• Policy trends. The pricing in of the Trump agenda & comments by Fed Chair Powell have seen US rate cut expectations pared back.

• USD upswing. The adjustment in yield spreads in the US’ favour is supporting the USD. We think this trend may have further to go.

• Data pulse. The monthly China activity data is due today. Tonight, focus will be on US retail sales given consumption is the economic engine room.

The post US-election market gyrations were on show again overnight as participants continue to contemplate what a Trump policy mix of trade-tariffs, greater fiscal spending, and steps to curb US immigration may mean for the outlook. While US equities underperformed after recently hitting record highs (S&P500 -0.7% vs EuroStoxx600 +1.1%), the opposite occurred in bond markets, and this had FX implications. Expectations of larger and faster ECB rate cuts have risen due to concerns about the Eurozone growth outlook given the potential drag on activity from US tariffs. According to ECB policymaker Nagel, the Trump tariff plan may cause an economic contraction and could cost Germany (the regions manufacturing powerhouse) 1% of GDP. The repricing in Eurozone interest rate expectations (almost 6 ECB rate cuts are factored in by Oct-2025) weighed on regional bond yields.

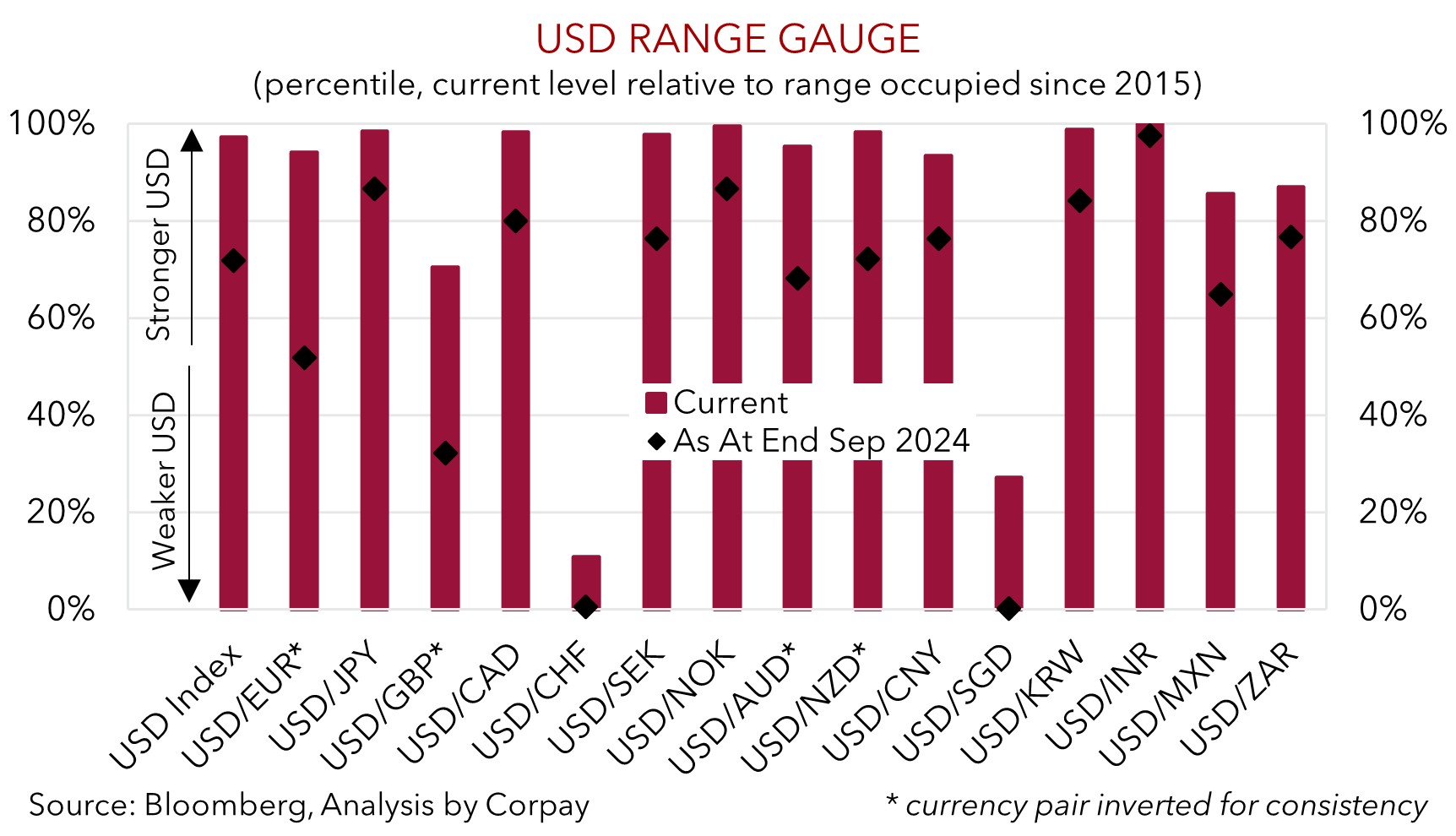

By contrast, odds of further rate cuts by the US Fed continue to be pared back. In addition to discounting of the Trump agenda Fed Chair Powell sent out some relatively ‘hawkish’ signals when speaking this morning. According to Chair Powell the US economy has been “remarkably good”, and this performance means policymakers can approach decisions “carefully” with current trends not suggesting the Fed needs to be in a hurry to lower rates. The probability of another 25bp rate cut by the US Fed