• Positive tone. Solid start to the week for risk assets. Equities rose, as did copper. USD softer. NZD (+1.3%) & AUD (+1%) outperform.

• Macro trends. China data showed signs of improving momentum. Topline US retail sales weaker than expected. Growth trends weighing on the USD.

• Central banks. Over coming days the Bank of Japan, US Fed, & Bank of England meet. Will the US Fed be more focused on inflation or growth?

Global Trends

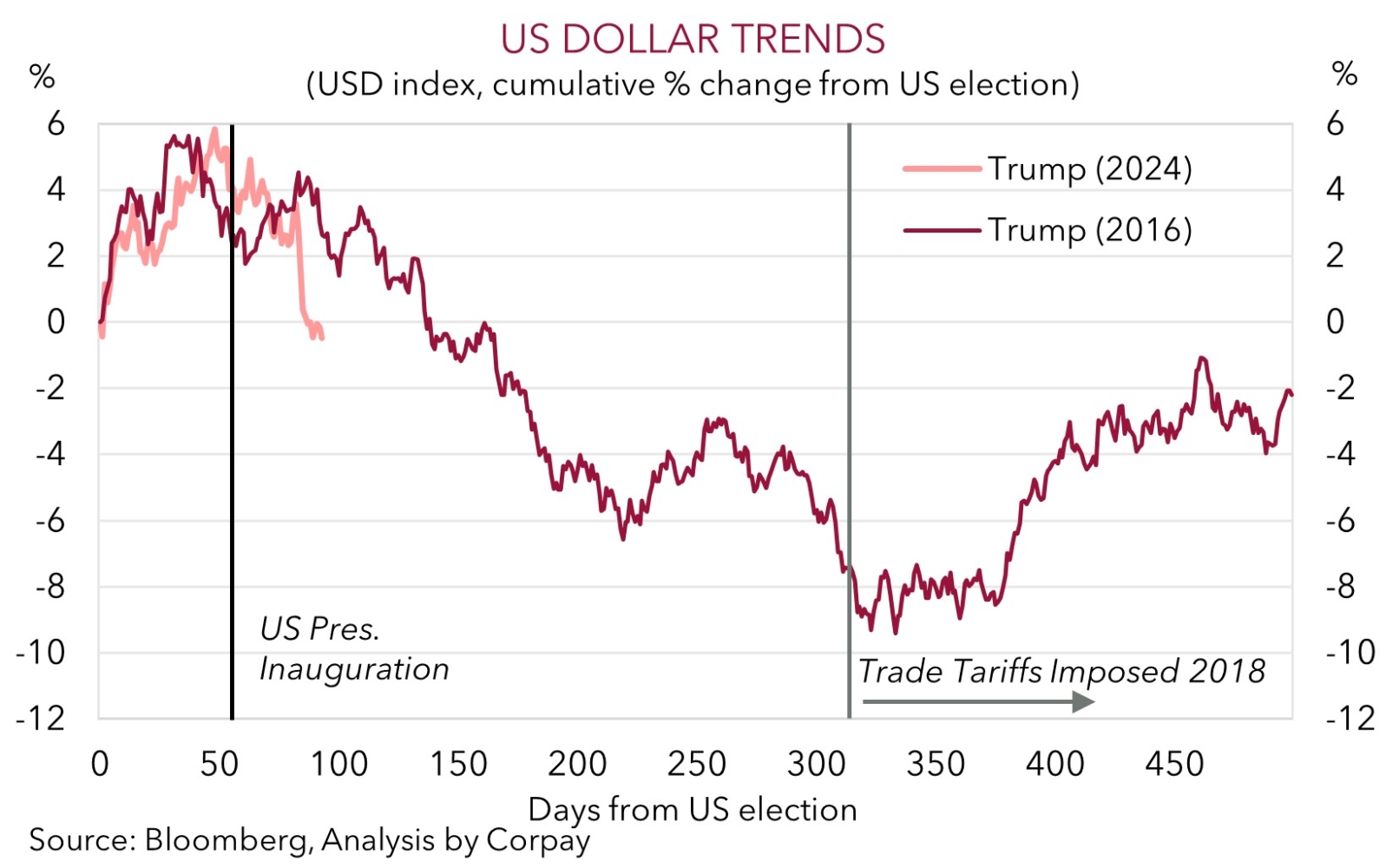

Last Friday’s burst of market optimism has carried over into the new week. The equity market rebound extended with the US S&P500 (+0.6%) recording its first back-to-back daily gains in a month. By contrast, long end bond yields eased with more sizeable catch-up declines in Europe coming through than in the US. The benchmark US 10yr yield drifted back to ~4.30%, just above its 1-year average, while the German 10yr fell ~6bps (yet it is still near the upper end of its multi-year range). In FX, the USD lost ground with the stronger EUR (now ~$1.0921, just below its 5-month peak), GBP (now ~$1.2993), and CAD outweighing the uptick in USD/JPY (now ~149.20). The friendlier market backdrop also helped the NZD (now ~$0.5819, a high since early-December) and AUD (now ~$0.6385, the top end of its recent range) appreciate. As our chart shows, the USD is following a similar path to what happened in the first year of President Trump’s first term.

