• Holding on. Quiet start to the week. US equities & base metals firmer. Long-end yields a bit lower, while the USD & AUD consolidated.

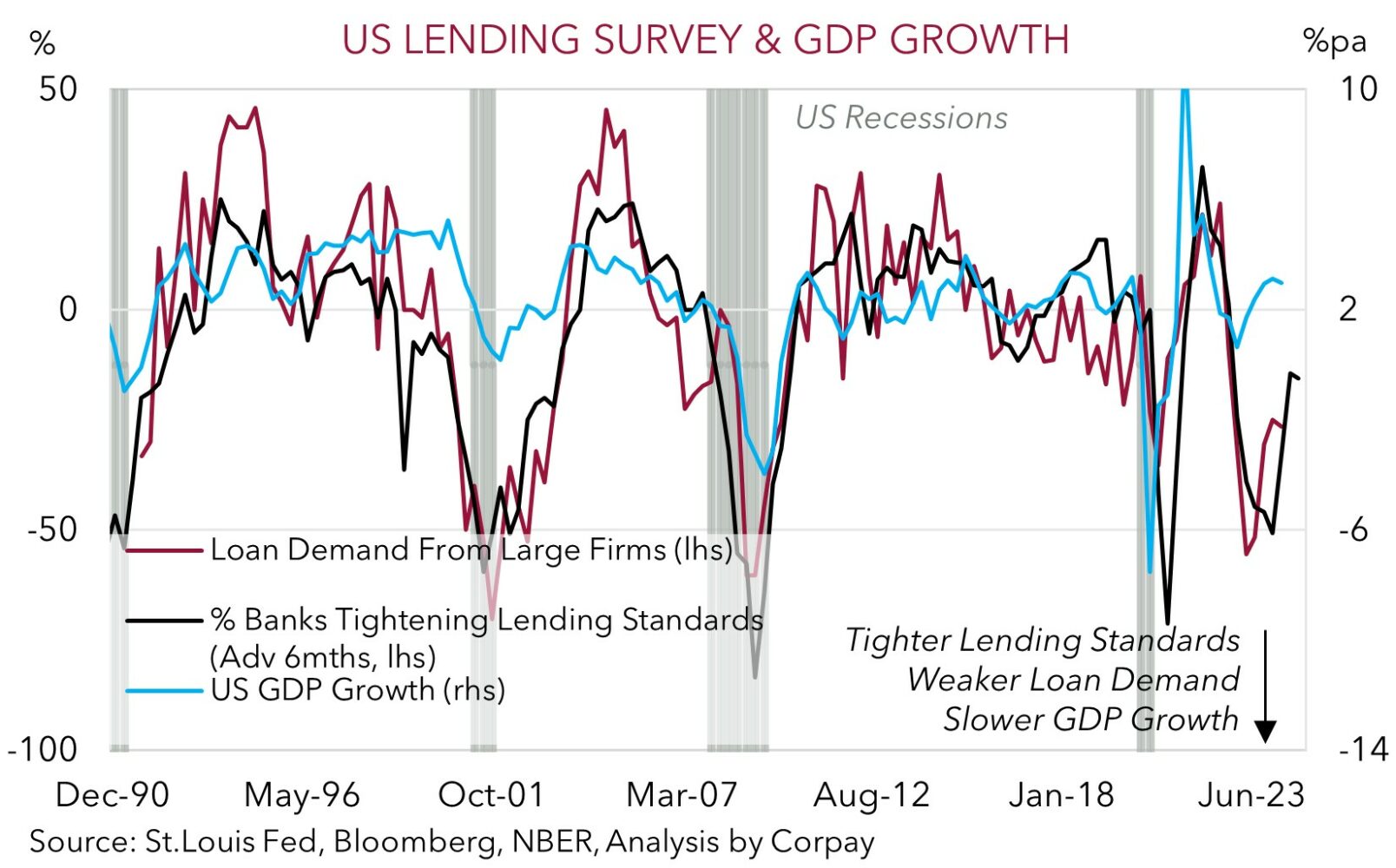

• Fed survey. The Fed’s latest lending survey shows credit conditions are still ‘tight’. This can crimp lending & US growth over time, bringing on rate cuts.