in mid-December is now below 60%, with only ~3 reductions assumed by markets by Q1 2026. The US 2yr yield rose ~7bps to be up at ~4.36%, the top end of the range occupied since early-August, with the widening in yield differentials in the US’ favour generating more USD support. As our range gauge chart shows the USD has been appreciating across the board since late-September. EUR is now tracking just above ~$1.05 (levels last traded in Q4 2023), GBP is sub ~$1.27 (a ~4-month low), and USD/JPY has poked its head over ~156 for the first time since July. Elsewhere, USD/SGD (now ~1.3450) is north of its 1-year average, while NZD (now ~$0.5852) and AUD (now ~$0.6460) remain on the backfoot. The NZD is down near its 2024 lows, with the AUD ~7% from its late-September cyclical peak.

The USD upswing is in line with our thinking. As outlined in our previous research we assumed that the Trump election win and the spillovers into US growth, inflation, and interest rate expectations would be USD positive (see Market Musings: Trump 2.0 & the AUD). We believe more signs that the US economy is outperforming its peers via a sluggish set of China activity figures (1pm AEDT) and/or solid US retail spending (12:30am AEDT) might reinforce the USD’s positive run.

AUD Corner

The stronger USD on the back of the uptick in US bond yields as Fed rate cut expectations continue to be pared back has exerted more downward pressure on the AUD (see above). At ~$0.6460 the AUD is tracking at a multi-month low and is a bit more than ~7% from its late-September peak. The USD upswing has been a key driver behind the AUD’s slide with the AUD still holding its ground on most of the major crosses. The AUD consolidated against the EUR, JPY, GBP, NZD, and CAD over the past 24hrs, while AUD/CNH (now ~4.6830) drifted a little lower.

