• Holding on. US sends out more tariff letters. Equities unfazed with S&P500 pushing higher. Bond yields dip. USD consolidated. AUD range-bound.

• RBNZ steady. RBNZ on hold. But underlying tone & outlook still points to a bit more easing over coming months. This should act as a NZD handbrake.

• AUD trends. AUD hovering near top end of its multi-month range. We think the risks of a USD rebound / AUD pull-back are starting to build.

Global Trends

Outside of a few more tariff letters being sent out by the US, news flow was light overnight and there were few economic data releases. Interestingly, equity traders continue to pay little regard to the latest Trump tariff threats with US and European stock markets pushing higher. The S&P500 (+0.6%) is within a whisker of its record highs. By contrast, bond yields declined with the US10yr rate shedding ~7bps to be back under its year-to-date average (now ~4.33%). And in FX, the USD consolidated with EUR (now ~$1.1723) treading water and USD/JPY (now ~146.28) slightly lower over the past 24hrs. The AUD (now ~$0.6537) and NZD (now ~$0.60) have also been range-bound with the latter showing limited reaction to yesterdays on hold decision by the RBNZ.

In terms of tariffs President Trump posted more letters indicating the new rates that are set to apply from 1 August, subject to trade negotiations ahead of that date. The latest batch of countries were generally minor US trading partners such as Algeria, Libya, Iraq, and the Philippines. Notably, the announced tariffs are on par with those unveiled on ‘Liberation Day’. The exception was Brazil. President Trump threatened to impose a 50% levy on imports from Brazil. This is up from 10% with the increase related to specific issues such as the treatment of former President Bolsonaro and free speech rights. The US runs a trade surplus with Brazil; hence this is another example of how President Trump may still look to use tariffs as a tool against wide ranging grievances not just trade imbalances.

