• Consolidation. Quiet end to last week. US stocks hit another record. USD drifted back a little. AUD hovering above its ~6-month average.

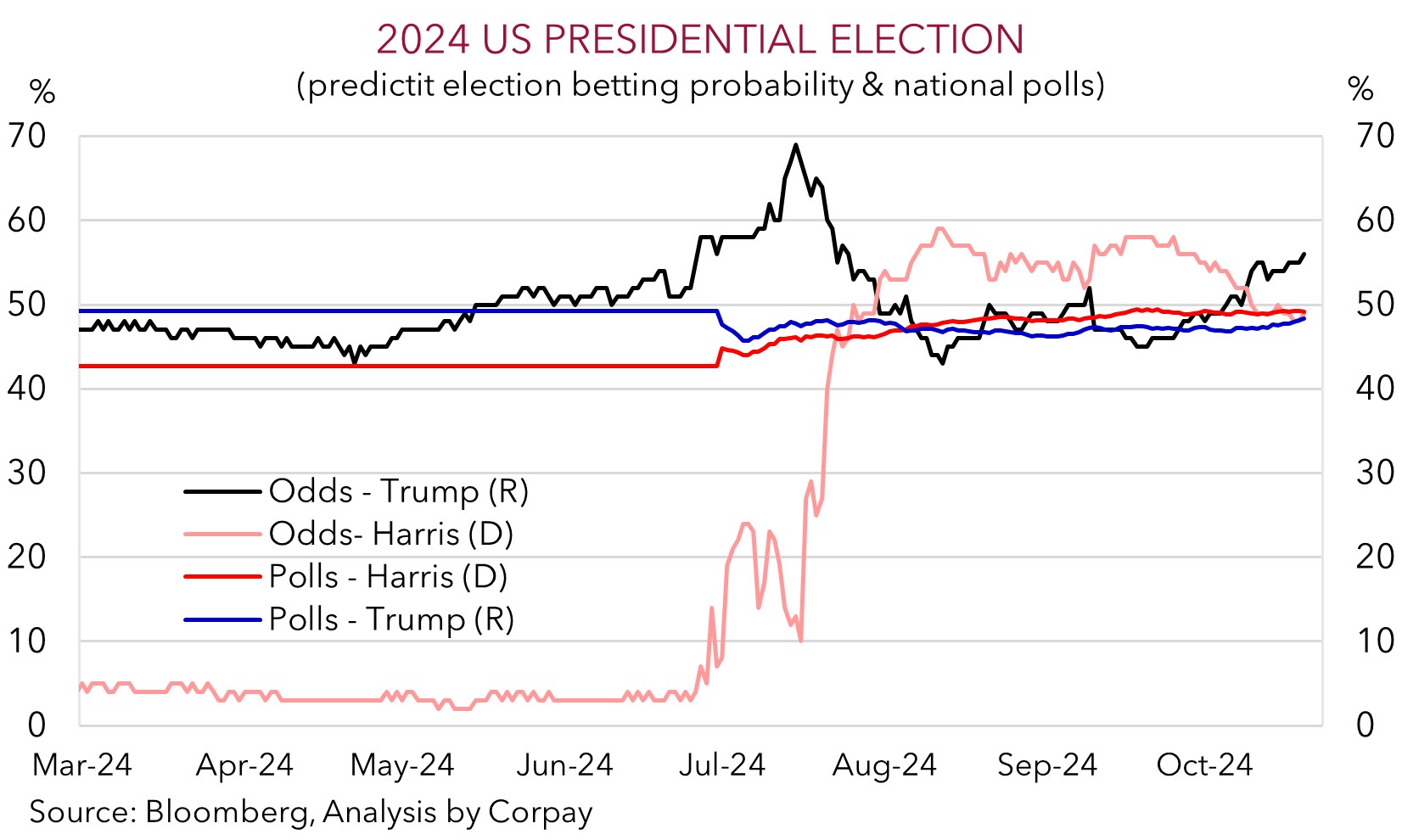

• US election. A relative quiet calendar means more focus could be on the US election. Former Pres. Trump ahead in the polls in several ‘swing states’.

