• Risk on. Equities continue to climb with the S&P500 up for the 8th straight day. The USD has weakened. The AUD is up at a 1-month high.

• Fed comments. A few Fed officials have suggested a cut in September is up for debate. Chair Powell speaks at Jackson Hole later this week.

• Already priced? But this already looks well priced in. Cautious comments from Powell could see US rate expectations & the USD rebound.

No new major news continues to be good news for markets. Equities have continued to power ahead. The US tech-focused NASDAQ outperformed (+1.4%) with the S&P500 (+1%) also rising for its 8th straight session, its longest winning streak of 2024. As a result, the S&P500 is a bit over 1% from its mid-July record highs, almost ~10% from the lows touched in the panic sell-off a few weeks ago. Elsewhere, oil prices lost ground with WTI crude falling 3% to ~US$74.40/brl on fresh reports a cease-fire may be brokered between Israel and Hamas. By contrast, base metals rose with copper and iron ore up between 1.3-2% as the positive mood overpowered lingering concerns about demand out of China.

In bonds, the US yield curve flattened slightly with the benchmark 10yr rate slipping (-1bp to 3.87%) and the policy expectations driven 2yr rate nudging up (+2bps to 4.07%). While in FX the USD extended its negative run with USD/JPY dropping under ~147, while the EUR (now ~$1.1085) hit its highest point of the year and GBP (now ~$1.2990) strengthened. The weaker USD has seen USD/SGD (now ~1.3085) tumble to levels last traded in early 2023. And the backdrop has helped cyclical growth linked currencies like the NZD (now ~$0.6110) and AUD (now ~$0.6730) outperform.

While there weren’t any major economic releases comments from a few US Fed officials was a factor behind the moves (especially the weaker USD). The comments suggest the start of the Fed’s easing cycle is on the horizon. According to the normally ‘dovish’ Daly (a voting member in 2024) the inflation data has given her “more confidence that we are on our way to price stability” so it is time to consider cuts. Added to that the normally ‘hawkish’ Kashkari (a non-voter this year) looks to have changed his tune. Kashkari previously thought a cut wouldn’t be warranted until year-end but now he believes “the balance of risks has shifted” given labour market trends so a move in September should be debated.

