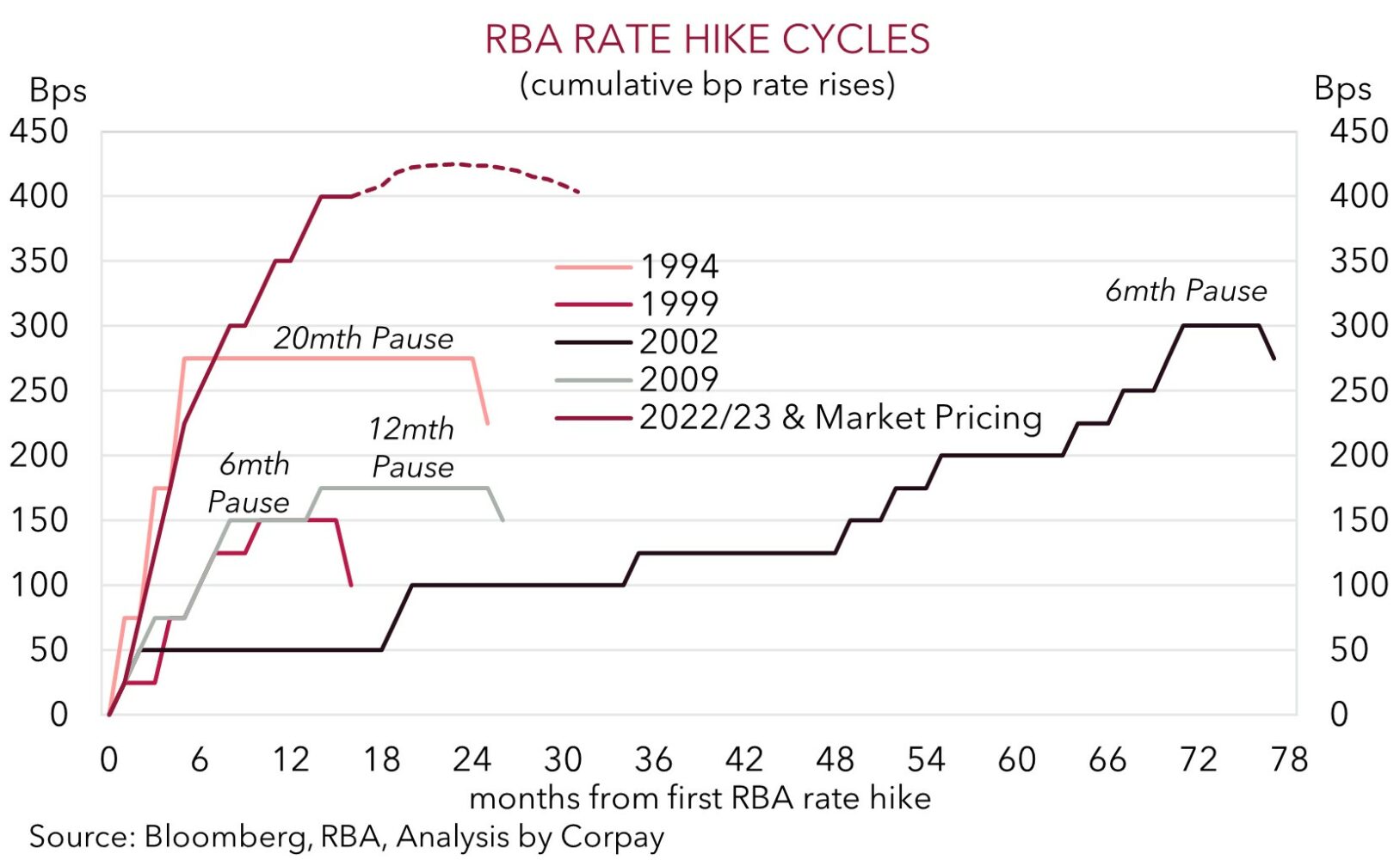

In what we think was another ‘finely balanced’ decision the RBA held the cash rate steady at 4.1% for the second straight month at today’s meeting. As stressed by the RBA interest rates have increased by 400bps since May last year. The tightening in policy is “working to establish a more sustainable balance between supply and demand in the economy”, and the decision to hold firm once again “will provide further time to assess” the impacts of past moves. As our chart shows, this has been the most aggressive policy tightening in several decades with the upswing in interest rates (so far) this cycle double the average increase put through over the previous 4 iterations.

