• Positive vibes. Risk markets have started the new week on firmer footing. US equities rose & the yield curve steepened. The USD consolidated.

• Regional data. AUD has found some support. Today, Australian consumer & business sentiment is released, as is the China trade data.

• US CPI. The latest US inflation read is in focus this week. Base-effects are no longer as favourable. A US inflation surprise could rattle market nerves.

Risk sentiment started the new week on the front foot. US equities recovered some lost ground. The S&P500 rose 0.9% overnight, though this follows last week’s 2.3% fall (the biggest weekly drop since March). In bonds, the US yield curve steepened, with the 10-year up ~6bps to 4.09% and the 2-year holding steady at ~4.76% after enduring a pull-back on Friday after the release of the mixed US labour market report. Across commodities, oil prices eased (WTI crude -1.1%), as did copper (-0.8%). In FX, the USD has consolidated with EUR hovering near ~$1.10 and USD/JPY down around ~142.50. NZD and AUD have tracked sideways over the past 24hrs, with the AUD (now ~$0.6573) finding some support over the past few sessions.

Macro wise, the US labour market report released at the end of last week was a mixed bag relative to market thinking. But in totality it continues to show that conditions remain tight and that core inflation could take some time to truly crack. While non-farm payrolls rose 187,000 in July, the US unemployment rate dipped to 3.5% (just above its ~50-year low) and wage growth was stronger than anticipated. Average hourly earnings (the monthly wage gauge) quickened to 4.4%pa, with wages now running at a brisk 5% annualized pace over the past few months. Based on this underlying backdrop, the US Fed is a long way from declaring victory on inflation. Indeed, overnight Fed Governor Bowman noted that additional hikes “will likely be needed” in her view, with NY Fed President Williams stating that policy may need to stay restrictive “for some time”. Markets are pricing in only a ~22% chance of another US Fed rate hike this cycle, with the first full rate cut factored in from May 2024.

