• Holding on. Despite Russia/Ukraine developments a ‘risk on’ vibe prevailed in markets. Equities higher, oil rose, & the AUD ticked up.

• European struggles. EUR & GBP weaker. Steady stream of ECB rate cuts anticipated as Eurozone economy navigates downside risks.

• AUD trends. AUD outperforms on the crosses. We think this can continue given diverging policy trends between the RBA & others.

Geopolitical risks intensified overnight after Russia launched a ‘new’ kind of ballistic missile for the first time in its war with Ukraine, a clear signal to the Western world that it is unlikely to take recent provocations lying down. Yet the market reaction was muted with a general ‘risk on’ vibe prevailing across most asset classes. Equities rose with the US S&P500 up ~0.7% and the EuroStoxx600 ~0.4% higher. US ‘small cap’ stocks outperformed with the Russell2000 index jumping 1.7%. And while European bond yields ended the session a little lower (German and UK 10yr rates fell ~3bps) US equivalents moved the other way. The benchmark US 10yr yield ticked up slightly (now ~4.42%) with the 2yr rate rising ~4bps (now ~4.34%).

The economic data flow and central bank commentary continued to move in favour of the US over the Eurozone. Weekly US initial jobless claims improved, a sign labour market conditions remain positive, and monthly existing home sales grew more than predicted. By contrast, members of the ECB generally expressed a ‘dovish’ tone. The ECB’s Stournaras stressed that policymakers should be cutting rates by 25bps at each meeting until the 2% ‘neutral’ level is reached. The ECB’s Chief Economist Lane also presented modelling which showed that trade fragmentation would be detrimental to China, and this in turn would have more negative spillovers to the EU than the US. On the back of the Eurozone’s economic struggles and risks stemming from trade tariffs and the Russia/Ukraine conflict markets are factoring in a steady stream of ECB rate cuts with ~136bps worth of easing priced in by Q4-2025. By contrast, markets now view another rate cut by the US Fed in mid-December as a 50/50 bet with less than ~70bps of easing discounted by the end of 2025.

Diverging policy trends and shifting yield spreads supported the USD index with EUR falling under ~$1.05 (the bottom end of its ~13-month range) and GBP slipping below ~$1.26. That said, it wasn’t all one way with the USD losing a bit of ground against the JPY (USD/JPY is at ~154.53). And although NZD drifted lower (now ~$0.5866) the AUD outperformed (now ~$0.6514), particularly against the weaker EUR and GBP.