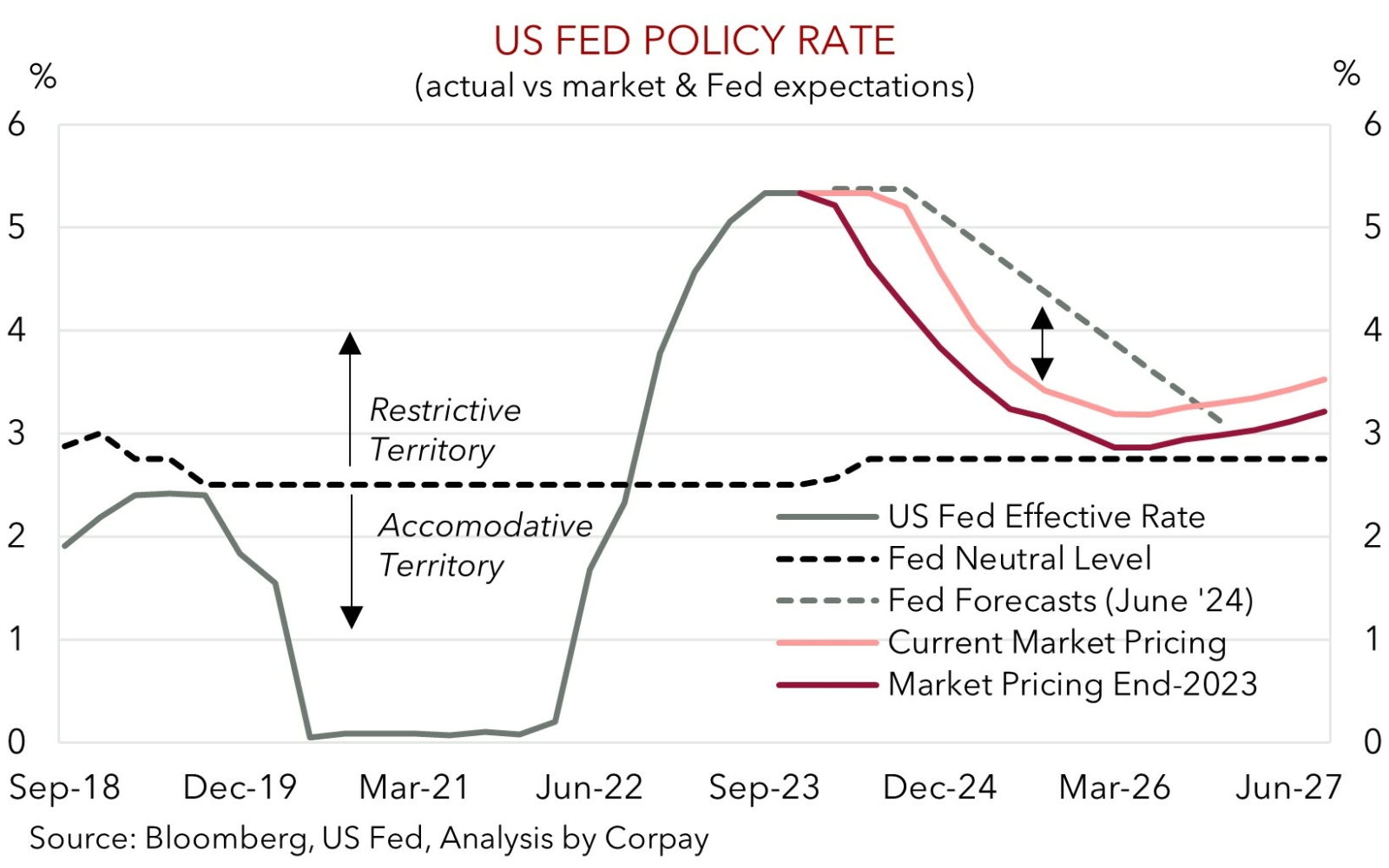

Over coming days the attention will be on the latest global business PMIs (Thurs) and Fed Chair Powell’s speech at the annual Jackson Hole event (Fri night AEST). As outlined previously, outcomes compared to expectations drive markets. And with this in mind we think signs in the PMI data that the US economy is still growing, and cautious comments from Chair Powell nodding to a potential move in September but stressing a gradual data driven recalibration is in train could see markets trim their elevated near-term Fed rate cut pricing. As our chart shows, the markets are now more ‘dovish’ than the Fed’s baseline view with ~32bps of cuts factored in at the September meeting and almost ~95bps baked in by year-end. If realised, we think an upward adjustment may see the USD claw back a little ground over the short-term.

AUD Corner

The AUD has continued to climb with the weaker USD and positive risk sentiment (as illustrated by higher equities and base metal prices) pushing it up to ~$0.6730 (see above). This is a ~1-month high and ~6% above the lows touched during the equity market driven bout of risk aversion a few weeks ago. The backdrop has also helped the AUD outperform on the crosses with gains of ~0.2-0.6% recorded against the EUR, JPY, GBP, CAD, and CNH over the past 24hrs.

The minutes of the August RBA meeting are released today (11:30am AEST). But based on the post meeting press conference and last week’s Parliamentary testimony we don’t expect them to provide any new information. Hence, offshore macro and market trends will continue to be the main AUD influence over the near-term. As discussed above, the global PMIs (Thurs) and US Fed Chair Powell’s Jackson Hole speech (Fri night AEST) are the main focal points over the rest of this week.

