• US tariffs. Markets rattled by President-elect Trump’s announcement tariffs would be imposed on Mexico, Canada & China on his first day.

• USD firmer. The move supported the USD & weighed on cyclical currencies like AUD & NZD. Negative risk sentiment saw the JPY outperform.

• Data flow. Today, the monthly AU CPI is due. RBNZ also expected to cut rates again with a 50bp reduction predicted by analysts.

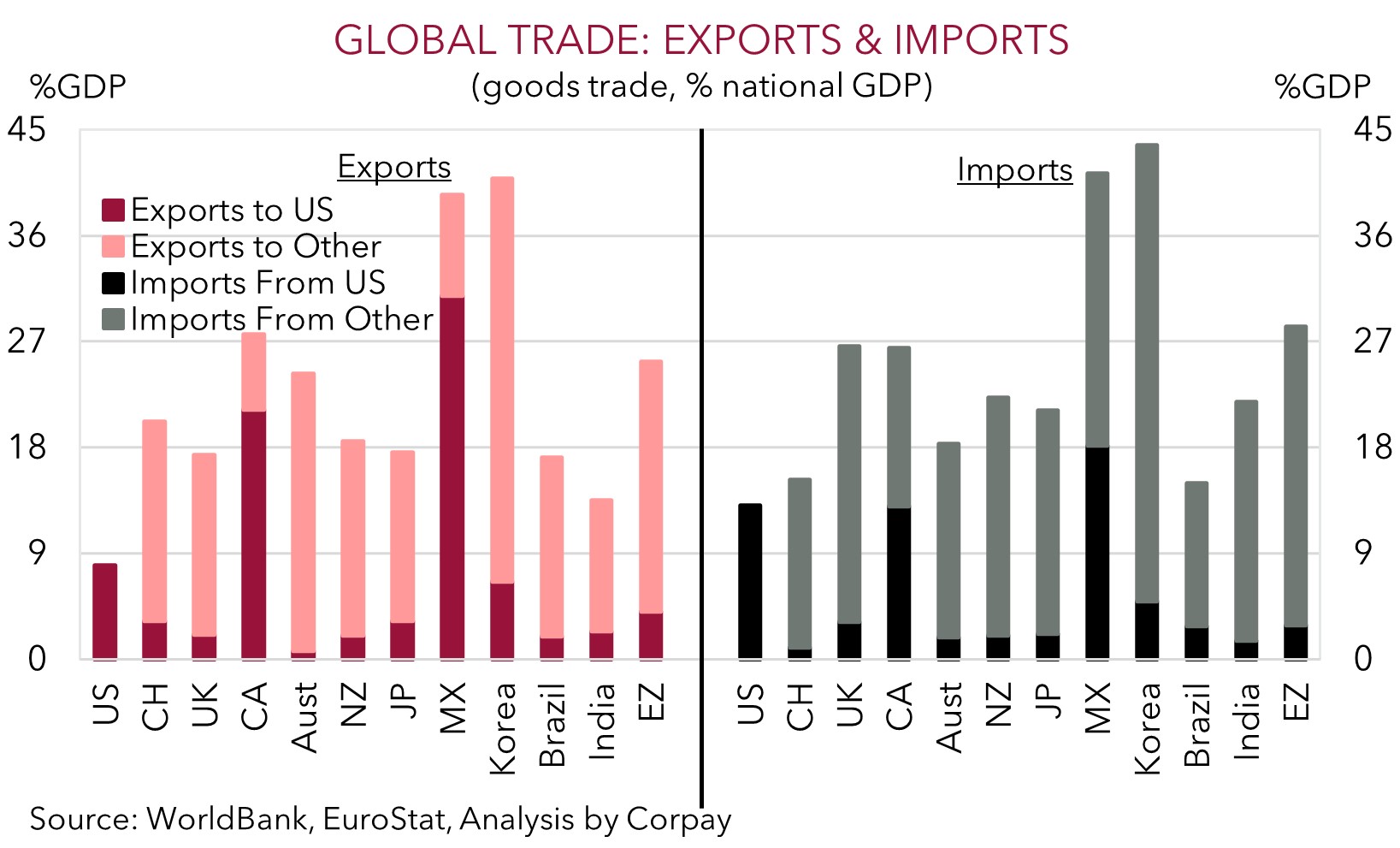

Markets were rattled yesterday after President-elect Trump fired a few shots in his post-election trade war. Via social media Trump stated that to curb the inflow of drugs and migrants he would impose 25% tariffs on goods imported from Mexico and Canada, and an extra 10% tariff on Chinese imports on his first day in office. Recall that tariffs on goods from China largely remain in place with President Biden not unwinding those put on by Trump in his first term. The announcements show Trump intends to hit the ground running and that tariffs will be a weapon in his arsenal. Markets seemed to have taken their eye off the ball recently with the nomination of Bessent as Treasury Secretary originally deemed as a sign measured steps might be taken. This is clearly not the case. Although the tariff announcements were limited to three nations, they are economically significant as Mexico, Canada, and China equate to ~42% of US imports. Moreover, while China faces the highest tariff intensity, the high share of Canada’s and Mexico’s exports sent to the US mean they face heightened macro risks. The US won’t be immune as the US consumer should ultimately bear the brunt of tariffs as the import duties are past on down the line in the form of higher prices which in turn could see the US Fed deliver fewer rate cuts than would have otherwise been the case.

As participants digested the news a burst of volatility ensued. On net, the major Asian and European equity markets declined (EuroStoxx600 -0.6%), while the US S&P500 ticked up (+0.5%). US bond yields nudged up with the benchmark 10yr rate rising ~4bps (now ~4.30%). The minutes of the last US Fed meeting, released this morning, also showed that there was broad support among policymakers to take a careful approach to future rate cuts. This is something markets are already anticipating with another move in December deemed to be a ~60% chance and less than 3 more US Fed rate cuts discounted by late-2025. In FX, the USD is on balance above where it was this time yesterday. EUR is down near ~$1.0475, GBP is around ~$1.2550, USD/CAD has risen (now ~1.4070, the top end of its 4.5-year range), as has USD/MXN and USD/CNH (now ~7.26, close to a ~4-month high). USD/JPY bucked the trend with the shaky risk sentiment JPY supportive (now ~153.05). Ahead of today’s RBNZ decision where a 50bp cut is anticipated (12pm AEDT) NZD (now ~$0.5828, the bottom end of its 2024 range) and AUD (now ~$0.6460) have been under pressure.

