• Macro trends. PMIs showed US economy is outperforming. Yield spreads support the USD. EUR slipped below ~$1.04 for first time since Q4 ’22.

• AUD holding. AUD bucked the trend. Relative strength on the crosses helped the AUD nudge up. We think these dynamics can continue.

• Event radar. Locally, monthly CPI & speech by RBA Gov. Bullock in focus. RBNZ expected to cut rates (Weds). US PCE & EZ CPI also due.

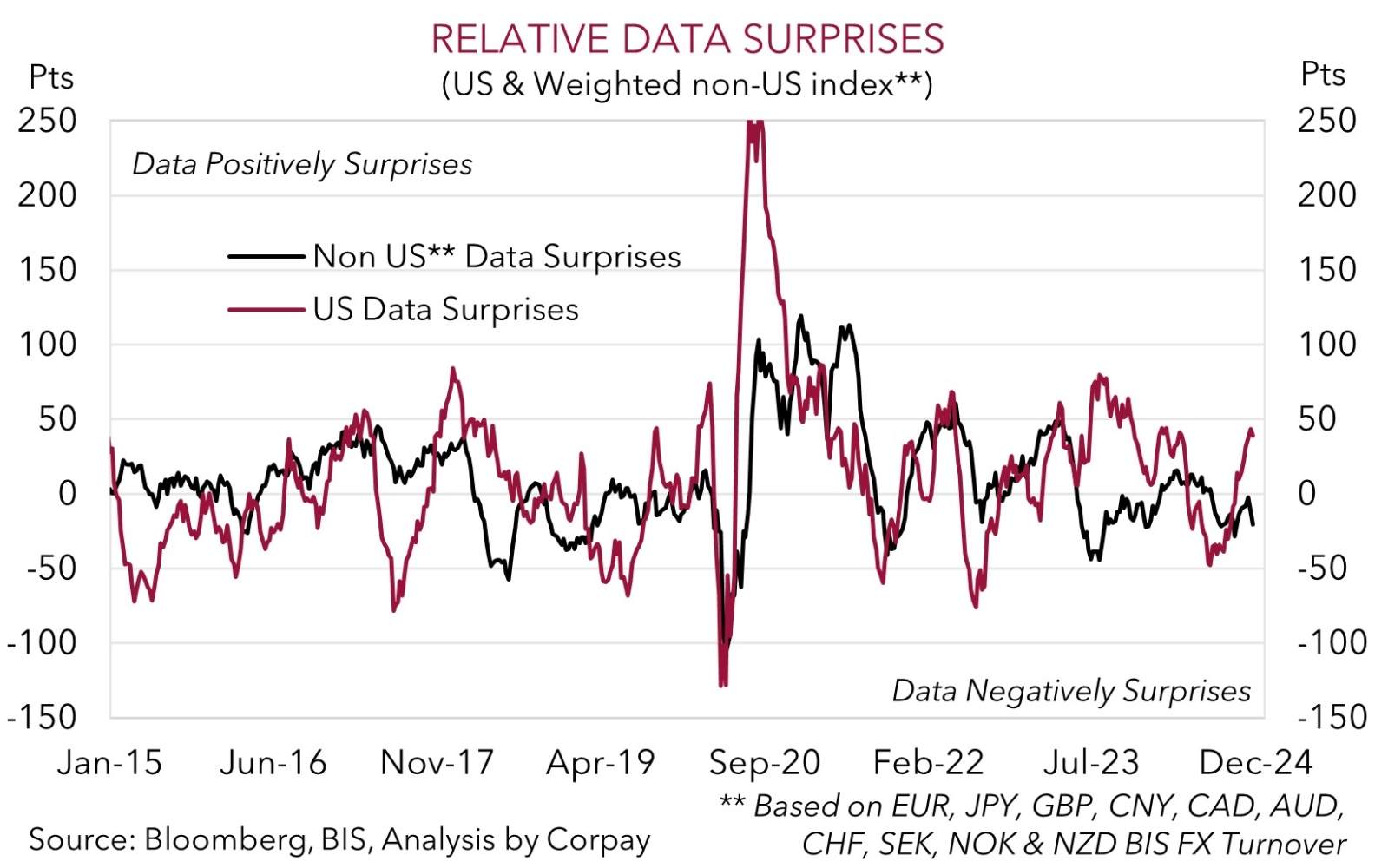

Relative strength of the US economy over its peers was on show again on Friday in the latest business PMI data. PMIs are leading indicators for growth, employment, and inflation. And in contrast to falls recorded in the UK and Eurozone, with composite gauges for both now in ‘contractionary’ territory, the US PMIs rose with the services sector measure jumping to its highest level since Q1 2022. Weaker than predicted UK retail sales data (-0.7% in October) compounded the downside surprise in the PMIs. As our chart shows, the US economic data is not only exceeding analysts’ expectations, but it is also clearly diverging from other major nations.

