• Mixed signals. US equities a bit lower, bond yields mixed, while oil rose. EUR rebounded following a ‘hawkish’ news article. AUD consolidates.

• US inflation. The latest US CPI report is released tonight. Headline inflation is set to jump because of oil, but core inflation is predicted to slow.

• Diverging trends. Australian consumer sentiment remains low, but business conditions improved. The local jobs data is released tomorrow.

Markets were generally well contained overnight as participants await tonight’s US CPI report (10:30pm AEST). In bonds, the US 2yr yield drifted a bit higher (+3bps to 5.02%), while long end yields moved the other way (US 10yr -3bps to 4.26%). Signs that the cracks in the UK labour market are starting to widen saw UK yields dip as traders continue to reassess the outlook for Bank of England policy (UK 10yr -6bps). The UK unemployment rate rose to 4.3% in July, the highest in nearly 2-years, jobs are being shed, and when measured on a monthly basis wage growth has continued to cool.

Elsewhere, US equities slipped back with the NASDAQ underperforming (-1% vs S&P500 -0.6%) after Apple led a tech-sector sell-off post its annual product launch. Across commodities the upswing in oil has continued. At ~US$88.90/brl WTI is near a 10-month high and nearly 33% above its mid-June level. As pointed out before this will generate a mechanical lift in headline inflation around the world over the next few months. Higher fuel prices also generally act like a tax on consumers and businesses. The jump in prices should add to the cost-of-living squeeze and slowdown in activity. In FX, the USD index has consolidated. EUR initially dipped overnight, though it recovered lost ground to be back at ~$1.0755 following media reports that the ECB sees inflation remaining above 3% next year, supporting the case for another rate rise as soon as this Thursday. GBP has slipped under ~$1.25, and although it has bounced up from its lows at ~147 USD/JPY remains ~0.5% below where it closed last week. Despite the crosscurrents AUD has held steady just above ~$0.6420.

