• Positive vibes. A weaker US jobs report & ISM services data exerted more pressure on US yields & the USD. The AUD’s revival continued.

• RBA meeting. Australian interest rate pricing has adjusted higher. But has it gone too far? The RBA may not match ‘hawkish’ market expectations.

• Event radar. Locally the RBA (Tues) is the main event. Offshore, the Bank of England meets. In the US several Fed members are due to speak.

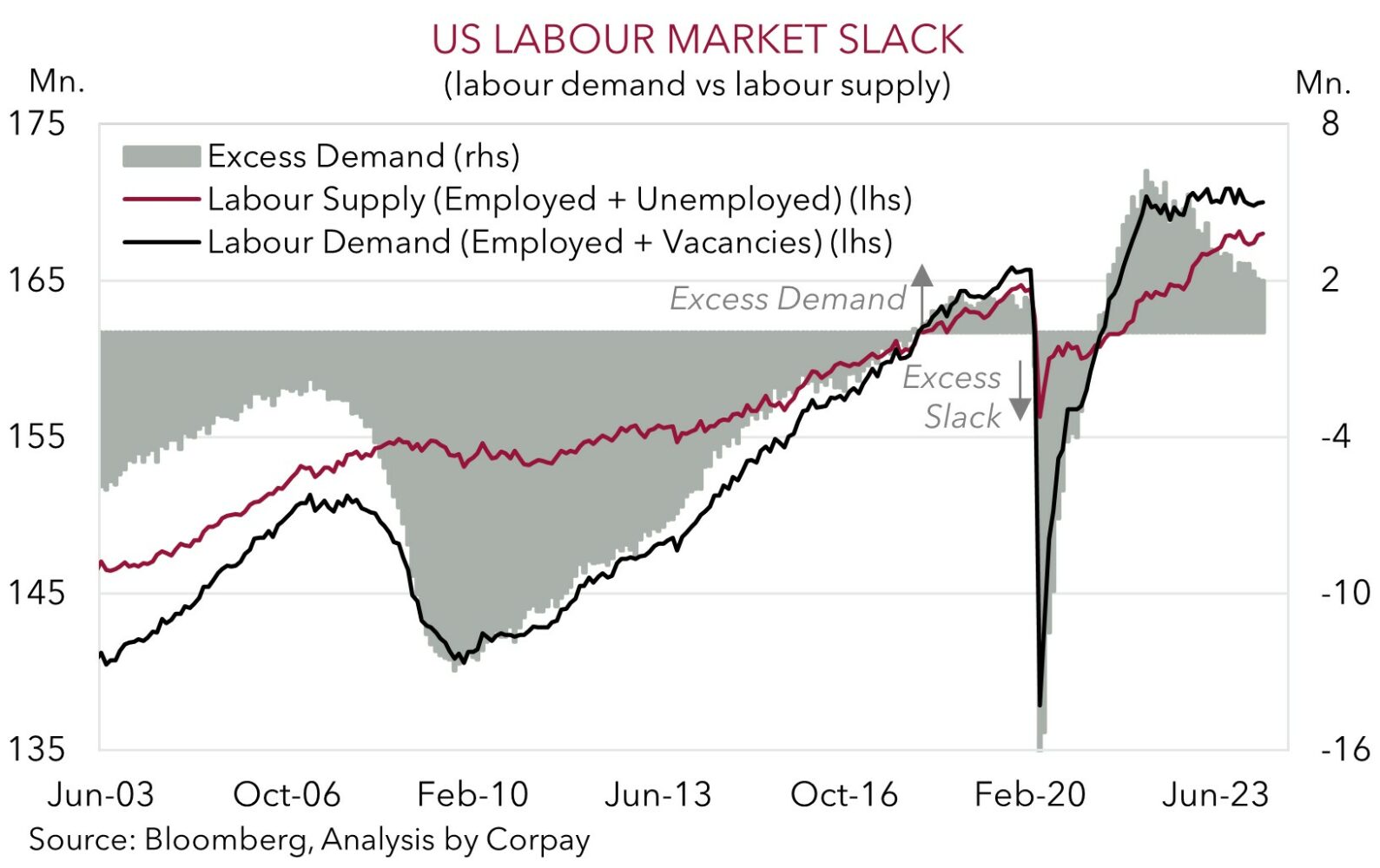

The positive market mood stemming from the less ‘hawkish’ than feared US Fed meeting continued on Friday. Softer US jobs and services ISM data supported the Fed’s stance. US jobs growth cooled in April with non-farm payrolls coming in below consensus. The 175,000 gain was a step down from the stellar Q1 pace and the lowest reading in 6-months. The US unemployment rate ticked higher (now 3.9%), and average weekly earnings (a wages proxy) slowed to less than 4%pa for the first time since mid-2021. As our chart shows, ‘excess heat’ continues to come out of the US labour market with demand waning and supply improving. These trends point to a further moderation in services/core inflation down the track. Added to that, forward-looking activity gauges are losing altitude. The services ISM dipped into ‘contraction’, something that hasn’t happened since late-2022. Employment intentions fell further and new orders/output declined as the lagged impact from past Fed policy tightening and tighter credit conditions continue to manifest.

In response markets continued to add back Fed policy easing to their implied interest rate path. ~45bps worth of Fed rate cuts by year-end are now discounted, up from ~28bps priced in last Tuesday. The shift in thinking has exerted downward pressure on US bond yields with the 2yr and 10yr rates shedding another ~5-7bps. This in turn boosted equities. The US S&P500 rose 1.3% on Friday (its largest daily gain in more than 2 months) with the tech-focused and interest rate sensitive NASDAQ outperforming (+2%). The USD remained on the backfoot. EUR is approaching its 200-day moving average (~1.0797), and USD/JPY remained heavy with the prospect of further intervention by Japanese authorities to prop up the still undervalued JPY front-of-mind for investors. At ~152.85 USD/JPY is ~4.5% below last Monday’s multi-decade high. Cyclical currencies like the AUD and NZD strengthened. The AUD (now ~$0.6612) is at the upper end of the range it has occupied since mid-January.

The US economic calendar is light with appearances by Fed members in focus. 2024 voters Barkin (Tues), Williams (Tues), Jefferson (Thurs), Cook (Thurs), Daly (Fri), and Bowman (Fri) are on the schedule. Most interesting should be comments from Williams (Tues 3am AEST). The heavyweight policymaker is typically on the more ‘dovish’ end of the spectrum, and we think a reiteration that he sees inflation slowing and rate cuts being the next steps may continue to weigh on the USD. Especially with the JPY (the second major USD alternative) clawing back ground. That said, a ‘dovish’ message from the Bank of England (Thurs 9pm AEST) about the possibility of its own easing cycle coming closer into view, could undermine GBP and generate a bit of renewed support for the USD later in the week.

AUD Corner

The AUD’s revival has continued. The lift in equities, firmer base metal prices (copper rose 1.9% on Friday), and narrower yield differentials as the weaker US jobs and ISM data generated a further pull-back in US rates supported the AUD. At ~$0.6612 the AUD is ~4% above its recent Israel/Iran risk aversion low and nearing the upper end of the range it has traded since mid-January. The backdrop also helped the AUD on most crosses. AUD/EUR (now ~0.6140) and AUD/GBP (now ~0.5268) are near their respective 4-month highs, AUD/CNH is above its 1-year average (now ~4.76), and AUD/CAD (now ~0.9047) is less than 1% from its 1-year peak. AUD/NZD has consolidated near ~1.10, its highest levels since June 2023.