The second estimate of US Q3 GDP, durable goods orders, initial jobless claims, and the PCE deflator are released tonight. In our opinion, signs US core inflation is sticky and/or more robust activity data could further temper US Fed rate cut bets. We think this, and the factoring in of the Trump policy agenda, should be USD positives (see Market Musings: Trump 2.0 & the AUD).

AUD Corner

The AUD is a bit battered and bruised with yesterdays tariff announcements by President-elect Trump supporting the USD and weighing on cyclical growth linked currencies (see above). Outside of the early-August ‘flash crash’ spike lower, at ~$0.6460 the AUD is near the bottom of its 6-month range. The AUD also lost ground on the crosses with AUD/JPY the biggest mover (-1.4% to ~98.90, a ~2-month low). Elsewhere, the AUD declined by ~0.3-0.5% versus the EUR, GBP, NZD and CNH over the past 24hrs as risk sentiment was rattled by the tariff news.

As outlined previously, we expect the pricing in and enacting of the Trump policy agenda of trade tariffs, greater fiscal spending, and steps to curb US immigration to keep the USD firm. This in turn looks set to keep the AUD in the mid-$0.60s over the next few quarters (see Market Musings: Trump 2.0 & the AUD). However, we don’t believe further falls in the AUD from already low levels will be sustained, nor would they be fundamentally justified. In our view, a fair degree of ‘bad news’ already looks baked in given the AUD is trading at a ~4 cent discount to our ‘fair value’ estimates. Moreover, as discussed before, over the past decade the AUD has not traded much below where it is (it has only been sub-$0.65 6% of the time since 2015) because of Australia’s terms of trade and improvement in its trade/current account position. We doubt these factors will meaningfully change. Australia’s export basket is rather tariff-insulated due to minimal domestic manufacturing, fact that the US has a trade surplus with Australia, and elevated chance authorities in China attempt to counter US tariff-induced export pain via steps to bolster commodity-intensive and internally focused infrastructure investment which is where Australia’s key exports are plugged into.

