For the first time in a while, the more detailed quarterly Australian CPI figures undershot expectations. The downside inflation surprise has seen the AUD dip in knee-jerk fashion towards its recent lows (now $0.6760) with the data creating a bit of doubt in the minds of markets as to whether the RBA will hike rates again at the 1 August meeting.

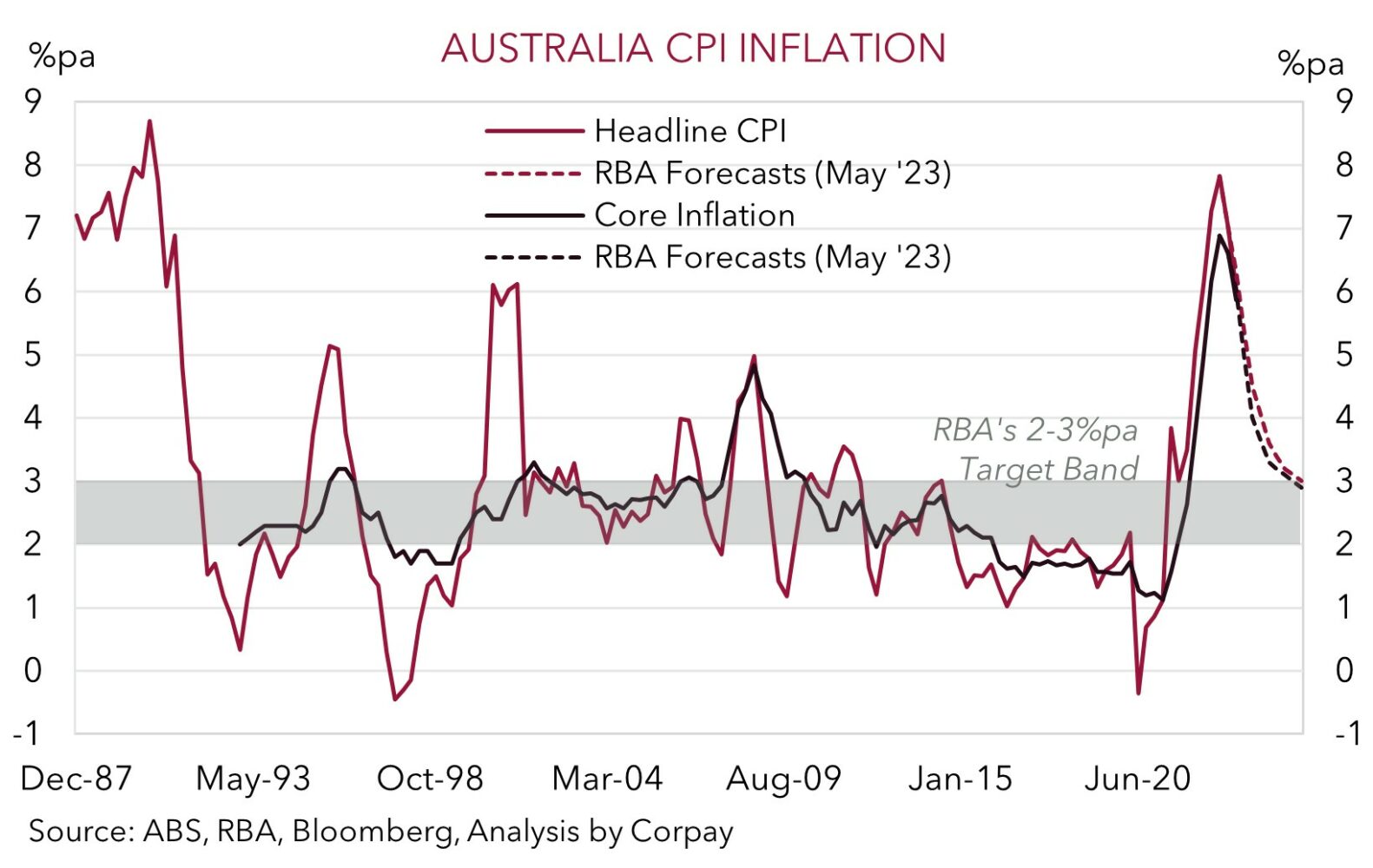

In terms of the data, headline inflation slowed to 6%pa. This is down from 7%pa in Q1 and a peak of 7.8%pa in Q4 2022. The market was looking for headline inflation to slow to 6.2%pa, while the RBA had penciled in 6.3%pa. Inflation is the rate of change in prices, so the deceleration (or ‘disinflation’) is not surprising as it is somewhat mechanical as last year’s larger price rises in things like fuel and other ‘goods’ roll out of calculations. Another drag on inflation in Q2 was lower domestic holidays prices as the jump over recent quarters partially unwound, while government rebates temporarily weighed on electricity costs. Trimmed mean (the RBA’s preferred measure of core inflation that strips out volatile items) also moderated slightly more than anticipated, but this has been, and should continue to be, a slower grind. Trimmed mean inflation slipped back to 5.9%pa (from 6.6%pa in Q1, and a peak of 6.9%pa in Q4). The RBA and consensus were predicting it to come in at 6%pa.

