• US trends. US equities power ahead, while bond yields & the USD lost ground. AUD up at a multi-week high despite the slump in iron ore.

• Fed speech. Fed Chair Powell speaks later this week. Will he push back on the still aggressive near-term rate cut expectations?

• Event radar. In addition to the Jackson Hole speech the global PMIs (Thurs), Japan CPI (Fri) & NZ retail sales (Fri) are also due.

It was a rather subdued end to a busy week on Friday with limited new economic information released to challenge the status quo. Equities continued to move higher with the S&P500 (+0.2%) recording its 7th straight daily increase. The bout of risk aversion two weeks ago when equity markets sold off sharply is fading into the background. The US S&P500 is within striking distance of its July peak, with last week’s 3.9% jump the biggest weekly rise in 9-months. Elsewhere, US bond yields slipped slightly. The benchmark US 10yr rate shed ~3bps to be at 3.88%. While this is above the lows touched during the recent turbulence, the moderating US inflation pulse and prospect of a US Fed rate cutting cycle is holding US bond yields towards the bottom end of their 1-year range.

Across commodities, gold hit a new record (now ~US$2508/ounce) with the unfolding global monetary policy easing cycle a supportive factor. WTI crude oil is hovering around its 1-year average (now ~$76.65/brl), and iron ore extended its slide to be at ~U$93/tonne. Concerns about demand given the structural challenges plaguing the Chinese property sector are one catalyst, however seasonal production swings would also be at play. Similar pullbacks in iron ore have occurred at this time in previous years. Indeed, the iron ore price is at levels it last traded in August 2023. In FX, the dip in US bond yields exerted downward pressure on the USD. The interest rate sensitive USD/JPY tracked the narrowing yield spreads to be under ~148. EUR (now ~$1.1025) is near the upper end of its multi-month range, as is GBP (now ~$1.2940). The positive risk vibes helped the NZD poke its head back above ~$0.60, while the AUD (now ~$0.6667) edged up towards a ~1-month high.

