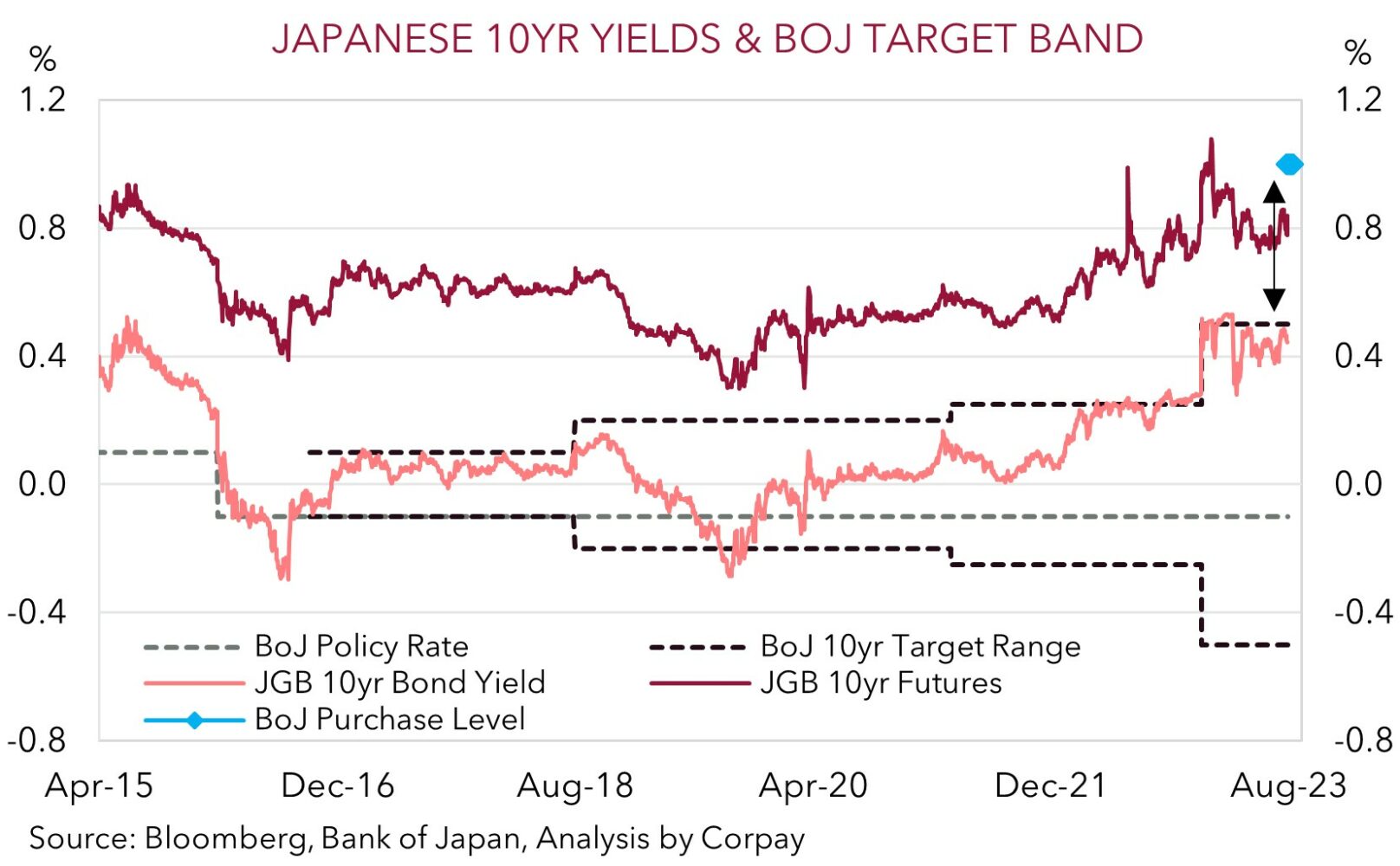

The tide looks to be (finally) turning when it comes to the Bank of Japan’s ultra-accommodative policy stance, albeit slowly. At today’s meeting, while the BoJ maintained its policy rate at -0.1% and its 10-year bond yield target at “about 0%”, its yield curve control framework was adjusted. Rather than having a rigid +/- 0.5% band around its 10-year bond yield target, things will now be controlled “flexibly”. Importantly, the BoJ also announced that it will offer to purchase 10-year Japanese government bonds at 1% each business day. In our mind this provides a guide to the BoJ’s new upper tolerance level when it comes long-term bond yields.

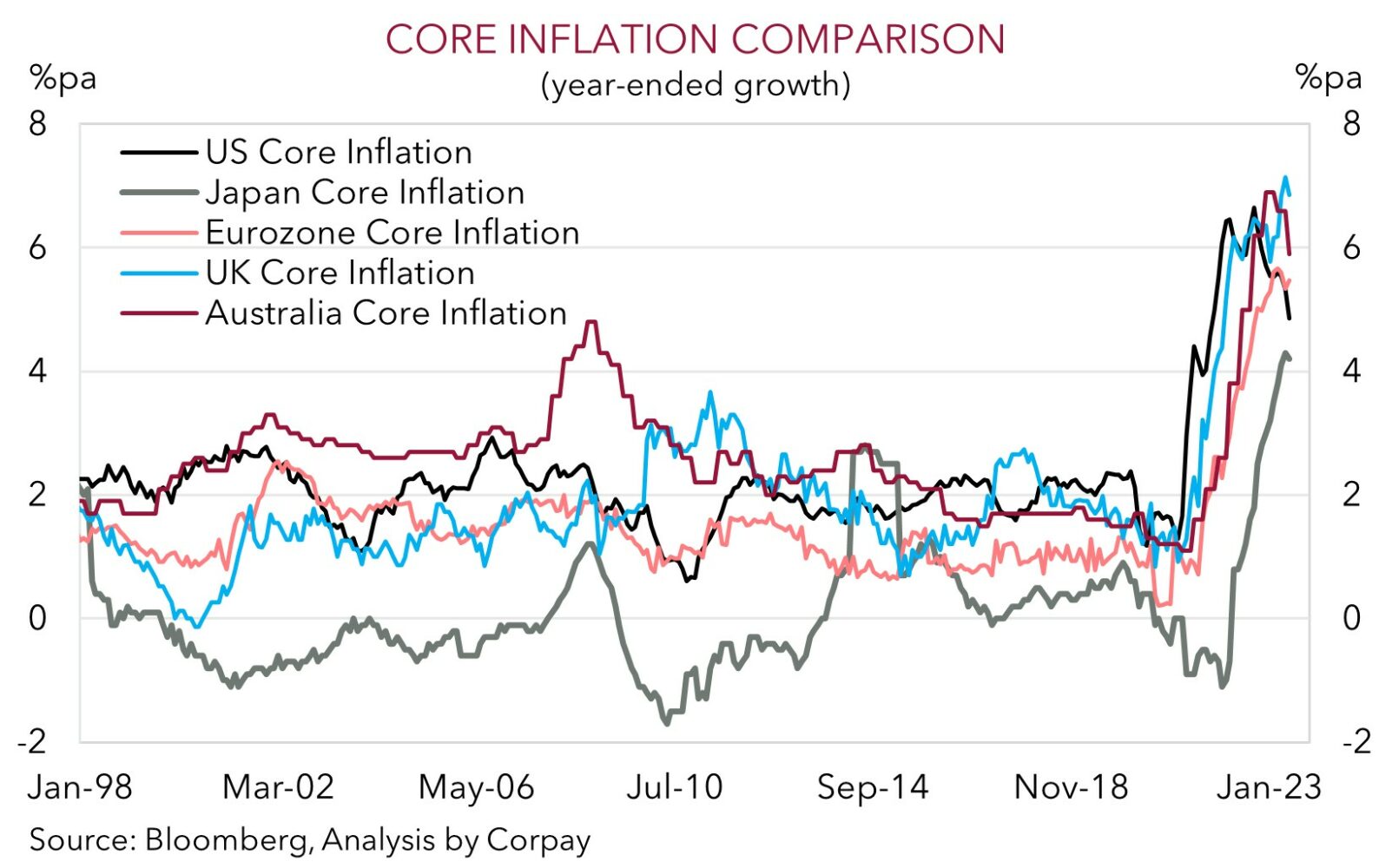

The BoJ may argue that this is just a technical change given its primary tools (i.e. the main policy rate, and quantitative easing/asset purchase program) weren’t tweaked, and that a further move down the normalisation path isn’t imminent, but we would beg to differ. Like the other major economies, except for China, Japanese inflation is running hot. Core inflation is north of 4%pa, the highest since 1981, and Japan’s domestic economy continues to hold up fairly well in the face of the global slowdown. In our opinion the BoJ’s upgraded view that core inflation could fall back below its 2%pa target in fiscal year 2024 looks overly pessimistic. Indeed, the BoJ’s own assessment is that the risks to inflation are “skewed upward”.

As with any long journey the first step is often the hardest, and for markets the opening of this door by the BoJ could see expectations looking for more start to grow. Over time, we expect this to be JPY supportive. More broadly, BoJ actions have been somewhat of an anchor for global fixed income markets. By allowing Japanese bond yields to move higher we think the BoJ’s actions could trigger a shift up (or more volatility) in other global bond yields, which in turn may act as a drag on risk assets such as equities, creating headwinds for cyclical currencies like the AUD and Asian FX in the near-term.

