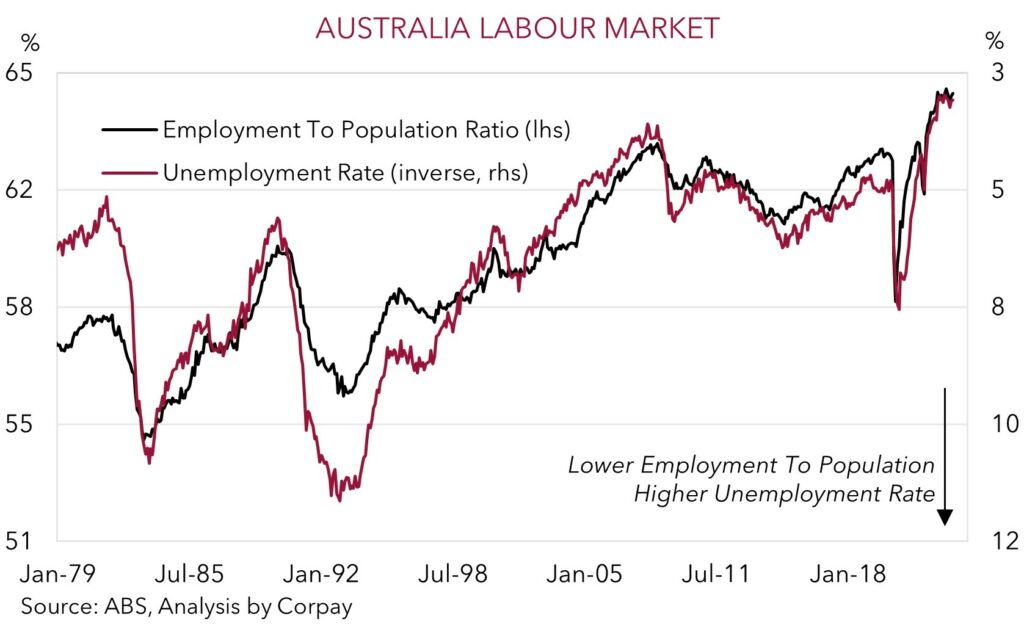

The Australian labour force report is notoriously volatile, and the March data generated yet another, albeit positive, surprise. Employment rose more than anticipated, with 53,000 jobs added in the month. This follows the ~64,000 jobs created in February. The mix was also favorable, with full-time employment leading the way (+72,200 in March). Labour market conditions remain tight. The employment-to-population ratio is historically high (now 64.4%), as is the participation rate, while unemployment is still very low. At 3.5% the unemployment rate remains near the lowest it has been since the early-1970’s. Indeed, on the monthly data going back to 1978, unemployment has only been lower 4 times.

The stronger labour report may see markets second guess its pricing for no more rate hikes by the RBA. Despite ‘pausing’ its rate hiking cycle in April, the RBA did retain a conditional tightening bias. As we outlined previously, the burden is on the data to force the RBA’s hand to raise rates further. While we think the overall domestic and global picture should see the pragmatic RBA continue to hold fire, we do believe the robust labour market data does increase the chances of another hike in May (see Market Wire – RBA: over and out). A lot will depend on the upcoming CPI report (released 26 April), broader global developments, and how much weight the RBA places on the large amount of tightening in the system that still hasn’t had its full effect.