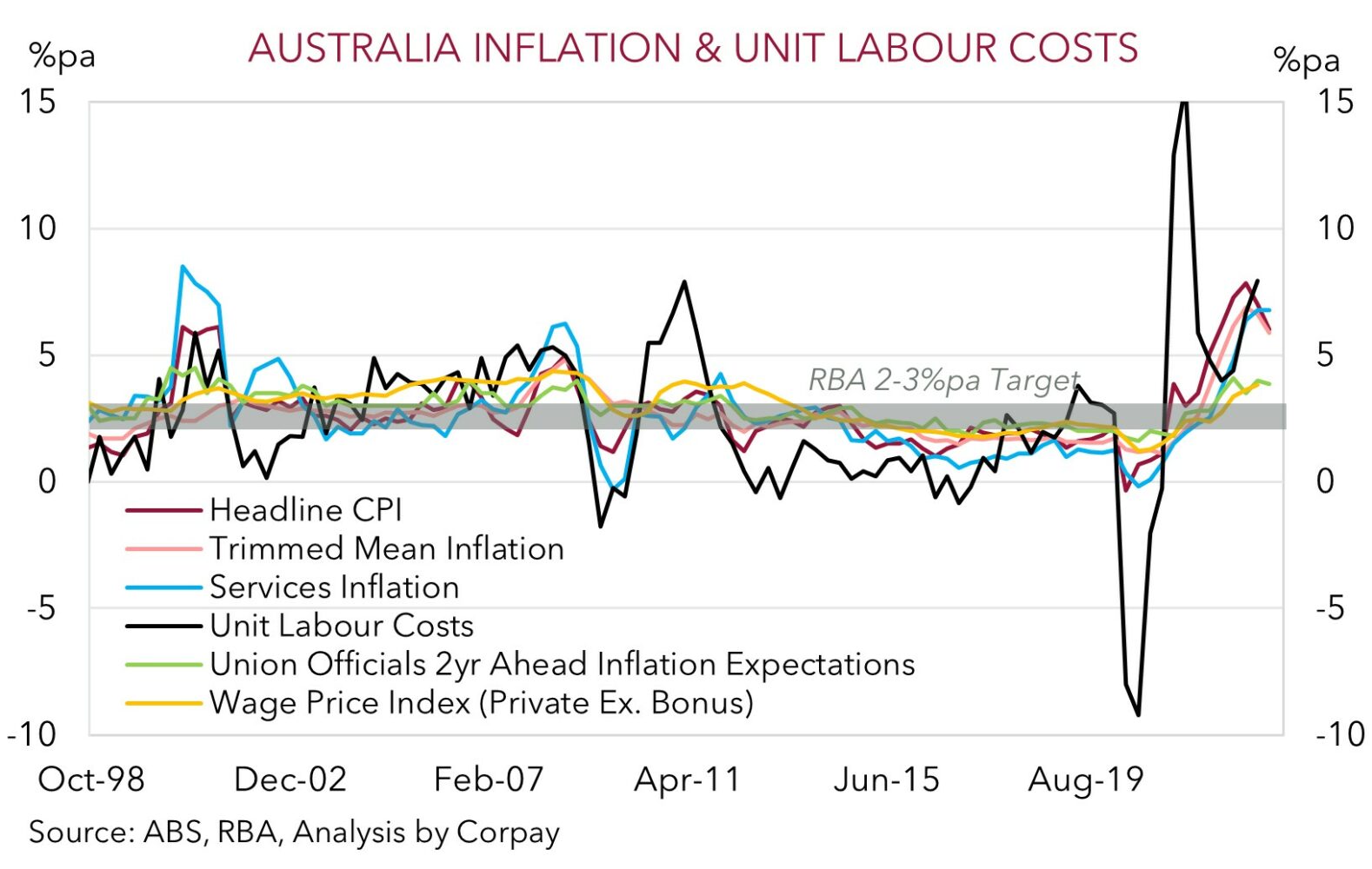

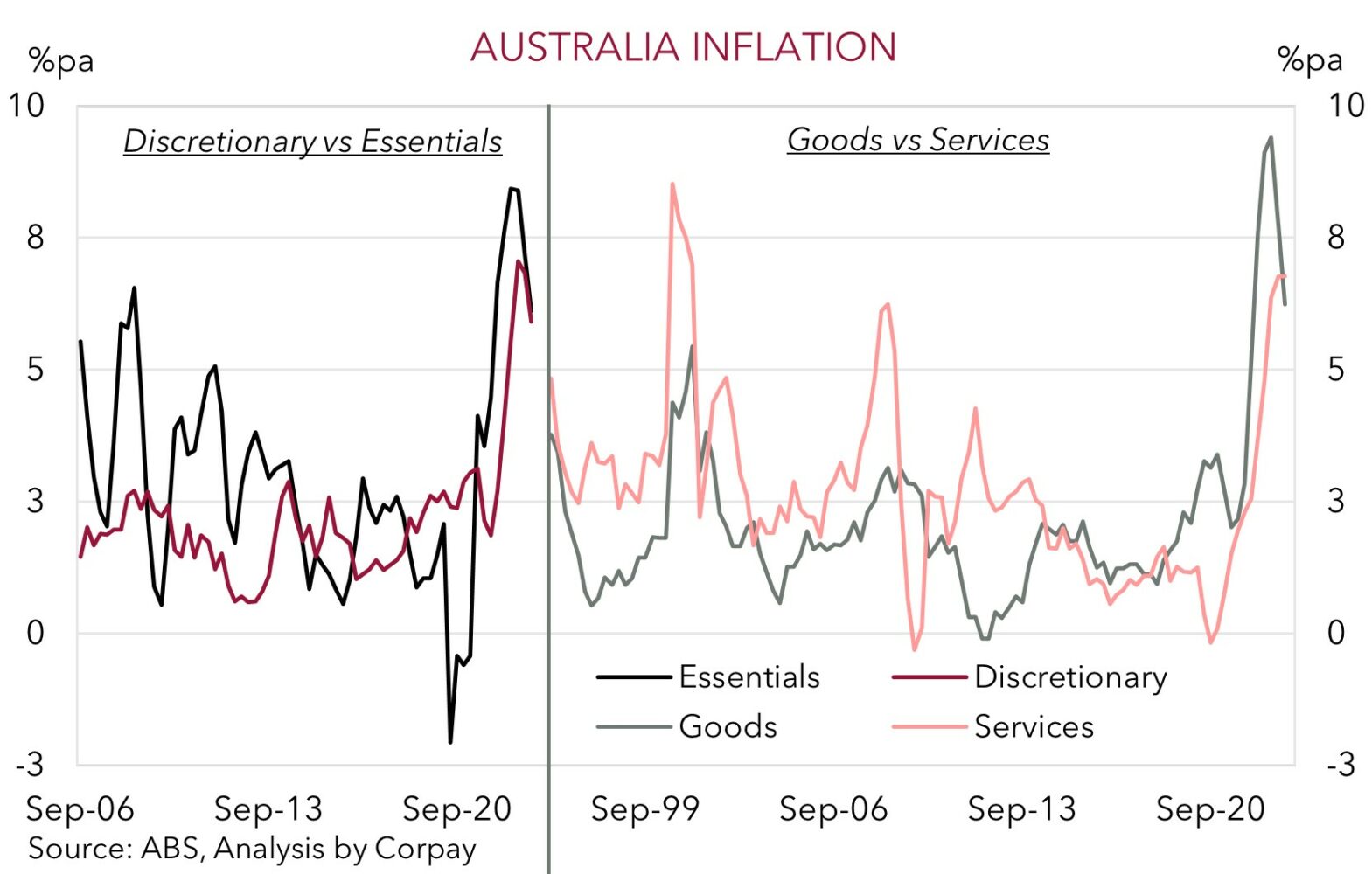

While there are some positives across the report, a closer look also shows that the inflation genie is still a long way from being back in the bottle. Of note, ‘sticky’ services inflation remains elevated, running at 6.8%pa in Q2. This compares to an average run rate of ~2.2%pa in the five-years pre-COVID, with annual ‘services’ inflation now exceeding ‘goods’ inflation for the first time since late-2018. The still tight labour market and lagged upswing in wages, and other things like accelerating rents given very low vacancy rates are some of the drivers here. Rents recorded their strongest quarterly rise since 1988 and have grown by 6.7% over the past year (the highest annual growth in ~14-years). The pressures on services prices will take time to turn around, with weaker economic growth needed to cool labour demand and in turn help contain and crimp wage growth. Labour is typically