• Risk off. Growth worries have weighed on cyclical assets. US equities fell, as did base metal prices. Bond yields declined. USD & JPY stronger.

• AUD weaker. Backdrop has exerted downward pressure on the AUD. There could be more to come if the US jobs data generates USD support.

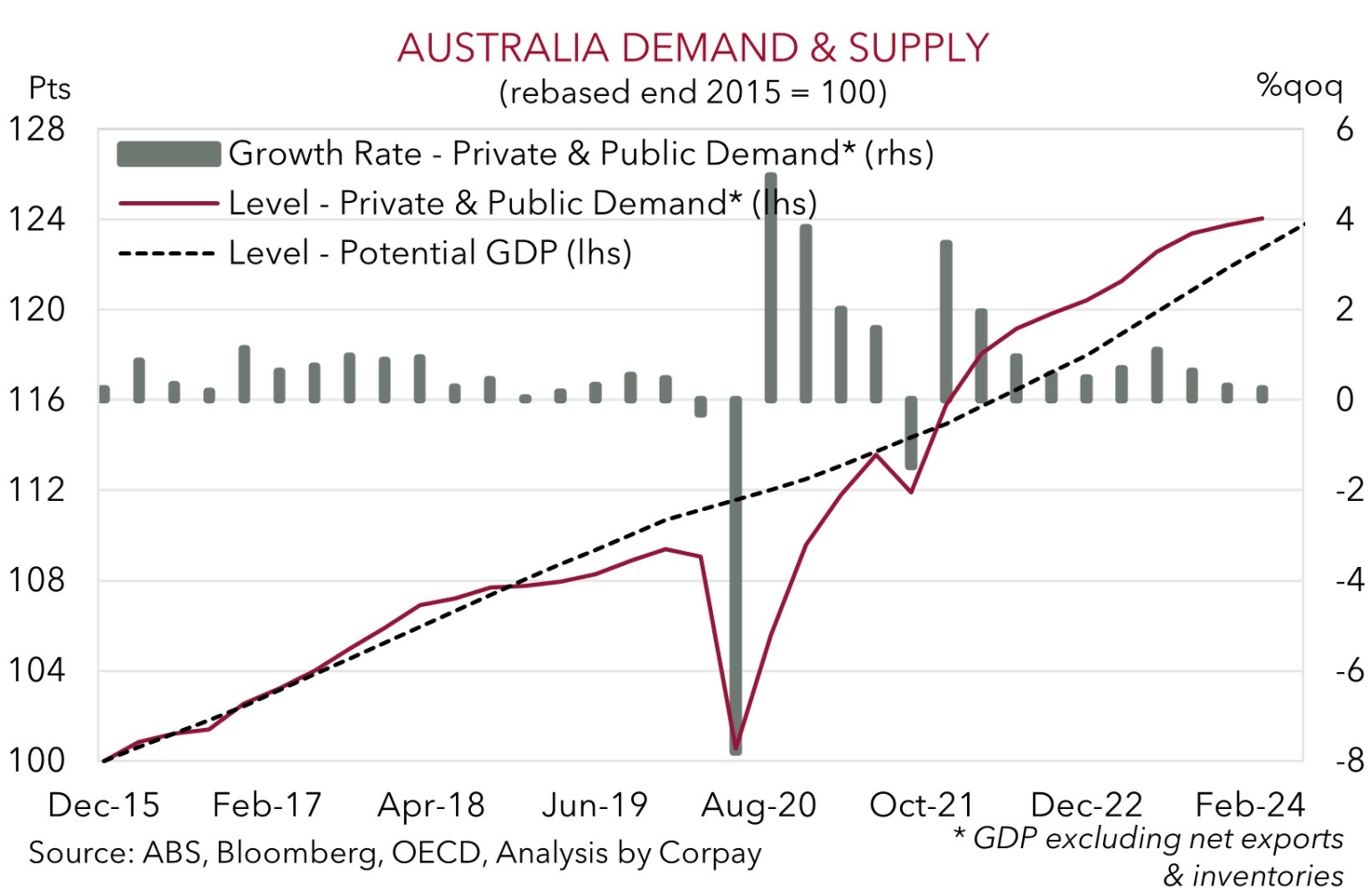

• AU GDP. Q2 GDP released today. Another weak quarter of growth likely. But level of demand is still high. RBA Gov. Bullock speaks tomorrow.

