• Push-pull. US equities rose, bond yields dipped & the USD reversed course as markets focused on the looming easing cycle. AUD traded in a 1.1% range.

• BoE holds. BoE mirrored the US Fed. Reference to further tightening was removed, but policymakers still not at the point to cut rates. GBP firmer.

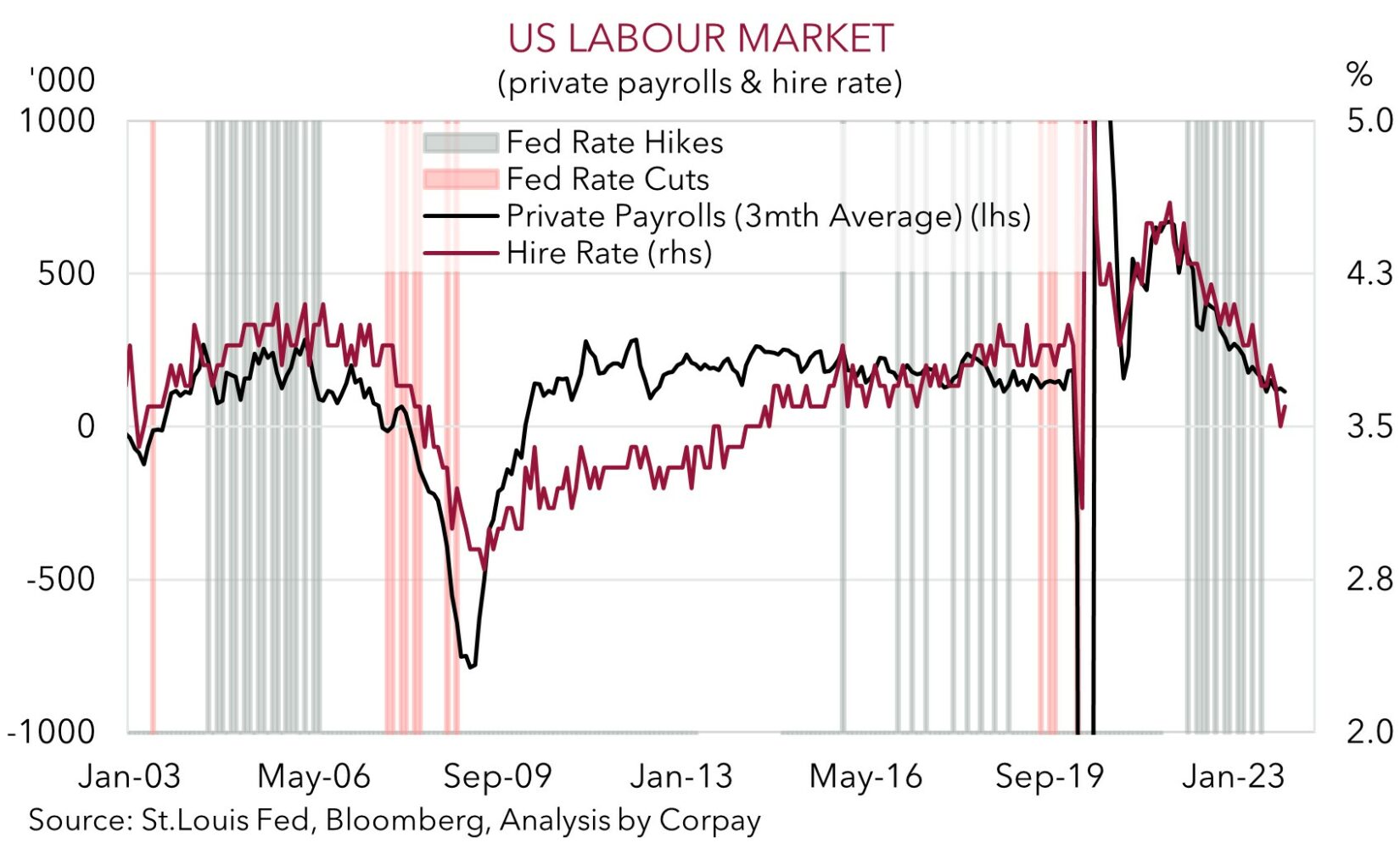

• US jobs. US labour market report in focus tonight. The data may generate another burst of FX volatility as it can influence US interest rate expectations.

