781, 0.6850

SGD corner

USD/SGD has continued to drift higher with the revival in the USD pushing the pair back above ~$1.33 for the first time in nearly two weeks (see above). On the crosses, EUR/SGD (now ~1.4805) ticked up a bit on Friday, with the relatively softer SGD a factor. EUR/SGD is now ~0.6% below its cyclical peak. SGD/JPY has also pushed back above ~106.50 for the first time since early-July, with the JPY losing ground ahead of this week’s BoJ meeting.

As discussed above, we think market volatility could lift this week, particularly over the back end, given the US Fed (Thursday), ECB (Thursday), and BoJ (Friday) meetings. We expect another 25bp rate hike from the US Fed and ECB, and think policymakers could reiterate that further tightening remains on the table given too high core inflation and tight labour market conditions. Although, when combined with solid US GDP (Thursday) and Wage/PCE inflation (Friday) data, we judge that the USD could outperform, supporting a further lift in USD/SGD. And while we believe the BoJ is more likely to hold steady, an adjustment to its policy settings is a risk due to the pickup in Japanese inflation. As outlined previously, in our view, it is a matter of when, not if the BoJ shifts course, and that over the medium-term there are more upside than downside JPY risks (see Market Musings: JPY: Asymmetric risks building).

SGD event radar: Singapore CPI (Mon), Eurozone/UK PMIs (Mon), US FOMC Meeting (Thurs), Fed Chair Powell Speaks (Thurs), ECB Meeting (Thurs), US GDP (Thurs), Bank of Japan Meeting (Fri), US PCE Deflator (Fri), US Employment Cost Index (Fri), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug), US ISM (2nd Aug), Bank of England Meeting (3rd Aug), US Jobs (4th Aug).

SGD levels to watch (support / resistance): 1.3140, 1.3200 / 1.3377, 1.3434