It has been a negative start to September with a bout of risk aversion rippling through markets overnight as the US returned from its long weekend. Some of the moves were reminiscent of the early-August burst of volatility. There doesn’t look to be a single trigger rather nervousness ahead of this week’s US jobs data and sluggish momentum indicators have rekindled growth concerns. In the US the ISM manufacturing index improved a bit in August but at 47.2 it remains in ‘contractionary’ territory (where it has been in 21 of the past 22 months). Under the hood there were mixed messages with new orders slipping, yet prices paid (a leading indicator for inflation) rose and hiring intentions improved.

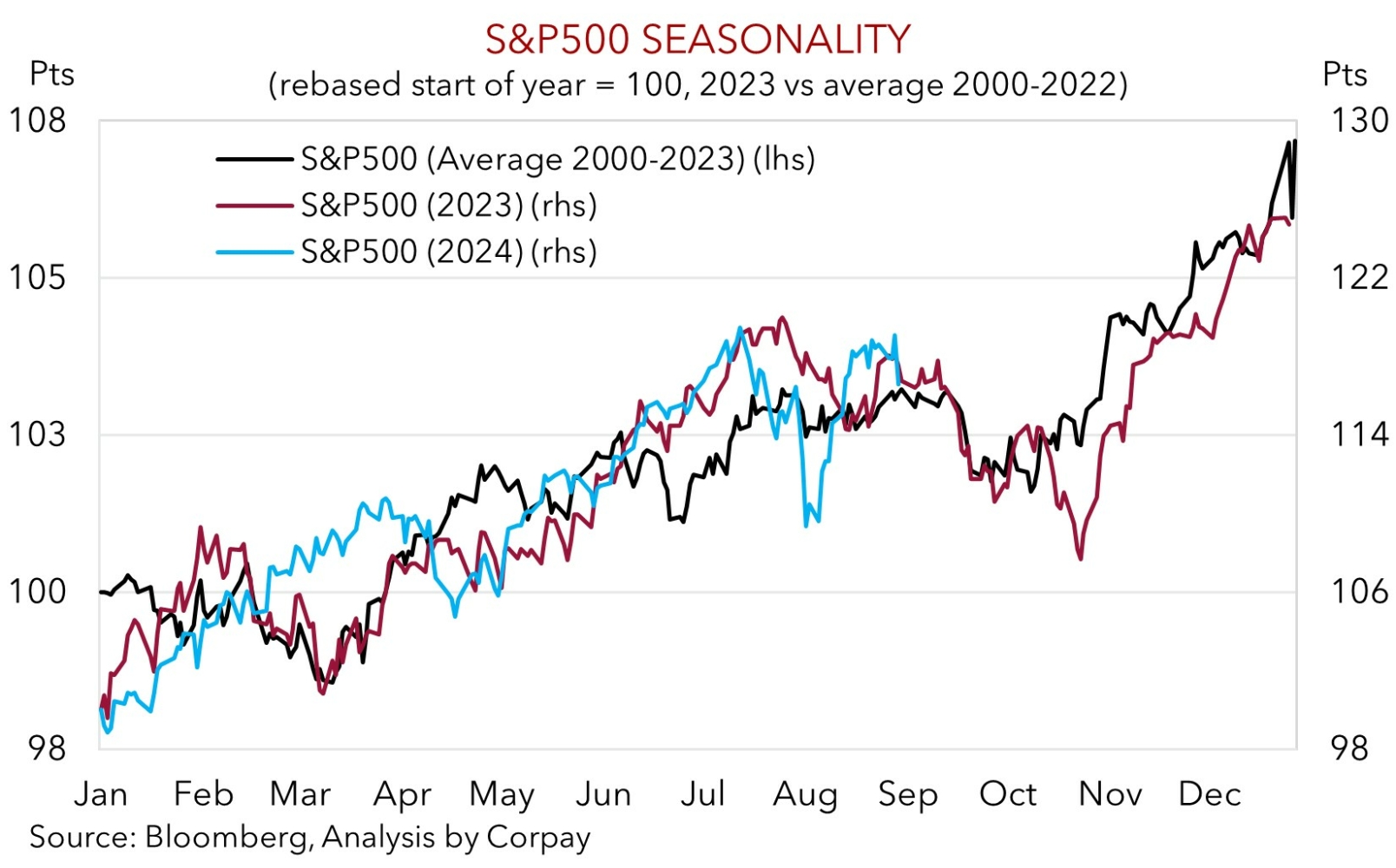

In terms of the numbers, equities fell with a drop in tech-stocks leading the line. The US S&P500 tumbled 2.1%, its largest (and only its 6th) daily fall since the 5 August panic sell-off, with the NASDAQ underperforming (-3.3%). September hasn’t gotten off to a great start, but this isn’t unusual as it has historically been the most negative time for US equities. Since the mid-1980’s the S&P500 has declined in ~61% of years in September as Northern Hemisphere participants returning from their summer break reassess the underlying outlook and risks.