Another busy session overnight with participants also continuing to digest yesterday’s US Fed meeting. US equities bounced back (S&P500 +1.1%) with a rebound in tech stocks and spillover from a further decline in bond yields supportive. US yields fell another ~1-6bps across the curve with the benchmark 10yr rate near the bottom of its multi-month range (now ~3.86%). Lower oil prices (WTI crude -2.2%) following reports of a possible ceasefire in the Israel-Hamas war and other bond friendly events has seen markets continue to focus on the looming global policy easing cycle.

In the US, weekly jobless claims (one of the best real time reads on the labour market) rose a bit with more people filing for unemployment benefits. Inflation-wise, US productivity was also stronger than anticipated, meaning unit labour costs were softer and in turn that broader price pressures are cooling. In the UK, in a similar move to the US Fed, the Bank of England held rates steady but toned down its guidance. The BoE jettisoned the reference to the possibility of “further tightening”, swapping it with a more flexible view that it is “prepared to adjust monetary policy” depending on the data and that it will “keep under review” how long rates should stay where they are. The latter was a shot across the bow of aggressive market pricing with BoE Governor Bailey also noting that although inflation has fallen things aren’t at the point where rates can be lowered. UK yields slipped modestly (~2-5bps lower across the curve) with a full BoE rate cut discounted by June.

Intra-day volatility in FX continued with the USD Index reversing course. The interest rate sensitive USD/JPY is hovering below ~146.40, GBP strengthened as the BoE wasn’t as ‘dovish’ as what was baked in (now ~$1.2745), and the EUR recovered (now ~$1.0870) with slightly higher than predicted Eurozone inflation also muddying the waters about the prospect of a near-term ECB rate cut. Eurozone core CPI eased to 3.3%pa with ‘sticky’ services prices still well above where they need to be. USD/SGD tracked the swings in the USD with the pair falling to the bottom of its range (now ~1.3368). The AUD unwound an earlier slide as the USD lost ground and US equities rose to be little different from this time yesterday (now ~$0.6570).

Focus tonight will be on the US labour market report (12:30am AEDT). Expectations are centered on jobs growth slowing (mkt 185,000), unemployment edging up (mkt 3.8%), and monthly wages growth moderating (mkt +0.3%). In our view, based on the signal from leading indicators and potential payback in some sectors after warmer than usual weather in prior months, risks appear tilted to labour conditions loosening more than thought. If realised, this is likely to exert downward pressure on the USD as markets laser in on the future Fed rate cutting cycle which we see kicking off mid-year (see Market Musings: US Fed pivot has further to run).

AUD corner

The AUD has continued to whip around with the currency trading in a ~1.1% range for the second day. After dipping early on the AUD rebounded as some softer US data weighed on the USD and US equity markets rose (see above). On balance, at ~$0.6575 the AUD is little different from where it was 24hrs ago, and it is broadly in line with where it started the week. That said, the AUD has remained on the backfoot on the crosses. The firmer GBP post the less dovish than priced BoE has pushed AUD/GBP to its lowest point since mid-September (now ~0.5156). AUD/EUR has slipped below its ~1-month average (now ~0.6045) with the upside surprise in Eurozone CPI EUR supportive. The pull-back in bond yields has also underpinned the JPY with AUD/JPY tracking under its 100-day moving average (~96.31) for the first time in ~6-weeks.

The recent burst of AUD volatility isn’t unusual (recall that since the mid-80’s the AUD has, on average, traded in a 3.1 cent range each month). And as we have discussed, we think the swings observed over January could be an example of what may be in store. Economic and policy turning points are normally associated with twists and turns given visibility of how things are travelling are often murkier at this part of the cycle, and markets often over/undershoot as the data validates or challenges assumptions (see Market Musings: AUD volatility: a taste of things to come?).

Given tonight’s US labour market report (12:30am AEDT), the AUD’s short-term volatility is likely to continue as the data can meaningfully shift the dial on US interest rate expectations. As mentioned above, US labour market conditions are projected to loosen and if this comes through we expect the USD to weaken, with a further drop in the US bond yields as the upcoming Fed easing cycle is factored in set to bolster risk appetite and the AUD. By contrast, an upside surprise in the US labour data is likely to see the USD strengthen (AUD decline) as markets trim near-term Fed rate cut pricing (markets are still discounting a ~40% chance of a rate cut in March despite the Fed’s explicit push back).

