It is increasingly obvious that profit expansion has played an uncomfortably-large role in sustaining high inflation. Corporate margins have expanded dramatically, with many of the world’s largest businesses earning more revenue even as volumes have fallen. Politicians in the US and Canada have seized on the issue, and have increasingly called out corporate “greed” as a major factor in driving prices higher.

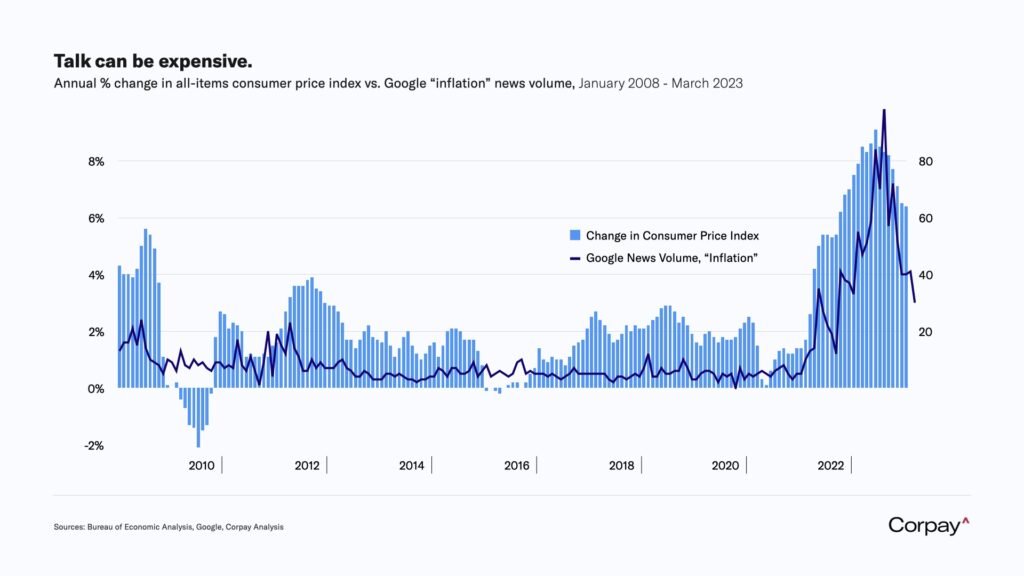

But what if it’s all in our heads? Or, more precisely, what if major corporations are only able to raise prices because consumer psychology has shifted after having been constantly bombarded by scary headlines about goods shortages, supply chain issues, wars, and other inflationary factors, making them more willing to pay more for basic household inputs? We’ve been sharing a version of the chart below in client presentations for much of the last year—mostly to illustrate the transitory nature of inflationary pressures—but it clearly shows how media alarmism about rising prices remains extremely elevated relative to pre-pandemic levels, even as the overall trend points down.

Think of all the stories about used cars, eggs, chicken wings, etc. that you’ve seen in recent years, and then think about how your own shopping behaviour has changed in response. Have you been (begrudgingly) willing to pay more? I know I have, and I would be willing to bet most people are the same.

They say talk is cheap, but in today’s environment, it might be very, very expensive.