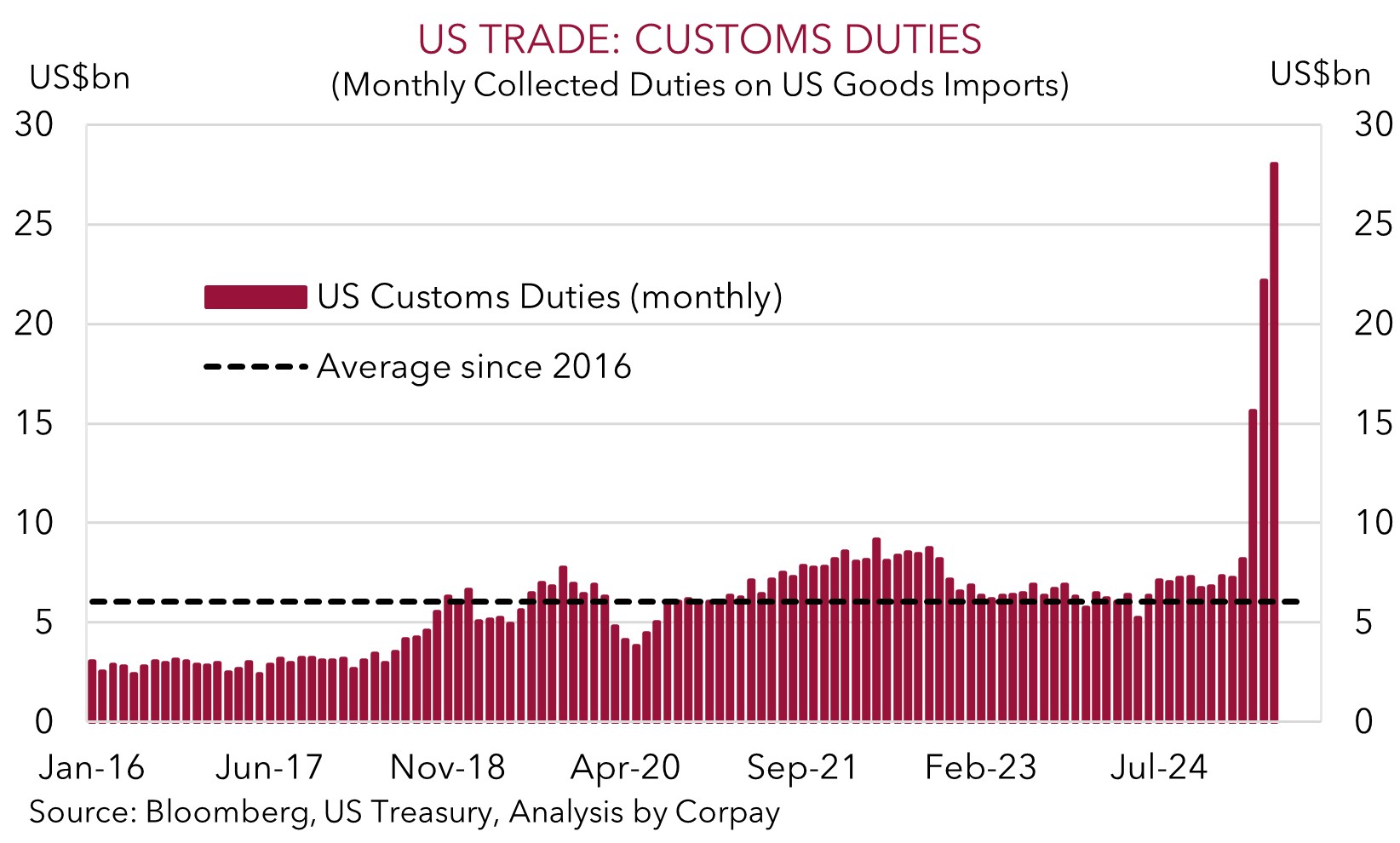

More tariff letters are due to be released over the coming days. Based on what has been trickling through and rhetoric of the Trump Administration tariffs on US imports look here to stay in some form. As our chart shows, the tariffs are a source of government revenue with duties collected from US importers over the past couple of months stepping up sharply. We feel markets may have become a bit complacent to the underlying growth/inflation risks posed by tariffs, and there is the potential for renewed bursts of USD supportive market volatility over the next few weeks as the new implementation dates come closer into view. As outlined previously, while we have a negative USD bias over the longer-run, in the near-term we believe there is the potential for the USD (which is still below our ‘fair value’ estimate) to recapture lost ground.

Trans-Tasman Zone

The AUD (now ~$0.6537) and NZD (now ~$0.60) have oscillated in narrow ranges over the past 24hrs, in line with the consolidation in the USD (see above). That said, the AUD has ticked up a bit on most of the major crosses with gains of ~0.1-0.3% recorded against the EUR, GBP, NZD, CAD, and CNH, with the AUD garnering relative support from firmer equity markets and industrial metal prices overnight.

