• Holding pattern. Modest moves in most markets overnight. JPY’s upswing extends. AUD range bound just above its 1-month average.

• UK rates. BoE cut interest rates by 25bps. 2 members voted for a larger move. More easing expected over time. AUD/GBP supported overnight.

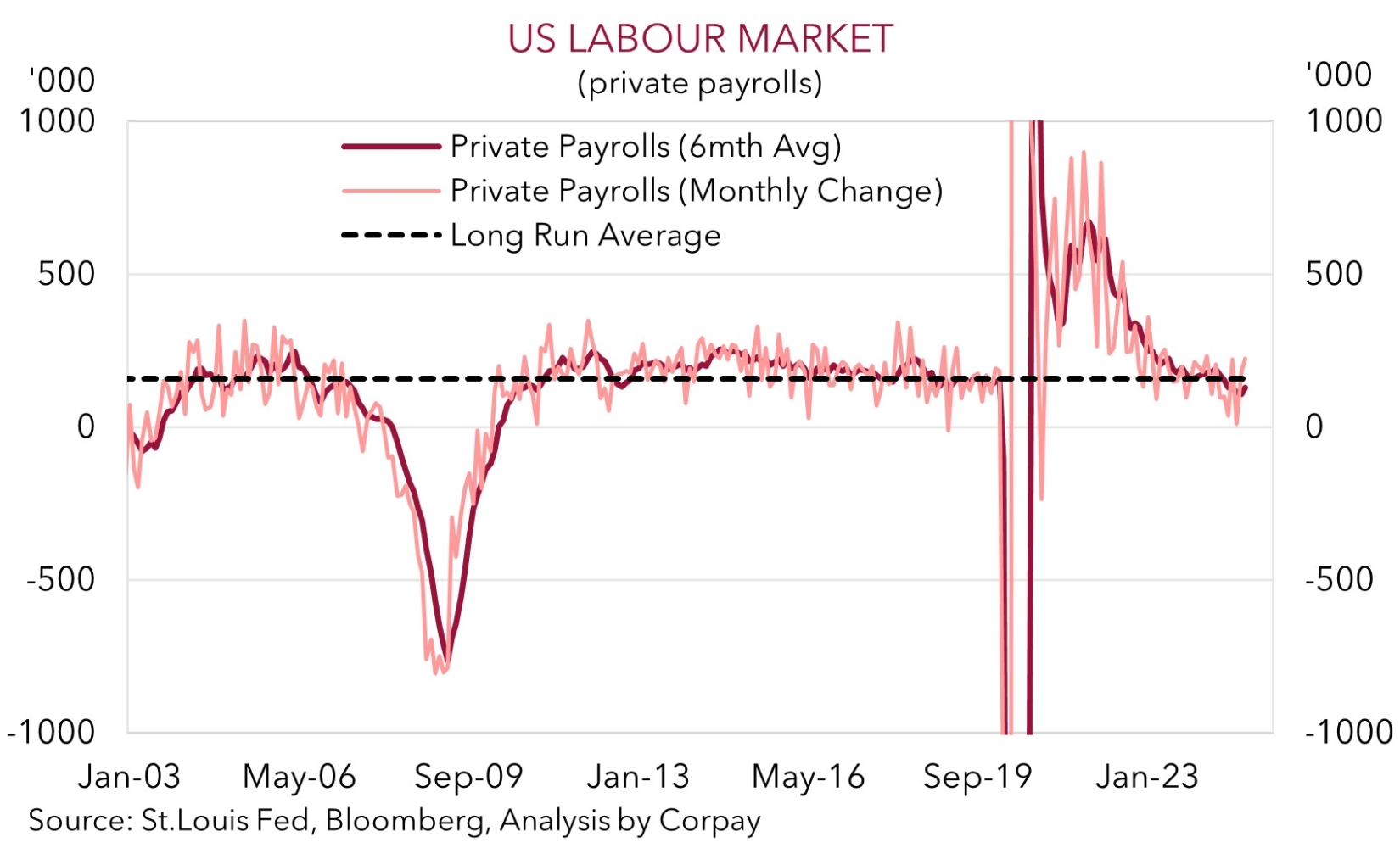

• US jobs. US employment report in focus tonight. Signs the US labour market is cooling could revive US Fed rate cut bets & drag on the USD.