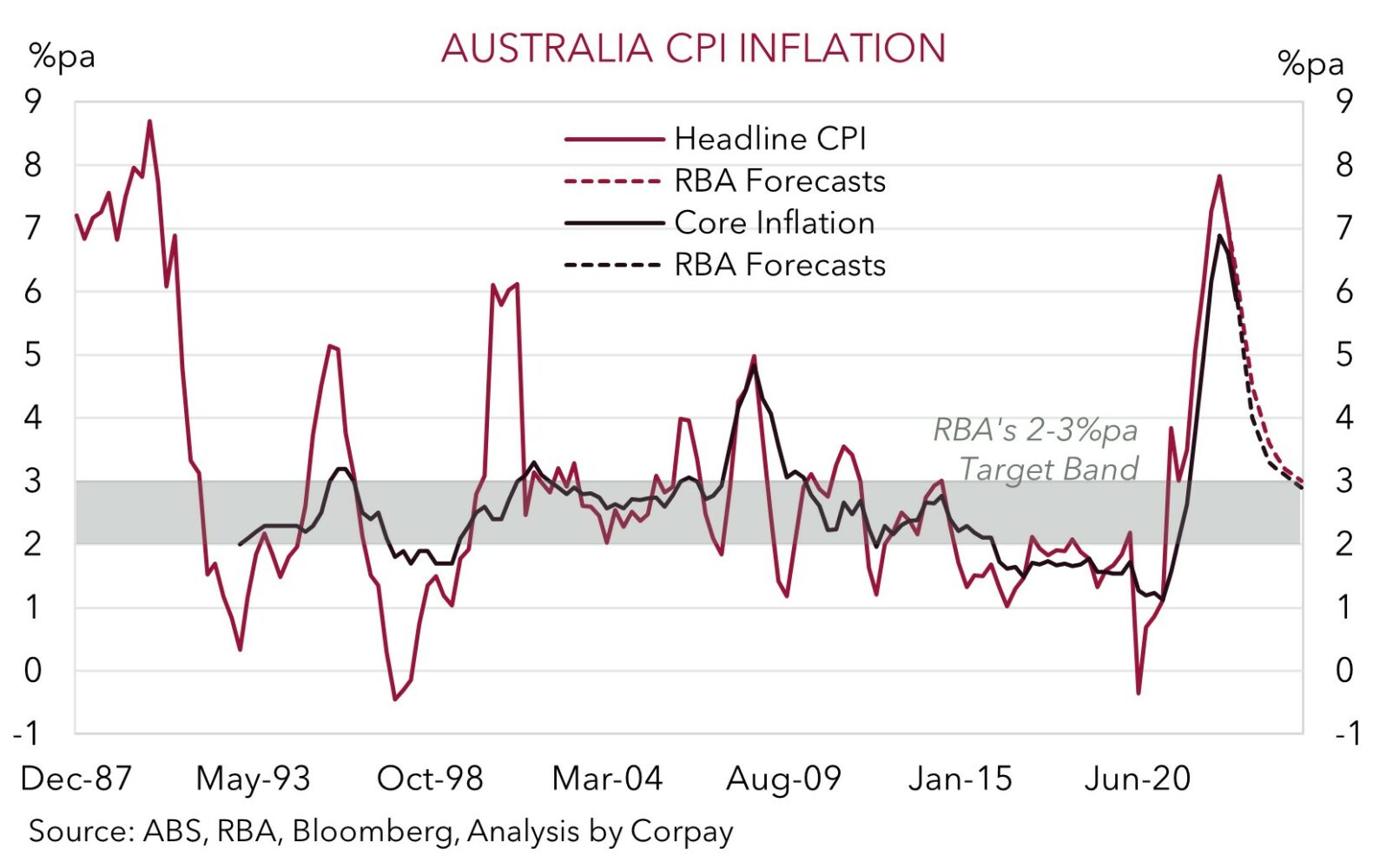

As outlined by the RBA, inflation is declining, but at 6% it is “still too high”, with prices of many ‘sticky’ services “rising briskly”. The RBA is forecasting inflation to continue to slow, though it is only projected to be “within the 2-3% target band in late-2025”. And for this to occur the below-trend growth in Australia’s economy is “expected to continue for a while”. The RBA’s updated projections have the economy growing by 1.75% over 2024 and a bit over 2% in 2025. Notably, after accounting for the robust population growth following the reopening of international borders, the RBA’s forecasts imply that there could be little contribution from per capita demand. This in turn should feed through negatively to the labour market with unemployment (now 3.5%) projected to rise to ~4.5% by late-2024.

