• Market swings. Mix of solid US data & tariff news weighed on equities, pushed up bond yields, & supported the USD. AUD & NZD lost some ground.

• Volatility. More US tariff announcements likely. This can generate volatility. Push-pull forces still at play. Further headline driven swings anticipated.

• Event Radar. In addition to US tariff news markets will be focused on US CPI, US retail sales, & Fed Chair Powell’s Congressional Testimony this week.

Global Trends

Some renewed pressure on equity and bond markets emerged on Friday night. The US S&P500 slipped back ~1% with the tech-sector underperforming (NASDAQ -1.4%). Bond yields reversed some of their recent falls with the US 10yr rate rising ~5bps (now ~4.49%) and the 2yr climbing ~8bps (now ~4.29%). On net, the underlying gyrations saw the USD tick up, though if you take a step back the USD still ended the week below where it closed the previous week. Across FX EUR has underperformed (now ~$1.0290) and GBP eased (now ~$1.2375). The backdrop helped the JPY extend its revival (USD/JPY is now ~151.30, a multi-week low). Closer to home, the NZD (now ~$0.5640) and AUD (now ~$0.6230) lost some ground, although the AUD remains ~2.5% above last Monday’s low point.

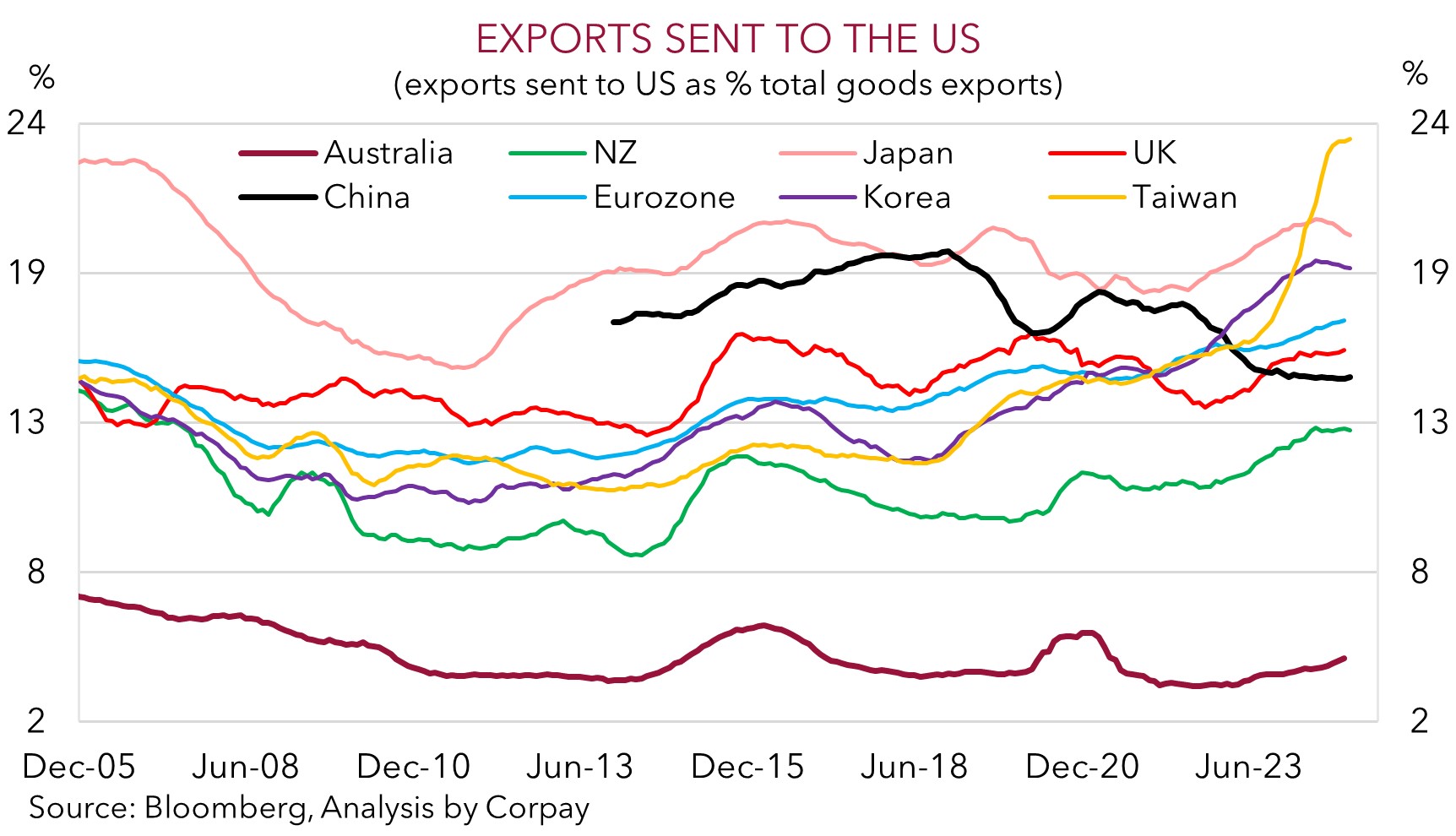

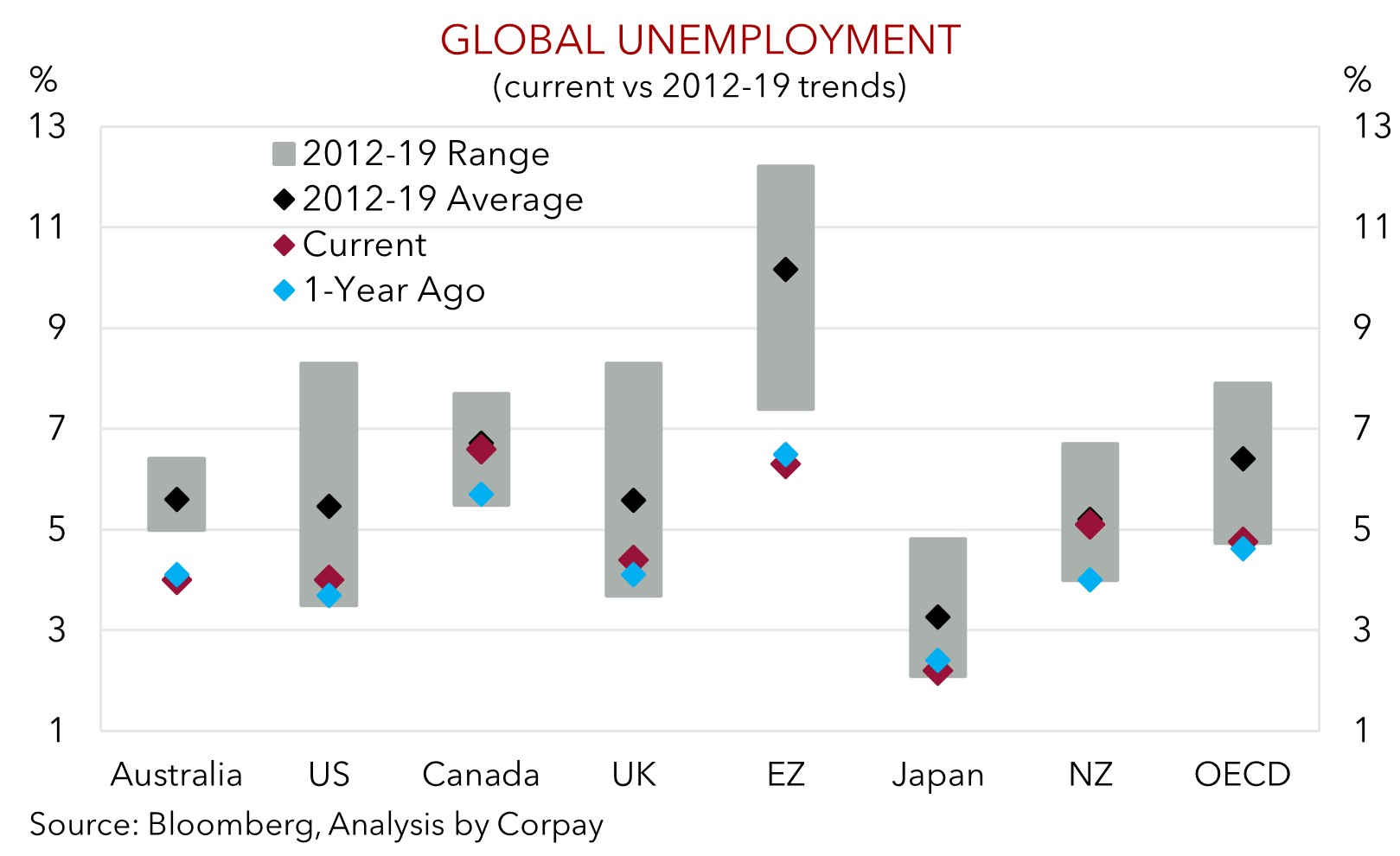

There were a few push-pull factors at play which drove the market swings. In terms of the data flow, the US jobs report was noisy but largely positive. Non-farm payrolls growth was weaker than forecast in January (143,000 vs mkt 175,000), but there were positive upward revisions to the prior two months. The US unemployment rate also dipped down to 4%, its lowest since last May, and as our chart shows, this is towards the bottom of its pre-COVID range. Elsewhere, while