Global Trends

A relative sense of calm in most markets overnight with only a few macro announcements, no fresh news regarding US trade tariffs, and the US jobs report due tonight. Equities edged higher with European stocks outperforming the US (EuroStoxx600 +1.2% vs S&P500 +0.1%). Bond yields partially reversed yesterday’s falls with US rates ticking up ~2-3bps across the curve. In FX, the USD index tread water, although this masked movement below the surface. EUR drifted a bit lower (now ~$1.0385) and GBP lost ground (now ~$1.2435). As expected, the Bank of England cut interest rates by another 25bps which lowered the policy rate to 4.5%. The surprise was the slightly more ‘dovish’ tone. Two members of the BoE committee voted for a larger 50bp reduction, and although the BoE is forecasting firmer UK inflation it also sees weaker growth. Markets are pricing in the next BoE rate cut by May and another by year-end. This might prove to be too optimistic.

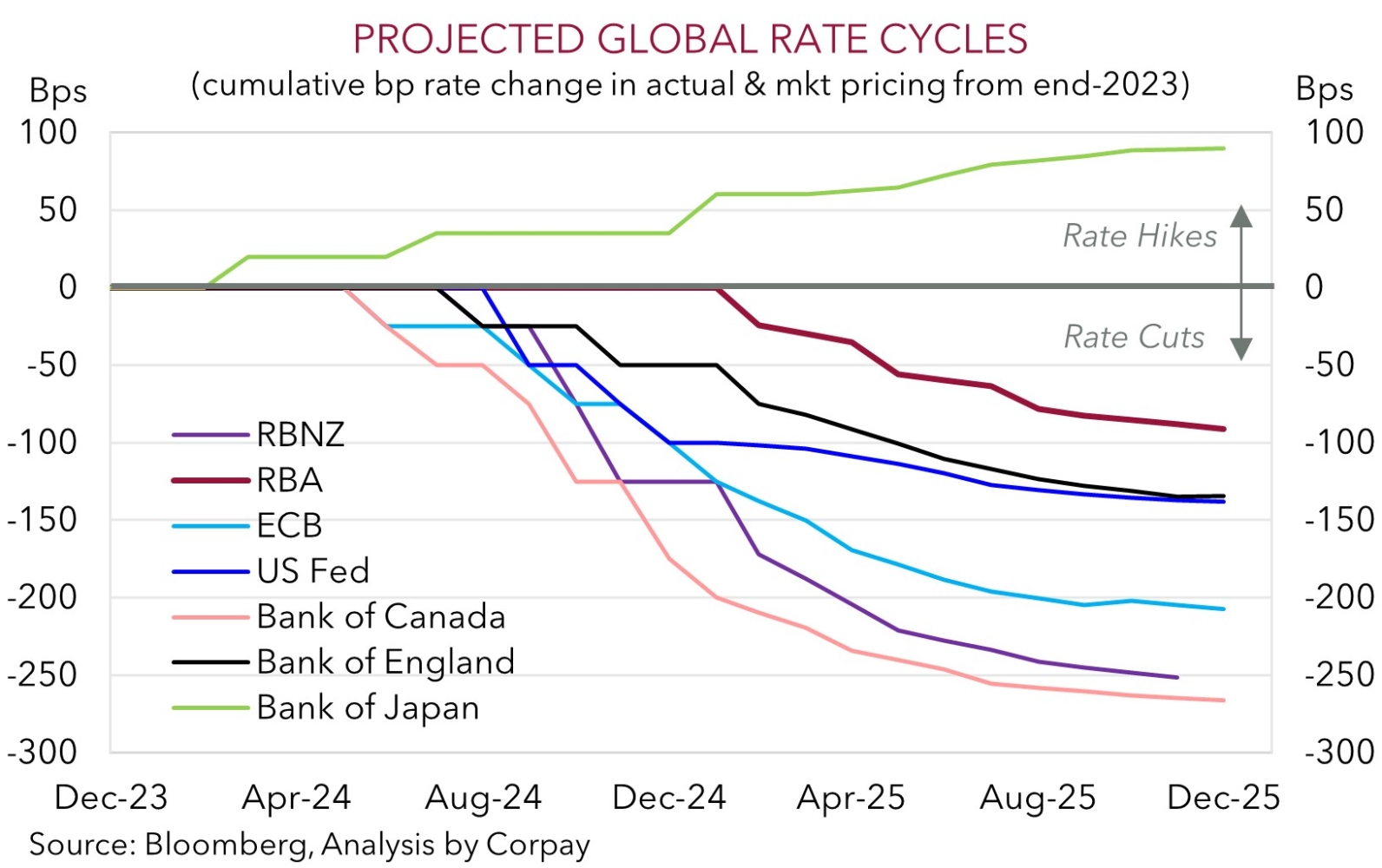

Elsewhere, the JPY’s broad-based revival extended. USD/JPY is at levels last traded in mid-December (now ~151.53), ~4.6% below its January highs. On top of the acceleration in Japanese wages earlier in the week, yesterday Bank of Japan policymaker Tamura stated two more rate hikes could be needed to contain upside inflation risks. The diverging policy trends between the BoJ and other major central banks, and the narrowing in yield differentials should continue to support the JPY over the medium-term, in our opinion. Closer to home, the NZD (now ~$0.5672) has slipped back a little and the AUD (now ~$0.6281) has been range-bound.

As discussed before, we believe markets will be subject to tariff-related headline risk for a while. But as observed over recent days, on the proviso there is no new tariff developments, we believe the elevated USD can remain on the backfoot. We continue to think a lot of positives have already been factored into the USD. The US jobs report is today’s market focal point (12:30am AEDT). Annual benchmark revisions should see US employment growth from the past year revised lower. The weaker standing in the US labour market coupled with negative payback after last months surprising surge in hiring and potential impacts from weather/fire disruptions suggest there are downside risks to consensus predictions. If realised, this could revive some US Fed interest rate cut expectations which in turn drags on the USD.