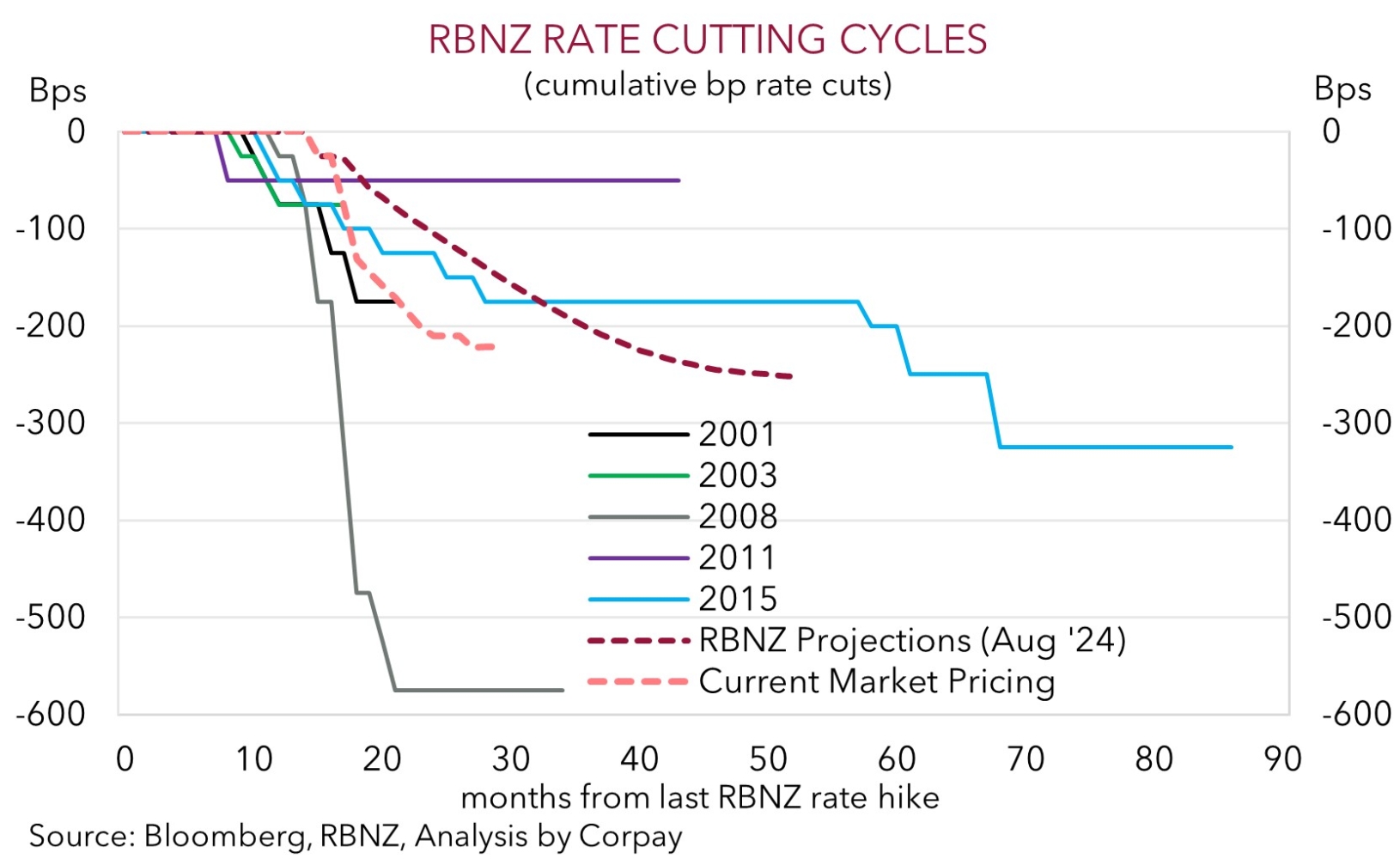

We also believe that diverging economic fundamentals between Australia and other nations should be AUD supportive against currencies like the EUR, NZD, CAD, GBP, and CNH. From our perspective, recent moves on several AUD crosses appear overdone. These contrasting trends could be on display today. Locally, the monthly CPI indicator for October is released (11:30am AEDT). Less favourable base effects as larger falls from a year ago drop out of calculations suggest headline and core inflation may have re-accelerated in October (mkt 2.3%pa from 2.1%pa). If realised, this would support our assessment that the RBA will lag its peers. We think the start of a gradual and limited RBA rate cutting cycle is a story for late-H1 2025. By contrast, the RBNZ is expected to deliver another 50bp rate cut (12pm AEDT) which would lower the OCR below the RBA equivalent for the first time since 2013. Widening cracks in the NZ economy means the RBNZ needs to get out of ‘restrictive’ territory quickly. We are projecting AUD/NZD to rise towards ~1.13 over coming months.