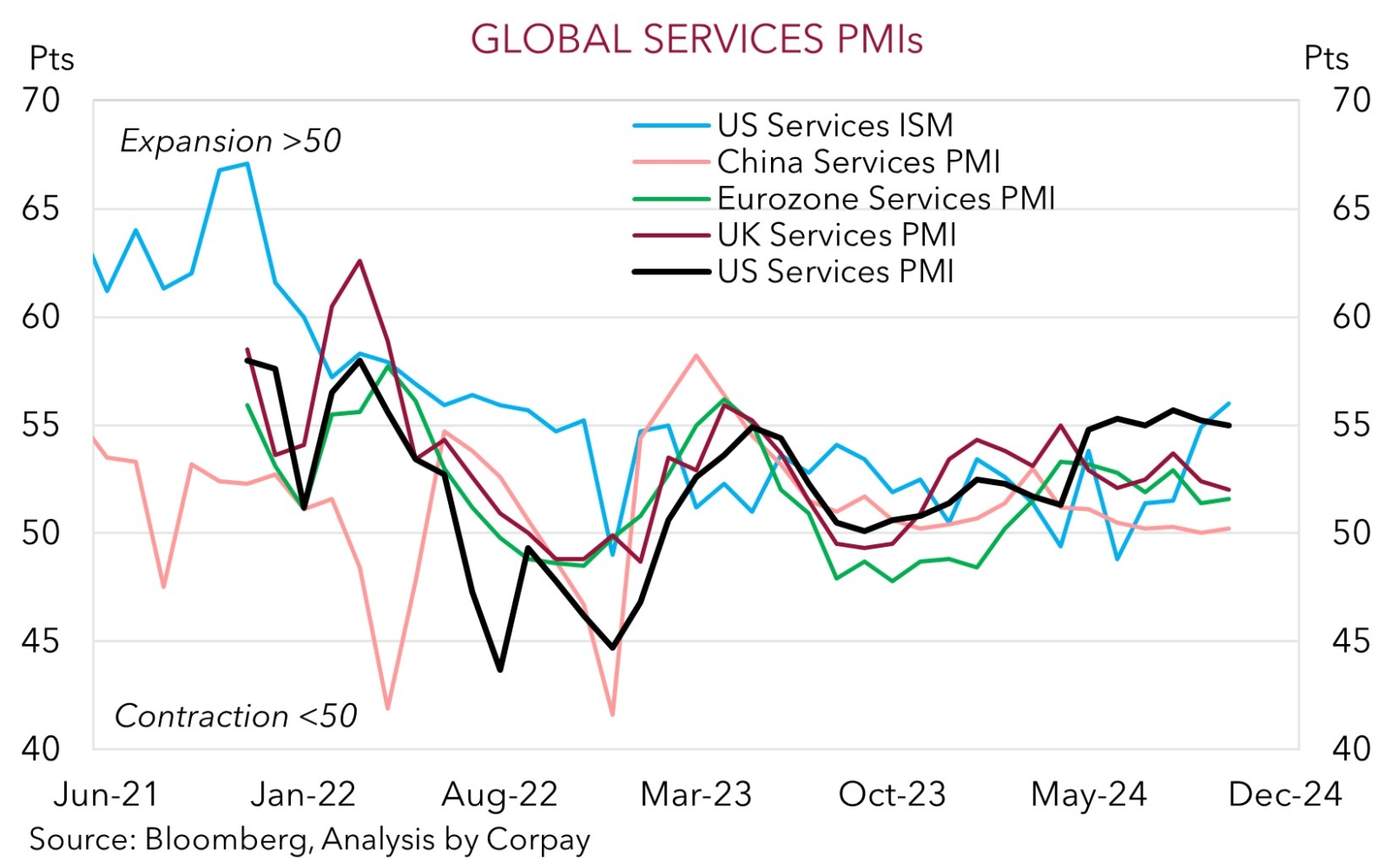

The latest batch of global business PMIs are released today (Japan 11:30am AEDT, Eurozone 8pm AEDT, UK 8:30pm AEDT, and US 1:45am AEDT). In our opinion, more signs the US’ relative economic strength is being maintained can be USD supportive. This would compound the geopolitical unease in Russia/Ukraine, and factoring in of the Trump policy agenda (i.e. protectionist trade tariffs, greater fiscal spending, and steps to curb US immigration) which we believe can keep the USD firm, particularly against the major European currencies (see Market Musings: Trump 2.0 & the AUD).

AUD Corner

Markets, including the AUD, have taken the latest negative Russia/Ukraine geopolitical developments in their stride. Outside of some weakness in the major European currencies and a small uptick in oil prices (Brent crude rose ~2%) there has generally been a ‘risk-on’ tone overnight. Higher equities and iron ore prices (now ~US$102/tn) supported the AUD, which partially unwound yesterday’s modest pull-back (now ~$0.6514). Relative outperformance on the crosses also gave the AUD a helping hand. AUD/EUR (now ~0.6217) is ~0.5% from its 2024 peak while AUD/GBP poked its head back above its 200-day moving average (~0.5171). With another large 50bp RBNZ rate cut anticipated next Wednesday AUD/NZD is also firmer with the cross-rate hovering north of ~1.11 for the first time since July.

In contrast to the additional rate cuts anticipated by the ECB, BoE, Bank of Canada, and RBNZ over the next year, markets are assuming a slow grind from the RBA. The first full 25bp RBA rate reduction is not factored in until July with a second rate cut not fully priced until early 2026. This is in line with our long-standing assessment that the resilient Australian labour market, sticky core inflation, elevated level of activity across the economy, and fiscal/income support running through the system, coupled with the RBA’s lower starting point should see it lag its counterparts in terms of when it starts and how far it moves during the easing cycle. We believe the start of a gradual/limited RBA rate cutting phase is a story for late-H1 2025.