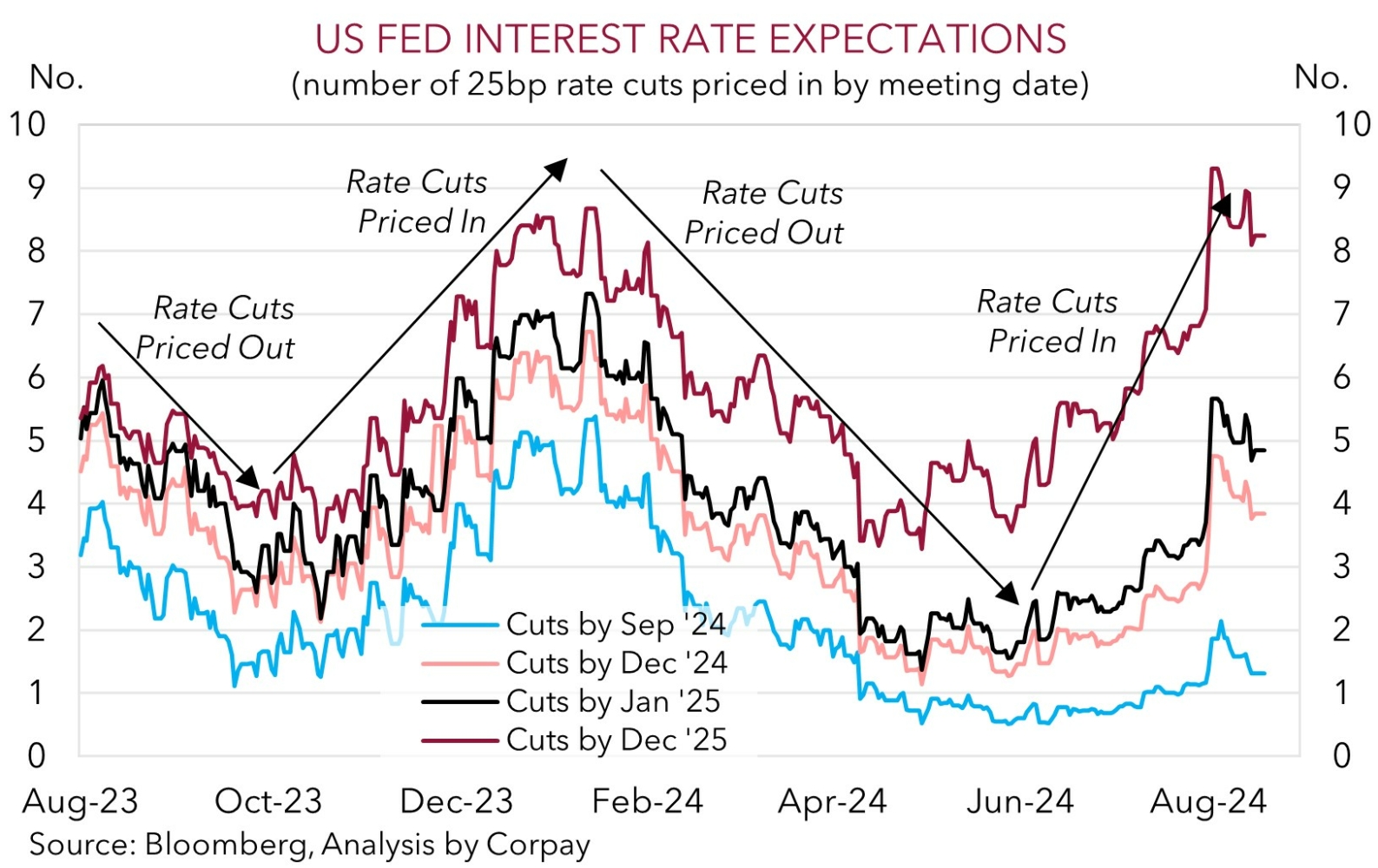

It is a light global release calendar this week. The minutes of the last US Fed meeting are due (Thurs morning AEST), as are the latest global business PMIs (Thurs), Canadian CPI (Tues), the ECB’s wage indicator (Thurs), NZ retail sales volumes (Fri), and Japanese CPI (Fri). The main event will be Fed Chair Powell’s speech on the outlook at the annual Jackson Hole Symposium (Fri night AEST). Outcomes compared to expectations drive markets. And with this in mind we think signs in the PMI data that the US economy is still growing, and cautious comments from Chair Powell nodding to a potential move in September but stressing a gradual data driven recalibration is in train could see markets trim their elevated near-term Fed rate cut pricing. The markets continue to factor in ~32bps of cuts by the Fed in September, and almost ~100bps by year-end. If realised, we think an upward adjustment may see the USD claw back a little ground over the short-term.

AUD Corner

The AUD has extended its revival. The softer USD on the back of lower US bond yields and upbeat risk sentiment (as illustrated by the upswing in equities) has pushed the AUD up to ~$0.6667 (see above). This is near its highest level in a month and over 5% above the panic equity market sell-off low touched 2-weeks ago. The AUD also strengthened on some of the major crosses with AUD/EUR (now ~0.6045) and AUD/GBP (now ~0.5152) at the top of their respective 3-week ranges. AUD/CNH (now ~4.7750) has also recovered back above its 1-year average, while AUD/NZD remains north of ~1.10. We think AUD/NZD might receive another boost this week if NZ Q2 retail sales volumes (Fri AEST) show another contraction which would reinforce the RBNZ’s ‘dovish’ turn.

