• Election jitters. A quiet start to the week with traders paring back some ‘Trump trades’. US equities eased & yields declined. USD a bit softer.

• US politics. Polls & probability gauges suggest the result is a toss-up. Binary reaction to the outcome likely with volatility also on the horizon.

• RBA today. No RBA policy changes expected. It may tweak its macro forecasts. We still think the start of its easing cycle is a story for H1 2025.

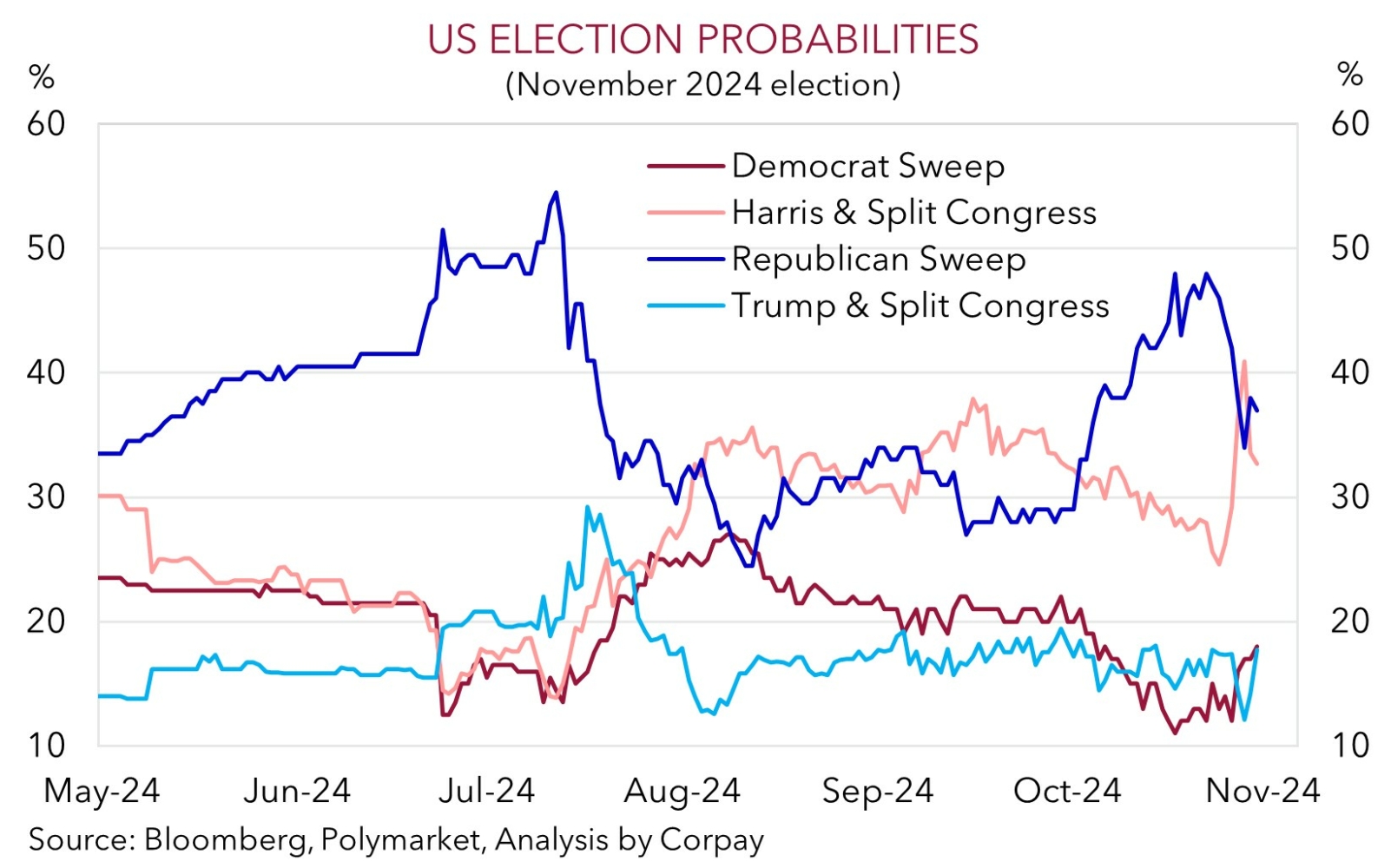

It has been a relatively quiet start to the week with markets lasering in on the upcoming US Presidential Election. The narrower gap between VP Harris and Former President Trump in the latest opinion polls, and shift in betting odds/probability gauges, has seen markets hedge their bets a bit and this has taken a little heat out of some ‘Trump trades’. US equities eased slightly overnight (S&P500 -0.1%), with US bond yields also ~3-8bps lower across the curve. The benchmark US 10yr rate essentially unwound Friday’s uptick and is now around ~4.3%, still towards the upper end of the range occupied since mid-July. In FX, the USD index is a touch lower, though the bulk of the modest pullback occurred in yesterday’s early Asian trade. EUR (now ~$1.0875), GBP (now ~$1.2955), and USD/JPY (now ~152.15) have oscillated in tight ranges over the past 24hrs. USD/SGD (now ~1.3190) edged a fraction lower, while NZD (now ~$0.5975) and AUD (now ~$0.6587) have given back some of yesterday’s Asian open gains ahead of today’s RBA meeting (2:30pm AEDT).

As mentioned yesterday the US Fed is meeting later this week (Fri morning AEDT) and another 25bp rate cut is widely anticipated. A 25bp rate reduction is also look for from the Bank of England (Thurs night AEDT), with the RBA predicted to keep its settings steady today. But barring surprise decisions central bank actions should be down the pecking order in terms of market drivers with US politics front and center. The polling and various market data are suggesting the US election outcome is a toss-up, in contrast to the elevated perceived chances assigned last week to former President Trump winning and the Republicans sweeping Congress. The lack of clarity points to bursts of market volatility ahead. Indeed, short-dated implied volatility for the major currencies is well above average, an indication traders are assuming some potentially large near-term swings.