the University of Michigan consumer confidence gauge softened, inflation expectations jumped as households started to think about what trade tariffs may mean for prices. This was compounded by media reports reciprocal tariffs could be imposed imminently with President Trump stating they may be announced on Monday or Tuesday. The moves would impose tariffs on US imports that are equal to rates trading partners impose on US exports. This morning President Trump indicated 25% tariffs on US steel and aluminum imports were also coming.

We think the ongoing threat of more US trade tariffs should be USD supportive. This may be reinforced this week by US macro trends. US CPI (Weds night AEDT) risks showing the disinflation pulse is stalling with core inflation expected to remain around 3.2%pa. We believe US retail sales (Fri night AEDT) should also show resilient consumer spending. This mix is likely to see US Fed Chair Powell (who is speaking on Tues and Weds night AEDT) reiterate that policymakers aren’t in a hurry to cut interest rates again and have time to watch the data. Markets are not fully pricing in the next US Fed rate cut until September, with another move only discounted by December 2026. In our view, the higher for longer US interest rate outlook can also help hold up the USD.

Trans-Tasman Zone

The uptick in the USD on Friday and early this morning on the back solid US labour market data, higher US inflation expectations, and comments about additional trade tariffs have exerted some downward pressure on the AUD (now ~$0.6230) and NZD (now ~$0.5640) (see above). However, the AUD has been more mixed on the crosses with AUD/EUR (now ~0.6060) edging up to a multi-week high. By contrast, AUD/JPY (now ~94.33) has remained on the backfoot with the market jitters compounding the JPY’s upswing stemming from expectations the Bank of Japan will raise interest rates again over coming months to help contain Japanese inflation.

