• US holiday. Quiet start to the week with the US on holiday. European yields ticked up, while in FX the AUD has been a relative outperformer.

• Iron ore. Sluggish China PMI data has weighed on iron ore. But limited AUD spillover, inline with the low correlation with prices over recent years.

• US data. Release calendar heats up with US ISM out tonight. Various jobs metrics due the next few days. Positive data could give the USD a boost.

With US markets closed for the Labour Day holiday swings across the major asset classes have been minimal at the start of the new week. The lackluster China business PMIs released over the weekend dampened investor sentiment in Asia yesterday with China’s CSI300 index falling 1.9% . But outside of that the other major equity markets are little different from where they closed last week. The China data also exerted downward pressure on iron ore with the ~4% decline pushing prices towards US$97/tonne. While this puts iron ore back near the bottom of its 2024 range, perspective is key as prices are still north of their ~10-year average. Elsewhere, European bond yields nudged up slightly with 10yr rates in the UK and Germany rising ~4bps. And despite the consistent barrage of negative news credit spreads (which are a truer reflection of the underlying macro risks) remain tight. US investment grade credit spreads are hovering close to pre-COVID levels.

In FX there have been limited moves. The USD index has consolidated with small upticks in EUR (now ~$1.1070) and GBP (now ~$1.3145) offsetting a firmer USD/JPY (now ~146.90, a 2-week high). After a strong run over late-August the NZD (now ~$0.6232) has drifted lower over the past few sessions. By contrast, the AUD (now ~$0.6790) continues to track around the upper end of the range it has occupied since early-January with the drop in the iron ore price generating no ill effects. As discussed previously the correlation between iron ore and the AUD has lessened over recent years. This reflects the fact iron ore price swings no longer trigger changes in mining investment, and in turn jobs, inflation, and interest rates as they did during Australia’s mining boom. Australia is now in the export volume stage of the cycle. These volumes (which are still high thanks to the larger size of China’s economy) are where the AUD impact is visible. But rather than being something which propels the AUD higher they are more akin to a downside support.