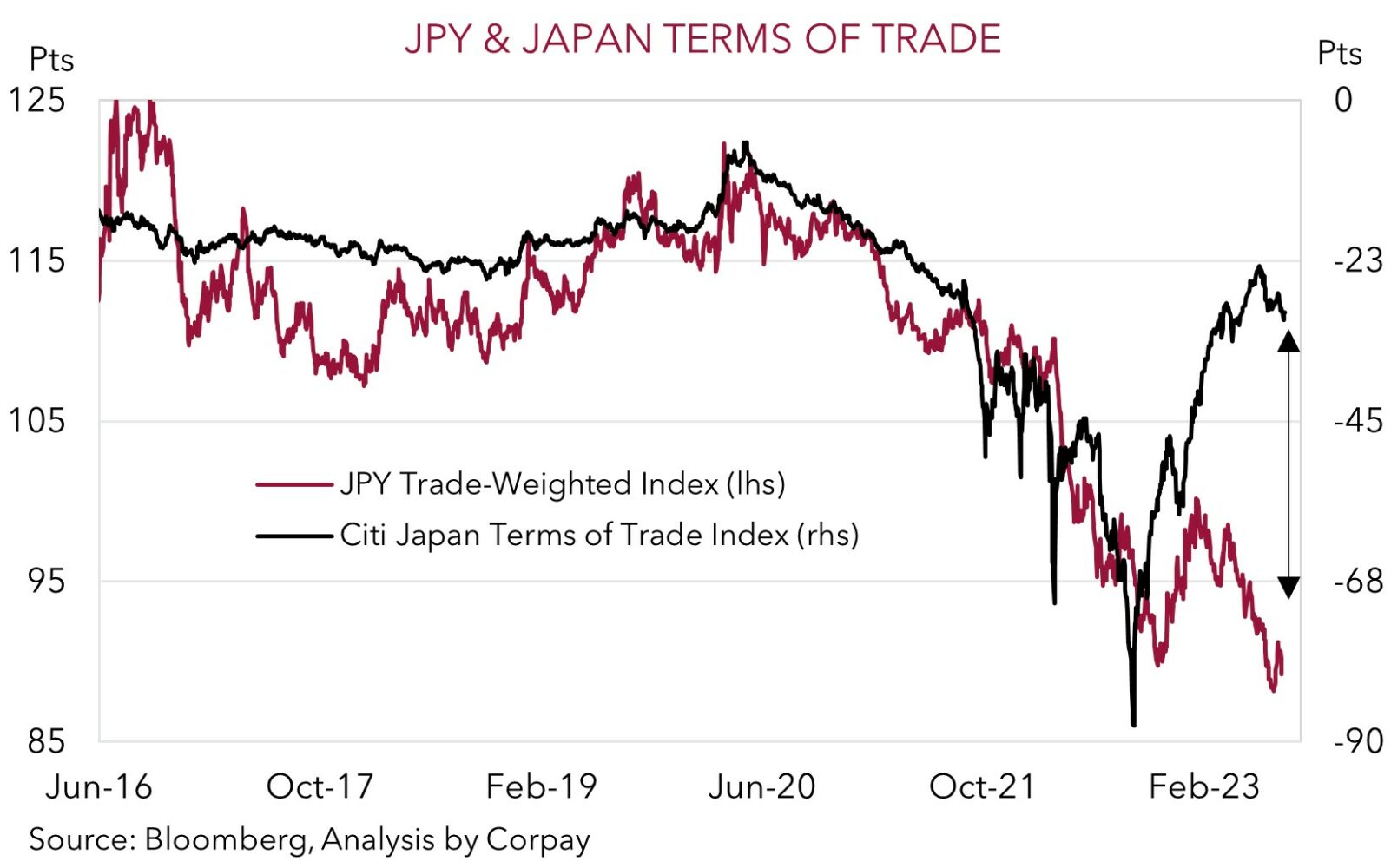

Today’s decision by the BoJ supports our bullish medium-term JPY bias. As outlined before, we think the undervalued JPY may have quite a bit of upside over the next year (see Market Musings: JPY: Asymmetric risks building). In addition to the (tentative) change in trajectory by the BoJ, which in our judgement could build over time and may stifle capital outflows from Japan due to the relatively more attractive yield on offer domestically (after accounting for hedging costs), we believe the JPY should also be boosted by the turnaround in Japan’s terms of trade and balance-of-payments position. Added to that, the backdrop of slowing global industrial activity and prospect of further bouts of volatility as the impacts of the BoJ actions and other macro forces continue to play out, are also typically JPY positive. We are forecasting USD/JPY to fall back down towards the mid-120s by mid-2024, with AUD/JPY projected to move back down into the high 80s over this time. We expect SGD/JPY, which is still historically high, to also trend lower over time.

As discussed, in the short-term the potential spillover of today’s BoJ announcement into other risk markets could exert further downward pressure on the AUD. This would compound the weaker AUD run being driven by the paring back of RBA rate hike bets following a string of softer than expected Australian economic data prints. On top of the bigger than forecast slowdown in Australian inflation (see Market Wire: Australian inflation: lower but not low), retail sales underwhelmed in June with monthly turnover falling by 0.8%. In our view, the AUD may continue to drift down towards ~$0.66 in the near-term. However, as mentioned previously, we don’t want to be overly bearish the AUD down near current levels. While it may not spring back quickly based on the sluggish domestic and global growth pulse, fundamentals such as Australia’s current account surplus (~1.4% of GDP) and the high level of the terms-of-trade should continue to act as downside cushions.

