After a few surprisingly solid months the latest Australian labour force lottery came in weaker than expected and this has added to the downward pressure on the AUD (now ~$0.6390). In terms of the numbers employment fell by 14,600 in July, with full-time jobs declining (-24,200) after a couple of robust results. This is only the 3rd fall in employment in the past 21-months and on net the Australian economy has still added ~387,000 jobs over the past year, but nevertheless when it comes to the AUD as is often the case “when it rains it pours”.

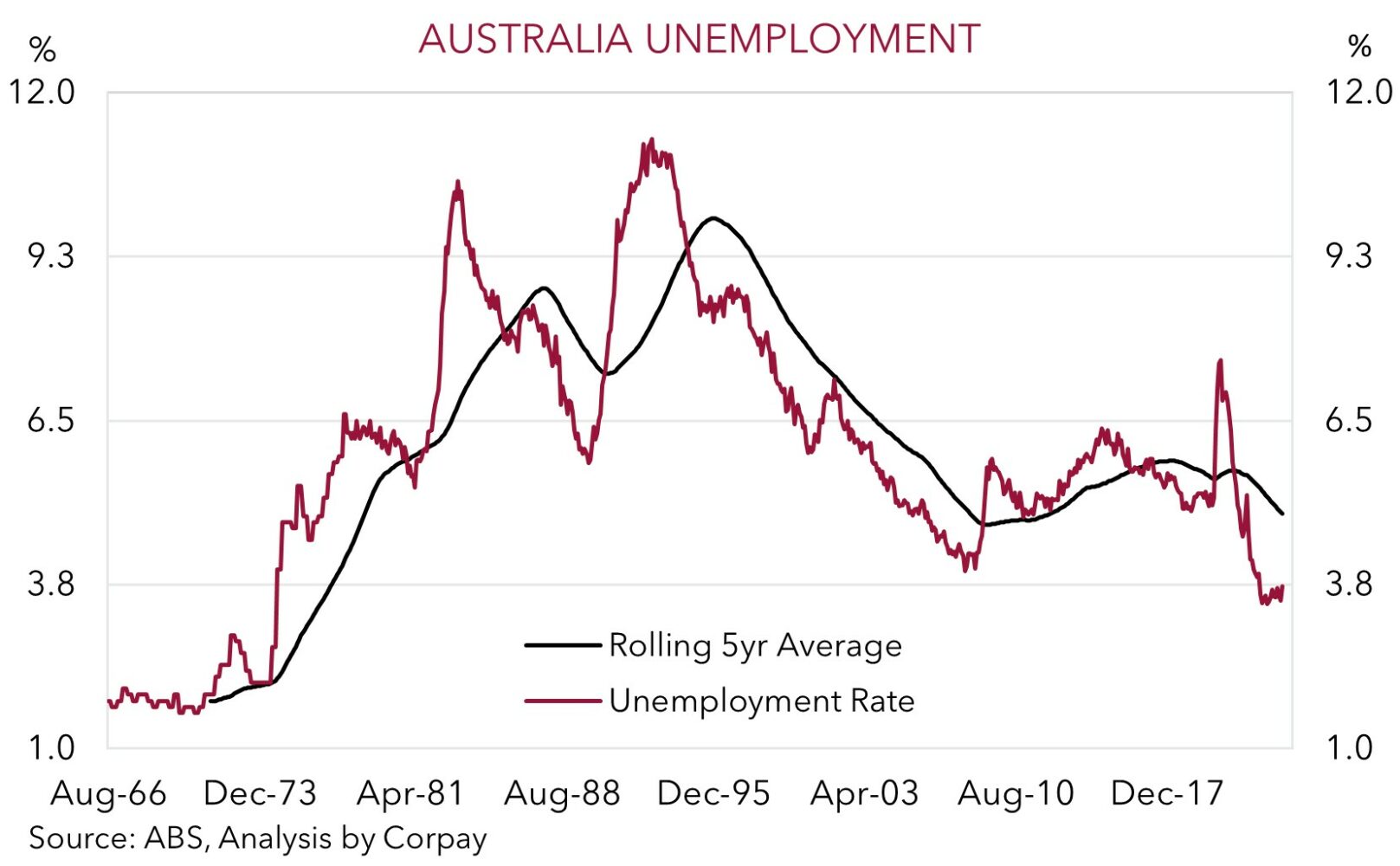

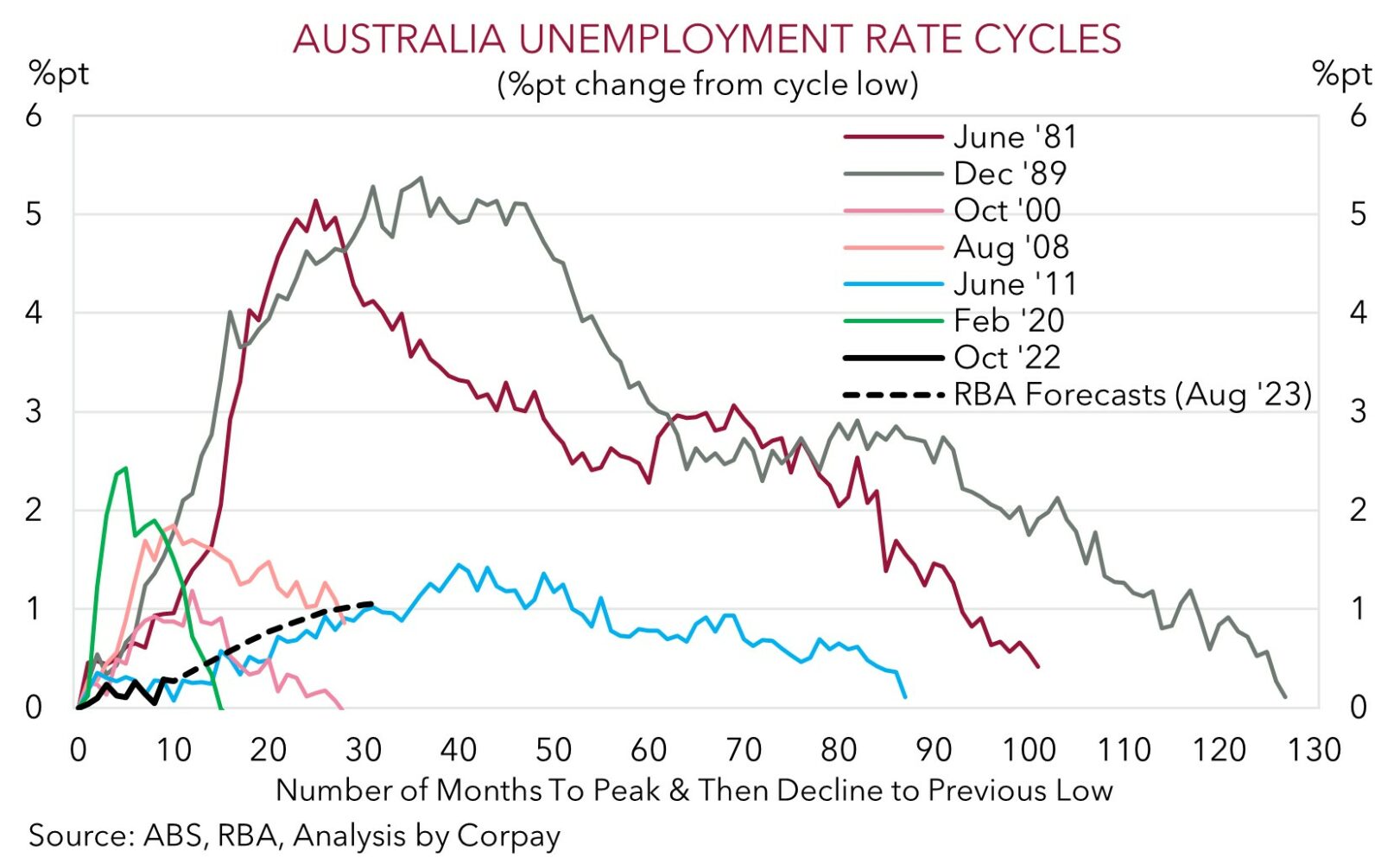

With the participation rate hovering at a still very high 66.7% and labour supply picking up on the back of the reopened international borders and faster population growth the unemployment rate ticked up a bit more than anticipated. The unemployment rose to 3.7% (from 3.5%) in July. This is still historically low, but the path of least resistance over the next year is for the unemployment rate to trend higher. Mathematically labour market slack is set to increase as softer demand on the back of the jump up in mortgage rates and reduced activity across the broader economy butts up against stronger population growth. Over recent months a range of forward-looking labour demand indicators such as job ads, skilled vacancies, hiring intentions, and forward orders have eased. On our estimates the hurdle rate to keep unemployment steady is now around ~33,000 jobs per month. This is much higher than it was during COVID when borders were shut, and indeed this type of run-rate was a hard task to achieve when the economy was firing on all cylinders never mind when momentum is decelerating. The RBA is, rather optimistically in our judgement, forecasting unemployment to only lift to 4.5% by mid-2025. As our chart shows, this would be a shallow lift in unemployment compared to past economic/labour market cycles.

Signs the labour market is (finally) turning, and our assessment that domestic activity could drop off considerably over coming months as the substantial cashflow hit on the indebted household sector gains traction (especially as the large amount of fixed rate refinancing takes place) supports our thinking that the RBA is unlikely to hike rates further from here (see Market Wire: RBA holds firm). Even with the RBA holding steady monetary conditions should continue to tighten as past moves continue to flow through to households and businesses, and with the fixed rate mortgage roll-off set to generate a fair degree of ‘natural’ tightening over the rest of this year and early 2024.

