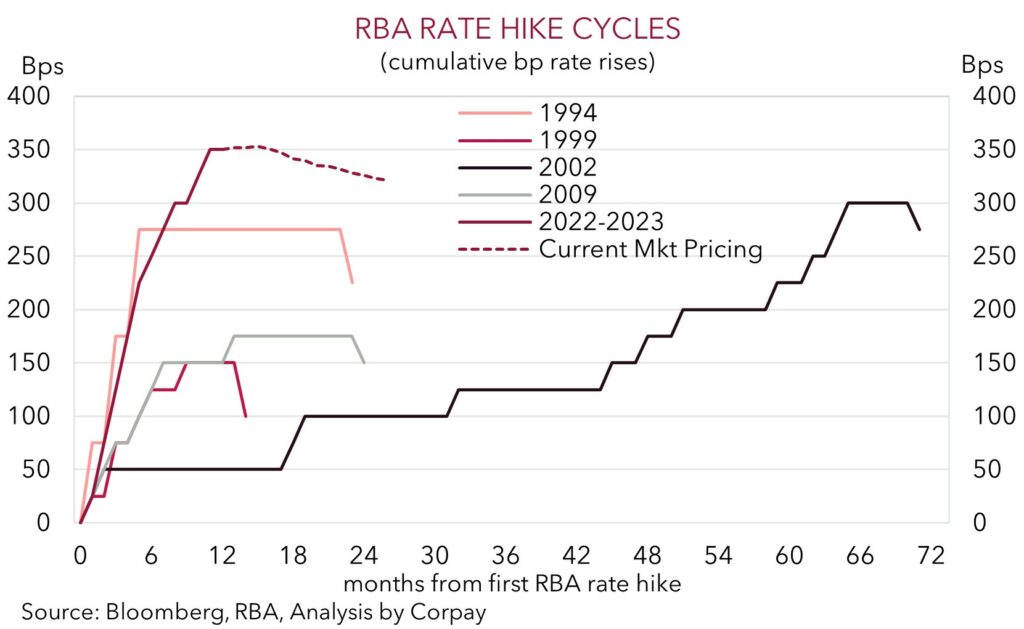

In what we think was a somewhat finely balanced decision the RBA finally ‘paused’ its rate hiking cycle at the April meeting. After raising rates aggressively since kicking things off in May 2022 (the RBA delivered a cumulative 350bps worth of hikes over the previous 10 meetings, the fastest and most abrupt tightening cycle since at least the 1980s), the RBA kept the cash rate steady at 3.6% for the second straight month.

