• Stronger USD. US jobless claims declined, another sign the labour market is still tight. US bond yields rose, supporting the USD.

• AUD round trip. The AUD’s Australian labour force & stronger CNH induced gains unwound overnight. AUD a bit firmer on the crosses.

• Next week. Q2 AU CPI (26 July) could make or break the case for an August RBA hike. US Fed, ECB, & BoJ policy decisions also on the schedule.

A more cautious tone across markets, with a round of disappointing tech-sector earnings results and ongoing signs of tight labour market conditions rattling nerves as it points to interest rates needing to stay high (or even higher) for longer. In the US, the S&P500 fell back ~0.7%, while the tech-focused NASDAQ declined ~2% with large falls in Tesla, Netflix, and semi-conductor chipmakers weighing on the index. By contrast, bond yields rose, with the US 10yr up ~10bps (now 3.85%) and the 2yr ~7bps higher (now 4.84%). European yields also increased, but by less than the US.

With yield differentials moving in favour of the US, the USD strengthened. EUR has slipped down to ~$1.1130 (~1.3% below this week’s high), while the interest rate sensitive USD/JPY has poked its head back above ~140 for the first time in just over a week. GBP has remained on the backfoot, and at ~$1.2870 it is ~2.1% below last week’s cyclical peak. There was also no joy for the NZD and AUD. The NZD is now tracking just above its 200-day moving average (~$0.6207), and the AUD has endured a round trip with yesterday’s Australian labour force and stronger CNH induced gains unwinding overnight.