one of the biggest costs for a services firm. The rent issue is also unlikely to improve for some time given the population boom, and with higher interest rates/tighter credit conditions set to suppress new housing construction/supply.

While inflation is lower it still isn’t low. Headline and core inflation in Australia is still around double the top of the RBA’s 2-3% target band, and as mentioned, various underlying pressures remain in place. Indeed, on our figuring, ~3/4% of the CPI basket is still growing at 3%pa or more. This is historically high. Based on the continued labour market strength (unemployment is 3.5%, just above its ~50-year lows), Australia’s lackluster productivity, unfolding pick up in wages and other services price dynamics, we think the RBA is still likely to deliver one more rate hike this cycle, taking the cash rate to a peak of 4.35%, to enhance its confidence inflation is truly on track to be back at target “within a reasonable timeframe”. The RBA is currently only projecting inflation to return to the top of the band by mid-2025. In our view, despite the slightly lower than predicted Q2 CPI print, the 1 August RBA meeting should still be considered ‘live’ for a change.

For the AUD, as stated above, the inflation outcome has exerted a little intra-day downward pressure. The US Fed policy announcement (Thursday 4am AEST) and Chair Powell’s press conference (4:30am AEST) are the next focal points. We, and the broader market, are looking for the US Fed to hike rates by another 25bps. And given the improving, but still too high US inflation and tight labour market, we think Chair Powell could reiterate that the fight isn’t over, that the door to further tightening is open, and that thoughts of rate cuts are some ways away. In our judgement, this type of “higher for longer” rhetoric could rattle market nerves and support the USD (potentially pushing the AUD down towards its ~50-day moving average (~$0.6697)).