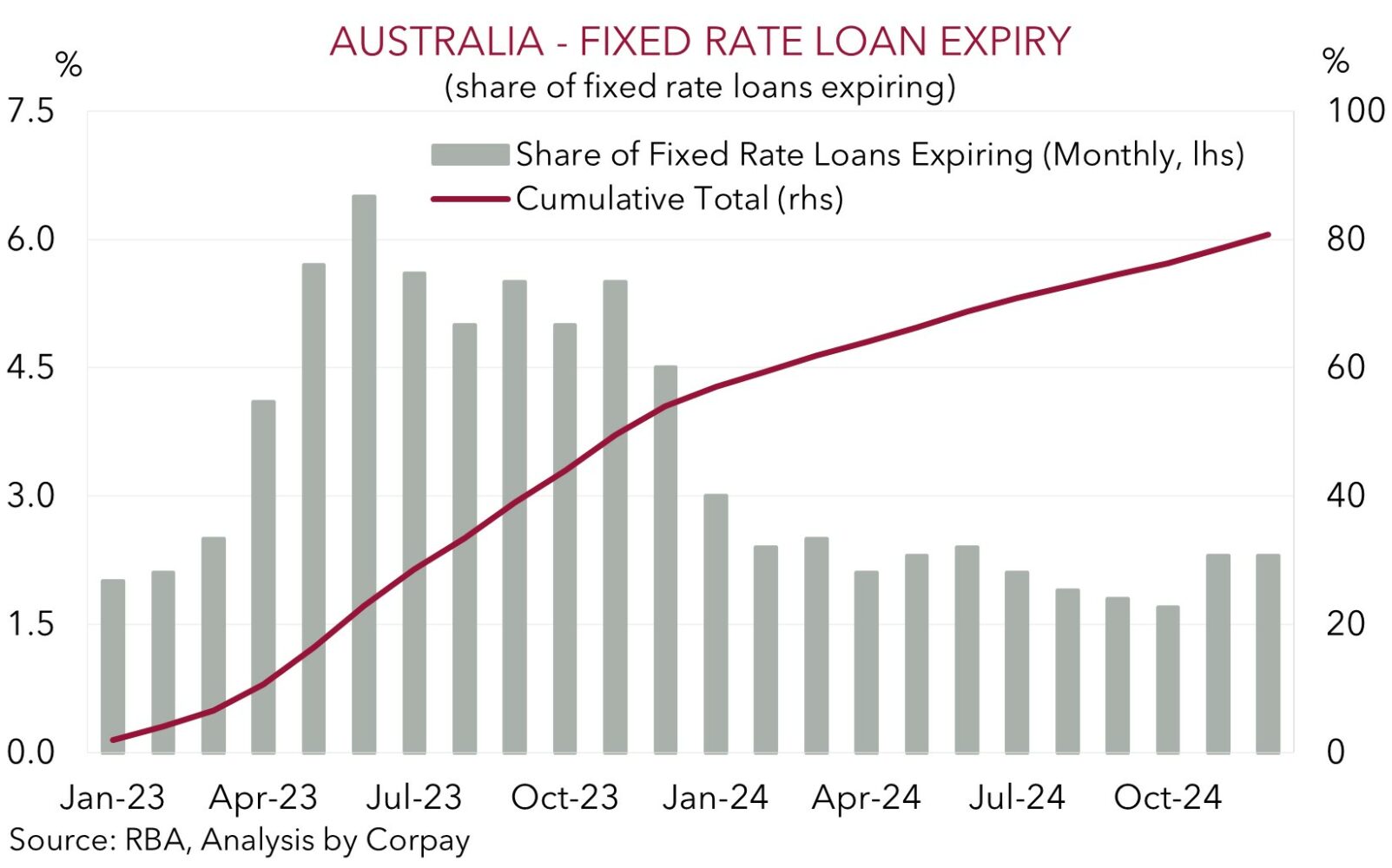

In terms of the policy outlook the RBA has once again retained its mild/conditional tightening bias. According to the RBA “some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe” however that will be driven by the data and evolving assessment of risks. In our view, although the RBA has left the door open to do more, if needed, we doubt the economic trends will justify further hikes from here. As emphasized by the RBA, household consumption growth “is weak, as is dwelling investment”. We believe that as the substantial cashflow hit on the indebted household sector gains traction, particularly as the large amount of fixed rate refinancing takes place and other cost-of-living pressures continue to bite, consumption and broader growth could slow considerably. As shown below, we are currently in the eye of the fixed rate refinancing storm, and this roll-off should generate a fair degree of additional ‘natural’ tightening over H2 2023.

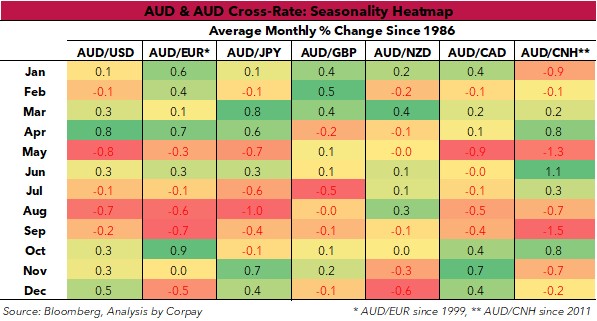

With a ~28% chance of a rate hike discounted ahead of today’s RBA meeting, and 18/30 surveyed market analysts looking for a move, the AUD has given up some ground following the no change decision (now ~$0.6670). Over the near-term, with the RBA meeting out of the way, we think the USD should reassert itself as the main driver. The latest US labour market report is due this Friday. In our view, risks appear tilted to another solid US jobs report. If realised, this may see interest rate expectations shift in favour of a stronger USD (and some more AUD downside pressure). Also of note is the AUD’s negative seasonal bias in August. As our heatmap below illustrates, on average the AUD, and a range of AUD crosses, tend to weaken in August before picking back up later in the year. Risk markets like equities typically endure some bouts of volatility at this time of the year as economic risks re-emerge, while other seasonal forces in things like iron ore production and trade flows also play a role. We believe something similar may unfold again in August 2023.

That said, as discussed previously, while we foresee a few more tricky months for the AUD as the slowdown in global industrial activity continues to gather pace, we also don’t want to be overly bearish down near current levels. From our perspective, fundamental supports such as Australia’s current account surplus (now ~1.4% of GDP) and the high level of the terms-of-trade should act as downside cushions. On our figuring, since 2015, when these factors kicked into gear, the AUD has only traded sub-$0.6650 ~6% of the time. On top of that, policy trends in China should be AUD supportive over the medium-term, in our view. To revitalize China’s stumbling post COVID recovery stimulus measures look set to come through. While we expect the measures to be skewed towards fostering labor-intensive consumption growth rather than boosting commodity-intensive infrastructure spending, a sturdier Chinese economy should nevertheless improve regional growth prospects and encourage CNH-supportive capital inflows. And based on the tight correlation between the two we think this may help the AUD edge up over late-2023/early-2024.