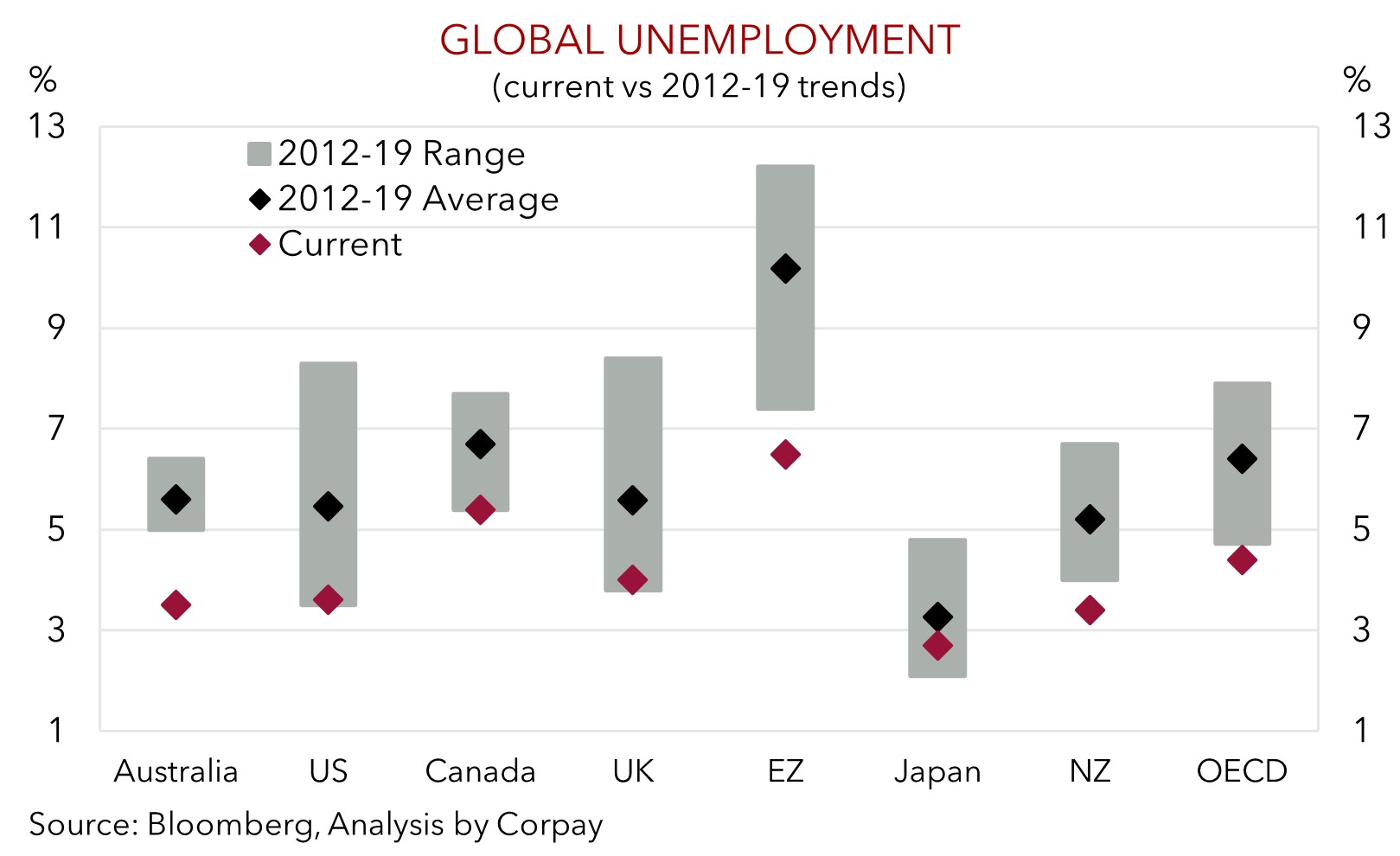

On the data front, US initial jobless claims, the weekly read on how many people are filing for unemployment benefits, came in lower than expected. At 228,000 jobless claims are back at a two-month low. This level of jobless claims is consistent with low unemployment and solid jobs growth. Added to that, some ‘special survey questions’ in the Philly Fed Business Outlook showed that ~58% of firms indicated they had higher labour costs over the past quarter and ~30% of firms now plan to increase wages this year by more than previously thought. Still robust labour markets raise the risk that high core inflation, which is underpinned by wages and ‘sticky’ services prices, doesn’t come down quickly. As our chart shows, this is a global problem. Unemployment rates haven’t budged from their respective COVID lows and remain well below levels needed for wages to be consistent with ~2%pa inflation. It is a hard pill to swallow, but to break the back of a services-driven inflation problem, policy needs to stay ‘restrictive’ for some time for growth to slow and unemployment to lift.

We think the USD can continue to claw back lost ground as we head into next week’s US Fed meeting (27 July AEST). Data trends point to another 25bp rate hike, in our view, and we believe policymakers could reiterate that further tightening is possible and that thoughts of rate cuts are some way away. In our opinion, this type of result could dampen risk sentiment, and/or support the USD against cyclical currencies like the AUD and NZD.

Global event radar: Japan CPI (Today), Eurozone/UK PMIs (24th July), US FOMC Meeting (27th July), Fed Chair Powell Speaks (27th July), ECB Meeting (27th July), US GDP (27th July), Bank of Japan Meeting (28th July), US PCE Deflator (28th July), China PMIs (31st July), Eurozone GDP & CPI (31st July).

AUD corner

AUD endured some volatility over the past 24hrs. On net it is little changed against the USD (now ~$0.6780). Yesterday’s AUD spike on the back of the better-than-expected Australian jobs data and stronger CNH as policymakers stepped up their efforts to support the currency couldn’t be sustained with higher US bond yields and stronger USD an offsetting force overnight (see above). That said, the AUD managed to post gains on most crosses. AUD/EUR has risen to ~0.6090, AUD/GBP is just under its 50-day moving average (~0.5287), and AUD/NZD has moved up towards ~1.09. As stated previously, it should be a bumpy ride, but in our view the diverging economic, labour market, and capital flow trends point to AUD/NZD moving higher over the medium-term (see Market Musings: Cross-Check: AUD/NZD – Diverging trends).

In terms of the local data ~32,600 jobs were added in June, led by further strength in full-time employment (+39,300). The unemployment rate (now 3.5%) is just above its ~50-year lows. The labour market is still chugging along. Conditions remain tight and hiring demand has (so far) moved in step with the jump in labour supply. We expect the labour market to weaken over time, but until it does, the pressure on the RBA to do even more to tackle still high inflation remains. In our opinion, the labour data supports the case for the RBA to hike rates again at the 1 August meeting, taking the cash rate to 4.35%. Although a lot will also come down to the Q2 CPI report (26 July). For more see Market Wire: Australian labour market: still on solid ground.

For the AUD, as shown again overnight, FX is a relative price and offshore trends often overpower domestic developments. We expect AUD volatility to continue over the near-term. While another hike by the RBA as soon as August should be AUD positive, the AUD will face headwinds from slower global growth and a firmer USD. We are looking for the US Fed to raise rates next week (27 July AEST) and we believe policymakers could note that further tightening is possible. This could rattle nerves and may give the USD a boost against cyclical currencies like the AUD.