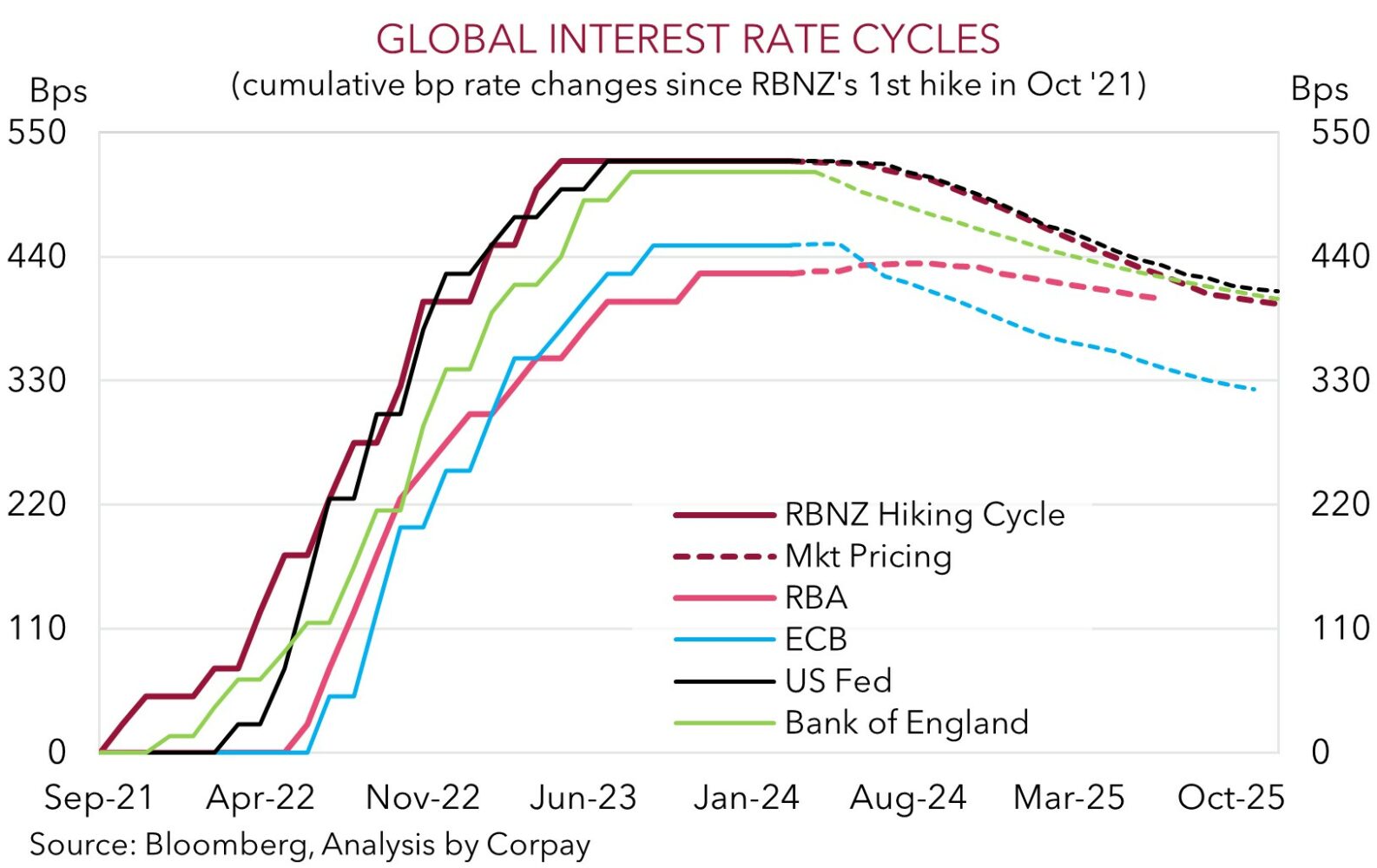

Despite the negative USD undercurrents we feel the AUD’s upswing could face a near-term domestic hurdle in the form of the RBA meeting (decision Tues 2:30pm AEST, press conference Tues 3:30pm AEST). The wide gap between AUD spot and our ‘fair-value’ estimate has closed over recent weeks. No policy changes are anticipated by the RBA this week with its updated projections and guidance the focal points. As per last week’s US Fed meeting outcomes relative to expectations will be important, and we think the ‘hawkish’ pivot in RBA expectations might have run too far too fast. Markets are pricing in a ~50% chance of another RBA rate rise by September; with a 25% probability it could occur by June.

In terms of the numbers, based on the recent run of data the RBA’s near-term unemployment forecasts should be revised down and short-term CPI inflation forecasts should be revised up. However, a ‘technical assumption’ that sees fewer rate cuts over the horizon compared to its forecasts from 3 months ago should also mean inflation is still seen trending down to target because of the more negative economic impacts higher rates for longer may produce. In our opinion, this might see the RBA reiterate its open-ended guidance that “the Board is not ruling anything in or out” rather than reverting to its prior rhetoric that “a further increase in interest rates cannot be ruled out”. The prior guidance was only changed at the last RBA meeting in March.

It may only be word play as by “not ruling anything in or out” does keep alive the prospect of further rate hikes if needed, but based on the short-sighted/fickle nature of markets if the RBA doesn’t explicitly alter its language, we think some of the froth may come out of Australian interest rate pricing, and this could see the AUD slip back. However, based on the softer USD, if realised we believe this could have a more pronounced short-term impact on crosses like AUD/NZD, AUD/EUR, and AUD/JPY.