• RBA meeting. RBA in focus today. Rates pricing has adjusted higher. Will the RBA match the markets thinking? If not, the AUD could fall back.

It has been a quiet start to the week across markets. This is unsurprising given the light event calendar. Last week’s moves stemming from the repricing in US interest rate expectations have generally been sustained or added to. European and US equities strengthened with the S&P500 up another ~1%. Following its recent rebound the S&P500 is within 2% of its record highs. As noted previously, the positive start to May in the US stock market isn’t surprising given the positive seasonal tendencies. Over the past 20 years the S&P500 has risen in May 15 times.

Elsewhere, long-end bond yields have drifted back a bit further with 10yr rates in Germany (now ~2.47%) and the US (now ~4.49%) ~2bps lower. Across commodities it is a sea of green with energy (WTI crude +0.7%) and industrial metals (copper +1.2%) rising. The copper price is back around the top of its 5-year range with the jump up in prices over recent months a positive signal for global activity over the period ahead given copper’s wide ranging industrial uses. In FX, the USD index consolidated with EUR hovering near ~$1.0770, while USD/JPY remains sub ~154 (~4% below last week’s multi-decade peak). USD/SGD is tracking a little above its ~200-day moving average (~1.3493), while ahead of today’s RBA decision (2:30pm AEST) and press conference (3:30pm AEST) the AUD is treading water towards the upper end of the range it has occupied since mid-January (now ~$0.6625).

US Fed voting members Barkin and Williams spoke overnight with limited impact. Watching the data to gain ‘confidence’ things are sustainably moving in the right direction before rate cuts can start was a central message. Barkin also noted that he was optimistic policy was restrictive enough to bring inflation down to target, highlighting that “the full impact of higher rates is yet to come”. Indeed, this what the Fed’s latest quarterly lending survey also indicated. Although they are off their highs, credit standards in the US are still ‘tight’. In time this can further constrain the flow of new lending, and as our chart shows, this normally sees US growth slow and the labour market loosen down the track. As this takes hold we expect markets to price in more policy easing by the US Fed, and we think this can exert downward pressure on the still elevated USD over the medium-term.

AUD Corner

The AUD has held its ground in quiet trade with the lift in US/European equities and firmer base metal prices supportive. At ~$0.6625 the AUD is approaching the top of the range is has traded since mid-January. The AUD has also drifted a touch higher on the crosses. AUD/EUR (now ~0.6150) is at a 4-month high, as is AUD/GBP (now ~0.5272). AUD/CNH is tracking above its 1-year average, while AUD/NZD (now ~1.1020) is at levels last traded in mid-2023.

We have a positive medium-term bias for the AUD due to factors such as the unfolding revival in China’s economy and outlook for a weaker USD. That said, we think today’s RBA meeting (2:30pm AEST) and press conference (3:30pm AEST) poses a short-term challenge given the AUD’s sharp rebound over a short space of time.