While equities across Europe and the US pushed higher on Friday in unison (S&P500 +0.4%, EuroStoxx600 +1.2%), the macro backdrop saw yield spreads move in favour of the US. Interest rate markets continue to toy with the idea that the ECB delivers a 50bp rate cut in mid-December with a steady stream of reductions factored in over the next year (~150bps worth of ECB cuts are discounted by October 2025). This exerted downward pressure on Eurozone bond yields with the German 10yr rate falling ~8bps to 2.24% and the 2yr rate shedding ~12bps (now ~1.99%). By contrast, US yields held their ground with the 2yr yield nudging up (+3bps to 4.37%). Odds of another rate cut by the US Fed in mid-December are close to ~50%, with less than 3 reductions anticipated by late next year.

In FX, the macro trends supported the USD with EUR slipping under ~$1.04 for the first time since Q4 2022 before bouncing back a touch this morning. News President-elect Trump has selected hedge fund manager Scott Bessent as his choice for Treasury Secretary has taken a bit of heat out of the USD given he seems to be more of a ‘fiscal hawk’ in favour of smaller deficits, although his views on other policies such as trade tariffs are inline with Trump. Elsewhere, GBP followed a similar pattern and despite a small uptick this morning it remains towards the bottom of its ~6-month range (now ~$1.2583). USD/JPY is tracking just above ~154, while ahead of this Wednesday’s RBNZ meeting where a 50bp rate cut is anticipated the NZD is hovering near its 2024 lows (now ~$0.5855). The AUD bucked the trend with the positive risk vibes and outperformance on the crosses helping it edge higher (now ~$0.6535).

It’s a holiday shortened week in the US with Thanksgiving on Thursday. Data wise, the US PCE deflator and durable goods orders are due (Weds night AEDT), with Eurozone inflation out on Friday. In our opinion, the USD is likely to remain firm, particularly against the European currencies. Stickiness in US core inflation and/or more robust activity data could further temper Fed rate cut expectations. We think this, and the pricing in of the Trump policy agenda, should be USD supportive (see Market Musings: Trump 2.0 & the AUD).

AUD Corner

Despite the stronger USD on Friday, stemming from more indicators showing the US’ economic outperformance over Europe (see above), the AUD has extended its modest upswing. The positive risk sentiment, as illustrated by gains in European and US equities and firmer oil and iron ore prices, has helped push the AUD up to ~$0.6535. Relative strength on the crosses has also been a factor. AUD/EUR (now ~0.6240) is near the top of its ~17-month range. AUD/GBP (now ~0.5193) is above its 1-year average, as is AUD/CAD (now ~0.9123), while AUD/CNH (now ~4.7338) is not that far away. AUD/NZD (now ~1.1172) is hovering around the upper end of the range it has occupied since Q4 2022.