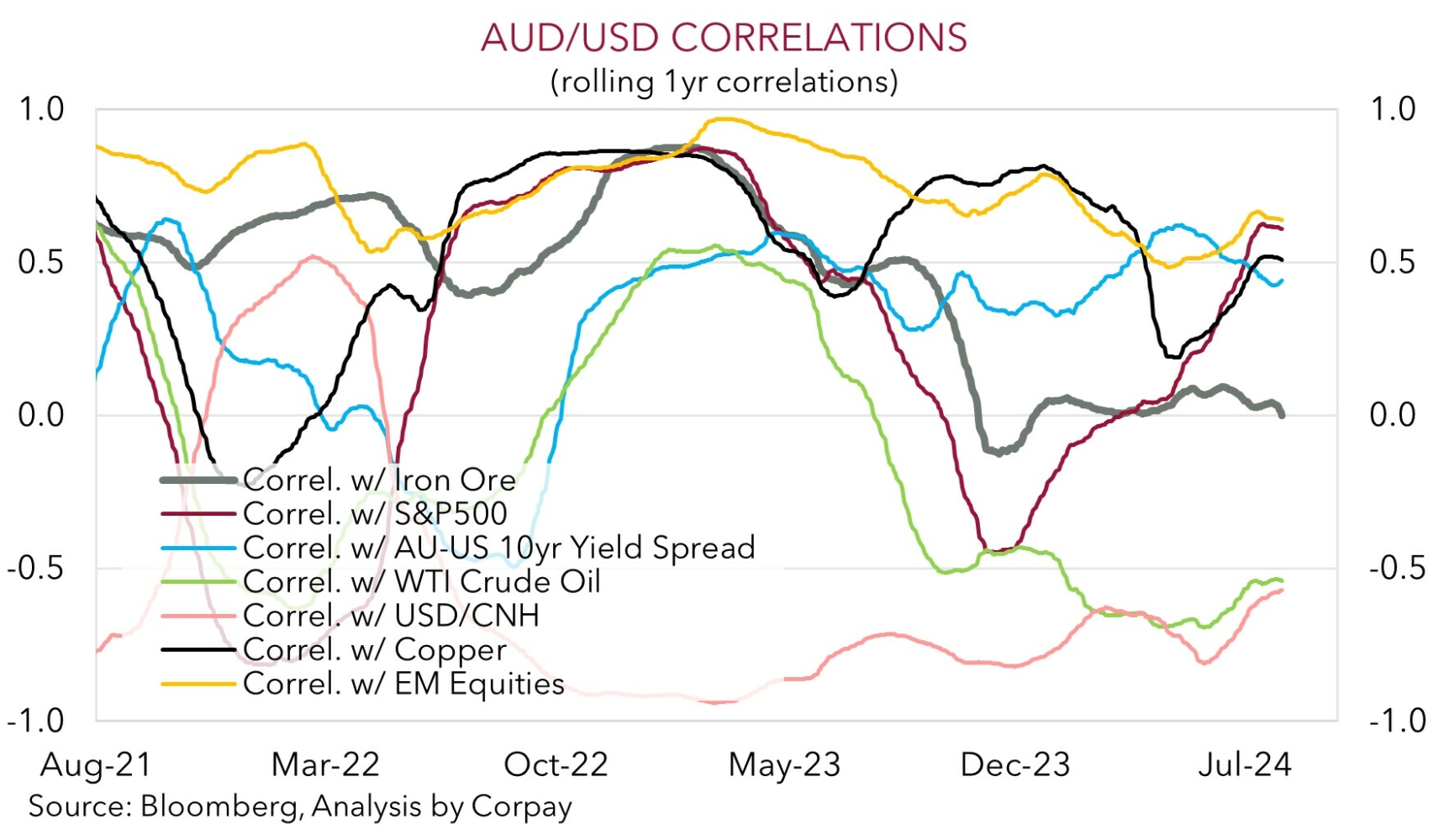

The AUD’s resilience in the face of falling iron ore prices may surprise some but not us. As mentioned above, the iron ore price (now ~US$93/tonne) has dropped to levels last traded a year ago. However, as our chart shows, the correlation between iron ore and the AUD has waned over recent years. This reflects the fact iron ore price swings no longer trigger changes in mining investment, and in turn jobs, inflation, and interest rates as they did during the mining boom. Australia is now in the export volume stage of the cycle. These volumes (which are still high thanks to the larger size of China’s economy) are where the AUD impact is visible. But rather than being something which propels the AUD higher they are more akin to a downside support. As pointed out previously, since Australia’s trade account improved in 2015, the AUD has seldom traded sub-$0.65. On our figuring it has only been below $0.65 in ~6% of trading days.

In terms of this week the local calendar is limited with the minutes of the August RBA meeting (Tues AEST) unlikely to reveal anything new given the post meeting press conference and last week’s Parliamentary testimony. Rather offshore trends will be in the driver’s seat. As flagged the key events will be the latest batch of global business PMIs (Thurs) and US Fed Chair Powell’s Jackson Hole speech (Fri night AEST). We think the USD could recoup a little lost ground if the data shows growth in the US remains positive and Chair Powell tempers expectations for aggressive easing over the next few meetings. While this could take some of the heat out the AUD we don’t think it should fall to far given ongoing strength on the crosses thanks to accommodative financial conditions and diverging expectations between the RBA and other central banks. We believe the shift in yield spreads in Australia’s favour is AUD supportive, particularly on crosses like AUD/NZD, AUD/EUR, AUD/CAD, and AUD/GBP where their respective central banks have started to cut rates.