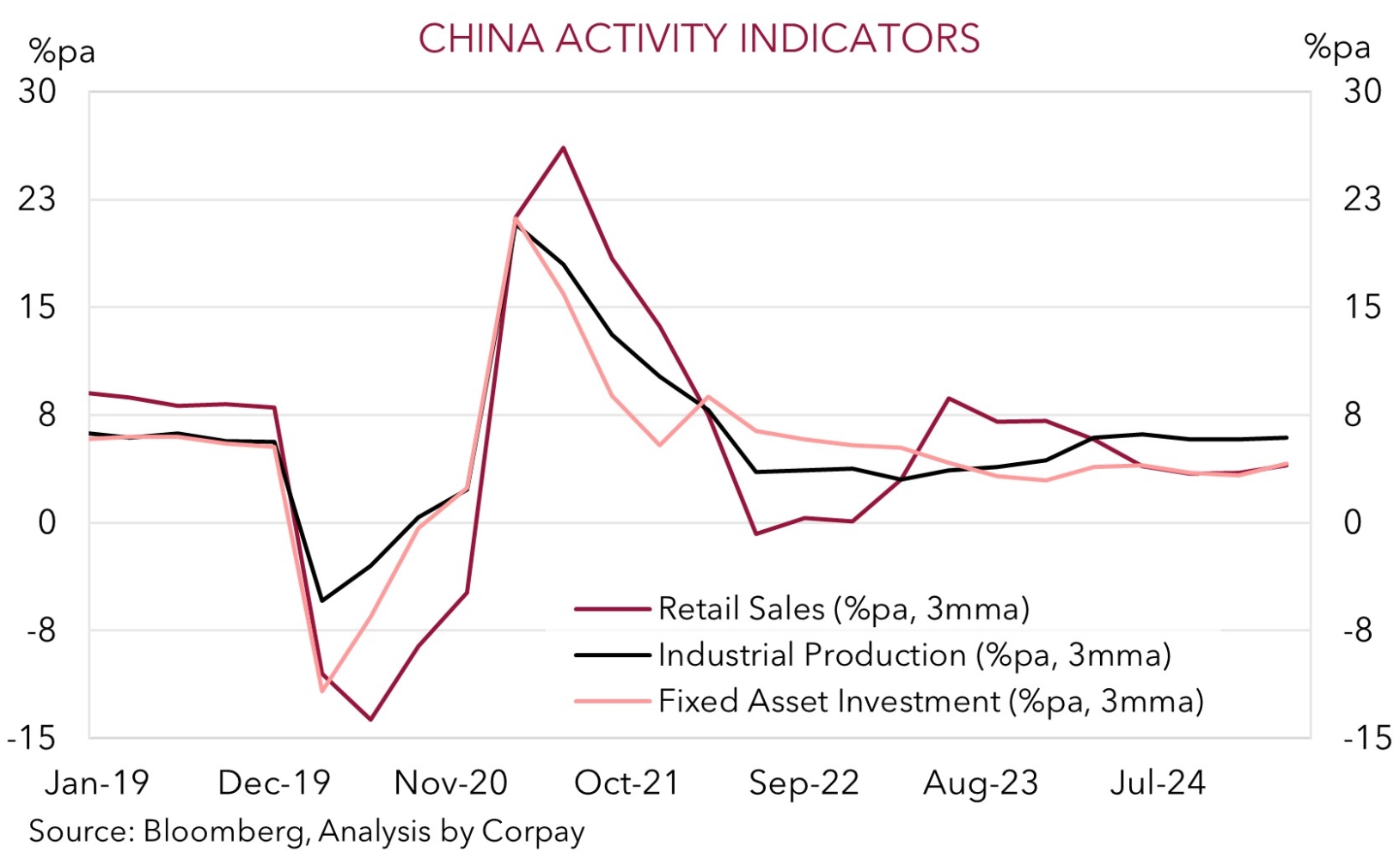

The lack of new US tariff-related news helped support risk appetite, while the incoming data continues to show trends are turning against the US (and the USD). In China, the February data batch indicated the economy has enjoyed a solid start to the year. Activity indicators such as retail sales, industrial production, and fixed asset investment were stronger than predicted despite headwinds generated by US trade policies. China’s economy still isn’t out of the woods, but the underlying momentum does look to be turning the corner as past stimulus gains traction and with more measures being unveiled as recently as last weekend. In the US, second tier data such as the Empire manufacturing survey and NAHB housing index undershot expectations, as did topline retail sales. Headline US retail sales grew by just 0.2% in February, after plunging 1.2% the month before. Weaker auto sales and spending at restaurants were factors, though things weren’t as bad when looking at the ‘control group’ measure which feeds directly into US GDP. On this basis US retail sales rose 1% in the month, easing fears the economy has completely stalled.

It is a busy few days macro-wise with the Bank of Japan (Weds), US Federal Reserve (Thurs morning AEDT), and Bank of England (Thurs night AEDT) all meeting. No policy changes are anticipated from these central banks, however we do believe the BoJ may flag more rate hikes are in the pipeline, while the BoE could note that further gradual easing is likely. In the US, we think the Fed might lower its growth projections while also nudging up near-term inflation forecasts. The outlook is uncertain; however, we think the cross-currents could see Fed Chair Powell sound a little more ‘dovish’ than what is factored into interest rate markets. If realised, this could see the USD weaken, but the prospect of broader US tariffs being announced on 2 April might act to limit moves.

Trans-Tasman Zone

The more positive risk sentiment, as illustrated by the continued rebound in equities and firmer base metals such as copper on the back of improving momentum in China’s economy (see above), coupled with a softer USD has boosted the NZD and AUD. The NZD is ~1.3% higher than where it was tracking this time yesterday to be up at ~$0.5819, levels last traded in early-December. The AUD has risen by ~1% over the