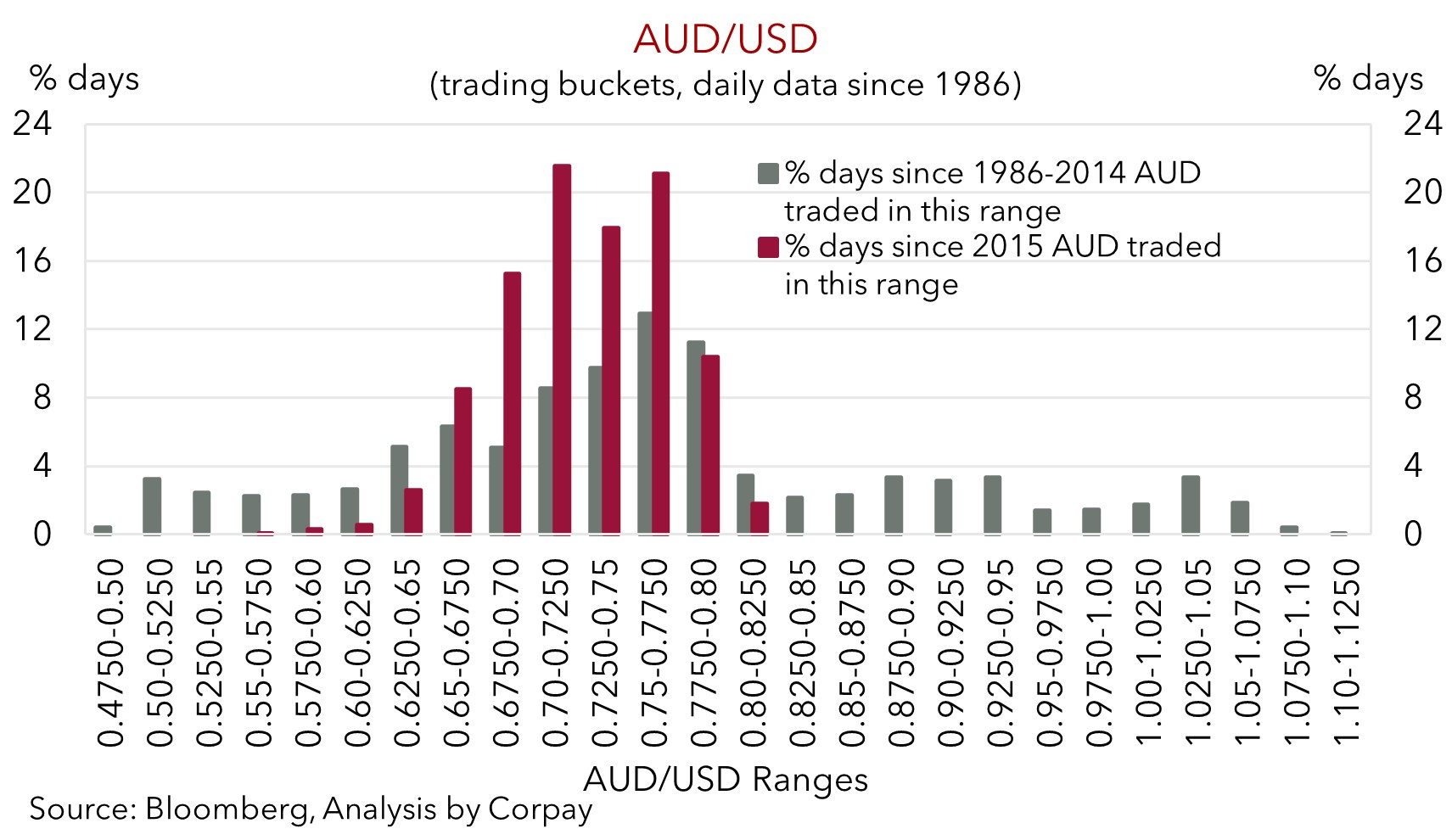

The negative Australian labour market surprise has compounded the other forces weighing on the AUD, namely the lingering concerns about the macro situation in China, a weaker CNH, worries inflation could persist in the major economies, shaky risk sentiment, USD supportive upswing in US bond yields, and negative seasonality at this time of year (see Market Musings: History doesn’t repeat, but…). While we think the AUD is likely to remain heavy over the near-term as these forces continue to play out, as we have pointed out before, down around current levels the AUD is tracking in somewhat rarefied air. Since 2015 AUD/USD has only been lower than current spot in ~2% of trading days.