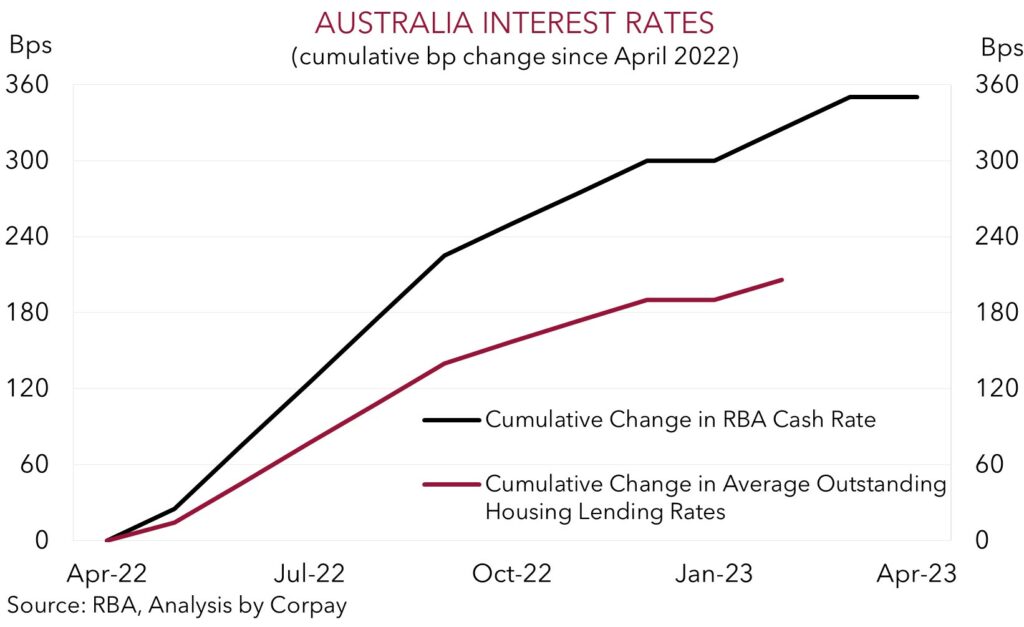

From a labour market perspective, in our opinion, this should be ‘as good as it gets’. The labour market is a lagging economic indicator. And while conditions still appear tight, given the time it takes to translate a job ad to a new hire, the March data reflects the economic state of play ~6-months ago. The global and domestic outlook has deteriorated since then. Central banks, like the RBA, have put through further rate hikes, credit conditions have tightened, market volatility has picked up, and the growth pulse has started to weaken. We expect domestic activity to decelerate over the period ahead as the jump up in interest rates constrains consumer spending, and this flows through the broader economy (see Market Wire: Growth Momentum Slowing). While the larger than normal share of households on fixed rate loans looks to have helped dull the initial rate hike pain and made the policy lags a bit longer this cycle, the result should ultimately be the same. As our chart shows, only around ~60% of the lift in the RBA cash rate has so far flowed through to the average outstanding mortgage rate. There is still a lot of ‘natural’ tightening to come as many households refinance very low fixed rate loans.

