• US jobs. A much stronger than expected US jobs report jolted markets. US yields rose. This supported the USD & pushed the AUD back to the bottom of its range.

• Too good to be true? Issues with seasonal factors & weather impacts could have made a good set of numbers look great. Payback likely over time.

• RBA in focus. A new year & a new format. No policy change anticipated. But Governor Bullock could follow the Fed & BoE in pushing back on rate cut bets.

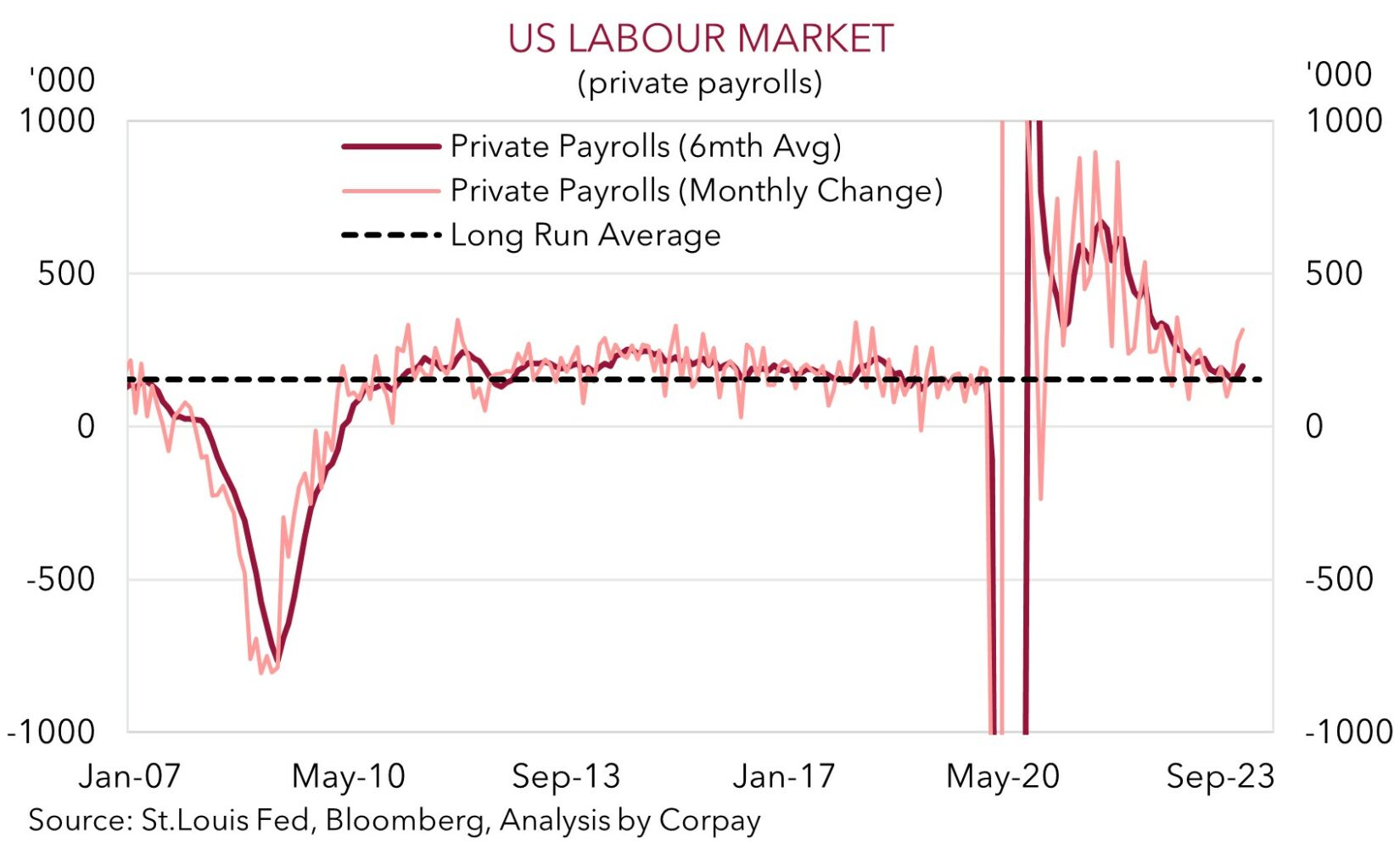

Another day another burst of volatility on Friday with a bumper US jobs report jolting markets. Nonfarm payrolls rose 353,000 in January, almost double predictions, with the unemployment rate holding at 3.7% and average hourly earnings accelerating (from 4.3%pa to 4.5%pa). There were positive revisions to prior months with the 3-month moving average of job gains now 289,000, up from an originally reported 165,000 in December. The data reinforced Fed Chair Powell’s comments that a March rate cut was ‘unlikely’. In response odds of a reduction were scaled back further. Markets that were still holding out hope of an early move despite the Fed’s rhetoric are now assigning a ~20% chance of easing in March (it was sitting at ~50% last week), with almost a full 25bp cut removed from the 2024 expectations curve.