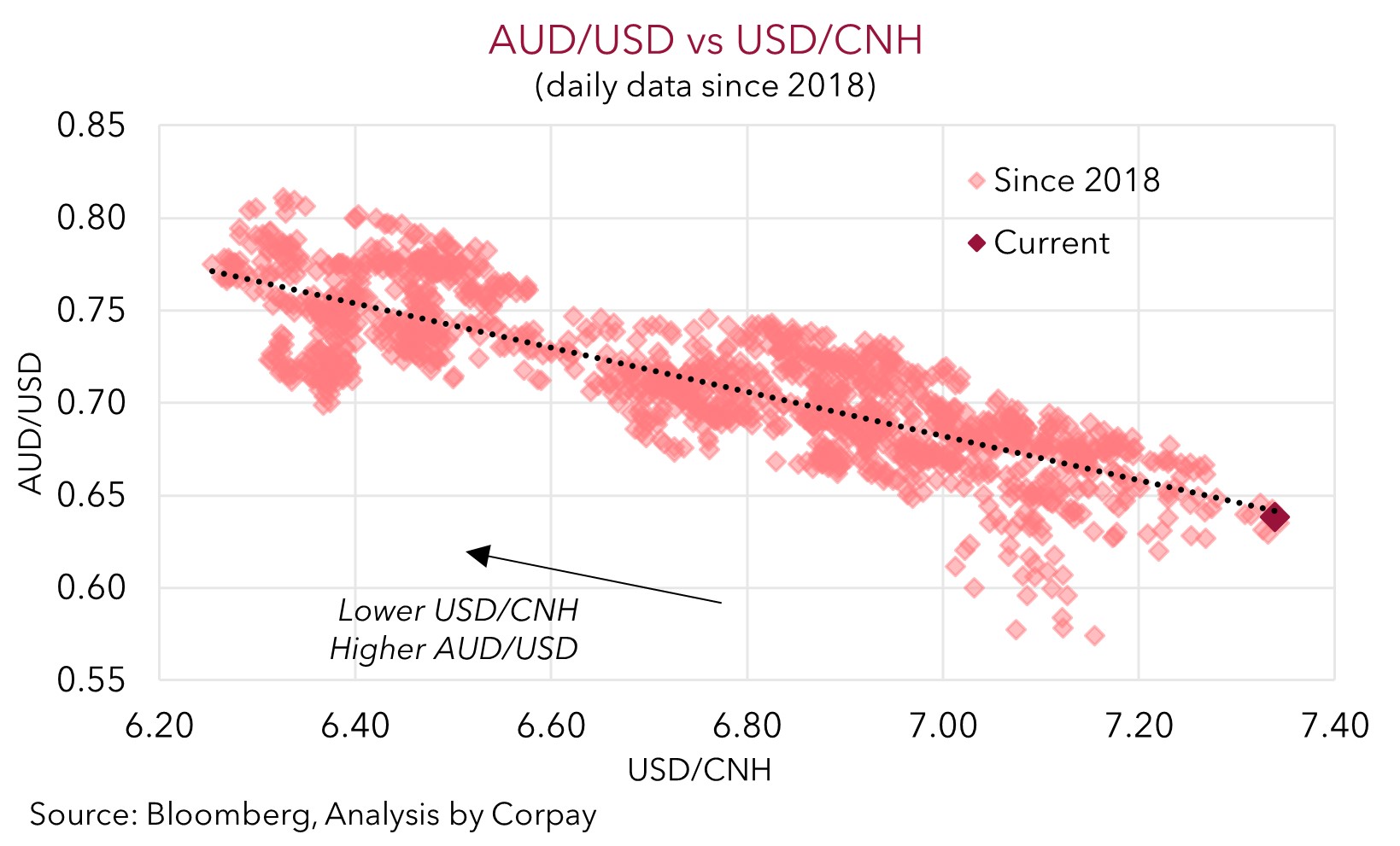

Supportive fundamentals including Australia’s current account surplus (now ~1.4% of GDP), flows related to the increasing pool of offshore investments undertaken by the superannuation industry, and the high level of the terms-of-trade should, in our view, help the AUD begin to stabilise. Beyond the still tricky short-term we continue to forecast the AUD to edge back into the low 0.70’s by mid-2024. Things always appear darkest before the dawn. Over the coming months we expect the USD downtrend to recommence and broaden out as the US’ relative economic strength fades (or at the very least the data fails to match lofty expectations) and with seasonal trends set to become more challenging. Added to that we think the AUD could receive a boost from a turnaround in CNH and/or ‘undervalued’ JPY which we believe would benefit from growth-friendly stimulus measures being unveiled in China aimed at reinvigorating the stuttering post-COVID recovery and/or more tentative steps taken by the BoJ to normalise its policy stance (see Market Wire: BoJ Loosens Its Grip).