• Event radar. Global PMIs due this week. Bank of Canada expected to cut rates again. Several key central bankers scheduled to speak.

A relatively quiet end to last week across markets. Equities remain firm with the US stockmarket extending its record run. The S&P500 (+0.4%), which hit yet another record high, posted its 9th increase in the past 10 weeks. China’s equity market also rose (CSI300 +3.6%) and is now ~24% from its mid-September low. The latest batch of activity data from China showed momentum remains sluggish. GDP growth slowed with the annual run-rate (now 4.6%pa) under the 2024 target. Although momentum across retail sales and industrial production is showing tentative signs of stabilising more stimulus measures are needed to cultivate the emerging green shoots. And this is what markets are anticipating. Speaking after the data PBoC Governor Pan noted that the real estate and stock markets are challenges in an economy that requires targeted support.

Elsewhere, there was little net movement in US bonds with the benchmark 10yr rate consolidating near ~4.08%, the upper end of the range it has occupied since August. On balance. the underlying resilience in the US economy has seen traders pare back expectations regarding future rate cuts by the US Federal Reserve over recent weeks. A 25bp reduction in early-November by the US Fed is still largely discounted, however at the turn of the month markets had been toying with whether another outsized 50bp cut might be delivered. By mid-2025 markets are now factoring in ~120bps worth of US Fed easing, down from ~180bps in late-September. In FX, the USD drifted a bit lower, but if you take a step back it remains close to its 1-year average. EUR ticked up from multi-month lows (now ~$1.0860), GBP is a touch stronger (now ~$1.3045), and USD/JPY dipped below ~150. NZD is tracking around the bottom of its ~2-month range (now ~$0.6070), with the AUD holding just above ~$0.67.

It is a quiet week ahead on the economics front. The latest batch of global business PMIs are due on Thursday, while the Bank of Canada is also predicted to lower interest rates by another 50bps (to 3.75%) given soft inflation and lingering risks to growth and jobs (Weds night AEDT). There are also several central bankers speaking including ECB President Lagarde, BoE Governor Bailey, and RBNZ Governor Orr. In our view, ongoing signs of relative outperformance in the US economy in the PMIs could support the USD. In addition to diverging macro trends, the looming 5 November US Presidential Election and greater perceived chance Trump retakes the White House may be USD positive factors given the potential inflation and interest rate implications from his platform of large-scale tariffs and greater fiscal spending.

AUD Corner

The slightly softer USD at the end of last week has helped the AUD hold up just above ~$0.67, a little above its ~6-month average. By contrast, the AUD has slipped back slightly on most of the major crosses, although the swings have been rather modest. AUD/EUR (now ~0.6170) is ~1.3% from its 2024 highs, AUD/JPY is hovering north of ~100, AUD/CNH (now ~4.7710) is above its 1-year average, and AUD/NZD (now ~1.1040) is still within striking distance of its cyclical peak.