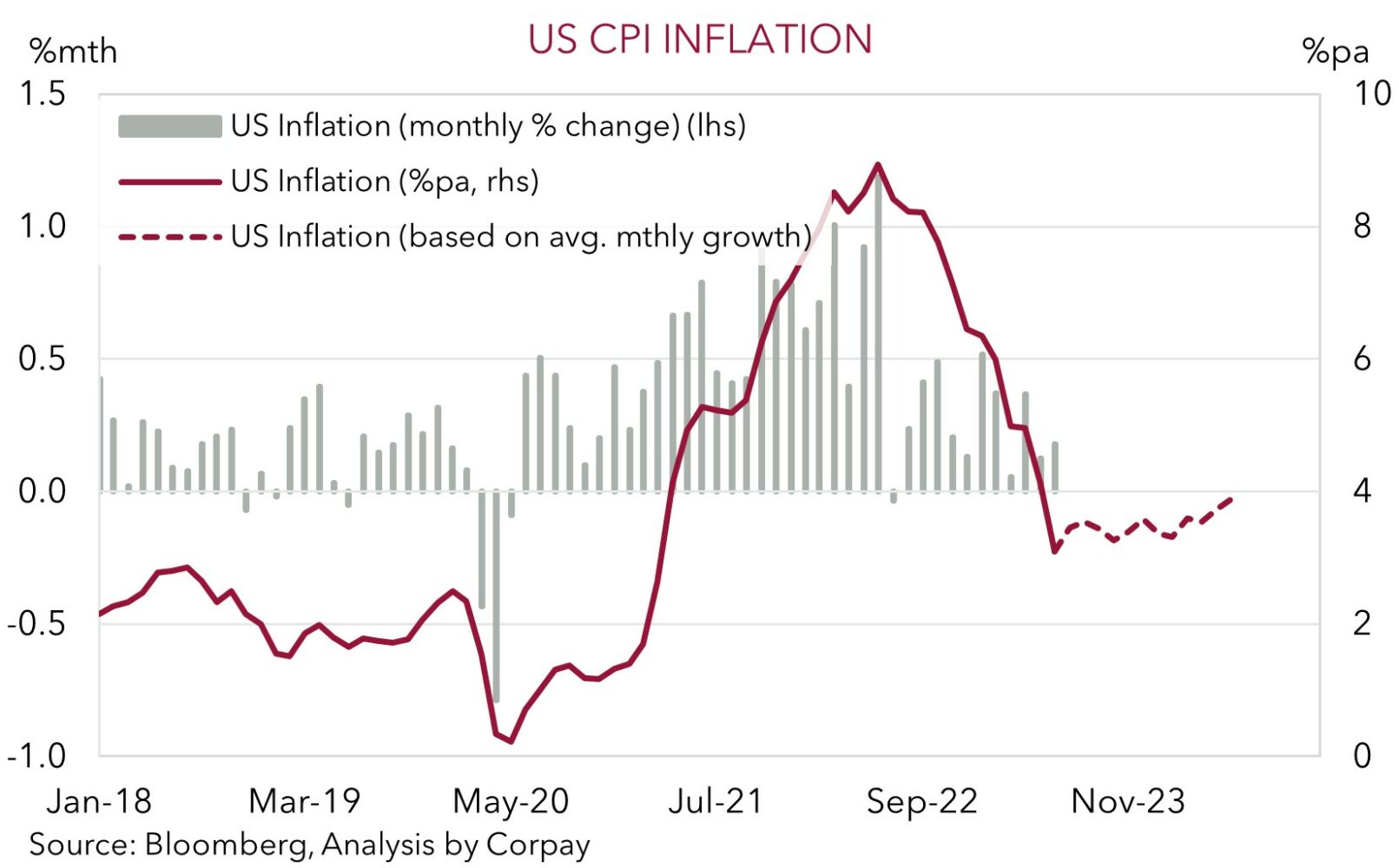

This week market attention will be on the July US CPI inflation data (released Thursday night AEST). As our chart shows, we are now at a trickier point of the story with the sharp deceleration phase in US inflation behind us given the ‘easy wins’ from the cycling of large base-effects have come to an end. Consensus is looking for US headline inflation to re-accelerate from 3%pa to 3.3%pa, with core inflation remaining firm at a well above target ~4.7%pa. In our opinion, markets, which have jumped on the ‘soft landing’ bandwagon, appear vulnerable to an upside US inflation surprise. We think signs that price pressures remain ‘sticky’ could dampen risk sentiment and/or provide the USD with some short-term support.

Global event radar: US CPI (Thurs), China Activity Data (15th Aug), US Retail Sales (15th Aug), RBNZ Meeting (16th Aug), UK CPI (16th Aug), Japan CPI (18th Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD corner

The AUD has found some support over the past few days with the USD consolidating and risk sentiment firmer at the start of the new week. But at ~$0.6573 AUD/USD remains near the bottom end of its ~2-month range. On the crosses, AUD/EUR (now ~0.5975) and AUD/GBP (now ~0.5143) are hovering around their respective 2023 lows, while AUD/JPY (now ~93.64) ticked up overnight with the upbeat tone weighing on the JPY. AUD/NZD remains sub 1.08.

Today, the latest reads on Australian consumer sentiment (10:30am AEST) and business confidence (11:30am AEST) are released, as is the China trade data (no set time). The slowing global economy combined with the faltering domestic recovery points to another soft set of Chinese export and import figures. A weak set of numbers could renew concerns about the state of the global economy, exerting a bit of intra-day pressure on the AUD, in our view. As could sub-par Australian confidence readings.

However, these prints should play second fiddle to the upcoming US inflation report (Thursday night AEST). As outlined, US inflation is now at an interesting pivot point with base-effects no longer as helpful to bring down annual growth given last year’s large price increases have washed through the calculations. Based on the bounce back in commodity prices and still robust wage growth, we think US inflation risks coming in above market expectations. If realised, we believe this could rattle market nerves and may give the USD a lift. All up, we continue to think that reduced RBA rate hike expectations, in combination with slowing global industrial activity and a firm USD can keep the AUD weighed down for a while longer.

That said, as flagged previously, we don’t want to be overly bearish the AUD around current levels. Fundamental supports such as Australia’s current account surplus (now ~1.4% of GDP) and the high level of the terms-of-trade should continue to act as downside cushions. Since 2015 the AUD has only traded sub-$0.6550 ~4% of the time. With seasonal trends set to become more positive for the AUD (and negative for the USD) later this year, and with CNH projected to strengthen on the back of more growth-friendly stimulus in China, we continue to forecast the AUD grinding up into the low 0.70’s by mid-2024.

AUD event radar: US CPI (Thurs), AU Wages (15th Aug), China Activity Data (15th Aug), US Retail Sales (15th Aug), RBNZ Meeting (16th Aug), UK CPI (16th Aug), AU Jobs (17th Aug), Japan CPI (18th Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), AU Retail Sales (28th Aug), RBA Deputy Gov. Bullock Speaks (29th Aug), AU CPI (30th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

AUD levels to watch (support / resistance): 0.6403, 0.6500 / 0.6664, 0.6732

SGD corner

Despite the volatility in US bond yields over the past few sessions as markets digested the latest US labour market report USD/SGD has remained range bound. USD/SGD (now ~$1.3410) is tracking just above its 50-day moving average. On the crosses, EUR/SGD (~1.4755) has ticked higher with the firmer EUR an underlying support, while SGD/JPY has edged back down towards ~106.

As discussed above the market focus this week will be on the US CPI inflation data (Thursday night). US inflation has decelerated meaningfully over the past few months as last year’s large price rises dropped out of annual calculations. But this has largely run its course. With base-effects now more difficult to overcome and with wages still quite strong, we think inflation could start to surprise complacent markets. In our judgment, a pick up in US inflation could see markets add to their near-term US Fed rate rise bets, and/or push out future rate cut expectations. This could give USD/SGD a boost, in our view.

SGD event radar: US CPI (Thurs), China Activity Data (15th Aug), US Retail Sales (15th Aug), UK CPI (16th Aug), Japan CPI (18th Aug), Singapore CPI (23rd Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug), China PMIs (31st Aug), Eurozone CPI (31st Aug), US PCE Deflator (31st Aug), US Jobs (1st Sep).

SGD levels to watch (support / resistance): 1.3140, 1.3200 / 1.3440, 1.3510