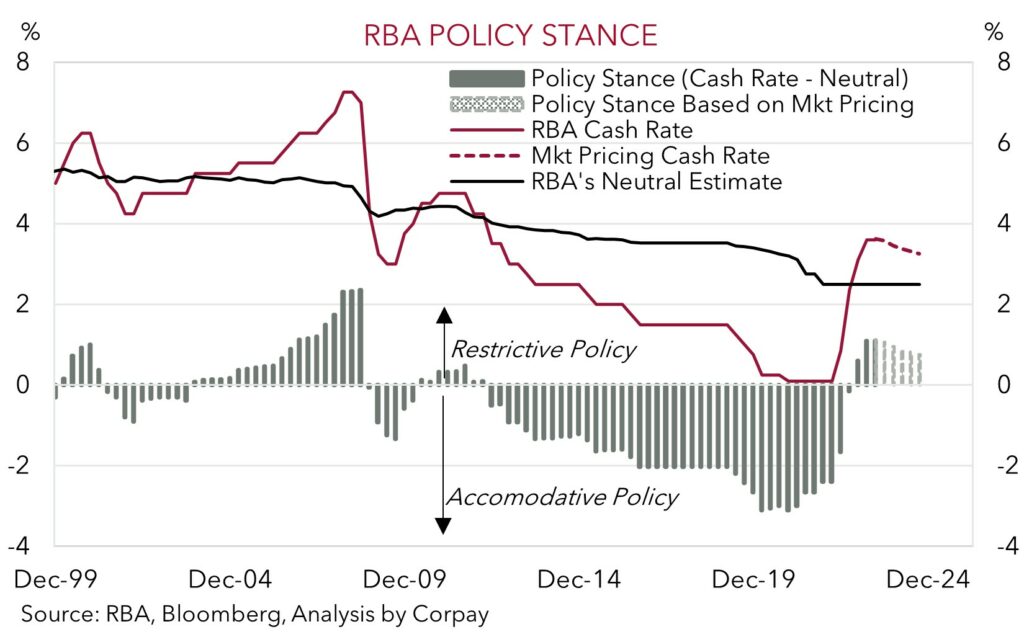

While the RBA held firm in April it has kept the door open to doing more down the track. However, further moves have become far more contingent on how the economy and inflation evolve. The RBA has retained a softened ‘conditional’ tightening bias, with the Board indicating that it expects “some” further tightening “may well be needed” to ensure inflation returns to target. This is less definitive than the message from the past few months when the RBA noted it “expects that further” tightening “will be needed”.

A shift to a more staggered and data-dependent approach isn’t unusual. As our chart shows, past RBA hiking cycles have had breaks to allow time for prior rate rises to flow through the economy. Monetary policy changes work with ‘long and variable’ lags, and each cycle has the potential of throwing up positive and/or negative surprises. Indeed, once the level of interest rates exceeds the equilibrium ‘neutral’ rate (which the RBA pegs at ~2.5-3%) and policy is in ‘restrictive’ territory as it is now, the focus of policymakers typically morphs into ‘fine tuning’ settings rather than delivering more blunt force trauma. That said, in our view, while further RBA moves are possible should inflation or the activity data positively surprise, our updated central case, based on how we anticipate things could unfold, is that the RBA’s tightening phase is now complete.

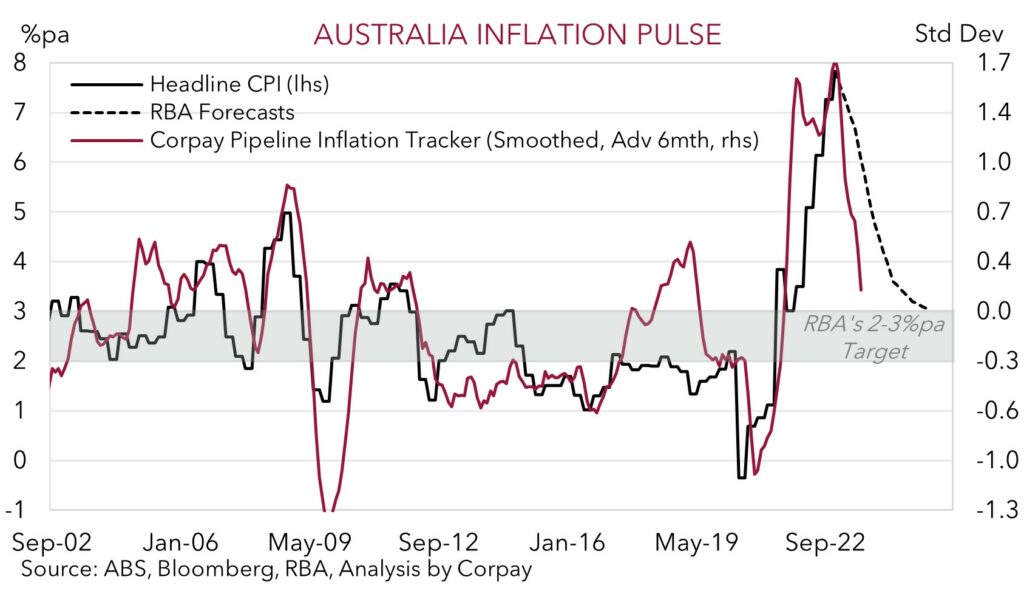

Data-wise, Australian inflation, which has been primarily driven by commodity and goods prices, is showing clear signs of turning. Our inflation pipeline tracker is pointing to a sizeable deceleration in annual inflation over the next few quarters. On the growth side, we expect a sharp slowdown in domestic activity over Q2/Q3 as the cumulative impacts from the jump up in mortgage costs and tighter conditions gains traction (see Market Wire: Growth Momentum Slowing). The RBA’s own analysis shows that only around ~50% of the increase in the cash rate delivered over the past year has flowed through to scheduled mortgage repayments.

