• Mixed markets. US equities dip with Nvidia lower in after hours trading. USD a touch firmer. AUD still hovering near the top of its multi-month range.

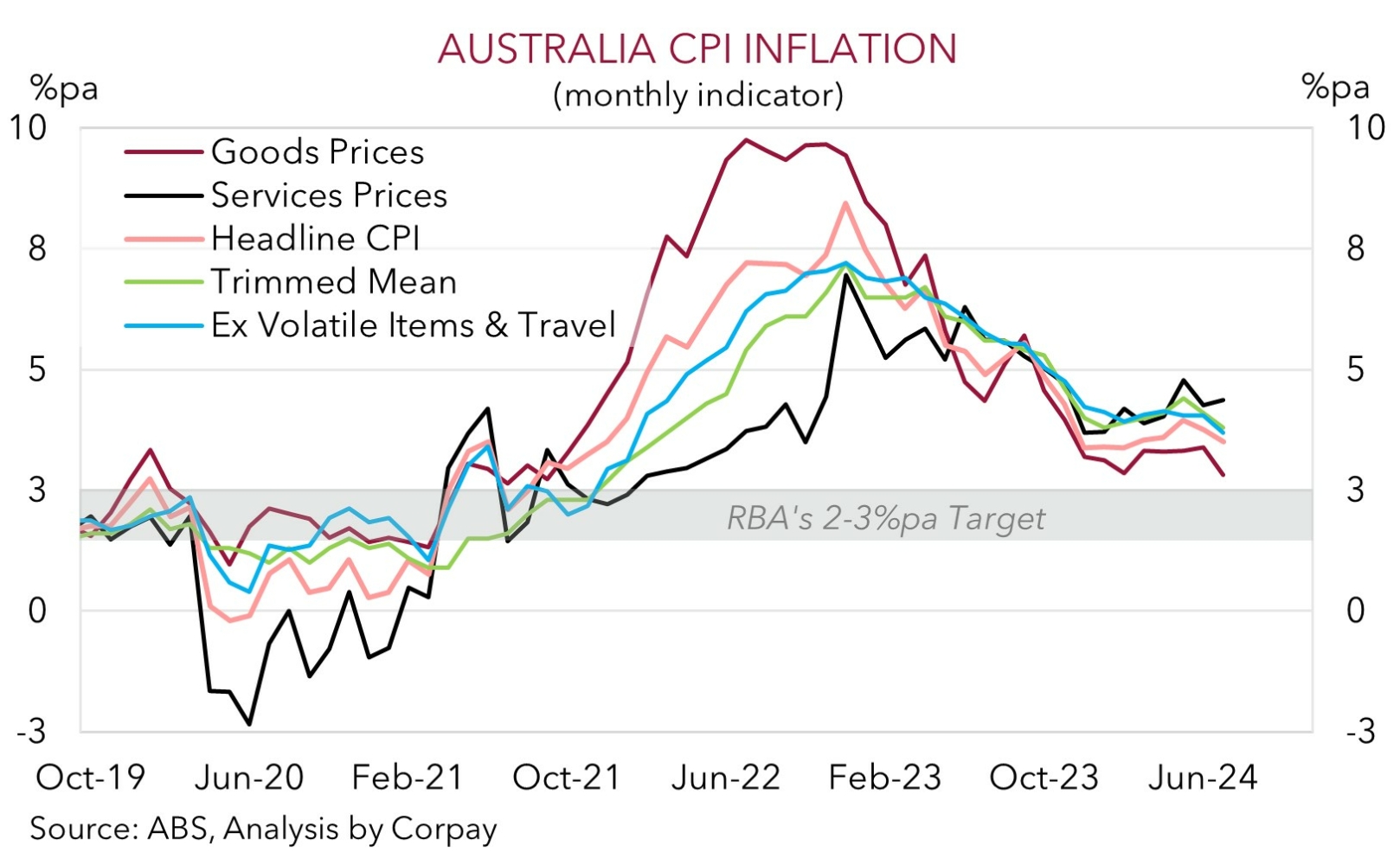

• AU inflation. Headline CPI slows, but not as much as predicted. Underlying inflation still sticky. RBA unlikely to ‘pivot’ like the US Fed for some time.