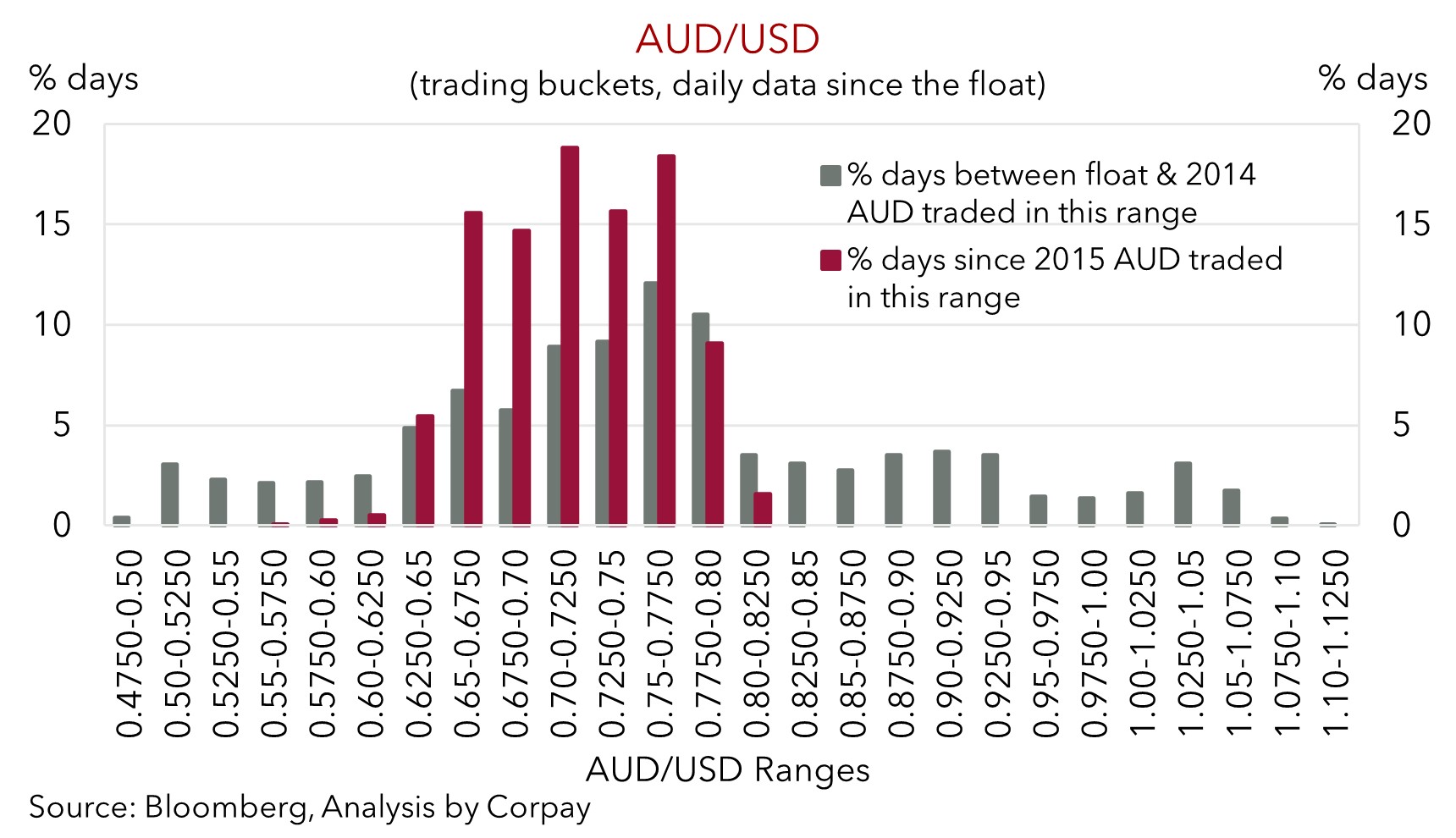

As discussed before, in our view the diverging policy trends between the RBA and other central banks should help the AUD strengthen against EUR, CAD, NZD, CNH, and to a lesser extent GBP over the medium-term. And as it has been doing recently, this can help offset headwinds created by an appreciating USD which we are projecting to continue over coming months as the Trump election policies are enacted and priced into markets. In our judgement this looks set to cap the upside in AUD/USD (i.e. we now see the AUD tracking in the mid-$0.60s over the next year) (see Market Musings: Trump 2.0 & the AUD). But various factors should continue to cushion the blow and work against being overly ‘bearish’ AUD/USD at already low levels. In addition to the projected further AUD outperformance on the crosses, we believe a decent amount of negativity is discounted given the AUD is ~4 cents under our ‘fair value’ estimate. Statistically, as we have repeatedly flagged, over the past decade the AUD hasn’t sustainably traded much below where it is because of Australia’s higher terms of trade and improvement in its trade/current account position. As our chart shows the AUD has only been sub-$0.65 6% of the time since 2015.