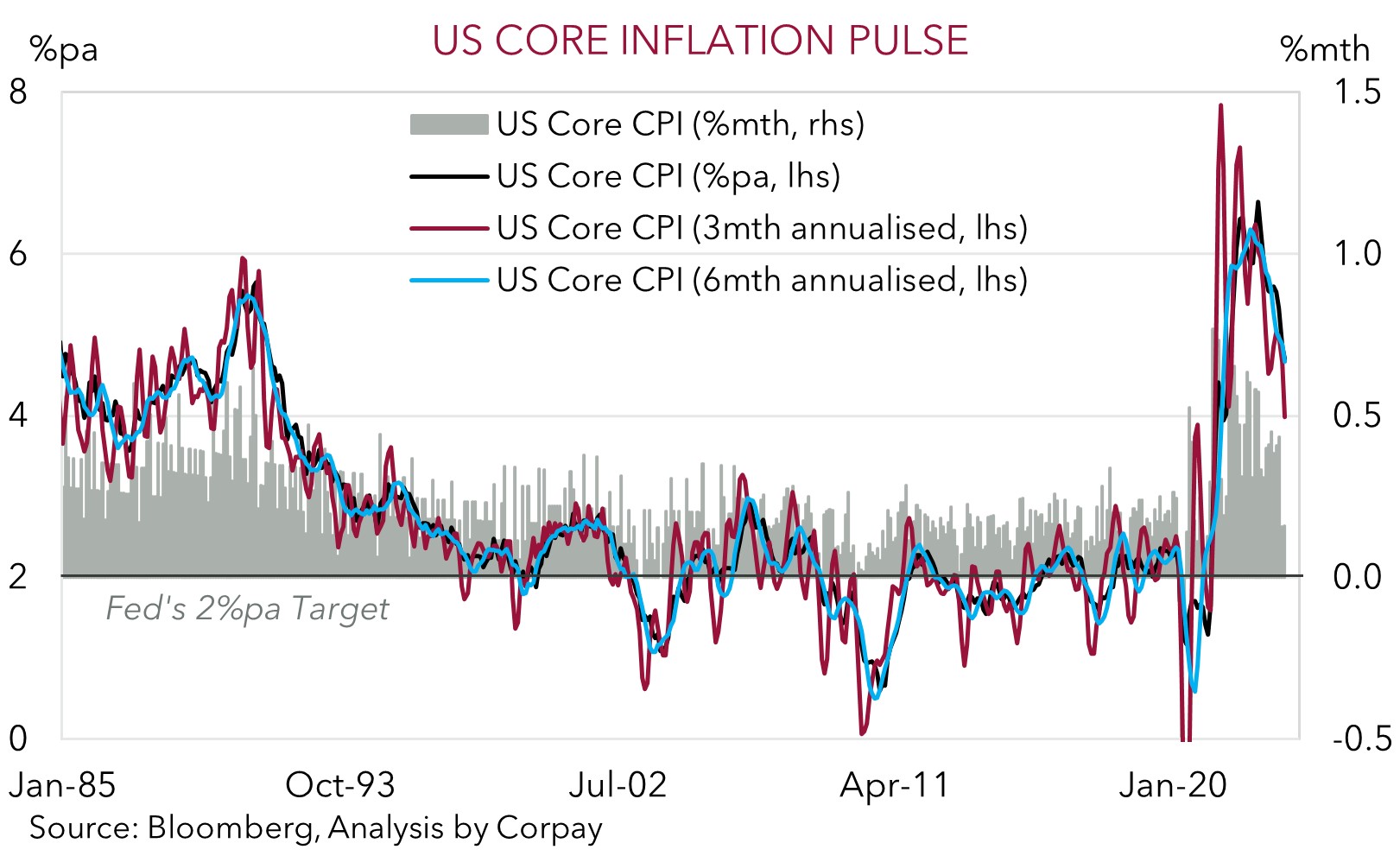

All eyes will be on tonight’s US inflation data. A large increase in gasoline prices in August, coupled with an expected rebound in airline fares, is expected to see headline inflation re-accelerate (mkt 3.6%pa from 3.2%pa in July). That said, the step down in core inflation, which strips out food and energy and is closely watched by policymakers as a gauge of the underlying pulse, is predicted to continue (mkt 4.3%pa from 4.7%pa in July). With markets already factoring in a ~50% chance of another Fed rate hike by year-end and a modest rate cutting cycle only expected from H2 2024 we believe a ‘higher for longer’ view is now well priced. The US inflation data is likely to generate some knee-jerk USD and broader market volatility. But on net, should US core/services inflation continue to slow we think the USD could come under some pressure, particularly if Thursday’s US retail sales print undershoots consensus forecasts and/or the ECB comes through with another rate rise.

Global event radar: US CPI (Tonight), US Retail Sales (Thurs), ECB Meeting (Thurs), China Activity Data (Fri), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD corner

The AUD has consolidated over the past 24hrs, with the modest gyrations across other asset markets and currencies ahead of tonight’s US CPI data (10:30pm AEST) netting off. At ~$0.6425 the AUD remains near a ~1-week high. On the crosses, the AUD has edged up a little against the JPY (+0.3% to ~94.50) and NZD (+0.2% to ~1.0884), and eased slightly against the EUR (-0.1% to ~0.5975) which was supported earlier this morning by a ‘hawkish’ ECB related news article that has raised the odds of another rate hike as soon as tomorrow night (see above).

