• Choppy times. US equities weaker at the end of last week. Paring back of rate cut expectations a factor. USD consolidates with USD/JPY declining.

• AUD trends. AUD hovering just above recent lows. Stronger for longer USD a medium-term AUD headwind. But AUD can edge up on the crosses.

• Event radar. Global PMIs & CPI data from the UK, Japan, & Canada is due. ECB, US Fed, & RBA members are also due to speak this week.

It was a choppy end to the week in markets on Friday with the US election outcome continuing to wash through and with the global data also generating pockets of volatility. The latest activity figures out of China showed tentative signs the various stimulus injections may be gaining traction with retail sales expanding at the fastest pace in several months (4.8%pa) and industrial production levelling out (5.3%pa). In the US, retail sales were better than anticipated with upward revisions to prior months and a solid 0.4% lift in October more evidence consumer spending is holding up. Given household consumption is the engine room of the US economy (it equates to ~3/4’s of US GDP) this reinforced the message from Fed Chair Powell the day earlier that policymakers might not need to be in a hurry to lower interest rates.

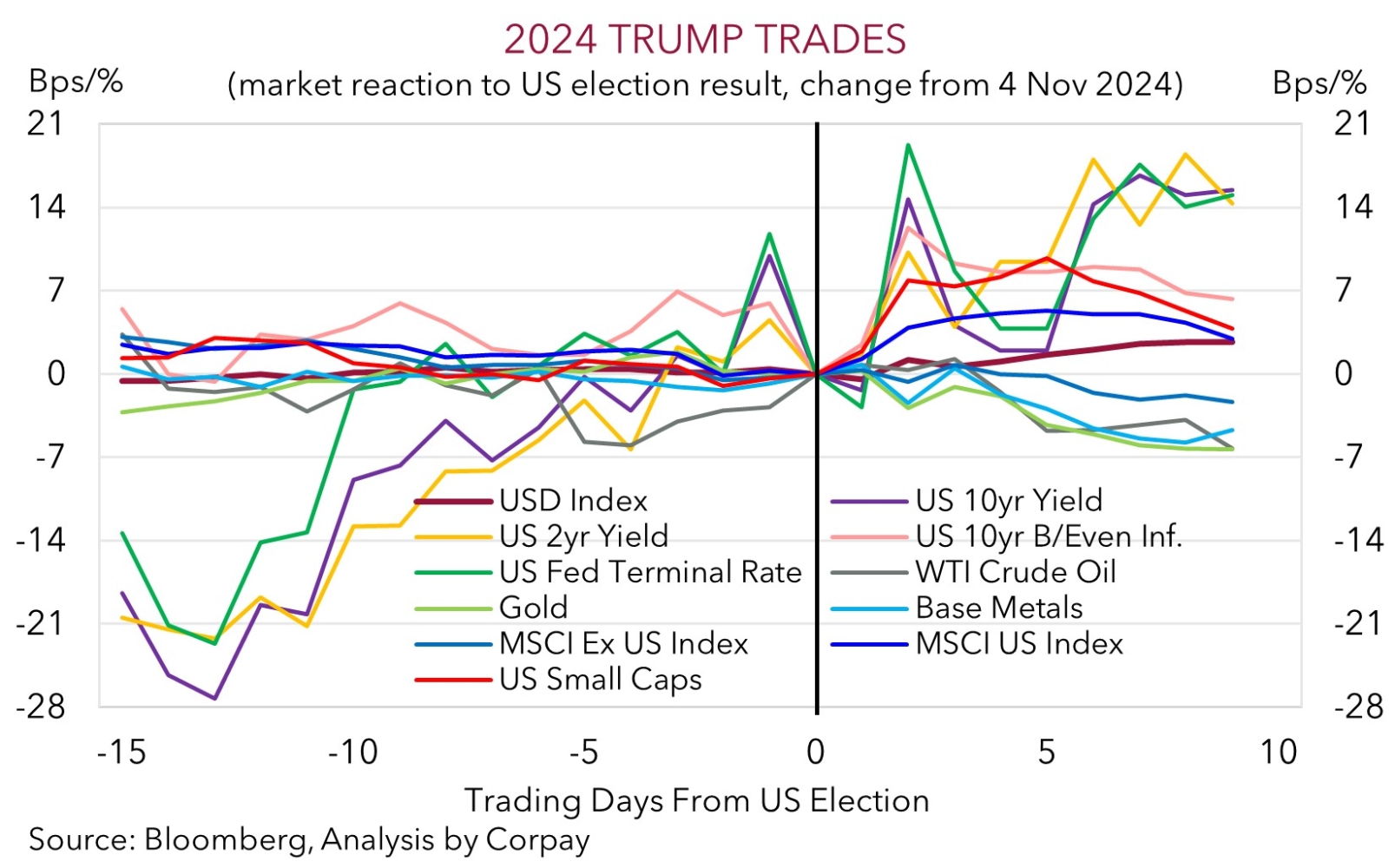

While an initial spike in US bond yields after the release of retail sales unwound rates remain elevated. The benchmark US 10yr yield is at ~4.44%, the upper end of the range occupied since early-June, with the 2yr yield (now ~4.30%) underpinned by a reduction in rate cut expectations. Another rate reduction by the US Fed at the December meeting is close to being a 50/50 