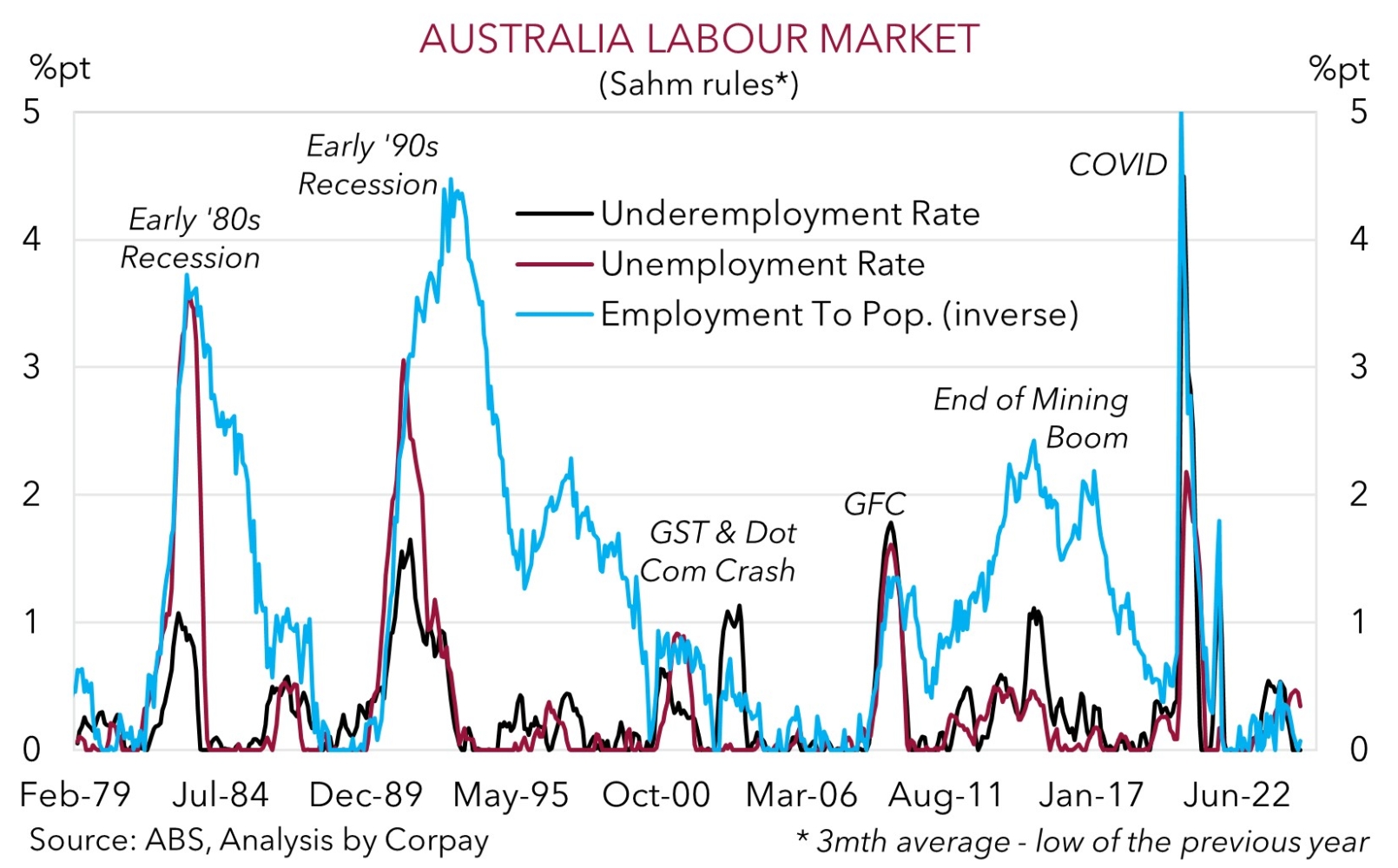

Locally, the October jobs report was released yesterday. And while monthly employment was slightly weaker than predicted (+15,900 vs +25,000 forecast) this follows a remarkably strong run (~387,000 jobs were added the past year). And the broader signals suggest underlying conditions are still positive. At ~2.7%pa annual jobs growth is above its long-run average. Elsewhere, youth unemployment improved, the number of hours worked rose, the employment to population ratio is at a record high, underemployment declined (and is not that far from its post-COVID lows), and the unemployment rate (~4.1%) is below ‘full-employment’. The resilience in the Australian labour market in the face of the jump up in interest rates over the past ~18-months underpins our our long-held assessment that the RBA (which wasn’t as aggressive as others on the way up) will lag its global counterparts in terms of when it kicks off and how many steps it takes during the easing cycle. We continue to believe that the start of a gradual/modest RBA rate cutting phase is a story for H1 2025 with May rather than February the possible jumping off point. Markets are now only fully discounting the first RBA rate cut in August 2025.

While we believe the positive USD factors discussed above should constrain the AUD’s medium-term upside (i.e. we now see the AUD tracking in the mid-$0.60s over the next year), and keep it on the backfoot near term, there are offsets against becoming overly bearish at current low levels. For one, a degree of ‘bad news’ already looks factored in given the AUD is trading ~4 cents under our ‘fair value’ estimate. Moreover, FX is a relative price, and several drivers remain in the AUD’s favour when it comes to AUD-crosses. Over time we think the diverging policy trends between the RBA and other central banks should help the AUD outperform EUR, CAD, NZD, CNH, and to a lesser extent GBP. This can offset some of the drag stemming from an appreciating USD.