The economic data calendar in Australia and NZ is limited this week with the RBA (18 Feb) and RBNZ (19 Feb) decisions the next major trans-tasman focal points. Hence, global forces and USD trends will be in the near-term driver’s seat. And as discussed above, we believe the prospect for more US tariff announcements, a cautious tone from Fed Chair Powell regarding future rate cuts, stickiness in US inflation, and/or robust US retail sales may keep the USD supported. This in turn is likely to see the AUD and NZD ease back a little over the near-term, in our opinion.

That said, beyond the short-term volatility, we remain of the belief that downside potential in the AUD should be somewhat constrained. This is because: (a) the AUD is trading at a discount to fundamentals (it is ~4 cents below our ‘fair value’ models); (b) sentiment is already skewed bearish (‘net short’ AUD positioning, as measured by CFTC futures, is elevated): (c) the AUD has not sustainably trading below where it is over the past decade (the AUD has only been sub-$0.62 ~1% of the time since 2015); (d) we feel tariff induced export risks in China are likely to be offset via measures aimed at boosting commodity-intensive infrastructure investment. This is where Australia’s exports are plugged into; (e) Australia’s export basket is tariff-insulated given its minimal manufacturing and with it running a trade surplus with the US; and (f) an RBA easing cycle looks rather well baked in. In our view, some of these factors can help the AUD hold up and outperform currencies like the EUR, CAD, NZD, and CNH over the period ahead.