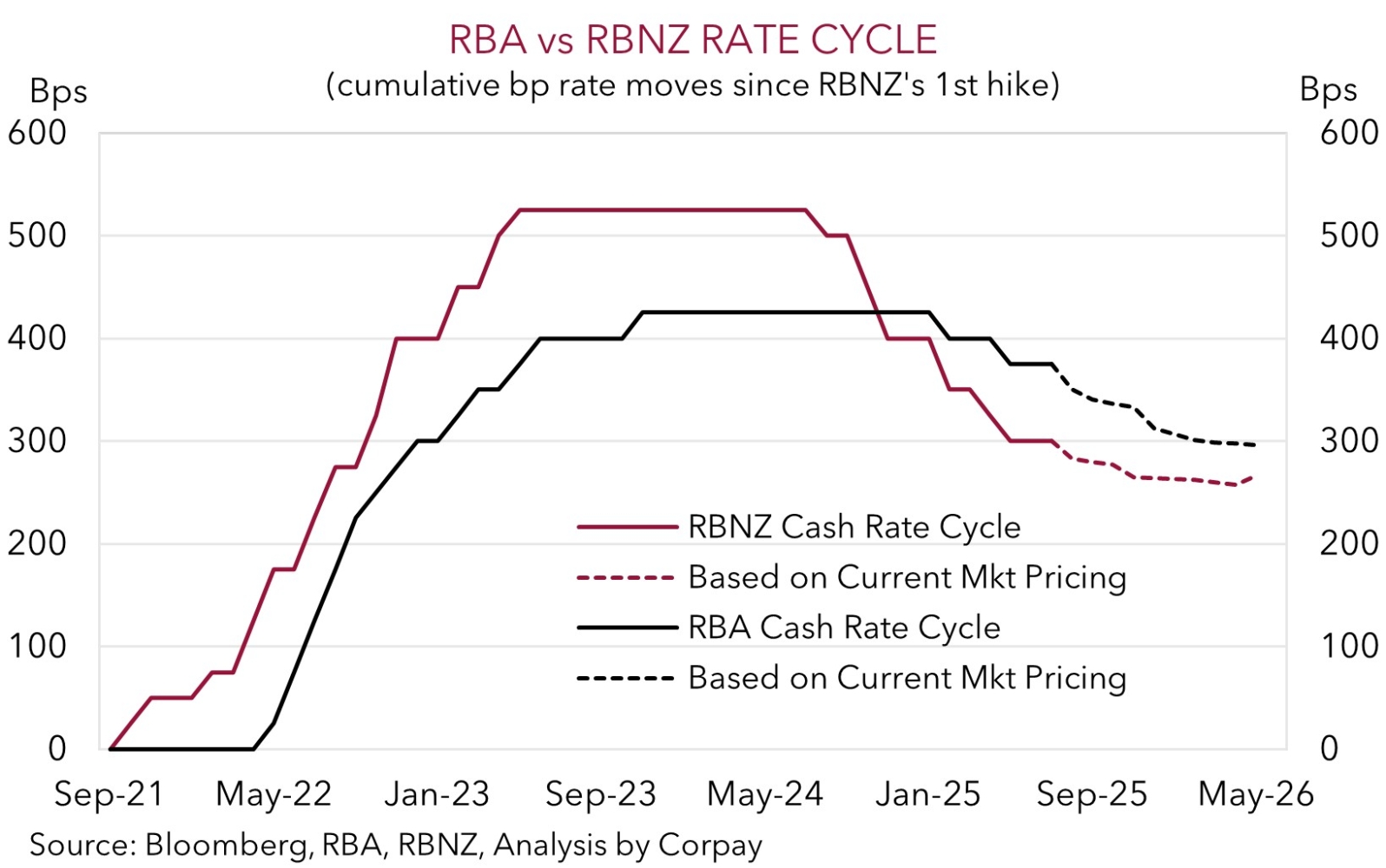

Across the Tasman, the RBNZ met yesterday and unlike the RBA earlier this week there were no surprises. The RBNZ kept interest rates steady at 3.25%, the first ‘on hold’ decision since the easing cycle kicked off last August. According to the RBNZ the outlook remains “highly uncertain” and future policy will be driven by NZ’s recovery speed and tariff impacts. We think that some further easing by the RBNZ is likely over coming months due to the sluggish momentum across parts of the NZ economy and labour market. In our view, this should act as a handbrake on NZD/USD.

In terms of the AUD, as mentioned above, we believe there is scope for some renewed bursts of USD supportive market volatility over the next few weeks. We think markets may have become too complacent about the downside risks to US/global growth and upside US inflation risks posed by US trade tariffs. US CPI inflation for June is out next week. An upturn in US inflation could see markets pare back US Fed rate cut expectations, which if realised might exert downward pressure on the AUD, in our opinion. Moreover, if we look further ahead, we would also flag that the USD has typically had positive seasonal tendencies in August which has usually translated into the AUD weakening more times than not at this time of the year. AUD/USD has fallen in August in 21 of the past 28 years. The implementation of the US’ new trade tariffs (due to come into effect on 1 August) could be a catalyst for these patterns to repeat in 2025.