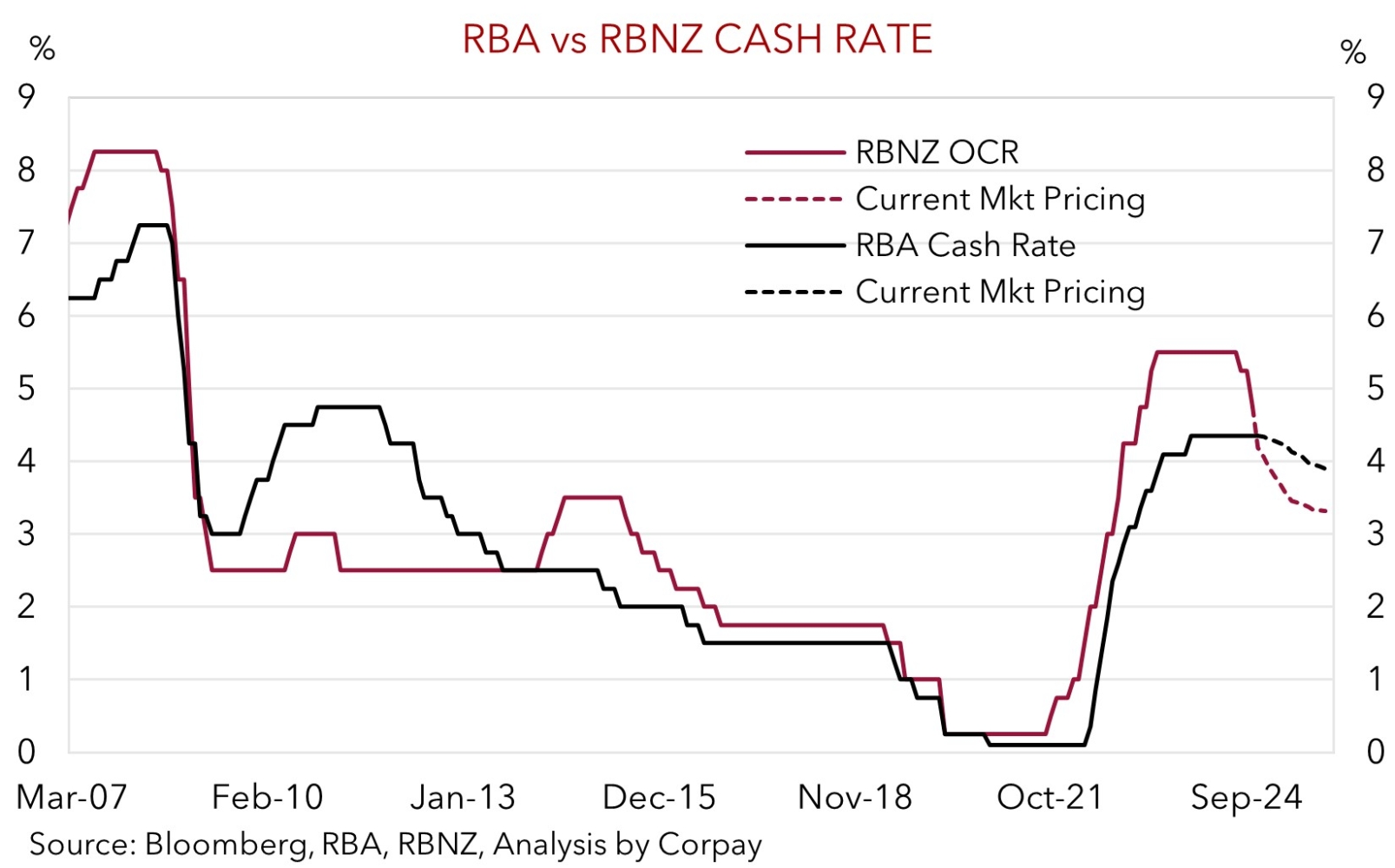

The AUD’s outperformance on the crosses, which has helped the AUD hold its ground against the USD, has been in line with our expectations (see Market Musings: Trump 2.0 & the AUD). We expect this to continue with AUD/USD projected to track in the mid-$0.60s over the next year, while diverging trends between the RBA and other central banks help the AUD strengthen against EUR, CAD, NZD, CNH, and GBP over the medium-term. These dynamics may get another kick along this week. Locally, the monthly CPI indicator for October is released (Weds), as are some partial inputs for Q3 GDP, with RBA Governor Bullock also speaking (Thurs night AEDT). Less favourable base effects as larger price falls from a year ago drop out of calculations suggest headline and core inflation may have re-accelerated in October (mkt 2.3%pa from 2.1%pa). If realised, this, and comments from Governor Bullock that policymakers are wary of lingering inflation risks due to the resilience in the labour market and global trends would reinforce our long-standing view that the RBA will lag its peers in terms of when it starts and how far it moves during the next easing cycle. We believe the start of a gradual/limited RBA rate cutting phase is a story for late-H1 2025.

By contrast, other central banks like the ECB, Bank of Canada, and RBNZ look set to continue to reverse course rather quickly over the period ahead because of the weakness in their respective economies and a more pronounced drop in inflation. Indeed, the RBNZ is predicted to lower its cash rate by another 50bps on Wednesday and flag it has more work to do over 2025. If realised, this would put the RBNZ cash rate at 4.25%, below the RBA equivalent for the first time in over a decade. The contrasting economic fortunes of Australia and NZ underpin our forecasts for AUD/NZD to rise towards ~1.13 over the next few months.