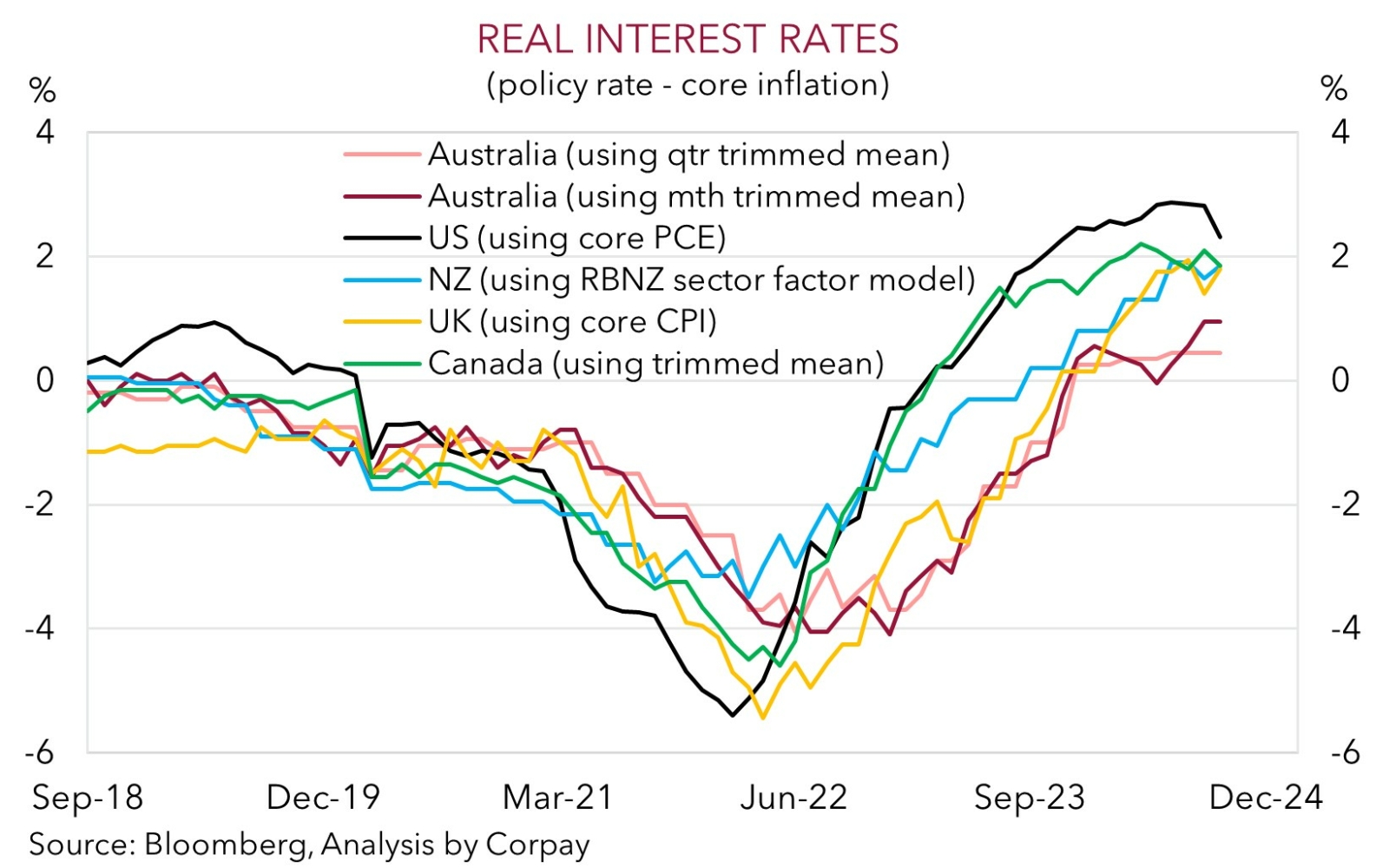

RBA Deputy Governor Hauser speaks today (12pm AEDT), but outside of that there is little on the domestic radar until the Q3 CPI inflation report (released 30 October). In our opinion, last week’s monthly jobs figures reaffirmed that local labour market conditions remain solid, and that the RBA is on a different path to its global counterparts. As pointed out before growth has slowed across many sectors but the level of activity, particularly across the labour-intensive services sectors, is above of its pre-COVID trend. The high level of aggregate demand is holding down unemployment and keeping domestic inflation sticky. We continue to believe that the start of a modest RBA interest rate cutting cycle remains a story for H1 2025 due in part because of a lower starting point. As our chart shows, real interest rates in Australia (i.e. adjusted for inflation) didn’t reach the heights they did in many other nations.

The unfolding divergence between the RBA and others should be AUD supportive, we think, especially against currencies like the EUR, CAD, GBP, and NZD where their respective central banks have begun to ease policy because of subdued growth and lower inflation. Indeed, as discussed above, the Eurozone PMIs (Thurs AEDT) may show sluggish momentum is continuing, while the Bank of Canada is predicted to reduce interest rates by another 50bps this week (Weds night AEDT). RBNZ Governor Orr might also talk up the prospects of more rate cuts in NZ when he discusses monetary policy (Thurs morning AEDT). That said, against the USD we feel the AUD’s potential near-term upside could continue to be constrained by the fast-approaching US election and increased chances former President Trump wins the 5 November political battle. Trump’s policy platform is generally viewed as being USD positive.