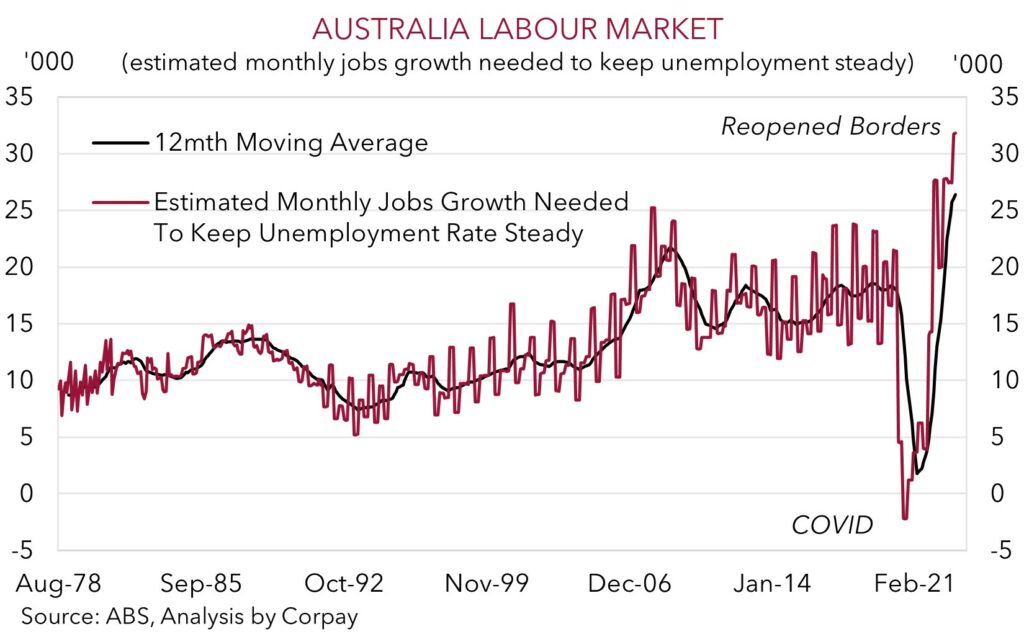

We expect slower growth, on the back of higher mortgage rates, to translate into reduced labour demand. This is already the signal coming through from various forward-looking labour demand indicators such as job ads and hiring intentions which are lower compared to a year ago. At the same time, the reopened international borders is boosting population growth and labour supply. The latter means the hurdle rate to keep the unemployment rate steady is now higher than it was during COVID. As our chart shows, we estimate that ~30,000 jobs now need to be created each month to prevent the unemployment rate rising. This is a difficult task on the best of days, never mind when growth is weakening. It is often overlooked how helpful the closed borders and more limited labour supply were in lowering unemployment. On our figuring had the population grown at the same rate over the past few years as it did pre-COVID, all else equal, the unemployment rate would now be just under 5% not 3.5%. Putting this all together, we believe the unemployment rate should level out and start to trend higher from here.

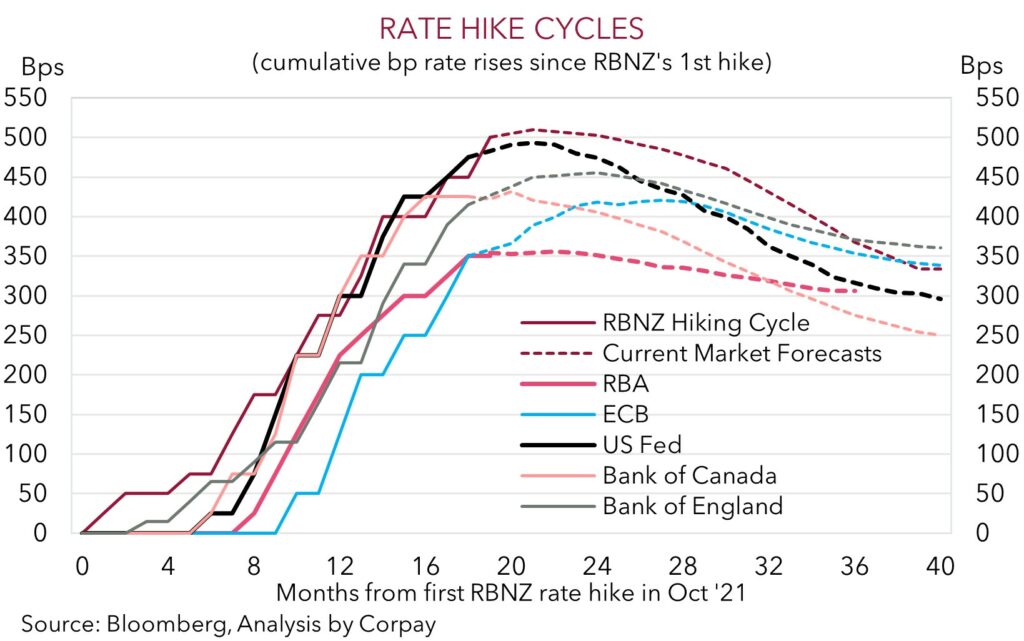

For the AUD, we think the better than predicted labour market report should provide some short-term support as probabilities of another RBA rate hike are bolstered. AUD/USD may edge up and test its 200-day moving average (~$0.6744) near-term. That said, the data doesn’t change our broader AUD views. We remain of the opinion that the AUD faces an uphill battle over the next few months as the aftershocks from the very fast and large global tightening cycle continue to show up across economies and financial markets. Increased volatility and slower global growth has historically been a backdrop that has favoured currencies like the USD, EUR and JPY over ones like the AUD and NZD that are leveraged to industrial activity (see Market Musings: Buckle up, volatility should continue). Additionally, while there is some renewed debate about whether the RBA could hike again in May, the bigger picture policy trends and expectations should remain in favour of currencies like the EUR, GBP and a lesser extent the USD where we judge central banks still have work to do to get on top of inflation, or the JPY where we think the Bank of Japan could be about to embark on a long overdue policy normalisation path.

However, the still resilient Australian labour market does feed into our positive AUD/NZD bias. With the policy tightening phase at or nearing its end, markets have started to focus more on other differentials such as growth and commodity prices. And on these metrics, we judge that the AUD should outperform the NZD. Growth-wise, the RBNZ moved earlier and has been far more aggressive than the RBA. As such we expect the NZ economy to experience a larger downturn, particularly with the RBA trying to achieve a ‘soft landing’ (see Market Musings: Cross-Check: AUD/NZD – RBNZ Shock & Orr).