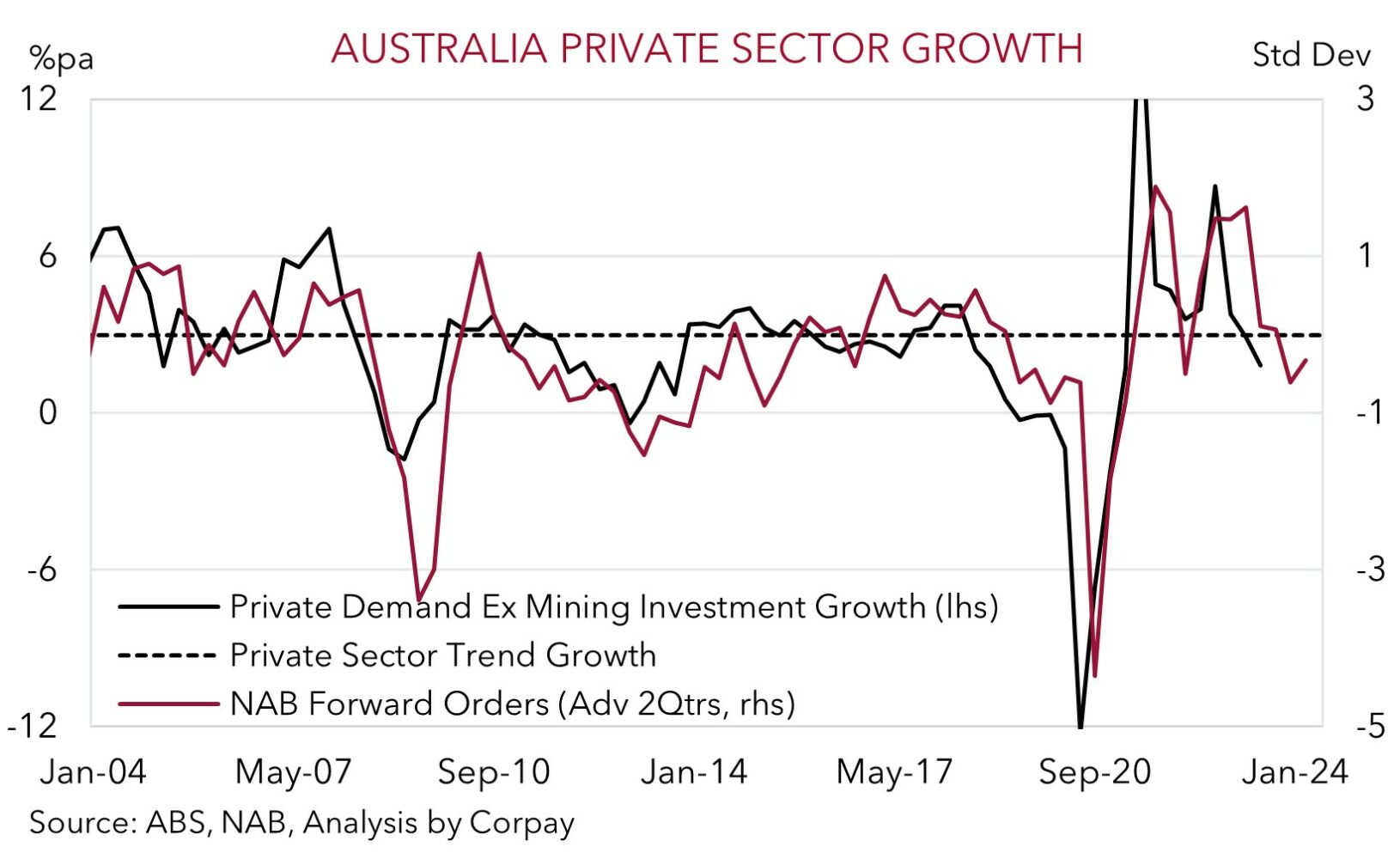

Locally, consumer and business sentiment was released yesterday. While consumer confidence remains at very low levels due to cost-of-living pressures, the NAB business survey suggests broader activity may be levelling off. Business conditions improved in September, moving further above average, with trading, profitability, and employment intentions all rising. Forward orders ticked up, a signal that private demand could be stabilising, and capacity utilisation rose. While this is welcomed from a growth perspective, with price pressures still elevated we think the RBA will need to remain vigilant to ensure that inflation expectations stay anchored. As such, another rate rise by the RBA down the track shouldn’t be completely ruled out, particularly with headline inflation set to lift near-term due to higher oil prices and a weaker currency. A solid rebound in jobs growth on Thursday, as some of the seasonal forces which impacted the data last month unwind, could see markets factor in more of a chance of another hike by the RBA. If realised, we think this could give the AUD some support.

Ahead of tomorrows Australian labour force report the AUD will also need to navigate tonight’s US inflation data. As discussed above market volatility could be elevated tonight, and over the next few days given the push-pull inflation factors at work, and with US retail sales, ECB policy decision, and Chinese activity data released later in the week. In terms of US inflation headline CPI is set to re-accelerate, however core inflation (which strips out energy and food prices) is expected to slow down. We think markets should focus more on the trend in core inflation given this is what Fed policymakers will be monitoring. In our judgement, a stepdown in US core inflation could see some of the heat come out of the USD as a ‘higher for longer’ Fed interest rate outlook now looks well priced in.

AUD event radar: US CPI (Tonight), AU Jobs (Thurs), US Retail Sales (Thurs), ECB Meeting (Thurs), China Activity Data (Fri), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), AU CPI (27th Sep), AU Retail Sales (28th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD levels to watch (support / resistance): 0.6320, 0.6360 / 0.6547, 0.6570

SGD corner

USD/SGD has endured a bit of volatility over the past 24hrs, in line with the broader USD trend (see above). But on net, at ~1.3606, USD/SGD is little changed from this time yesterday. On the crosses, EUR/SGD (now ~1.4632) more than recouped earlier losses late in the US session with the jump in the EUR on the back of ‘hawkish’ ECB media reports a factor. SGD/JPY (now ~108.14) has ticked back up and is near the top of its historic range.

As mentioned, the market focus tonight will be on US CPI inflation. Over the next few days US retail sales, the ECB decision, and China activity data are also due. All up, we continue to believe that there are a lot of positives priced into the USD. In our view, with a ‘higher for longer’ US Fed interest rate outlook adequately factored in, and with the US’ relative economic strength unlikely to last, we think the USD could be at greater risk from softer than anticipated data. A step down in US core inflation, combined with another potential ECB rate rise, sluggish US retail sales, and/or further signs China’s growth momentum is stabilizing, may exert some downward pressure on USD/SGD over the period ahead.

SGD event radar: US CPI (Tonight), US Retail Sales (Thurs), ECB Meeting (Thurs), China Activity Data (Fri), US Fed Meeting (21st Sep), Bank of England Meeting (21st Sep), Bank of Japan Meeting (22nd Sep), Eurozone/US PMIs (22nd Sep), Singapore CPI (25th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

SGD levels to watch (support / resistance): 1.3400, 1.3455 / 1.3690, 1.3711