bet, with only 3 more rate cuts factored in by the end of 2025. The recent upswing in US yields, coupled with some exhaustion in the post-election ‘Trump trade’ euphoria saw US equities end last week on a weaker note. The S&P500 shed 1.3% on Friday with the tech-focused NASDAQ underperforming (-2.2%). That said, as our chart illustrates, US equities have outperformed their global peers since the US election with Trump’s ‘America First’ platform and outlook for greater fiscal spending factors at play. In FX, the USD tread water near its 2024 highs with the sluggish EUR (now ~$1.0530, the bottom of its ~13-month range) and softer GBP (now ~$1.2633) following a lackluster Q3 UK GDP report offset by a firmer JPY. USD/JPY declined by ~1.3% on Friday (now ~154.20) on the back of the shaky risk sentiment and FX intervention threats by Japanese authorities. Japanese Finance Minister Kato indicated that they are monitoring markets with a ‘high sense of urgency’ and are ‘ready to respond’ to excessive moves. Elsewhere, the NZD (now ~$0.5859) and AUD (now ~$0.6464) consolidated just above recent lows.

Looking ahead, the latest global business PMIs are due (Friday), as is UK CPI (Weds), with several ECB and US Fed members also set to hit the wires this week. The light calendar and signs of fatigue following the adjustments since the US election makes us think markets could be in for a bout of range trading over the near-term. However, further out we continue to expect the USD to edge a bit higher and stay stronger for longer due to the growth/inflation and interest rate spillovers from the Trump policy mix (see Market Musings: Trump 2.0 & the AUD).