The first exit polls are scheduled to be published at ~9am Wednesday Sydney time. Voting progressively closes across the US in the hours after that (from ~11am Weds AEDT, with states equal to ~80% of the Electoral College closed by ~1pm Weds AEDT). Battleground states of Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania and Wisconsin are the ones to watch. That said, based on the use of mail-in voting, the tightness in the polls, and prospect for recounts to be triggered and/or court challenges, a definitive result may not be known for days (or weeks). Based on how things are tracking we believe the stage is set for a binary reaction with a Trump win likely to see the USD strengthen given his policy platform of protectionist trade tariffs, greater fiscal spending, and moves to curb US immigration. By contrast, a Harris victory could see the USD fall back as risk premium is removed and business as usual resumes (see Market Musings: US election – FX inflection point).

AUD Corner

On net the AUD is still above where it closed last week however it has unwound a bit of yesterday’s early-Asian session uptick as markets adjust positions ahead of the US Presidential Election (see above). At ~$0.6585 the AUD is hovering just below its ~1-year average. It has been a similar story on the major crosses with the AUD generally slipping back a little from where it was this time yesterday. The AUD has eased by ~0.2-0.4% against the EUR, JPY, GBP, CAD, and CNH over the past 24hrs.

Domestically, the RBA meets today (2:30pm AEDT) with Governor Bullock’s press conference held later on (from 3:30pm AEDT). No policy adjustments are anticipated. All economists surveyed are looking for rates to be held at 4.35% with markets also factoring in no change. This is a more in-depth quarterly meeting with the RBA refreshing its forecasts. We think the RBA may mechanically tweak its growth and inflation outlooks slightly lower due to technical factors such as a drop in the oil price and a higher interest rate path relative to the August forecast round. In our view, this suggests there is a risk the RBA softens its forward guidance with rate hikes unlikely to be up for discussion. That said, we don’t feel the RBA will undertake a ‘dovish’ pivot and flag cuts are around the corner given the resilience in the labour market and with a sustained return of inflation to target still some time away. We believe the RBA is on a different path to its peers with the start of a modest cutting cycle a story for H1 2025. Over the medium-term the diverging trends between the RBA and others should be AUD supportive, especially versus EUR, CAD, GBP, and NZD.