Trans-Tasman Zone

AUD has held in a tight range over the past 24hrs (now ~$0.6281) while NZD (now ~$0.5672) has drifted lower with a few push-pull forces at work. That said, compared to earlier in the week volatility has subsided with the improved underlying sentiment helping the AUD rebound ~3.2% from Monday’s low point. On the crosses the AUD was mixed overnight. AUD/EUR has edged up towards its 1-year average (now ~0.6048), AUD/NZD (now ~1.1073) nudged higher, and AUD/GBP (now ~0.5051) was supported by the ‘dovish’ Bank of England interest rate cut (see above). By contrast, AUD/JPY has continued to move lower on the back of the JPY’s upswing. At ~95.17 AUD/JPY is at a 5-month low. Heightened expectations the Bank of Japan has more work to do to cool inflation is in line with our thinking. We see a bit more downside in AUD/JPY over the medium-term.

As mentioned above, on the assumption there is no new US tariff-related news, the market driver into the end of the week will be the US jobs report (12:30am AEDT). We believe the risks are slightly tilted to the report showing US labour market conditions are loosening, which if realised may exert pressure on the USD and provide some more support for the AUD. As is the case every month, the AUD is likely to be volatile around the release of the US jobs figures. But taking a step back from the potential short-term gyrations we remain of the view that even on a positive surprise in the US jobs data downside potential in the AUD should be somewhat limited.

This is because: (a) the AUD is still trading at a discount to fundamentals (it is ~4 cents below our ‘fair value’ models); (b) sentiment is already skewed negatively (‘net short’ AUD positioning, as measured by CFTC futures, is stretched): (c) the AUD has not sustainably trading below where it is over the past decade (the AUD has only been sub-$0.62 ~1% of the time since 2015); (d) we feel tariff induced export headwinds in China are likely to be offset via measures aimed at boosting commodity-intensive infrastructure investment. This is where Australia’s exports are plugged into; (e) Australia’s export basket is tariff-insulated given its minimal manufacturing and with it running a trade surplus with the US; and (f) a RBA policy easing cycle looks discounted. In our judgement, these forces should help the AUD outperform currencies like the EUR, CAD, NZD, and CNH over the period ahead.