• Mixed signals. US equities rose on Friday. Bond yields nudged up. US holiday tonight but there is plenty of important data on the horizon.

• USD bounce. Higher US yields generated a bit of USD support. AUD eased. Markets still look to be pricing in too much US Fed easing, in our view.

• Event radar. Locally, Q2 GDP & a speech by RBA Gov. Bullock in focus. Offshore, US jobs data due with non-farm payrolls rounding out the week.

US equities rose on Friday with the S&P500 (+1%) now fractionally under its record high. The early-August panic volatility has faded into the background with the S&P500 recording its 4th straight monthly gain (or 10th increase in 11 months) as the incoming data and commentary from influential central bankers bolstered expectations a steady stream of global interest rate cuts is in the pipeline. Indeed, cooling inflation pressures on both sides of the Atlantic supported risk sentiment on Friday, as did reports from China that policymakers are thinking about allowing homeowners to refinance as much as US$5.4 trillion in mortgages. Data wise, Eurozone CPI inflation slowed to 2.2%pa in August, a low since mid-2021, while in the US the PCE deflator (the US Fed’s preferred inflation gauge) showed the monthly pulse remains subdued with the annual run-rate holding steady at 2.5%pa. At the same time US consumer spending accelerated a little suggesting that the economy is still in decent shape.

Elsewhere, US bond yields nudged up as markets pared back some of the outsized policy easing assumptions that have been factored in. The US 10yr yield ticked ~4bps higher (now ~3.90%) with the 2yr rate consolidating around the lower end of its ~15-month range (now ~3.92%). This also flowed through to the USD. EUR has slipped back down towards ~$1.1050, GBP is near ~$1.3130, and the interest rate sensitive USD/JPY has poked its head above ~146. NZD (now ~$0.6248) and the AUD (now ~$0.6765) eased a touch into the end of the week thanks to the firmer USD.