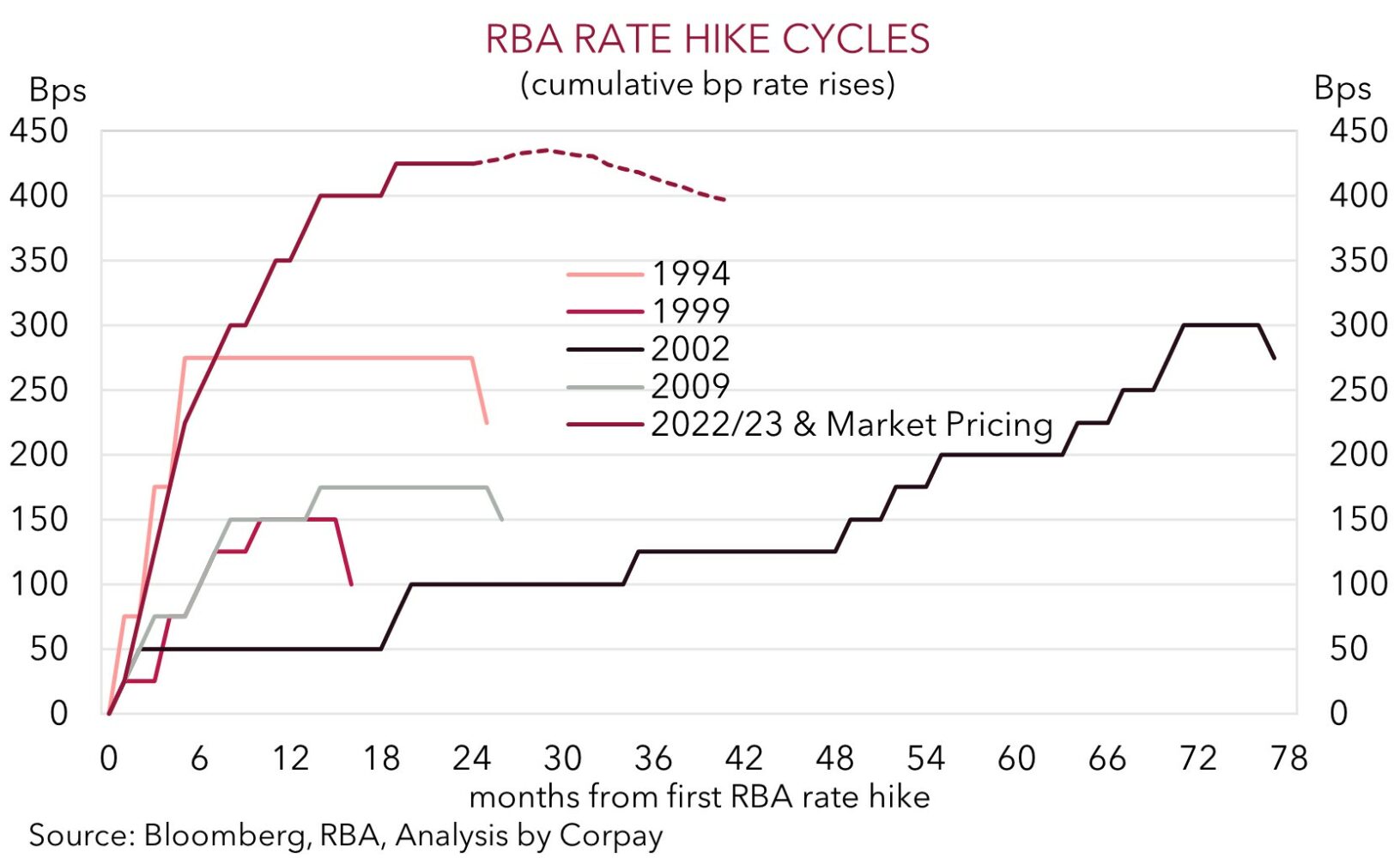

No policy changes are anticipated by the RBA (only 1 of the 31 analysts surveyed is looking for a hike) with its updated forecasts and guidance in the spotlight. Like last week’s US Fed meeting outcomes compared to what is expected will be important, and although we believe the ‘hawkish’ turn in RBA expectations is somewhat justified given the Q1 CPI surprise, the extent of the upswing in market pricing may have run too far. Interest rate markets are penciling in a ~70% chance of another RBA rate rise by Q3.

Based on recent data the RBA’s near-term unemployment forecasts should be revised down and short-term CPI inflation projections revised up. But with the RBA set to use a ‘technical assumption’ assuming fewer cuts over the horizon we think inflation will still be shown falling to target over the next few years due to the spillover drag on growth and jobs higher for longer rates produces. In our judgement, while the RBA will talk tough about the risks of further tightening, it may not be enough to see it jettison its open-ended guidance that “the Board is not ruling anything in or out” and revert to prior rhetoric that “a further increase in interest rates cannot be ruled out”.

The RBA’s current language (which it only put in place last meeting) gives the Board optionality and already keeps the door open to more hikes, if needed. Based on the short-sighted/fickle nature of markets if the RBA doesn’t explicitly alter its language, we feel some of the heat could come out of Australian interest rate pricing as it would rekindle thoughts the RBA is a ‘reluctant hiker’ and this could see the AUD lose some ground. However, based on the softer USD, if realised, this could have a more pronounced short-term impact on crosses like AUD/NZD, AUD/EUR, and AUD/JPY.