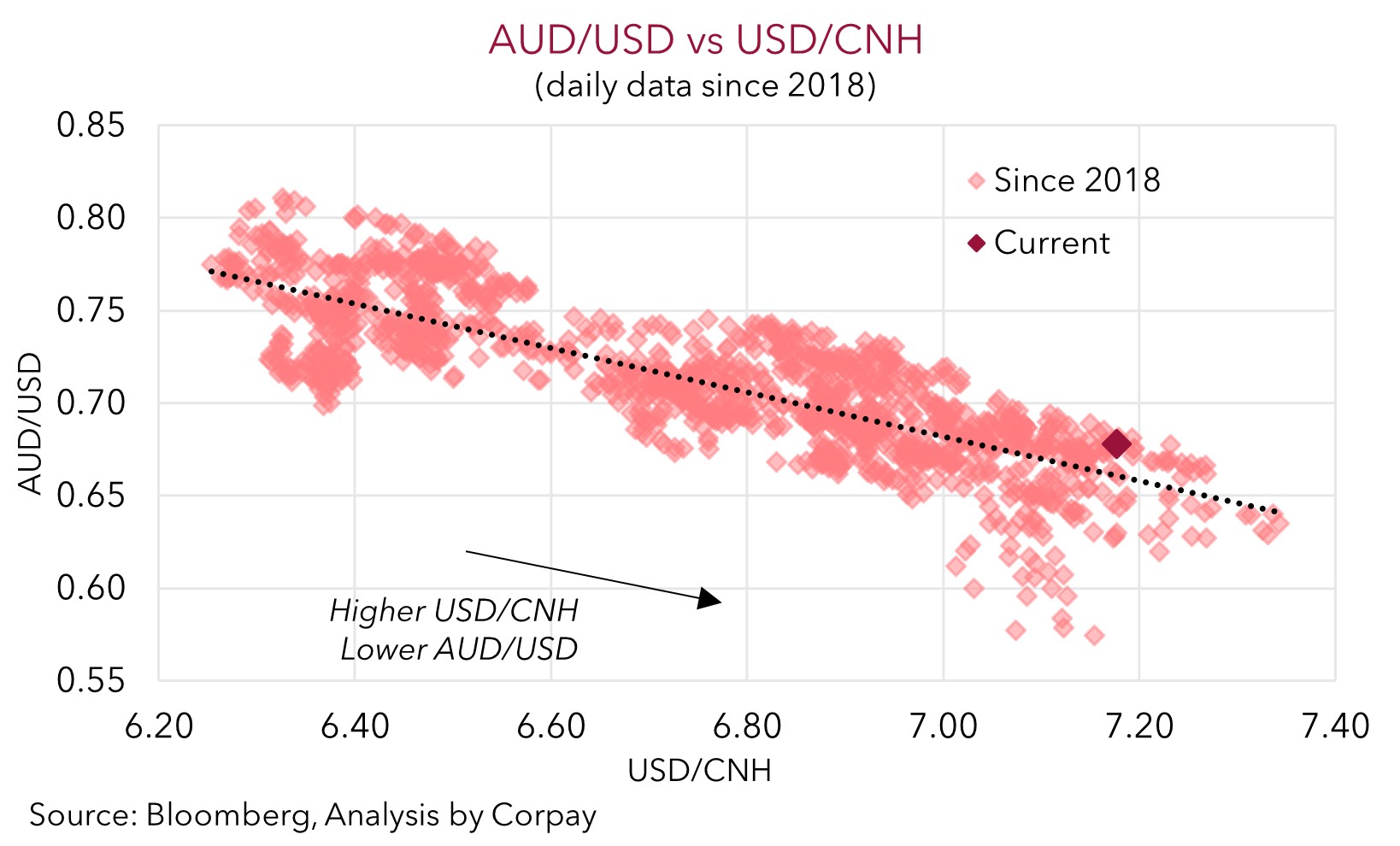

That said, what happens in China also remains important for the AUD’s medium-term trajectory. China’s post-COVID recovery is faltering. We are looking for policymakers to announce more measures to reinvigorate China’s economy. The late-July Politburo meeting may be a point when additional steps are flagged. We believe support could be skewed towards labor-intensive consumption growth, rather than commodity-intensive infrastructure spending. Nevertheless, a relative improvement in the China’s economic fortunes should, in our view, encourage CNH-supportive capital inflows over H2. A stronger CNH and sturdier Chinese economy are factors behind our forecasts looking for the AUD to gradually push up into the low 0.70s by early-2024. As the chart shows, USD/CNH and the AUD/USD have a tight (inverse) relationship.

AUD event radar: Japan CPI (Today), Eurozone/UK PMIs (24th July), AU CPI (26th July), US FOMC Meeting (27th July), Fed Chair Powell Speaks (27th July), ECB Meeting (27th July), US GDP (27th July), Bank of Japan Meeting (28th July), AU Retail Sales (28th July), US PCE Deflator (28th July), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug).

AUD levels to watch (support / resistance): 0.6692, 0.6718 / 0.6850, 0.6925

SGD corner

USD/SGD has edged up a bit further over the past 24hrs. At ~$1.3267 USD/SGD is now ~0.7% above last week’s low. The jump up in US yields on the back of the solid US jobless claims data has supported the USD (see above). On the crosses, EUR/SGD (now ~1.4772) has drifted a little lower due to the dip in EUR/USD, however it remains within 0.8% of its cyclical highs. SGD/JPY has also ticked up, and at ~105.54 it is around its highest since 10 July.

As flagged over recent days and discussed above we think the USD (and USD/SGD) can continue to recoup lost ground in the lead up to next week’s US Fed meeting. From our perspective, the still healthy US activity data pulse, tight labour market, and too high core inflation points to another 25bp rate hike by the US Fed, and importantly, we also think policymakers could reiterate that further tightening remains on the table. At the same time, various indicators show that global industrial activity is slowing. This is typically a drag on growth-linked currencies like the SGD.

SGD event radar: Japan CPI (Today), Singapore CPI (24th July), Eurozone/UK PMIs (24th July), US FOMC Meeting (27th July), Fed Chair Powell Speaks (27th July), ECB Meeting (27th July), US GDP (27th July), Bank of Japan Meeting (28th July), US PCE Deflator (28th July), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug).

SGD levels to watch (support / resistance): 1.3140, 1.3200 / 1.3377, 1.3434