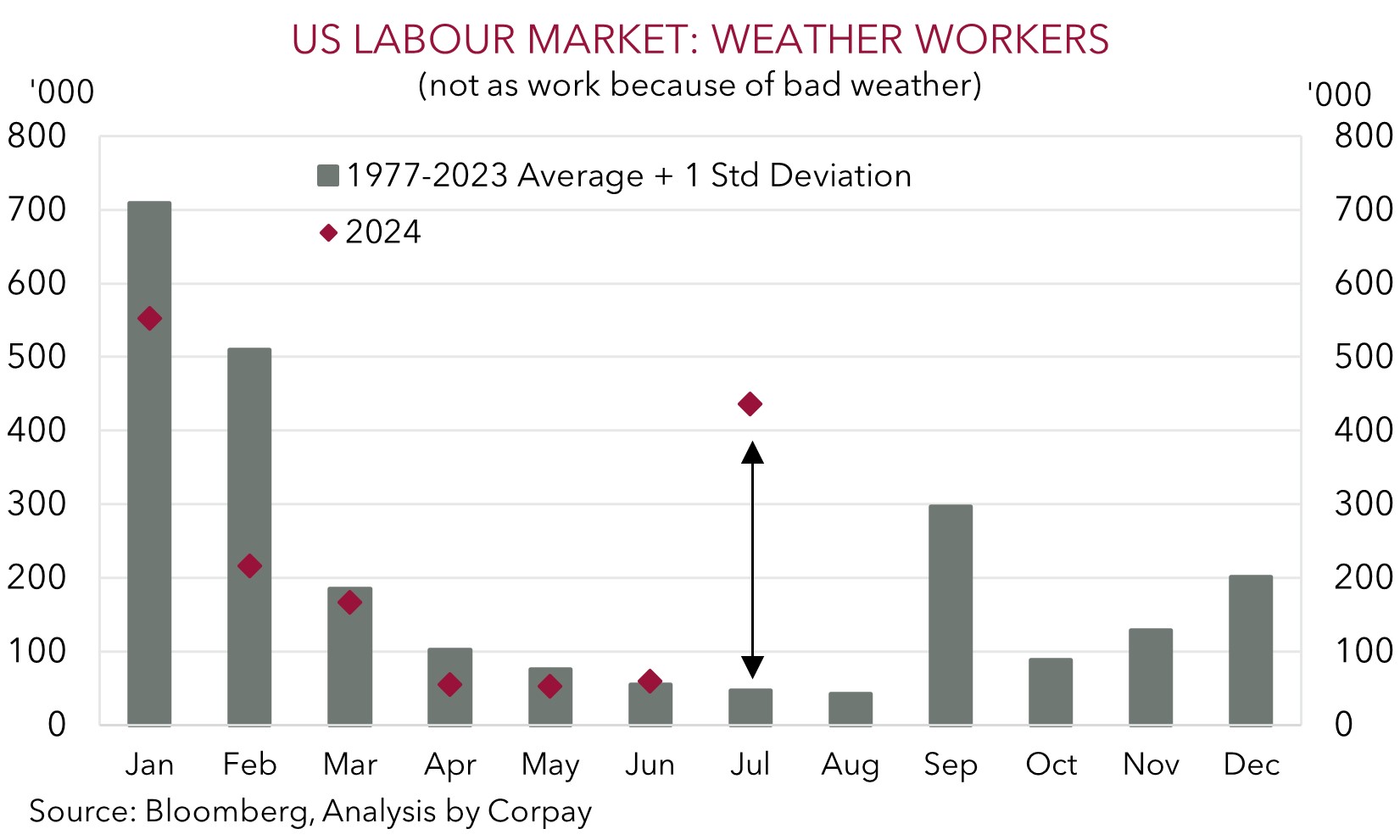

The US is out on Monday for Labour Day. But things should heat up as the week rolls on. Looking ahead the manufacturing ISM (Weds 12am AEST), JOLTS job openings (Thurs 12am AEST), ADP employment (Thurs 10:15pm AEST), services ISM (Fri 12am AEST), and monthly non-farm payrolls report (Fri 10:30pm AEST) are due. According to Chair Powell the US Fed is now more attentive to downside labour market risks given upside inflation risks have diminished. Hence, the incoming jobs data will influence how large upcoming rate cuts may be (the next Fed decision is 19 Sep AEST). As mentioned before, we believe the July US jobs data was heavily impacted by Hurricane Beryl (as shown there was a big jump in the number of people not at work because of bad weather). As such we think the risks reside with positive statistical payback in August. In our opinion, an improvement in US labour conditions might see participants trim their US Fed rate cut expectations, which in turn could be USD supportive. There is ~155bps worth of cuts priced in over the Fed’s next 5 meetings. Based on history, without an employment shock we judge this to be too aggressive.

AUD Corner

The uptick in the USD on the back of slightly higher US bond yields, coupled with softer energy (WTI crude -3%) and base metal prices (iron ore -1%) took some of the air out of the AUD on Friday (see above). That said, at ~$0.6765 the AUD is still lingering near the upper end of its multi-month range with last week’s modest slip the first weekly decline in 4-weeks. The AUD also eased on most of the major crosses with falls of ~0.2-0.5% recorded against the EUR, GBP, NZD, CAD, and CNH. By contrast, AUD/JPY is a little firmer and is tracking close to its 1-year average (now ~99).