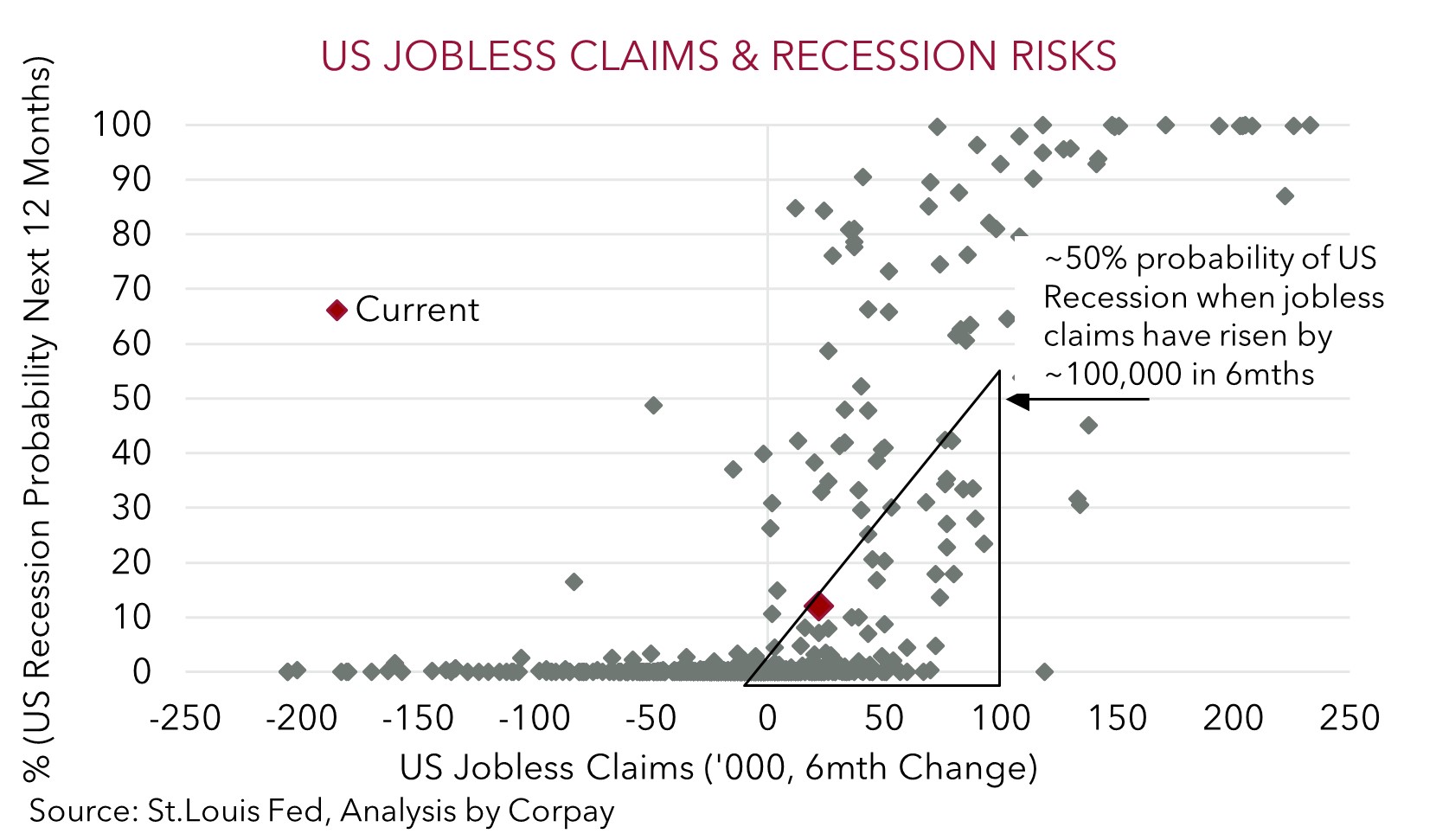

• Global data. US weekly jobless claims & German inflation due tonight. Tomorrow, Eurozone CPI & the US PCE deflator are released.