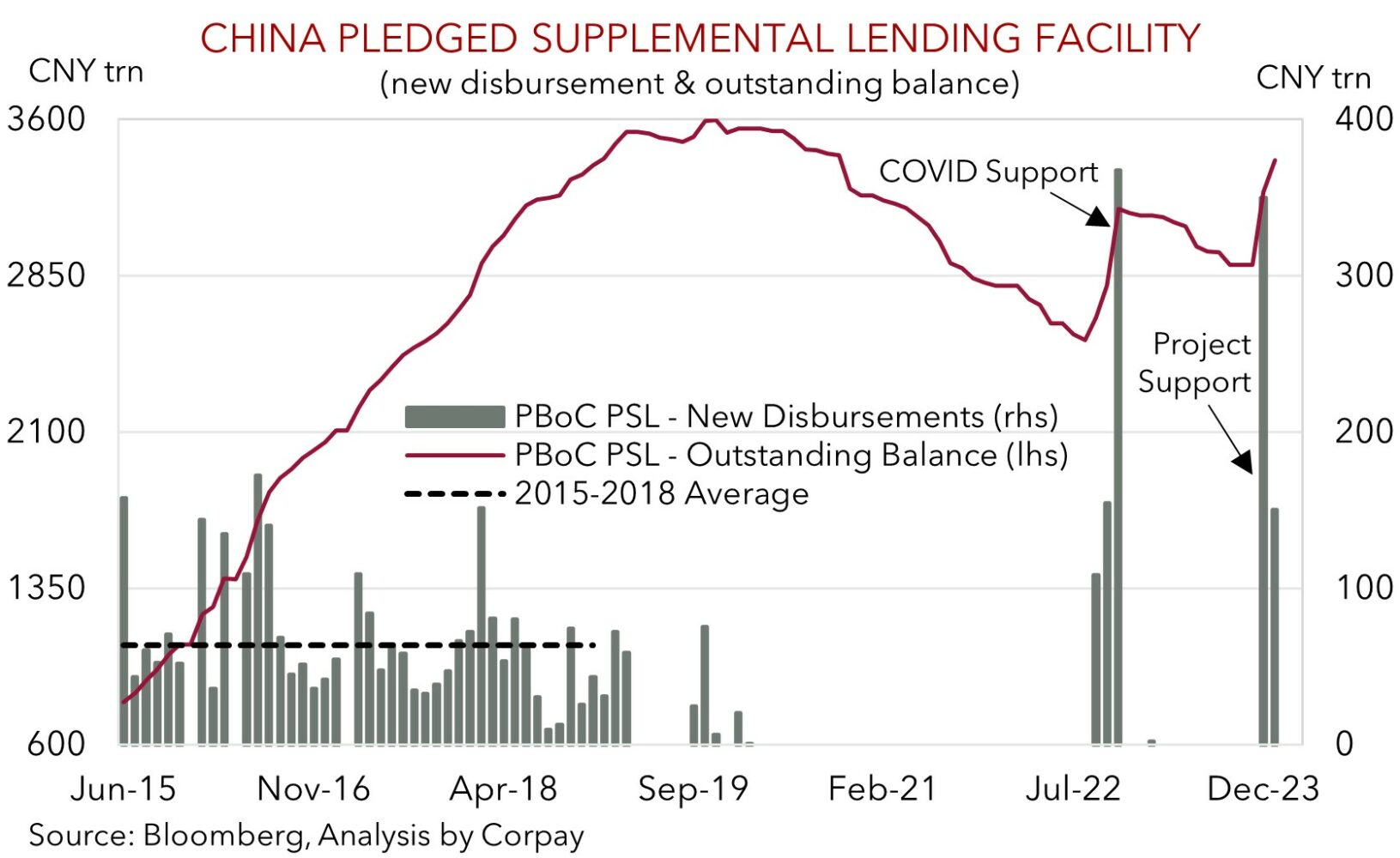

However, beyond short-term gyrations, on balance we continue to hold a positive medium-term bias for the AUD with: (a) narrower Australia-US short-dated yield differentials (as the RBA lags other major central banks during the easing phase); (b) support to domestic activity from the incoming tax cuts and a larger population; (c) a paring back of ‘net short’ AUD positioning (as measured by CFTC futures); and (d) a sturdier Chinese economy as stimulus gains traction projected to give the AUD a helping hand over the year. Our baseline view is for the AUD to average a slightly higher level over 2024 compared to last year (i.e. ~$0.69 vs $0.66 in 2023) with the AUD kicking on into the low ~$0.70s in H2.

AUD levels to watch (support / resistance): 0.6480, 0.6510 / 0.6620, 0.6660