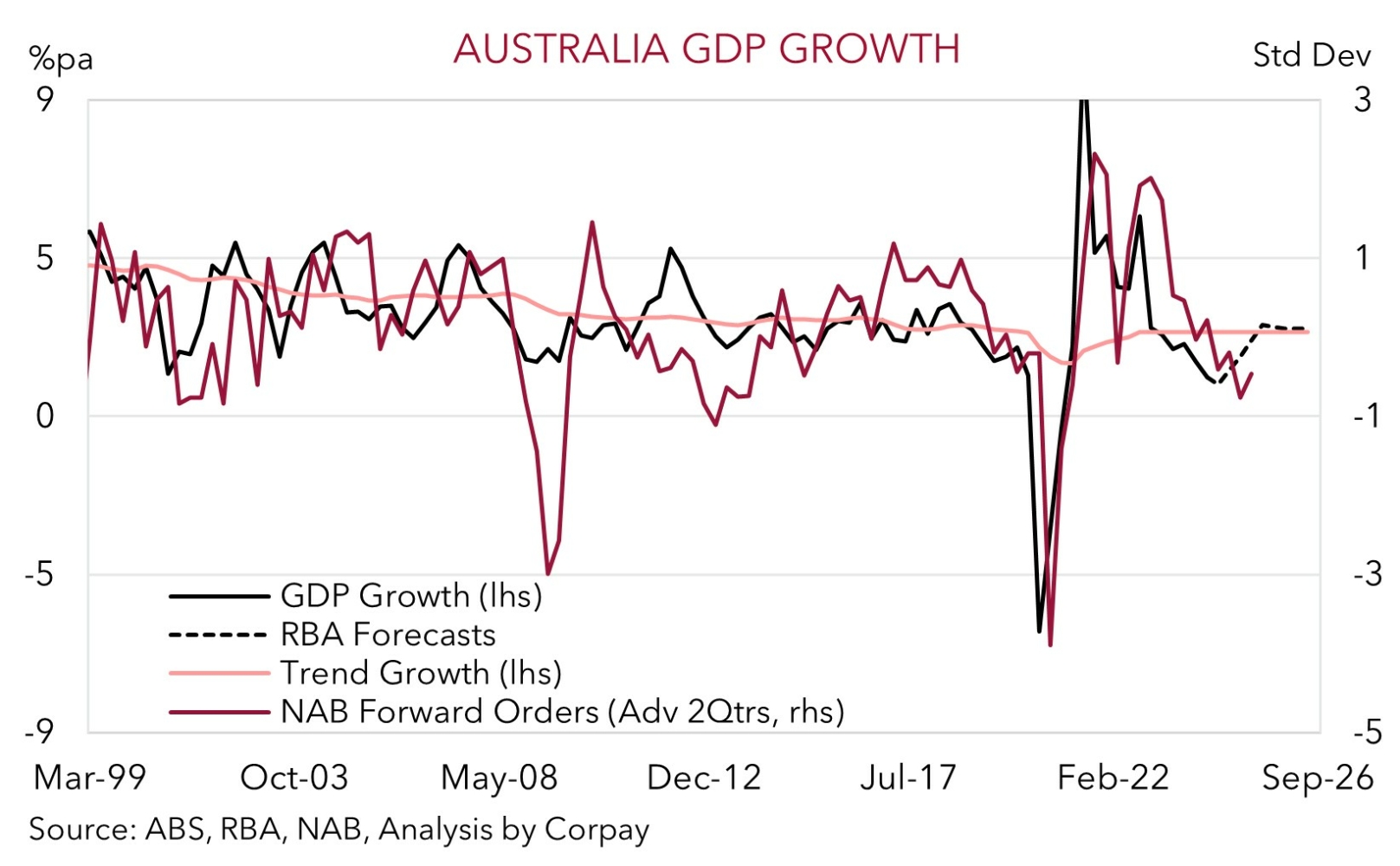

There are a few important local and global data points and events on the radar this week. As mentioned, focus in the US will be on the various labour market metrics with the monthly non-farm payrolls report (Fri night AEST) rounding things out. Domestically, Q2 GDP is out on Wednesday and RBA Governor Bullock speaks on Thursday. More GDP inputs are released today and tomorrow but based on what we already know another tepid quarter of growth is on the cards as high interest rates constrain consumer spending and investment. The market consensus is looking for growth of 0.2%qoq or just 0.9%pa, broadly inline with the RBA expectations. Hence, we doubt this will be enough to shake the RBA’s resolve given it is also looking at other things like the level of activity relative to supply, labour market conditions, and the underlying inflation pulse in its decisions. With this in mind we think Governor Bullock should reiterate the view that interest rate cuts aren’t anticipated this year. This was something Deputy Governor Hauser also outlined late last week when he stressed the RBA isn’t “yet as confident” about the outlook as the US Fed which in turn means it is looking to keep rates steady for the time being.

While we believe the diverging monetary policy outlooks between the RBA and others should be AUD supportive on crosses like AUD/EUR, AUD/CAD, AUD/GBP, and AUD/NZD where their respective central banks have started to lower rates, we do feel AUD/USD is facing near-term headwinds and downside risks thanks to our thoughts the US jobs market may partially rebound. If realised, based on the US Fed’s updated labour market focus, this could see US rate expectations and the USD adjust higher.