US bond yields lifted with the 2yr (now 4.36%) and 10yr (now 4.02%) rates up 16bps and 14bps respectively. Big moves on the day, but taking a step back shows yields are only where they were tracking a week or so ago. Despite the jump in yields US equities had a positive session (S&P500 +1.1%). A strong performance across tech (NASDAQ +1.7%) and views the robust labour market means the economy is still chugging along underpinned sentiment. In FX, the USD strengthened with the Index touching its highest since mid-December. EUR fell under ~$1.08 and in line with the increase in yields USD/JPY shot up to ~148.40. AUD unwound the recovery staged heading into the US data and is back near the bottom of its range (now ~$0.6515).

While the January jobs data supports the Fed’s near-term hawkishness (and the USD), a deep dive suggests the adage that “if it’s too good to be true, it probably is” may hold true. Statistical shenanigans around seasonal factors and weather impacts could have played a role in making a good set of numbers look great. This is something the Fed’s Goolsbee noted after the release (“if you peel back the onion a little bit, it’s not as strong as that headline number advertises”). The size of the payrolls lift in January might be partly due to new seasonal patterns in the US data post the COVID disruptions statisticians are struggling to adjust for. Colder weather, which reduced the workweek but had no impact on salaries, also probably boosted average hourly earnings. All up, based on this and the signal from leading indicators, some retracement in the January figures looks likely over coming months.

Any fall-out from weekend US-led military actions in the Middle East, and speeches by Fed members will be in focus. Chair Powell appears on US “60 minutes” today (11am AEDT) with another 13 appearances scheduled by other members this week. We think further push back on near-term easing pricing can keep the USD elevated with next week’s CPI and retail sales the next data catalysts for a re-think.

AUD corner

After grinding higher earlier in the session Friday’s positive US jobs report and resultant jump in bond yields and the USD has seen the AUD tumble back to the bottom of its recent range (now ~$0.6515) (see above). But in a sign of how USD rather than AUD-centric the moves were the AUD is little different on most crosses. The AUD is, on net, virtually unchanged against the EUR and GBP compared to this time Friday, and while AUD/JPY (+0.5%) rose as the JPY weakened on the back of higher global bond yields, AUD/CNH (-0.5%) went the other way.

As pointed out in our recent research, ongoing pockets of AUD volatility should be anticipated over the period ahead as geopolitical risks wax and wane, growth/inflation data deviates from expectations, and interest rate pricing consequently adjusts (see Market Musings: AUD volatility: a taste of things to come?). This is not unusual as turning points in economic cycles are difficult to navigate.