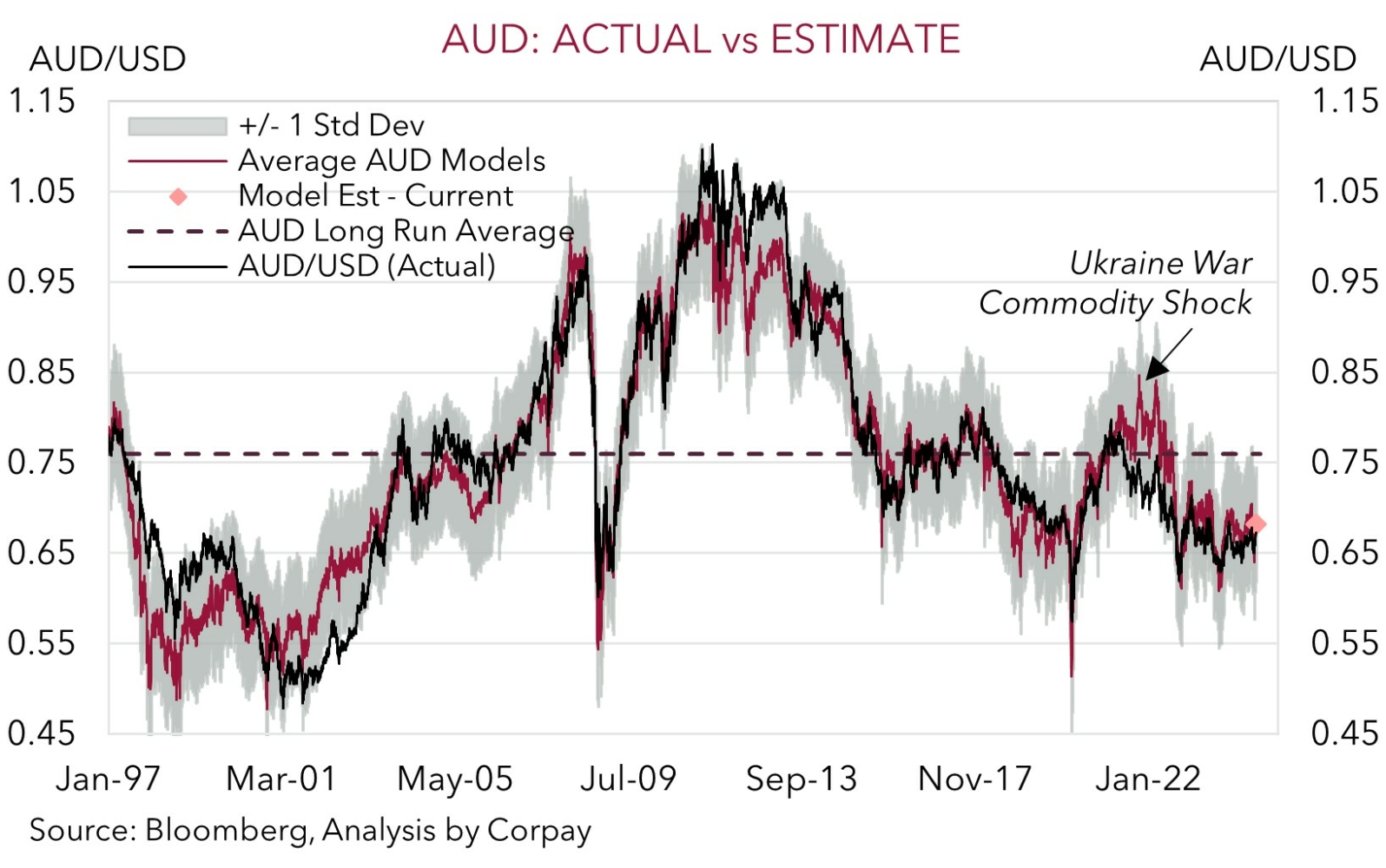

While we continue to have a positive bias for the AUD over the medium-term (particularly on crosses like AUD/EUR, AUD/GBP, and AUD/NZD) thanks to the diverging policy outlooks between the ‘higher for longer’ RBA and other central banks which are already in the process of lowering rates we also believe the AUD’s revival might soon stall. Technically, due to the speed of its rebound, the AUD is approaching ‘overbought’ levels on ‘relative strength indices’. Added to that, the valuation gap between the AUD and our suite of ‘fair value’ models, which we have pointed to over recent weeks, has now largely closed (see chart below). And as mentioned above, we think there is a risk the upcoming events help the the USD bounce back a little. Signs US growth remains positive and/or cautious comments from Fed Chair Powell which lean against the markets aggressive policy easing assumptions could generate an upward repricing in US interest rate expectations.