AUD Corner

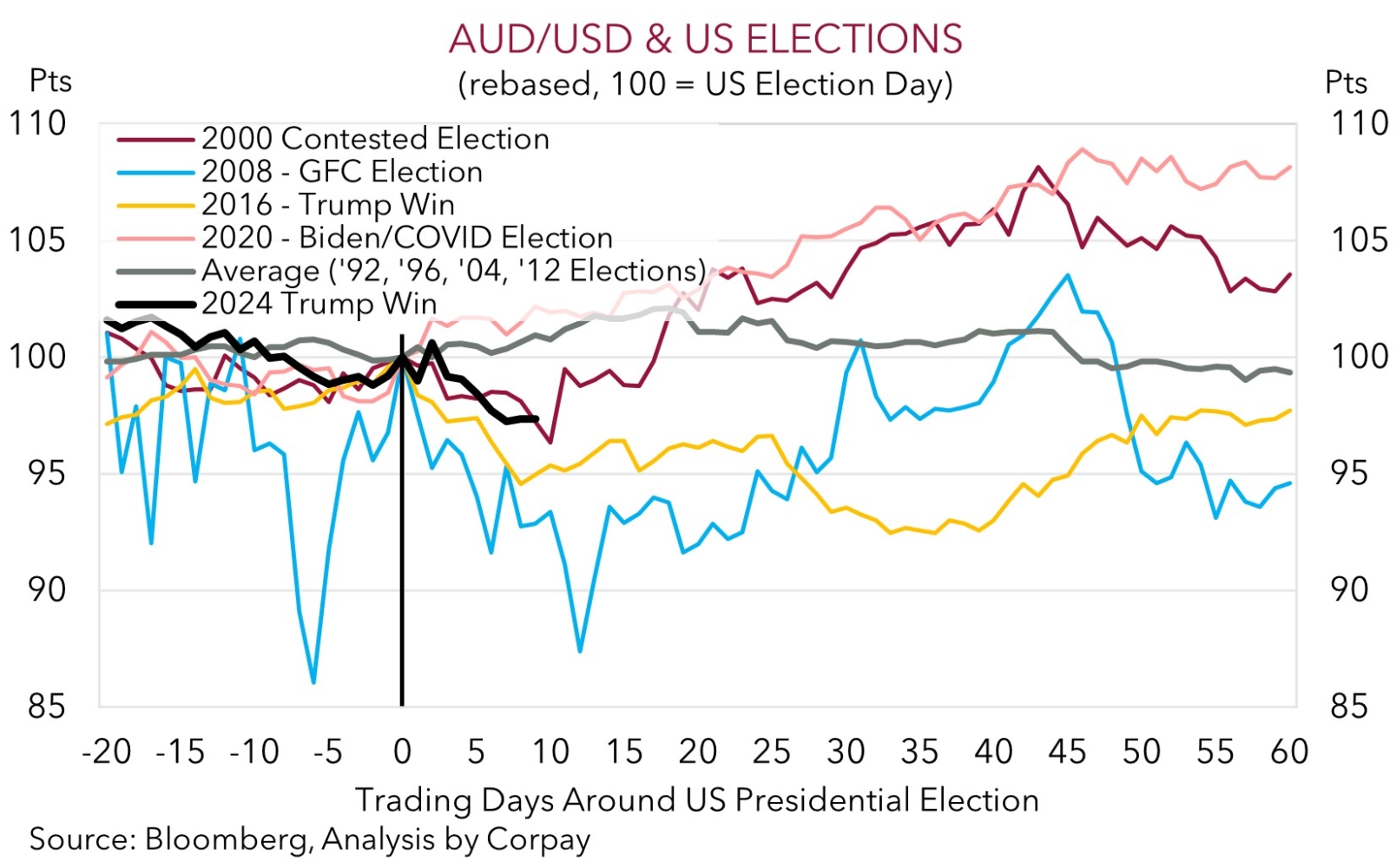

After a difficult spell, the consolidation in the USD and signs of improved momentum in China’s economy at the start of Q4 helped the AUD level off on Friday (see above). That said, at ~$0.6465 the AUD is still tracking around its multi-month lows and is a little over ~7% from its late-September peak. On the crosses, the AUD put in a mixed performance with modest gains against the EUR (+0.1%), GBP (+0.4%), and CAD (+0.4%) coming through. By contrast, the rebound in the undervalued JPY following the shot across the bow of markets by Japanese authorities that intervention risks have risen saw AUD/JPY drop back under ~100 for the first time in several weeks.

As mentioned there is limited top tier global economic data scheduled for release this week with the monthly business PMIs (Fri), UK inflation (Weds), and central bank speeches scattered over coming days the points of focus. It is a similar story locally with a speech by the RBA’s Kent (5:30pm AEDT) and appearance by Governor Bullock (Thurs) the main events. As discussed, we think that after the markets rather rapid-fire post-US election adjustment a period of range trading may be on the horizon in the short-term. This could help the AUD nudge up a little, but we don’t feel the underlying medium-term dynamics are set to change. As outlined in our previous research, we believe the Trump policy platform of large-scale trade tariffs, greater fiscal spending, and moves to curb US immigration should be USD supportive which in turn acts to constrain the AUD’s medium-term upside (i.e. we now see the AUD tracking in the mid-$0.60s over the next year) (see Market Musings: Trump 2.0 & the AUD).

However, we feel there are offsets against becoming overly bearish at current low levels. A degree of ‘bad news’ looks factored in given the AUD is trading ~4 cents under our ‘fair value’ estimate. Statistically, over the past decade the AUD has not sustainably traded much below where it now is (it has only been sub-$0.65 6% of the time since 2015) thanks to the higher level of the terms of trade and improvement in Australia’s trade/current account position. It also shouldn’t be forgotten than FX is a relative price, and several drivers remain in the AUD’s favour when it comes to AUD-crosses. Over time we think the diverging policy trends between the RBA and other central banks because of Australia’s more resilient labour market, stickier core inflation, and elevated aggregate demand stemming from the surge in the population should help the AUD outperform EUR, CAD, NZD, CNH, and to a lesser extent GBP. We continue to believe that the start of a gradual RBA rate cutting phase is a story for H1 2025. This can counteract the drag stemming from a further appreciation in USD.