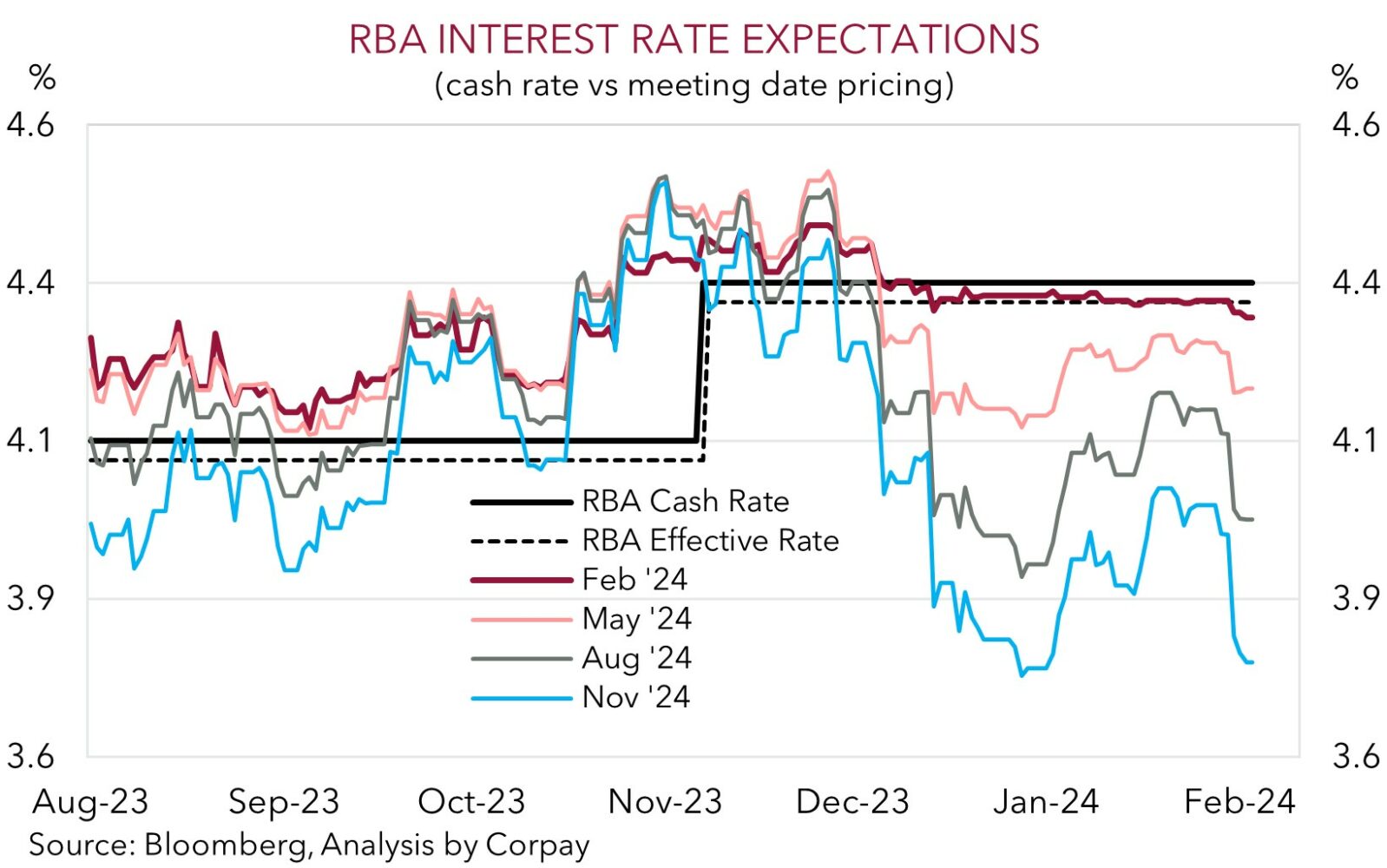

The AUD gyrations can continue this week with the RBA in focus (Tuesday). This is not only the first meeting of 2024 but also the first under the new structure. The decision and updated quarterly forecasts are released at 2:30pm AEDT and Governor Bullock holds a press conference from 3:30pm AEDT. Governor Bullock is also speaking again in Parliamentary Testimony (Friday). Following the step down in inflation and softness in consumer spending no change in policy is widely anticipated. Rather the focus will be on the RBA’s latest projections and forward guidance.

While inflation is heading in the right direction, and the RBA’s forecasts are likely to show it back in the 2-3%pa target band around mid-2025, we think policymakers will continue to provide an even-handed policy outlook (i.e. still not completely rule out the risk of another move if the services inflation surprises, but stress the main discussion is on how long high interest rates may need to remain in place). That said, we think the RBA will be reluctant to point blankly state the next rates move could be down. And given interest rate markets appear to have priced in a more definitive ‘dovish’ turn by the RBA (see chart below), much like the USD and GBP reaction to last week’s US Fed and BoE meetings, we believe a push back on near-term policy easing calls may give the AUD some renewed support as short-dated interest rate expectations adjust. However, given the firmer USD backdrop, we feel an AUD rebound is more likely to come through more durably on the crosses. AUD/EUR and AUD/NZD are two that stand out in our mind that could recover lost ground based on the EUR’s negative seasonality at this time of the year coupled with the Eurozone’s economic struggles, and with the Q4 NZ labour market report (released Wednesday) set to show conditions are loosening. Indeed, both pairs are already trading below levels implied by fundamental drivers such as relative interest rate expectations.

AUD levels to watch (support / resistance): 0.6480, 0.6500 / 0.6580, 0.6660

SGD corner

USD/SGD has whipped around over the past week as US interest rates and the USD reacted to the US Fed meeting and labour market report. That said, on net, at ~1.3425 USD/SGD is only marginally higher than where it was trading this time last week. On the crosses, EUR/SGD has slipped back (now ~1.4480) with patchy Eurozone economic data exerting pressure on the EUR. And after easing back over most of last week SGD/JPY rebounded on Friday (now 110.52) with the jump up in US bond yields weighing on the JPY.

As mentioned, volatility in markets, the USD and USD/SGD is likely to continue for a while as expectations about when the next global policy easing cycle may start and how far rates could fall continue to be swung around by the incoming data. This week Fed speakers will be in focus, and we think that a further push back on near-term rate cut pricing could give the USD (and USD/SGD) a bit more of a boost. Though with odds of a Fed rate cut in March having adjusted meaningfully (now ~20% after being as high as 90% late last year) upside potential in the USD looks more limited from here, in our view.

SGD levels to watch (support / resistance): 1.3340, 1.3390 / 1.3465, 1.3485