Other cyclical assets weakened. Brent crude slumped ~4.9% to be near ~U$73.70/brl, a low since last December, following reports a deal may be struck in Libya between various factions that would restore oil production. Elsewhere, the pull-back in iron ore continued (-3.2% to US$93.90/tonne, near the lower end of its 2024 range) and copper lost ground (-2.9%). Bond yields declined with long-end rates in Europe and the US ~6-7bps lower. The benchmark US 10yr yield is at ~3.83%, around the bottom of its ~1-year range, while the US 2yr yield shed ~5bps (now ~3.86%). In FX, the backdrop has generally supported the USD, although the JPY has also appreciated. EUR (now ~$1.1045) and GBP (now ~$1.3113) eased, and ahead of tonight’s Bank of Canada meeting (11:45pm AEST) where another dovish rate cut is widely expected USD/CAD edged up (now ~1.3550). By contrast, USD/JPY lost ~1% (now ~145.45). In addition to the market wobbles the JPY also garnered support from Bank of Japan Governor Ueda reiterating further rate hikes are possible if the Japanese economy and inflation follow the banks forecasts. The environment has also seen the NZD (now ~$0.6185) and AUD (now ~$0.6710) depreciate with both where they were tracking early last week.

In the US JOLTS job openings are in focus tonight (12am AEST), with ADP employment (Thurs 10:15pm AEST), the services ISM (Fri 12am AEST), and the monthly non-farm payrolls report (Fri 10:30pm AEST) out over the next few days. As discussed previously, in our view signs of improvement in the US labour market might see markets trim their still aggressive near-term US Fed rate cut expectations. And if realised this could see the USD’s rebound extend.

AUD Corner

The AUD has lost ground over the past 24hrs with the bout of risk aversion on the back of lingering global growth worries exerting downward pressure on cyclical assets like base metals and equities as well as generating USD demand (see above). We had been flagging the short-term headwinds and downside risks that were brewing for the AUD over the past few days. At ~$0.6710 the AUD is back where it was trading early last week. The AUD has also weakened on the crosses with falls of ~0.8-1% recorded against the EUR, GBP, CAD, and CNH. There has been an even more sizeable move in AUD/JPY (-2.2% to ~97.60) with the JPY underpinned not only by its traditional ‘safe-haven’ properties but also by relatively ‘hawkish’ BoJ rhetoric.

Locally, Q2 GDP is released today (11:30am AEST). The various bits and pieces that have flowed through over recent days point to another sluggish quarter of activity. This is hardly surprising as higher interest rates and cost of living pressures constrain consumer spending and investment. The market consensus is penciling in growth of 0.2%qoq or just 0.9%pa. This is broadly inline with the RBA’s forecasts. Although growth momentum is subpar, we doubt it will be enough to change the RBA’s guidance given this is the price that needs to be paid to tame inflation, and as the level of activity (which is being boosted by a larger population) continue to outstrip supply. The mismatch between demand and supply is holding up the labour market and underlying inflation. RBA Governor Bullock is speaking tomorrow on ‘The Costs of High Inflation’.

We continue to think that the RBA is on a slightly different path to many of its global peers. In our opinion, sticky domestic/services inflation, the fiscal income support from stage 3 tax cuts and other relief measures, still elevated level of activity, and lower interest rate starting point should mean that the RBA lags others in terms of when it starts and how far it goes during the next easing cycle. In our judgement, the diverging monetary policy trends should be AUD supportive on crosses like AUD/EUR, AUD/CAD, AUD/GBP, and AUD/NZD where their respective central banks have started to lower rates over the medium-term. That said, when it comes to AUD/USD, as discussed over recent days, we do believe there is scope for the AUD to remain on the backfoot over the near-term if, as we anticipate, a rebound in the US labour market indicators generates more support for the beleaguered USD.