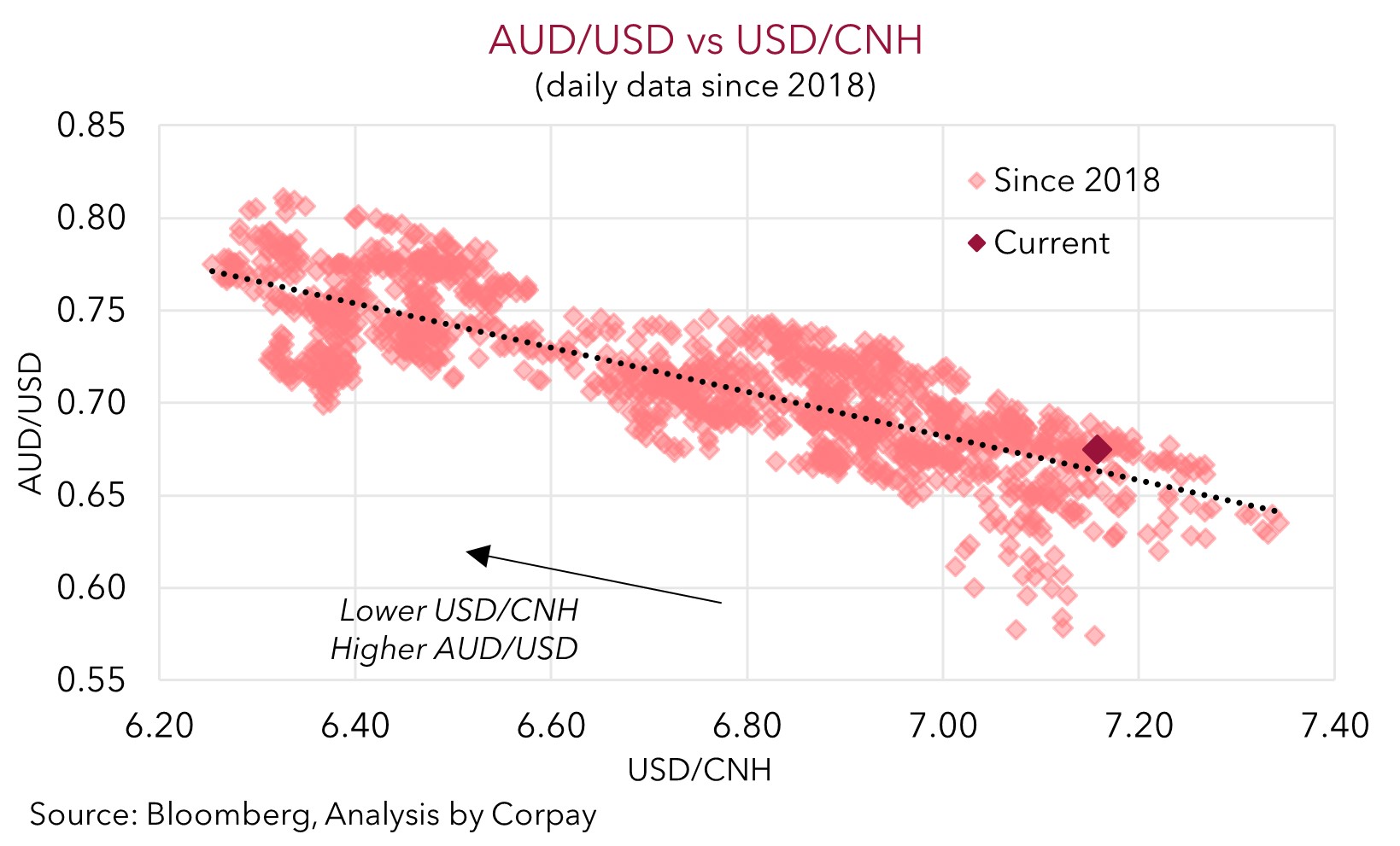

However, as outlined before, although we don’t see the AUD snapping back sharply for a while yet given the sluggish global and domestic growth pulse, we don’t want to be overly bearish down around current levels. From our perspective, fundamentals such as Australia’s current account surplus (~1.4% of GDP) and the high level of the terms-of-trade should continue to act as downside cushions. On our figuring, since 2015, when these AUD positive forces kicked into gear, the AUD has only traded sub-$0.6650 ~6% of the time.

After a few more tricky months, we continue to forecast the AUD to climb up into the low 0.70’s by early-2024. As the worst of the global downturn passes, and lower inflation enables the US Fed to definitively move away from its ‘inflation fighting’ stance we are looking for the USD to weaken. On top of that, we believe developments in China should also be AUD supportive over the medium-term. China’s post COVID recovery is stumbling, with policymakers acknowledging the “new difficulties” at the recent Politburo meeting. The shift in tone is in line with our thinking that more stimulus measures to reinvigorate China’s faltering economy are set to come through. Although we continue to expect the measures to be more skewed towards fostering labor-intensive consumption growth rather than boosting commodity-intensive infrastructure spending, in our opinion, a sturdier Chinese economy should improve regional growth prospects and encourage CNH-supportive capital inflows. And based on the still tight correlation between the pairs we think this should help the AUD grind higher over time.