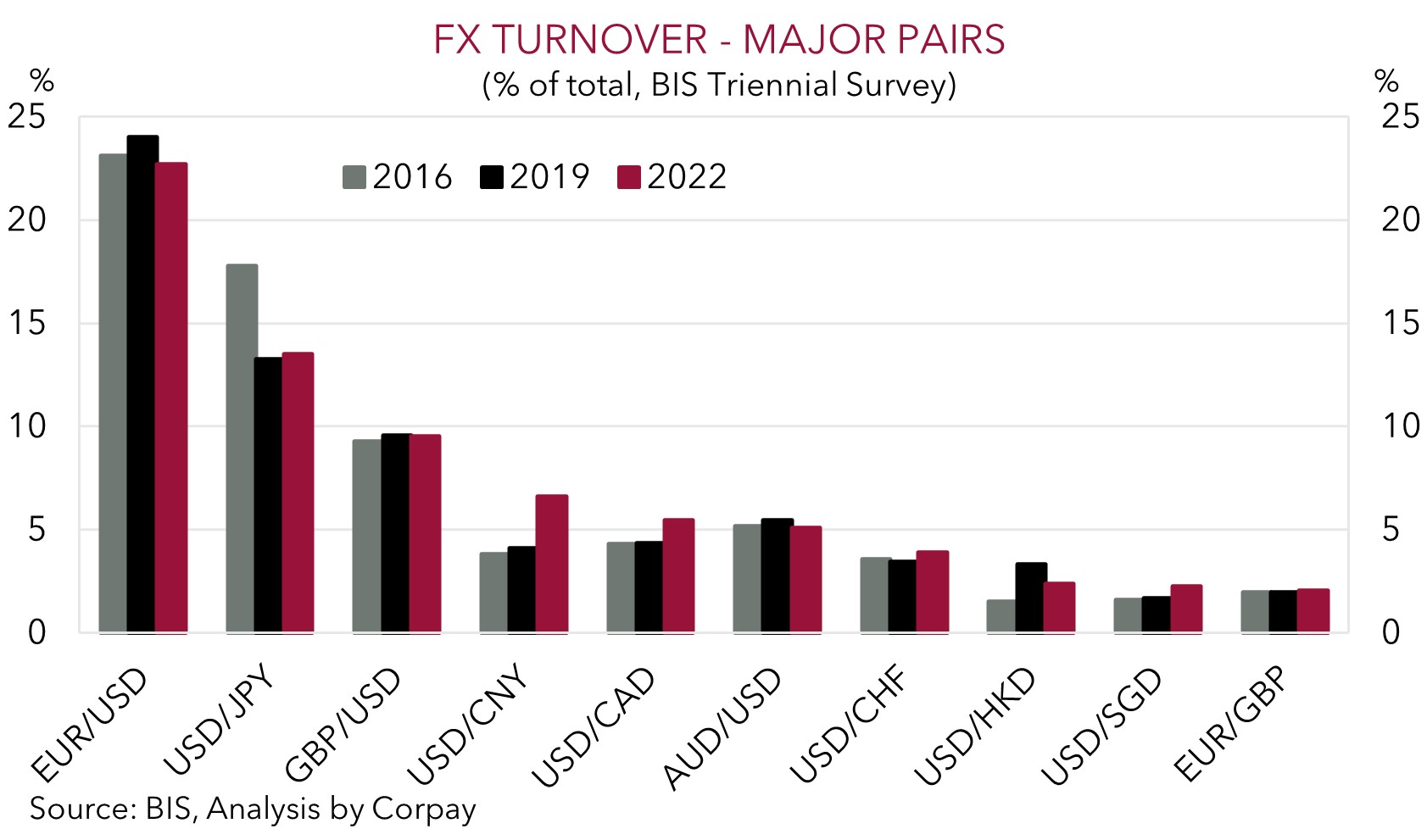

Moreover, over the longer-term, a stronger JPY and a rebound in CNY, stemming from a policy-induced re-acceleration in Chinese economic growth, are factors which we expect to ultimately weigh on the USD. This is a major driver behind our forecasts looking for the AUD to grind back into the low 0.70’s by H1 2024 after navigating a few more tricky months. As the chart below shows, USD/JPY and USD/CNY are the 2nd and 4th most traded currency pairs. Hence, trends in the JPY and CNY have a major influence on the USD outlook.