The cashflow hit on indebted households should intensify over the next few months, and a decent amount of natural tightening should occur as the large pool of cheap COVID-era fixed rate loans are refinanced at much higher interest rates. In our opinion, this should see consumer spending, particularly on discretionary areas, slow markedly. Ultimately, a period of sub-trend growth should feed through and reduce labour demand at the same time labour supply has picked up on the back of reaccelerating population growth stemming from the reopened international borders. This mix points to unemployment rising over the next year. This in turn should ease wage pressure points that have built up in some industries and help dampen inflation.

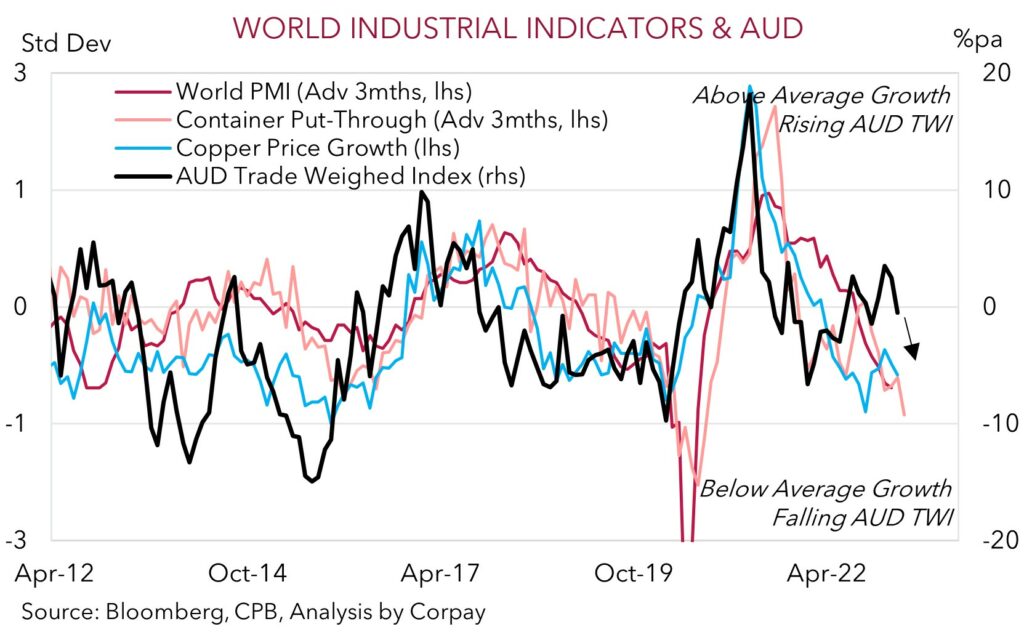

For the AUD, we expect the RBA’s more cautious approach and signs it is at (or very close) to the end of its tightening cycle to take some of the heat out of the currency generated by the sharp rise in energy prices following the surprise decision by the OPEC+ group to cut back production. We remain of the view that the AUD faces an uphill battle over the next few months as the aftershocks from the very fast and large global tightening cycle continue to show up across the real economy and financial markets. Increased market volatility and slower global growth has historically been a backdrop that has favoured currencies like the USD, EUR and JPY over ones like the AUD and NZD that are leveraged to global industrial activity (see Market Musings: Buckle up, volatility should continue). Additionally, we believe the diverging policy trends and expectations should also keep the AUD on the backfoot against currencies like the EUR, GBP, and a lesser extent the USD where the central banks still have more work to do to get on top of inflation, or the JPY where we think the Bank of Japan could be about to embark on a long overdue policy normalisation path.