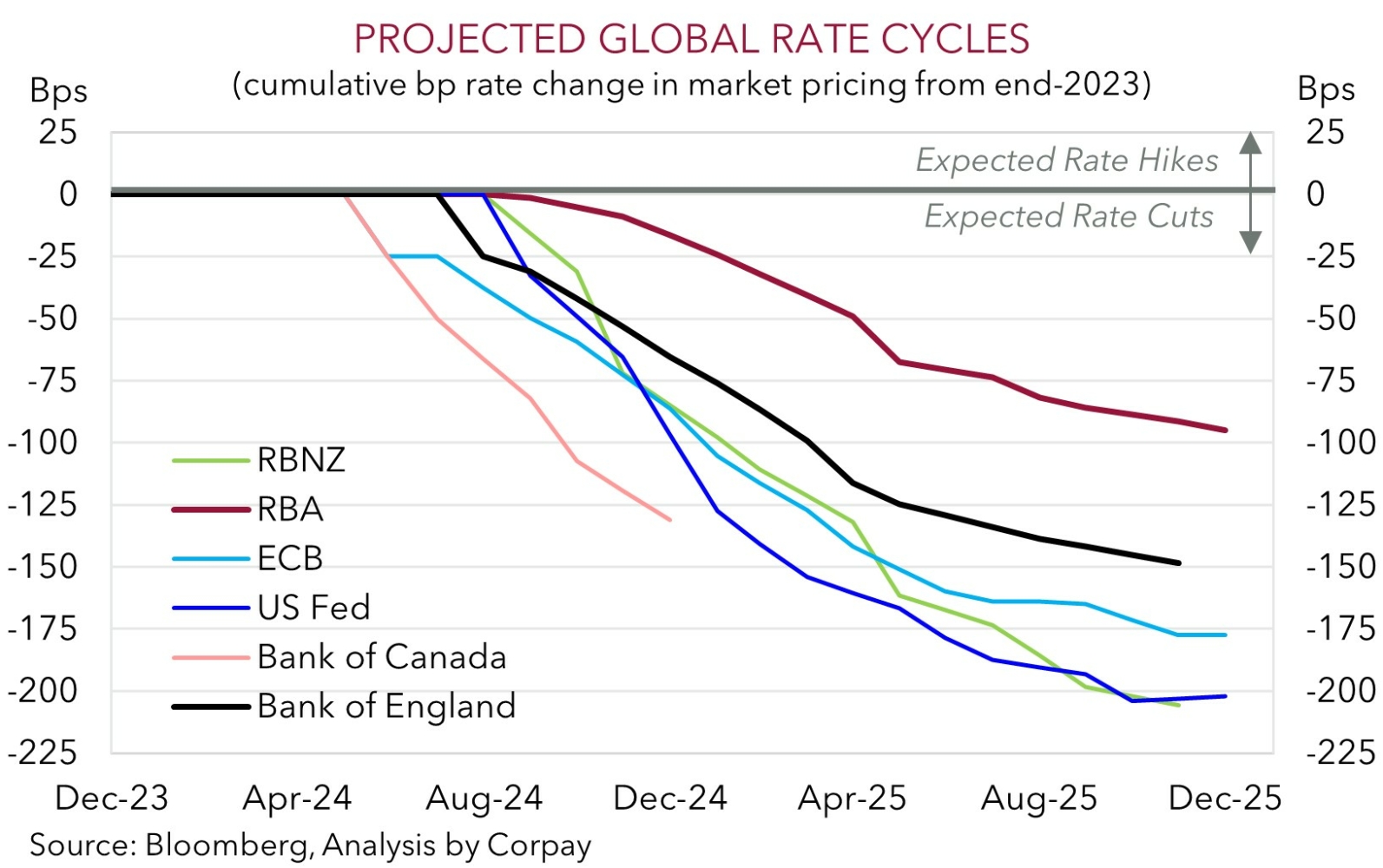

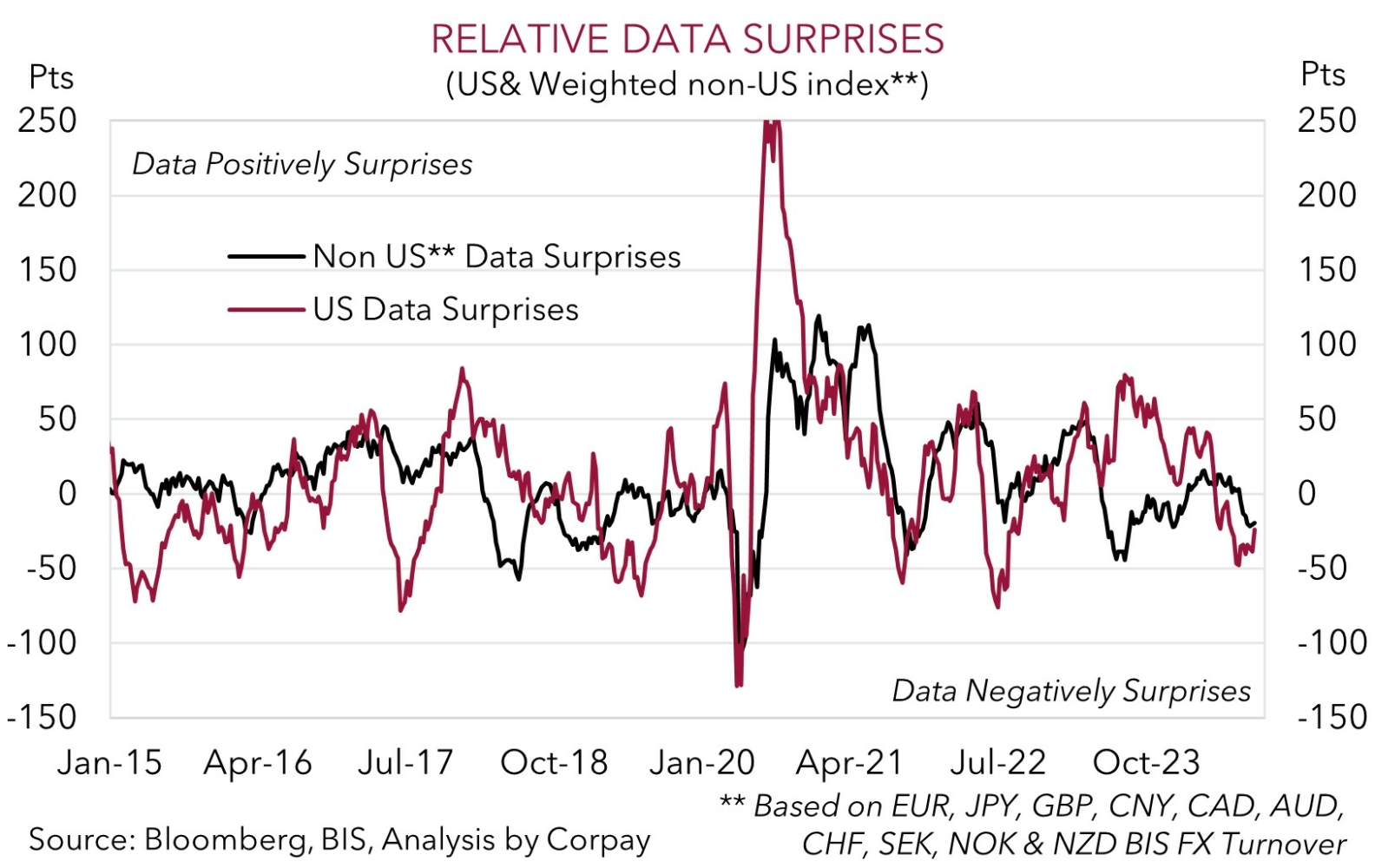

The US economic data calendar starts to heat up tonight with the release of the manufacturing ISM survey (12am AEST). This will be followed over the next few days by JOLTS job openings (Thurs 12am AEST), ADP employment (Thurs 10:15pm AEST), the services ISM (Fri 12am AEST), and the monthly non-farm payrolls report (Fri 10:30pm AEST). In our opinion, signs of improvement in the US data, particularly across the labour market metrics following the recent negative weather disruptions, could see markets pare back their aggressive US Fed rate cut expectations. There is ~153bps worth of rate cuts factored in over the Fed’s next 5 meetings. An upward adjustment in US interest rate expectations on the back of positive US data surprises could see the USD recoup a little lost ground, in our view.

AUD Corner

The AUD has drifted a touch higher during the US holiday impacted quiet start to the week. At ~$0.6790 the AUD is still tracking towards the upper end of its ~7-month range. The AUD has also outperformed on the crosses. The AUD has risen by ~0.2-0.7% against the EUR, GBP, NZD, CAD, and CNH over the past 24hrs, with a slightly larger gain coming through against the JPY (+0.9% to ~99.75).

As mentioned above, the firmer AUD has come about despite iron ore prices losing altitude. As discussed, this isn’t a surprise to us given the limited correlation between swings in the iron ore price and the AUD over the past few years due to the different stage of the mining/export cycle Australia is now in. On top of that the AUD also ignored yesterday’s soft Q2 company profits and inventories figures. More building blocks for Q2 Australian GDP (which is due tomorrow) are out today with net trade and government spending released (11:30am AEST). The data is confirming what we already know. High interest rates are constraining spending and investment, and another tepid quarter of growth is on the cards. Consensus is looking for GDP growth of 0.2%qoq or 0.9%pa, broadly in line with the RBA forecasts. Hence, we doubt this will be enough to alter the RBA’s resolve given this is what is needed to break the back of inflation, and as it is also lasering in on other things like the level of activity relative to supply which is what influences labour market conditions and services prices rather than just growth rates.

We remain of the view that the diverging monetary policy trends between the RBA and others should be AUD supportive on crosses like AUD/EUR, AUD/CAD, AUD/GBP, and AUD/NZD where their respective central banks have started to lower rates. Indeed, we believe the Bank of Canada could cut interest rates again this week (Wednesday 11:45pm AEST). That said, when it comes to AUD/USD we also think short-term headwinds and downside risks are brewing because of our thinking that the US economic/labour market data might bounce back. If realised, this may see US interest rate expectations and the beleaguered USD adjust a bit higher.