past 24hrs and is near the upper end of its ~3-month range (now ~$0.6385). The underlying market environment has also helped the NZD and AUD outperform on the crosses, though the relatively stronger performance by the former has pushed AUD/NZD down towards ~1.0970. By contrast, AUD recorded gains of 0.4-0.8% versus the EUR, GBP, CAD, and CNH, while AUD/JPY jumped ~1.3% to be north of ~95.20.

As discussed, there are a few events scheduled this week that may generate more AUD and NZD volatility over coming days such as the Bank of Japan (Weds) and US Fed (Thurs morning AEDT) meetings. Added to that Q4 2024 NZ GDP is also due (Thurs AEDT), as is the monthly Australian jobs report (Thurs). We believe the NZ data should show a rebound in activity in late-2024, though it shouldn’t be enough to eliminate the need for more RBNZ interest rate cuts. This could put a ceiling on the NZD’s near-term recovery. In Australia, we think the jobs data will show conditions remain solid. Last month there was a larger than normal number of people unemployed but waiting to start work. This group transitioning into jobs points to another robust report, which if realised should solidify expectations looking for a slow/limited RBA rate cutting cycle and generate more AUD support, in our view.

On balance, we continue to think more bouts of AUD volatility are probable over coming weeks, particularly as 2 April approaches. This is when the US will make its broader ‘reciprocal tariff’ announcements. But over the medium-term we believe there is more upside than downside potential for the AUD. A decent amount of negativity still looks factored in with the AUD running ~3-4 cents under our ‘fair value’ models. The AUD has also not traded much below where it is over the past decade (AUD has only closed below $0.6385 ~5% of the time since 2015). Structural factors that cushioned the AUD down here (i.e. Australia’s improved capital flow trends and higher terms of trade) remain. Moreover, as flagged before, we think any tariff induced export pain in China should be offset via measures aimed at boosting commodity-intensive infrastructure investment. This is AUD supportive given this is where Australia’s key exports are plugged into. The upswing in EUR stemming from greater European fiscal spending and JPY due to BoJ rate rises might also be AUD supports via drags created on the USD.