Light news and data flow has kept most major asset classes range-bound over the past 24hrs. US equities slipped back ahead of the much-anticipated results update from megacap Nvidia (S&P500 -0.6%, NASDAQ -1.1%). In the end Nvidia reported a jump in profits and sales compared to a year ago, however a revenue forecast that fell short of lofty expectations caught the eye and dragged down the share price ~7% in after-hours trading. At such elevated valuations stocks like Nvidia are ‘priced for perfection’, hence any deviation from expectations can generate a sizeable response. This may have a negative ripple effect on Asian stocks in today’s trade.

Elsewhere, curve steepening in bonds continued with the US 2yr rate shedding another 3bps (now ~3.87%) and the 10yr rate ticking up (+1bp to 3.83%). By contrast, while UK bond yields consolidated yields in Germany dipped ~2-3bps. Across commodities, the revival in iron ore stalled with prices hovering near ~US$101/tn. WTI crude oil and copper also weakened by ~1.5-2%. At ~US$74.50/brl WTI crude has fallen back to where it was trading a week ago with the geopolitical/supply risks that pushed up prices at the start of this week unwinding. In FX, the USD index edged up with the major European currencies losing ground (EUR and GBP declined ~0.5%), while USD/JPY is a bit higher (now ~144.50). USD/SGD (now ~1.3030) is treading water just above its cyclical lows. The NZD (now ~$0.6243) and AUD (now ~$0.6783) are on net fractionally lower compared to this time yesterday.

Over the rest of this week the global data calendar does heat up slightly. US weekly jobless claims are due tonight (10:30pm AEST), as is German CPI inflation (10pm AEST). Tomorrow, Eurozone CPI and the US PCE deflator (the Fed’s preferred inflation measure) are released. As outlined over the past few days because of Chair Powell’s ‘dovish’ guidance markets are grappling with the idea the Fed kicks off its easing cycle with outsized cuts. There is ~160bps worth of cuts priced in over the US Fed’s next 5 meetings. Based on history and underlying US economic trends we think this is too aggressive. 25bp steps appear more appropriate. Hence, we believe a paring back of the substantial near-term Fed rate cut assumptions because of better than anticipated US activity/inflation data may give the USD some short-term support. Indeed, jobless claims still aren’t flashing ‘red’. Historically, a 100,000 increase in jobless claims over a 6-month window has coincided with odds of a US recession over the next year lifting to 50% or more. Things are still a long way from that.

AUD Corner

The AUD has consolidated over the past 24hrs up near the top end of its multi-month range with domestic economic factors and global market trends push and pulling on the currency (now ~$0.6783). By contrast, the AUD has slightly outperformed most of the other majors. AUD/EUR (now ~0.61) is back above its 1-year average, while AUD/GBP (now ~0.5142), AUD/JPY (now ~98), and AUD/CAD (now ~0.9143) have risen by ~0.1-0.3%. AUD/CNH (now ~4.8367) is around a 1-month high, while AUD/NZD is holding its ground north of its 200-day moving average (~1.0850).

Locally, monthly CPI inflation for July was released yesterday. The monthly series is not a perfect replication of the quarterly data but it still provides insights into the inflation pulse. Headline inflation moderated slightly less than predicted (3.5%pa from 3.8%pa) with the Federal/State governments electricity subsidies starting to have an impact. This should continue to artificially drag down headline inflation over the next few months. However, beyond that and the disinflation in ‘goods’ prices (which is more pronounced in the first month of the quarter) the improvement in core/services inflation continues to be slow going. The underlying inflation pulse is still not where it needs to be for the RBA to be comfortable enough to declare victory especially given the high level of activity across the economy and low unemployment.

Hence while we think the AUD (which is still trading near ‘overbought’ levels on several technical trading indicators) may drift back over the short-term because of the risk the USD recoups lost ground, over the medium-term (barring bursts of risk aversion) diverging trends between the RBA and others should be AUD supportive. We continue to believe that the start of a limited RBA easing cycle is a story for H1 2025. If realised, this should see relative yield spreads progressively turn more in favour of the AUD.