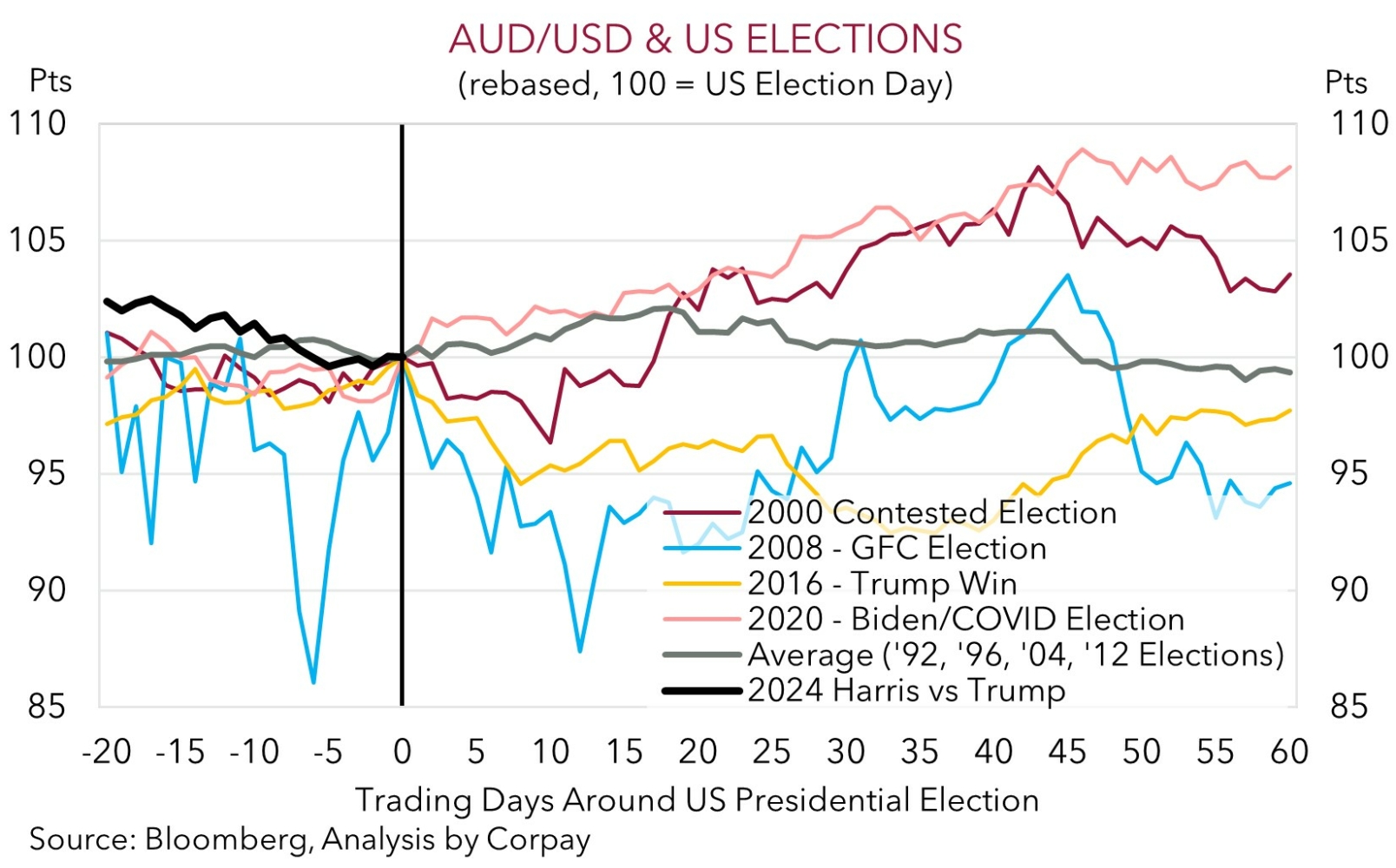

However, over the near-term, US politics and USD trends should have more say on what happens to the AUD. As discussed above, the US election exit polls (~9am Weds AEDT) are due tomorrow morning with voting booths progressively closing from 11am Wednesday AEDT. But based on the closeness in the polls, use of mail-in votes, and potential recounts/court challenges definitive results may not be known for a while. This points to a period of market (and AUD) volatility as the election data generates false signals and/or until clear results trends emerge. As our chart shows, during the 2000 contested US election the initial political uncertainty saw the USD rise/AUD fall. This time might be similar. More broadly, due to how close the US election is now looking, we feel the market response to the outcome may be binary. As outlined before, based on his policy platform a Trump win could see markets reprice the path forward for growth and inflation, which in turn might see the USD appreciate (AUD weaken). Conversely, a victory by VP Harris may see the USD depreciate (AUD strengthen). For more see Market Musings: US election – FX inflection point.